- myFICO® Forums

- Types of Credit

- Credit Cards

- New credit cards from Ally Bank

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New credit cards from Ally Bank

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New credit cards from Ally Bank

Ally Bank has always had a gap when it comes to credit cards. Way back in 2016, they had a co-brand card with TD Bank, but that folded after a few years. During the pandemic, they planned to acquire CardWorks (owner of Merrick Bank), but that fell through.

Then at the tail end of last year, Ally acquired Fair Square, the issuer of Ollo credit cards. The Ollo cards are invitation only, and aimed at the subprime market. Most notably, at least from our perspective, their card lineup included one of the "unicorn" cards, the Ollo Optimum. Many rebuilders pined for an invitation which would net them 2.5% cashback on everything.

A lot of us were wondering what this acquisition would mean, and we appear to have a partial answer. Ally has 4 new credit cards:

- Ally Platinum MasterCard: A credit builder card, with no rewards but access to a FICO score (unsure which), and a promise of regular CLI reviews

- Ally Everyday Rewards MasterCard: 3% back on gas, groceries, and drugstores

- Ally Unlimited Rewards MasterCard: A 2% back on everything card

- Ally Unlimited Rewards MasterCard for Nurses and Educators: Seems identical to the basic Unlimited card, except with a choice of two short logos

While all the cards are linked from Ally's home page, there doesn't seem to be a big announcement, and they're all invitation only, so this appears to be a soft rollout.

They all have a very similar, minimalistic appearance, with only the word "Ally", the chip, the MasterCard logo, and the tap-to-pay symbol on the front (plus "Educators Inspire" or "Nurses Care" for their fourth card). The cards are monocolor or subtly gradiated purple (Platinum), gray (Everyday), or black (Unlimited). I think they're quite attractive.They're not using the Ollo branding.

Most basic features seem identical across all their cards, with no earnings caps, no redemption minimums, and the rewards don't expire. They also have no fees for returned payments, no fees for going over their limits, and no rake hikes after a missed payment. This seems to be generally in line with Ally Bank's philosophy of no or minimal fees.

Some basic information is missing, with no mention of annual fees, late payment fees, foreign transaction fees, APR ranges, SUBs, and so on. Though they've apparently partnered with Bankrate, because invitations are available though their CardMatch program, and they published two articles (article one, article two) with some additional details. (Note the articles contradict each other, in some minor details.) According to BR, all the cards have no FTF (or only the Platinum), offer a CLI review after 6 months (or only the Platinum, after 5 on-time payments), the only method of redemption is statement credit, they have an APR of 28.99% (or 17.99% to 28.99%), and they may offer a 0% APR for 15 months SUB in the future. The Platinum is aimed at those with fair to good credit, and has no AF, though there are fees for BTs and cash advances. There are two different versions of the Everyday, one with no AF and one with a $39 AF. The Unlimited card is "reserved for Ally customers with high credit scores", and weirdly promotes an ability to freeze your card as if that was some premium feature.

Overall, my impression is that Ally isn't trying to outcompete with the big issuers with benefits. Instead, they're aiming to provide simple no-fuss and low-fee cards with decent if not groundbreaking rewards. Their cards range all the way from subprime to superprime, so they're trying to have cards for everyone. There's nothing there to appeal to optimizers, but they might be useful for rebuilders or those new to credit -- we'll have to see how they are with account reviews, CLIs, and generally providing a ladder up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

Nice write-up, thanks @Anonymalous

5% CB rotating:

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

Having a card for teachers and nurses is smart because even if the economy gets really bad teachers and nurses should still be able to find jobs. Plus many are in unions which can also help provide a little more job stability.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

I received a pre-approved offer for their Unlimited Cash Back Mastercard today. I usually toss offers in the trash but I saw the name and decided to open the envelope then I found this tread while doing research. It seems like a decent card. My BK DC was 4 1/2 months ago. Scores are in the mid-upper 600s so I doubt the SL limit will be impressive. I planned to be in the garden until June so this might end up in the circular file. I have five weeks to think about it though.

Does anyone know which CB they pull from?

TD Cash Card - $7500 / Capital One Savor - $7500 / Apple Card - $6500 / Mercury - $5000 / Capital One QuickSiver - $5000 / Ally Master Card - $4300 / DCU Visa - $3000

$38,800

DCU Auto Loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

@masscredit wrote:I received a pre-approved offer for their Unlimited Cash Back Mastercard today. I usually toss offers in the trash but I saw the name and decided to open the envelope then I found this tread while doing research. It seems like a decent card. My BK DC was 4 1/2 months ago. Scores are in the mid-upper 600s so I doubt the SL limit will be impressive. I planned to be in the garden until June so this might end up in the circular file. I have five weeks to think about it though.

