- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Minimum usage to keep Chase and CapOne happy?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Minimum usage to keep Chase and CapOne happy?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

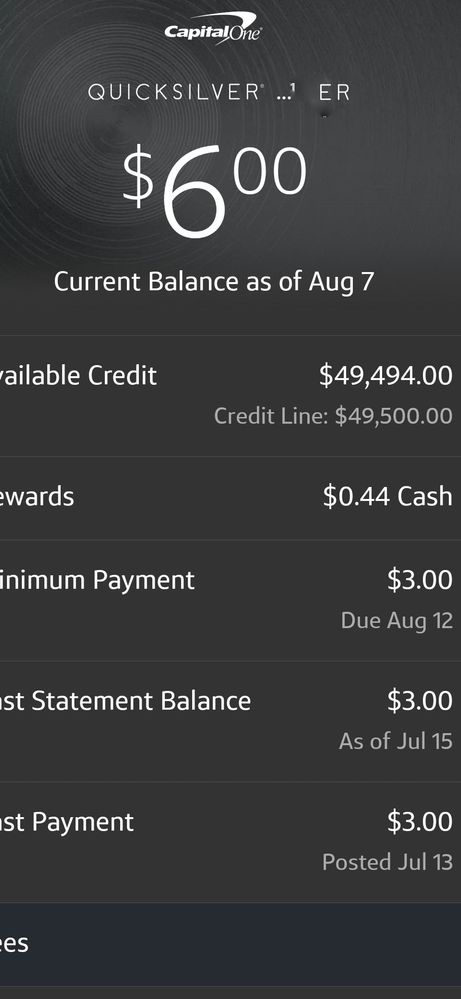

First off, this is the highest Cap One limit that I've ever seen! Secondly, I think they're not giving you 50k because it has something to do with the rewards tier they can/can't offer at that limit.

Starting FICO 8s | 06/2018: EX 601 ✦ EQ 605 ✦ TU 590

Starting FICO 8s | 06/2018: EX 601 ✦ EQ 605 ✦ TU 590Current FICO 8s | 9/2022: EX 732 ✦ EQ 739✦ TU 743

2023 Goal Score: 760+

Business Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Gmood1 wrote:Sigh..lol

You can have a very small reoccurring charge on the Cap One and be just fine OP. There's no minimum amount needed to keep limits. The goal is keeping it active.

I've put a $2 to $3 monthly charge on my Cap one set to autopay for over 3 years now. The limit is still the same as it was when I set up the reoccurring bill.

Have you been charging so little for a long time? A few of us were caught up in CLD action by Cap One for having high limits and low spend (NOT no spend), seems that you missed out! I went from $35k to $10K even though I was spending in the low hundreds a year

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:

Less concerned about Chase with respect to their own cards, just do not want them to cause a problem with getting his current goal card (an Apple Card) and then maybe a B&H financing card. Does not seem like it would make sense to switch it to a Freedom Unlimited (missing the signup bonus), given that, he will probably close it once it does not really have a big impact on his average account age.

Another eventual option would be to close the Slate and move its limit over to the Freedom. Someone will have to confirm the specifics. But I believe that if the card has had recent use, all but $500 would be movable. If it has been unused for maybe two months, the whole limit would be movable.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:

Have you been charging so little for a long time? A few of us were caught up in CLD action by Cap One for having high limits and low spend (NOT no spend), seems that you missed out! I went from $35k to $10K even though I was spending in the low hundreds a year

Yeah, that was the situation where limits were cut if they were over 10k and spending averaged about $100 or less over a period of about a year. We haven't heard specifically about that type of cut for a while.

If I remember correctly, the reasons went something like this:

- Low usage on this Capital One card

- Low usage on other Capital One cards

- Low usage on non-Capital One cards

The way the reasons were ordered, I get the impression that @Gmood1 might have missed this AA because he covered himself with plenty of usage on non-Capital One cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@HeavenOhio wrote:Another eventual option would be to close the Slate and move its limit over to the Freedom. Someone will have to confirm the specifics. But I believe that if the card has had recent use, all but $500 would be movable. If it has been unused for maybe two months, the whole limit would be movable.

He will probably move the limit after he gets an Apple Card. That way making the request does not jeopardize getting the card (in other words, if they decide to close his account as a result of making the credit limit transfer request). He will not close the Slate until it does not matter to his Average Age of Accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:

@HeavenOhio wrote:Another eventual option would be to close the Slate and move its limit over to the Freedom. Someone will have to confirm the specifics. But I believe that if the card has had recent use, all but $500 would be movable. If it has been unused for maybe two months, the whole limit would be movable.

He will probably move the limit after he gets an Apple Card. That way making the request does not jeopardize getting the card (in other words, if they decide to close his account as a result of making the credit limit transfer request). He will not close the Slate until it does not matter to his Average Age of Accounts.

Unless a cardholder is experiencing other financial issues, reallocation doesn't trigger closures.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@blindambition wrote:<br/Unless a cardholder is experiencing other financial issues, reallocation doesn't trigger closures.

Not only was he not experiencing any other financial issues when they cut his limits, he had just paid off all his cards but the one with no interest so we are a bit skittish. The only Chase cards that would interest him at all are the Sapphire Preferred or Reserve and the United Mileage Plus Explorer Card, so if these cards went away, he would only care as it would affect his chances of getting one of those later. However, he cares about his scores, so for the moment he does not want to do anything that might, for whatever reason, no matter how unlikely, might create a problem with them. :-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:

@Gmood1 wrote:Sigh..lol

You can have a very small reoccurring charge on the Cap One and be just fine OP. There's no minimum amount needed to keep limits. The goal is keeping it active.

I've put a $2 to $3 monthly charge on my Cap one set to autopay for over 3 years now. The limit is still the same as it was when I set up the reoccurring bill.

Have you been charging so little for a long time? A few of us were caught up in CLD action by Cap One for having high limits and low spend (NOT no spend), seems that you missed out! I went from $35k to $10K even though I was spending in the low hundreds a year

@Anonymous

In the last four years, I've spent maybe $250 to $300 total, using the Quicksilver card.

My Walmart MC was taken over by CO late last year. That card gets $600 to $800 a month in spend.

They even have me a $1000 CLI on it back in January of this year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

In other news, I found the upgrade link in another thread, checked and it offers him Venture One, Venture, and QuickSilver. Is there any reason at all not to upgrade right now (he would take the QuickSilver)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Minimum usage to keep Chase and CapOne happy?

@Anonymous wrote:In other news, I found the upgrade link in another thread, checked and it offers him Venture One, Venture, and QuickSilver. Is there any reason at all not to upgrade right now (he would take the QuickSilver)?

There's no reason to keep a CO Plat if you can upgrade it to a rewards-earning card.