- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: How Solid is this?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How Solid is this?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How Solid is this?

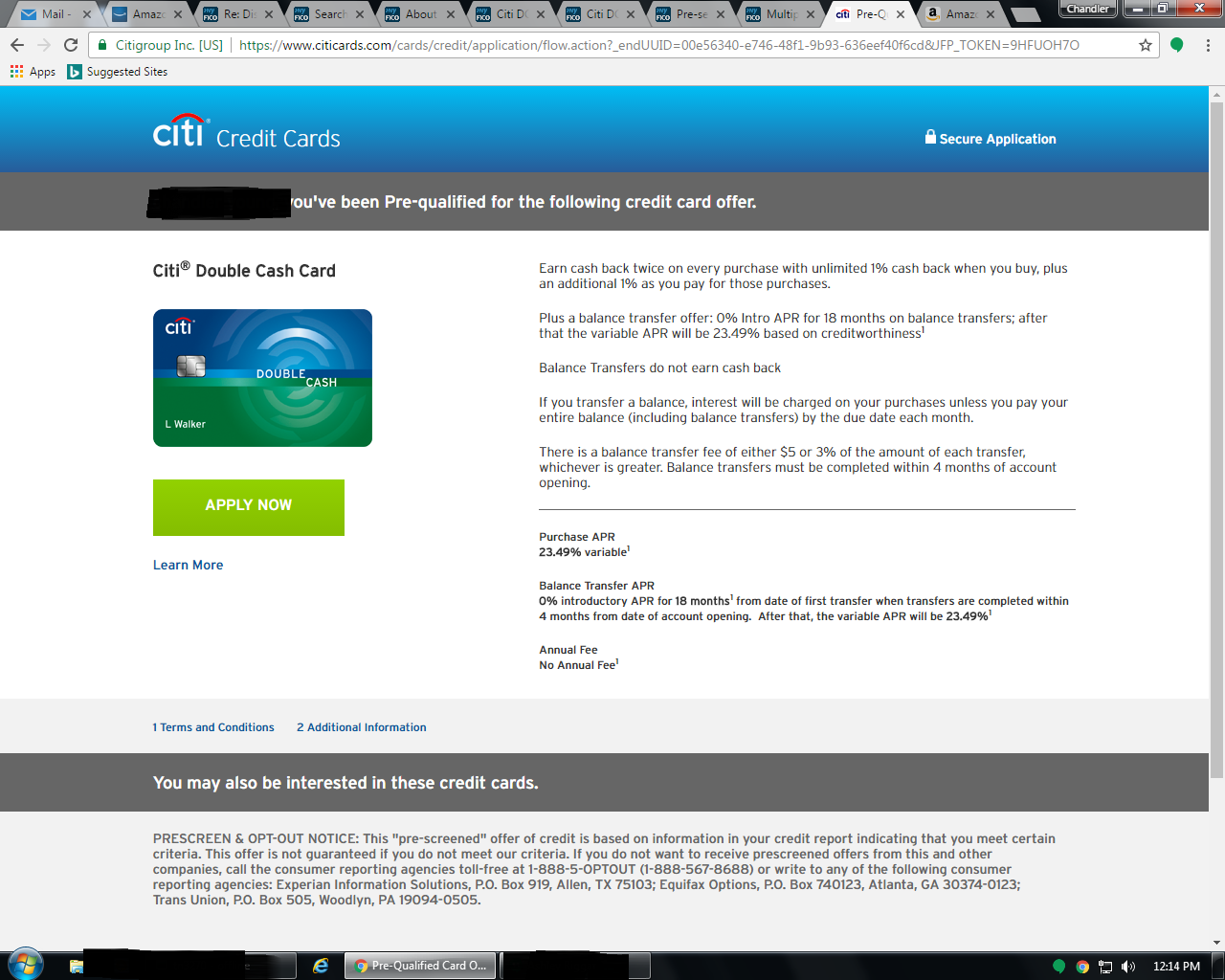

My scores dont really warrant a DC pre-approval like i just received do they?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

Possibly. Those are not good terms -- 23.49% with no 0% period (some offers have 18 mo. at 0%). And probably a low SL -- upside is that Citi is good with CLIs and APR reductions. If you want the card, go for it.

Citi uses FICO 8 Bankcard, which may be higher than the scores in your sig.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

unless you want yet another low sl/cl high % card you should pass. imo you dont need any more cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

@Anonymous wrote:My scores dont really warrant a DC pre-approval like i just received do they?

Citibank preapprovals are considered reliable.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

Mostly will get you an approval but beware of a very low starting limit (typically $1K - 2K) and obviosuly that unsually high APR.

| 769 | 774 | 764 | UTIL: 2% | AAoA: 5yr 8mos | Total Credit Line: $873,950 |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

Im not going to jump on it, I was just shocked that I had a pre-approval for it. I thought my scores would be way too low for them. Im waiting for a few more months then I will be out of 5/24 to apply for chase cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

@Anonymous wrote:Im not going to jump on it, I was just shocked that I had a pre-approval for it. I thought my scores would be way too low for them. Im waiting for a few more months then I will be out of 5/24 to apply for chase cards

The great thing about Citi pre-qual (and Cap1) is that as your score/credit gets better, you can see better offers with lower APR. DW first pre-qual APR was high, her score increased with time and now the pre-qual put her at lowest APR available.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

keep checking online for prequalified offers with citi. the more you check the more they mail you and the terms should get better. you should be able to get a dc with 0% for 15-18 months on bt's AND purchases with a lower APR. however the highest apr is what you're seeing which is possibly due to your scores. once you are in the high 700's that should change.

HOWEVER, if you need the BT now, you can still take advantage of 2% if you pay in excess of the minimum payment to cover the monthly charges.

If you want to get chase cards that is a wise idea to worry about 5/24.

Your shared secure addition was a good idea.

Do the 2 non major CC's in OP's sig count towards 5/24? If not, check online with chase to see if you have any prequalified offers.

Anyway yes it may start with a low CL, but you can always take a HP later on when scores are better to get an increase. Mine started at 2400 and got a sp increase to 3800 in under 5 months. Then when it was 7 months old got an increase to 10k, then when it was a year old increased to 15k. Scores at approval were 700. And I was getting mail offers just like that and online, then one day a 0 for 18 months then 13.99 (now 14.49) offer came in the mail on purchases and BT's, so I took it.

To recap, if those 2 store cards don't count, which here says they dont http://millionmilesecrets.com/2016/10/23/do-store-cards-count-towards-the-chase-524-rule/ then you should check chase for prequalified offers, and if you see any post it here

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How Solid is this?

@newhis wrote:

@Anonymous wrote:Im not going to jump on it, I was just shocked that I had a pre-approval for it. I thought my scores would be way too low for them. Im waiting for a few more months then I will be out of 5/24 to apply for chase cards

The great thing about Citi pre-qual (and Cap1) is that as your score/credit gets better, you can see better offers with lower APR. DW first pre-qual APR was high, her score increased with time and now the pre-qual put her at lowest APR available.

+1 and to others also.

Use this as a gardening measure. Over time, checking at the first of the month, you should see your offer improve.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765