Does anyone know which CB they pull from?

Interesting, that's the card that Bankrate said was for people with excellent credit scores. Do have you an existing relationship with Ally? In any case, your getting the mailer does strongly suggest that they're targeting people who are working on their credit.

I'd guess they probably inherit many of their underwriting practices from Ollo, but unfortunately Ollo isn't on the master list of which report will be pulled. Searching around the Approvals board, there's at least two reports of an EX/TU double pull ([1] [2]). But we can't be sure. If you take the plunge, definitely let us know!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

@Anonymalous wrote:

Interesting, that's the card that Bankrate said was for people with excellent credit scores. Do have you an existing relationship with Ally? In any case, your getting the mailer does strongly suggest that they're targeting people who are working on their credit.

I'd guess they probably inherit many of their underwriting practices from Ollo, but unfortunately Ollo isn't on the master list of which report will be pulled. Searching around the Approvals board, there's at least two reports of an EX/TU double pull ([1] [2]). But we can't be sure. If you take the plunge, definitely let us know!

My EX/TU scores are 647/652. I did some more research last night and throughly read everything that came with the offer. It says they can retract the offer if scores or info on the reports change in a negative way from what it was when it was sent out. Mine has remained the same. It does note that the lowest limit a person would receive is $300. That's my concern. My limits are currently in the $3000-$6500 range (secured) so I rather not throw a low limit into the mix. These cards are new so no history on how they grow.

TD Cash Card - $7500 / Capital One Savor - $7500 / Apple Card - $6500 / Mercury - $5000 / Capital One QuickSiver - $5000 / Ally Master Card - $4300 / DCU Visa - $3000

$38,800

DCU Auto Loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

Sounds like you talked yourself out of it, @masscredit. I generally agree that given your scores, a high SL is probably not in the cards. And while we can hope that Ally will be generous with CLIs, that's wishful thinking at this point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

@Anonymalous wrote:Sounds like you talked yourself out of it, @masscredit. I generally agree that given your scores, a high SL is probably not in the cards. And while we can hope that Ally will be generous with CLIs, that's wishful thinking at this point.

I'm a "maybe". I won't mind an inquiry on one of those reports but don't want to take one for $300. I'd be happy with $3K. Hopefully other members here take advantage of this offer and post their results.

TD Cash Card - $7500 / Capital One Savor - $7500 / Apple Card - $6500 / Mercury - $5000 / Capital One QuickSiver - $5000 / Ally Master Card - $4300 / DCU Visa - $3000

$38,800

DCU Auto Loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

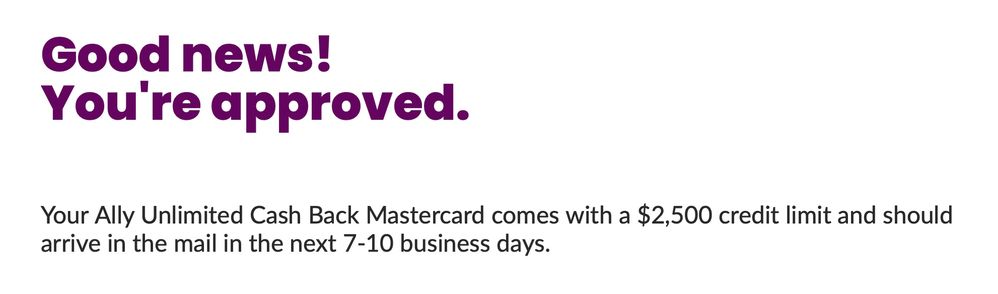

Well... I fell out of the garden earlier when I applied and was approved for a Cap 1 Savor One card so I figured I'd take one for the team and check out the pre-approval for Ally. My current scores are EQ - 685, TU - 652 and EX - 647. Utilization is at 1%.

This is what I was rewarded with -

TD Cash Card - $7500 / Capital One Savor - $7500 / Apple Card - $6500 / Mercury - $5000 / Capital One QuickSiver - $5000 / Ally Master Card - $4300 / DCU Visa - $3000

$38,800

DCU Auto Loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New credit cards from Ally Bank

I just checked my alerts. There is an inquiry fron Ally on my TU and EX reports.

TD Cash Card - $7500 / Capital One Savor - $7500 / Apple Card - $6500 / Mercury - $5000 / Capital One QuickSiver - $5000 / Ally Master Card - $4300 / DCU Visa - $3000

$38,800

DCU Auto Loan