- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Strategy to get to 21 cards...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Strategy to get to 21 cards...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Remedios wrote:What's special about 21 cards?

Have you been hanging out at Credit Karma or something?

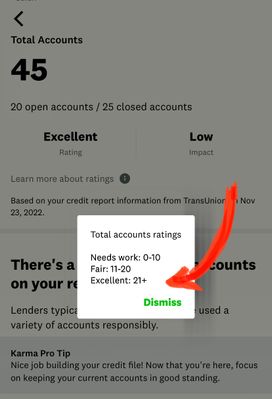

I believe so. Screen Shot from Credit Karma - Total Accounts metric.

It's true that there is nothing magical about 21 accounts for FICO scoring, @dytch2220. If anything, this might be a minor consideration for the Vantage Score used by Credit Karma but not by most lenders. And note the impact is "Low." And of course, Credit Karma wants to see members add more cards to get the click-bait referral fees, so they want you to apply!

Good advice here to grow your cards and don't worry about getting to 21+. ![]()

*You'll also note on my screen shot that closed (but reporting) acccounts are included in that metric.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$898K

Top Lender TCL - Chase 156.4 - BofA 99.7 - AMEX 95.0 - CITI 94.5 - NFCU 80.0

AoOA > 30 years (Jun 1993); AoYA (Feb 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

Yea @dytch2220 , nothing special about 21 accounts. 7 is more than enough. Ignore CK's recommendations or whatever.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

To many of you that gave valuable and respectful input, thank you.

For those of you that gave scolding responses or tried to make me feel stupid for asking questions towards what I thought was a legitimate aim, shame on you. Is this not a place to be mentored?

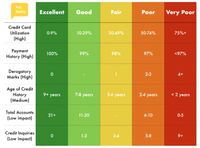

The root source of the information may well be Credit Karma, however, I got it from a YouTube channel called "Ask Sebby". See chart below.

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@SouthJamaica wrote:

@dytch2220 wrote:What is the best strategy for getting to the magic #21 cards. I have 7 currently and am still in the late stages of repair before I will have "good" credit so I can start applying for cards I really want to keep. I'm looking for the most efficient without hindering my ability to get increases or impacting my credit scores unduly.

If you dont' mind sharing, would also like suggestions of cards I should apply for from good through excellent. I'm mainly looking for cash back and/or no annual fee type cards. I do have accounts with USAA and PenFed, but no credit lines as of yet.

The best thing you can do is to NOT apply for so many cards. I don't know why you think 21 is a magic number.

Thank you for the reply. Considering your signature shows that you have 33 revolving lines of credit, how/why did you acquire so many? Why was this the magic number for you, and why should I avoid doing the same?

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@simplynoir wrote:I'm failing to understand why you want to apply for more cards right now. You state you're still in the credit repair stage of your rebuild and from what I can see in your signature with perhaps the exception of your Capital One Platinum have good cards to use right now. I wouldn't even consider anything right now and even when clean be slow and methodical with lenders possibly tightening their belts

I didn't say that I'm applying for cards right now. I said as you mentioned that I'm in the late stages of my repair where I will soon be able to begin applying for cards that I want. I'm trying to come up with a strategy ahead of that.

The CapOne Platinum card sucks. It was the secured card that eventually graduated to unsecured, however, it is ineligible for CLI or product change. I haven't closed it yet because it's my oldest.

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@dytch2220 I think where the misconception comes into play (with interpretation of that chart, for instance) is this: Those numbers referenced are what the "average highest achievers" in each rating category maintain. It does NOT mean that in order to have an excellent rating in credit mix, you have to have 21 cards. That chart, and the corresponding VantageScore 3 "explainers", simply indicates the average high acheiver with excellent rating has an average credit age of 9.5 years and has 21+ accounts, which by the way includes any student loans, installment loans, lines of credit, auto loans, mortgages, in addition to any store or bank issued credit card accounts. These 21+ accounts are normally acquired organically, as/when needed, over that average 9.5 yr time span.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Who_wuda_thought wrote:@dytch2220 I think where the misconception comes into play (with interpretation of that chart, for instance) is this: Those numbers referenced are what the "average highest achievers" in each rating category maintain. It does NOT mean that in order to have an excellent rating in credit mix, you have to have 21 cards. That chart, and the corresponding VantageScore 3 "explainers", simply indicates the average high acheiver with excellent rating has an average credit age of 9.5 years and has 21+ accounts, which by the way includes any student loans, installment loans, lines of credit, auto loans, mortgages, in addition to any store or bank issued credit card accounts. These 21+ accounts are normally acquired organically, as/when needed, over that average 9.5 yr time span.

