- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: New member, some questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New member, some questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

Thanks for the advice.

One more thing I did, earlier in the week I opened a bank account with Logix CU. SInce they did a hard pull in order to open the checking account I asked them to apply that towards refinancing my auto loan and seeing if I qualified for their credit card as well. I was told I qualify for 8.5% on the auto loan, of which I currently pay 12.9, and 14.99 on the card which would be my lowest rate. I am supposed to speak to a loan officer on monday about those things.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

@dize wrote:Thanks, Im currently working on that with all of my derogs. Ultimately, the cards that suit my life best, and I would hope to get, are the hyatt or hilton cards, the total rewards visa,and the amazon visa. How far off do you think I am on those? I can probably have my util down to 20% or lower next month.

Im debating on a 76 gas card as I get all of my gas from there, but I currently pay cash. Since using credit is 10 cents a gallon more it only makes sense to use credit If I have their card. Other than that I would like an Amex one day, but I'm in no rush for that.

The 76 card gives 5 cents a gallon, ignoring the short term 10 cents benefit. Thats actually pretty poor, as there are several cards that give 5% cash back at any gas station, and with gas prices they way they are, 5% is a lot more than 5 cents a gallon...

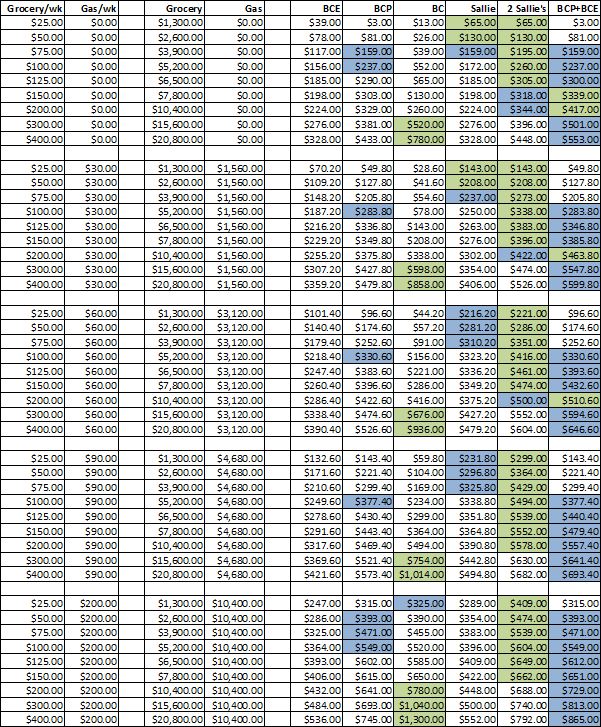

Consider the Sallie Mae rewards mastercard (when you get your utilization down): 5% on Grocery stores capped at $250/month, 5% at Gas Stations capped at $250/month, and 5% at Book Stores (like Amazon.com purchases) capped at $750/month. https://www.salliemae.com/credit-cards/sallie-mae-card/

Here is a comparison based only on Grocery and Gas station spending:

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

Actually, doing the math the 5% remains to be better unless gas drops below 3$ a gallon, and I'm not limited to one gas station. Though, being limited to the first $250 spent on gas, and then 1% after that. I spend 600-1000 a month on gas depending how busy I am. Doing the math I am currently paying 4.25 a gallon on gas. so for the first 58 gallons or so I will be paying 4.03 a gallon, and for the next 80 or so gallons I will be spending 4.20. so In total I will be spending $570, and thats on a $600 month. With the 5 cent savings from the 76 card I would end up spending about $565 on the same amount of gas. Reason being is that the gas stations lately charge 10 cents extra for credit, unless it's their own credit card. So I would be getting rewards on 4.25 rather than paying a flat 4.10.

It might actually be beneficiel to use it for the first 250 then go cash after that though.

Are there any other cards that don't cap the 5% off on such a low dollar amount?

Thanks. I appreciate the suggestion.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

And I'm sorry, I don't exactly understand the chart. What does each collumn represent? thanks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

Each column represents the amount in savings you'd make per the amount of category spending.

