- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Hello Kitty Visa Platinum Reward Card

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Hello Kitty Visa Platinum Reward Card

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Hello Kitty Visa Platinum Reward Card

I think this is new. Has anyone heard of it or have any information on it?

I'm not familiar with UMB Bank. I wonder who they pull, what kind of scores you need, and what a starting CL is like? HP/SP CLIs?

http://www.sanrio.com/hello-kitty-visa-reward-card/

https://www.umb.com/groups/public/documents/web_content/014154.pdf

13.99-17.99% APR. $0 AF.

0% introductory APR for the first 12 billing cycles for balances transferred within 60 days from account opening. After the first 12 billing cycles, and for Balance Transfers made more than 60 days from account opening, 13.99% to 17.99% (based on your credit worthiness) if your Balance Transfer is treated as a Purchase, or 24.99% if your Balance Transfer is treated as a Cash Advance

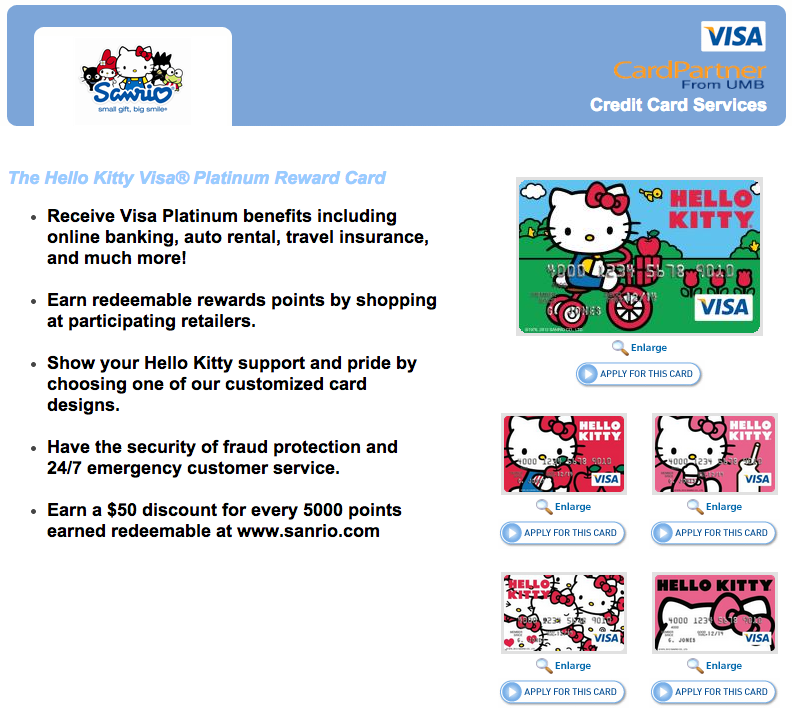

5 card designs... my fiance wants them all. ![]()

*Edit* Fixed Typo

12/19/19

12/19/19  06/11/20

06/11/20  07/02/20

07/02/20Total CL: $708,900. Largest CL: Amex Bonvoy Brilliant $70K. Apple Card $40K. Chase Ritz Carlton $35K. Mouseover for individual CLs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

United Missouri Bank as they used to be called, pulled TU for me several years ago...don't know what score you need, but I was denied with a 670 or so.

No idea about credit limits or CLI's.

Fico 9: EX 765 09/13/24, EQ 776 10/04/24, TU 755 08/15/24.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

I applied with them and was told that I had too many new accounts in the last two years! I'll never get in with them if they expect me not to apply for anything for that long.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

@navigatethis12 wrote:I applied with them and was told that I had too many new accounts in the last two years! I'll never get in with them if they expect me not to apply for anything for that long.

To this I agree. I've gone 1 month without app'ing and its killing me. Almost applied for a card last night, but I resisted...phew

September 2014: EX 721 I EQ 741 I TU 742

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

I hear the card can also act as a glow stick too.

Always follow these rules: Only take a HP for a new account. Always use the best rewards card for that reward category. Don't close a card unless you know you really should. Never use more than 35% of a credit limit. Recon as much and as best you can. Use the introductory period to the best advantage. Get the signup bonus. Whenever possible PIF or balance transfer so you pay less in interest. Never give an excellent rating when it is actually the norm. Always look for a discount as more is always better.

Always accept candy from strangers because they have the best candy or from people you know have good candy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

@bernhardtra wrote:I hear the card can also act as a glow stick too.

lol, are you serious?

Also, she wants me to figure out how to get all 5 designs. I said maybe if she keeps ordering replacement cards and hope that she can pick her design? Anyone with experience with that?

12/19/19

12/19/19  06/11/20

06/11/20  07/02/20

07/02/20Total CL: $708,900. Largest CL: Amex Bonvoy Brilliant $70K. Apple Card $40K. Chase Ritz Carlton $35K. Mouseover for individual CLs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

Try using one as a custom image on the Cap One card! Then you can easily cycle through them.

Now I know it would be a boring (but much better) world if everyone was like me, but someone actually likes those designs? Mmmm

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

A quick glance around, it looks like their other cards have gone to people with 700+ and good records. Not much activity since 2011 though on the site I checked. They seem a bit capricious.

UMB also does some other benefit cards like a Linux one, animal welfare benefit cards, etc.

A few people have been declined for excessive number of cards, debt structure, unacceptable past or present history, etc. So much for "I will help you, I will support you." ![]()

It is quite kawaii though.

01/10/2016 698/711/730 but still to and fro a bit

Climbing to 700 and beyond. It's too cold for gardening.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

@Anonymous wrote:Try using one as a custom image on the Cap One card! Then you can easily cycle through them.

Now I know it would be a boring (but much better) world if everyone was like me, but someone actually likes those designs? Mmmm

Will Cap One let you use trademarked design using their custom image? I didn't think you could, I have a few design I wouldn't mind having!

@NoAnchoviesPlease wrote:A quick glance around, it looks like their other cards have gone to people with 700+ and good records. Not much activity since 2011 though on the site I checked. They seem a bit capricious.

UMB also does some other benefit cards like a Linux one, animal welfare benefit cards, etc.

A few people have been declined for excessive number of cards, debt structure, unacceptable past or present history, etc. So much for "I will help you, I will support you."

It is quite kawaii though.

Thanks for this information!! I wasn't aware UMB did all those too. Hopefully with her relatively thick file, even with a recent app spree, she'll get approved. I'll post the results when she apps. Cause, she will.

And yes, even I think it's quite kawaii! But then again, I practically live in a Sanrio with the amount of Hello Kitty stuff my fiance has.

12/19/19

12/19/19  06/11/20

06/11/20  07/02/20

07/02/20Total CL: $708,900. Largest CL: Amex Bonvoy Brilliant $70K. Apple Card $40K. Chase Ritz Carlton $35K. Mouseover for individual CLs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Hello Kitty Visa Platinum Reward Card

@striehl8212 wrote:

@navigatethis12 wrote:I applied with them and was told that I had too many new accounts in the last two years! I'll never get in with them if they expect me not to apply for anything for that long.

To this I agree. I've gone 1 month without app'ing and its killing me. Almost applied for a card last night, but I resisted...phew

It's about applications in aggregate: no rational lender is expecting you to go cold turkey, but they might want a customer who's more abstemious (more established / stable in credit report terms).

Eventually other than the credit card offer churners everyone eventually gets all the cards they need and their file becomes idle for years at a time.

The wierd one on the Hello Kitty card, who do they think they're marketing to anyway? Younger generations especially with the current instant gratification culture are likely to run counter to this particular underwriting ideal. Seems like a sloppy idea, but their underwriting could be markedly different for this product compared to their others.