Thank you, that was helpful.

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@dytch2220 wrote:

@SouthJamaica wrote:

@dytch2220 wrote:What is the best strategy for getting to the magic #21 cards. I have 7 currently and am still in the late stages of repair before I will have "good" credit so I can start applying for cards I really want to keep. I'm looking for the most efficient without hindering my ability to get increases or impacting my credit scores unduly.

If you dont' mind sharing, would also like suggestions of cards I should apply for from good through excellent. I'm mainly looking for cash back and/or no annual fee type cards. I do have accounts with USAA and PenFed, but no credit lines as of yet.

The best thing you can do is to NOT apply for so many cards. I don't know why you think 21 is a magic number.

Thank you for the reply. Considering your signature shows that you have 33 revolving lines of credit, how/why did you acquire so many? Why was this the magic number for you, and why should I avoid doing the same?

I'm not SJ, but I think the point is that all/most of those cards was obtained for some reason (i.e. SJ wanted THAT card for some feature it had) rather than trying to get to 21

FWIW: probably should be reiterated here that a (near) perfect score can be had with just 3 cards. If you can PIF all the time, probably easier to handle a much smaller set of cards to achieve a good result

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@dytch2220 wrote:To many of you that gave valuable and respectful input, thank you.

For those of you that gave scolding responses or tried to make me feel stupid for asking questions towards what I thought was a legitimate aim, shame on you. Is this not a place to be mentored?

The root source of the information may well be Credit Karma, however, I got it from a YouTube channel called "Ask Sebby". See chart below.

Take note....the average high preformer in this chart shows 0 inqueries in the last 12 months. This, along with his 9+ year credit history, no derogetory data, 100% payment on time, and under 1% utilization have more to do with the high score than the number of cards. Adding cards will make it take longer to get high scores, but will in fact make those scores easier to maintain. I have 27 cards, and adding another does very little to my score now. Adding one card when I only had 3 cards created a much larger hit. It has a lot to do with the AAoA, plus of course inqueries. Adding a new card with 0 aging now barely affects my AAoA, because it is averaged with all those well aged cards. My cards have been attained gradually over about 15 years or more. Having that many cards, does now mean I can practically ignore the statement date as far as trying to limit utilization. I pay all cards in full, but my total credit limits are over 250,000, so 2500 bucks reporting is under 1%. The main question is, does the OP want quick results that are difficult, if not impossible to maintain? Or, does he want a long wait that will create a credit profile that is very resilient, without causing huge drops while getting there? IMHO, there are much quicker ways to 800+ scores than the methodical path I chose, but I have not heard of any that others that are as sustainable.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@dytch2220 Most folks are more concerned with FICO scoring rather than Vantage Scores. I fall into that category. One thing I have found particularly helpful, as somewhat of a "what if" guide, is myFICO"s free FICO score estimator. I think it is based on FICO SCORE 8.

I have input hypothetical parameters, changing them up here and there, to approximate what score range might be possible in various scenarios. Generally, it appears that DP's presented here in the forums indicate the estimator is likely fairly accurate, given if selectable variables fit. To get into the 800+ (Exceptional) on the estimator, one would need an oldest account of at least 5 years of age, either loan/mortgage and/or credit card. But the estimator's max selectable option for number of credit cards is "5+", so I don't know how having a good number more than that may or may not offset the 5-yr minimum oldest account age (to reach/exceed 800+ score). I kind of lean towards not, as I think they would have included more variables if applicable.