Gardening since 7/16/14

Current: EQ 711 7/13/14; EX 724 TU 721 6/19/14

Goal: 760+

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

I understand now, thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

@dize wrote:Actually, doing the math the 5% remains to be better unless gas drops below 3$ a gallon, and I'm not limited to one gas station. Though, being limited to the first $250 spent on gas, and then 1% after that. I spend 600-1000 a month on gas depending how busy I am. Doing the math I am currently paying 4.25 a gallon on gas. so for the first 58 gallons or so I will be paying 4.03 a gallon, and for the next 80 or so gallons I will be spending 4.20. so In total I will be spending $570, and thats on a $600 month. With the 5 cent savings from the 76 card I would end up spending about $565 on the same amount of gas. Reason being is that the gas stations lately charge 10 cents extra for credit, unless it's their own credit card. So I would be getting rewards on 4.25 rather than paying a flat 4.10.

It might actually be beneficiel to use it for the first 250 then go cash after that though.

Are there any other cards that don't cap the 5% off on such a low dollar amount?

Thanks. I appreciate the suggestion.

Thats a lot of gasoline each month. Personally, I last purchased gasoline over 15 years ago ![]() But I do buy a lot of walking shoes and socks...

But I do buy a lot of walking shoes and socks...

So, you should glance at this big list of cards, arranged by best cards in various categories. Just scroll down to the Gas section; http://boardingarea.com/frequentmiler/2012/11/09/best-category-bonuses/comment-page-3/#comment-39437...

So, from the list you may want to see if you qualify to become a member of Fort Knox Federal Credit Union. Also Penfed has some cards that can give 5% cash back if used in an automated gas pump, I don't know why they were moved down to the 3% section on that list.

The business version of the Costco American Express gives 4% on Gas Stations on the first $7000 per year. So thats a reasonable supplimental card.

Offhand, I know the Chase AARP VISA Signature card (there are 2 versions, choose the Gas & Restauarant one) is uncapped 3% cash back at Gas Stations and Restaurants. Its not the highest cash back percentage, but the uncapped feature would really simplify things. I hear you can apply without joining AARP, just leave the field blank where the application asks for your AARP membership number. https://creditcards.chase.com/aarp/cardmember

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

@Themanwhocan wrote:

Penfed has some cards that can give 5% cash back if used in an automated gas pump, I don't know why they were moved down to the 3% section on that list.

There was a period when Penfed were changing the planned reward structure almost every week. So currently you get 3% on the Cash Rewards (and an annual fee) if you don't also have a "qualifying product". If you do, you get 5% and no AF. (And the qualifying product can be a very small deposit in a money market account, it turns out). But the Penfed Plat Rewards Sig gives 5 points (worth about 4.5%) without any qualification, so that should be listed as a 5x card (sort of!)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

Thanks, I saw the fort knox one last night, but I ahd never heard of that CU being talked about so I wasn't sure how good it was. As long as gas stays above $4, though, anything that is a consistent 3% would save me money or the 76 card and give me the option of going to shell or chevron as well.

How would I go about getting a business card? I am technically self employed (sales contractor), so I am considering opening up a business and running my sales through that, as well as all of my business expenses, to make taxes easier. Maybe that would make a business card a possibility?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New member, some questions

@dize wrote:Thanks, I saw the fort knox one last night, but I ahd never heard of that CU being talked about so I wasn't sure how good it was. As long as gas stays above $4, though, anything that is a consistent 3% would save me money or the 76 card and give me the option of going to shell or chevron as well.

How would I go about getting a business card? I am technically self employed (sales contractor), so I am considering opening up a business and running my sales through that, as well as all of my business expenses, to make taxes easier. Maybe that would make a business card a possibility?

There is a business credit section here on Myfico, i'm sure they could help. And of course the Small Business Administration sba.gov

Basically it sounds like you are already a business. A Sole Proprietorship.

TU-8: 804 EX-8: 805 EQ-8: 788 EX-98: 767 EQ-04: 752

TU-9 Bankcard: 837 EQ-9: 823 EX-9 Bankcard: 837

Total $443,800