- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: Strategy to get to 21 cards...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Strategy to get to 21 cards...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 55k

Total utilization above 50 pct.

Ficos ,most are slightly above 700, the 9's slightly higher than the 8's

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

When I was in rebuild mode I took this route, more or less. My first CC after my Chapter 13 discharge was a secured CapOne Platinum; I learned to hate the card as the maximum $1,000 credit limit was insufficient for my monthly spend; I closed it after less than 7 weeks. I figured CapOne would return the hate for me closing the card so soon after opening it, however, almost exactly six months to the day after I closed the Platinum they sent me a "Pre-Approved" application for an unsecured Quicksilver card; I took the bait and have been using it ever since.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Horseshoez wrote:

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

When I was in rebuild mode I took this route, more or less. My first CC after my Chapter 13 discharge was a secured CapOne Platinum; I learned to hate the card as the maximum $1,000 credit limit was insufficient for my monthly spend; I closed it after less than 7 weeks. I figured CapOne would return the hate for me closing the card so soon after opening it, however, almost exactly six months to the day after I closed the Platinum they sent me a "Pre-Approved" applicaiton for an unsecured Quicksilver card; I took the bait and have been using it ever since.

What's your limit on that QS card now?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Herb8108 wrote:

@Horseshoez wrote:

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

When I was in rebuild mode I took this route, more or less. My first CC after my Chapter 13 discharge was a secured CapOne Platinum; I learned to hate the card as the maximum $1,000 credit limit was insufficient for my monthly spend; I closed it after less than 7 weeks. I figured CapOne would return the hate for me closing the card so soon after opening it, however, almost exactly six months to the day after I closed the Platinum they sent me a "Pre-Approved" applicaiton for an unsecured Quicksilver card; I took the bait and have been using it ever since.

What's your limit on that QS card now?

I assume you are asking me?

My card started out in may 2021 as an unsecured 300 sl platinum, now its a 5000 cl Quicksilver.

At 5 months i pc'd my plat to QS, a few days later i got an automatic cli to 1800. 6 months later i requested a cli and they gave me 200 so my cl was 2000.

This month they gave me an automatic cli to 5000 cl

>/ nfcu platinum 15k, BABY NEEDS NEW SHOES !!!!!

closed-- reflex, applied bank, first digital, mission lane, ikea, fingerhut, big lots, valero gasoline, ollo, more to come

Rebuilding since September 2020

who i burned - chase, cap 1, TD bank, Sync, were the biggies

Income 55k

Total utilization above 50 pct.

Ficos ,most are slightly above 700, the 9's slightly higher than the 8's

TCL - about 110k

Retired since 2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@SUPERSQUID wrote:

@Herb8108 wrote:

@Horseshoez wrote:

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

When I was in rebuild mode I took this route, more or less. My first CC after my Chapter 13 discharge was a secured CapOne Platinum; I learned to hate the card as the maximum $1,000 credit limit was insufficient for my monthly spend; I closed it after less than 7 weeks. I figured CapOne would return the hate for me closing the card so soon after opening it, however, almost exactly six months to the day after I closed the Platinum they sent me a "Pre-Approved" applicaiton for an unsecured Quicksilver card; I took the bait and have been using it ever since.

What's your limit on that QS card now?I assume you are asking me?

My card started out in may 2021 as an unsecured 300 sl platinum, now its a 5000 cl Quicksilver.

At 5 months i pc'd my plat to QS, a few days later i got an automatic cli to 1800. 6 months later i requested a cli and they gave me 200 so my cl was 2000.

This month they gave me an automatic cli to 5000 cl

That's good I can't get nothing from them and it's been 7 years

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Herb8108 wrote:

@Horseshoez wrote:

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

When I was in rebuild mode I took this route, more or less. My first CC after my Chapter 13 discharge was a secured CapOne Platinum; I learned to hate the card as the maximum $1,000 credit limit was insufficient for my monthly spend; I closed it after less than 7 weeks. I figured CapOne would return the hate for me closing the card so soon after opening it, however, almost exactly six months to the day after I closed the Platinum they sent me a "Pre-Approved" applicaiton for an unsecured Quicksilver card; I took the bait and have been using it ever since.

What's your limit on that QS card now?

I opened the card in December of 2020 with a $3,000 limit; it got bumped the obligatory $300 about six months later. I left it alone until mid-summer 2022 when I requested a CLI and was grated a new limit of $4,800.

Chapter 13:

- Burned: AMEX, Chase, Citi, Wells Fargo, and South County Bank (now Bank of Southern California)

- Filed: 26-Feb-2015

- MoC: 01-Mar-2015

- 1st Payment (posted): 23-Mar-2015

- Last Payment (posted): 07-Feb-2020

- Discharged: 04-Mar-2020

- Closed: 23-Jun-2020

I categorically refuse to do AZEO!

In the proverbial sock drawer:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@SUPERSQUID wrote:

@Herb8108 wrote:I'm in the same boat as you I have the platinum card from capital one but it's a secured card and mines never graduated to an unsecured card so I've been stuck with it for about 6-7 years. Granted I'm still rebuilding as well capital one just doesn't seem to offer me any advantages I never get any increases they never upgraded my card to a regular account, and it's also my oldest card I got it when I started my rebuild

If you have had that secured platinum more than 6 months pay a visit to the capital one prequalify page, they might offer you another card unsecured, ymmv. its not a hard pull to check.

My situation is a little different, but I feel your pain. I applied for the Plat on 6/2019 and was approved for a $200 limit with a $99 deposit. On 1/2020 I received an auto CLI to $500. I'm not 100% sure when it was graduated to unsecured but it was long ago. Since then I've been unable to get a limit increase and the same goes for a product change. I've tried calling by phone and using the Cap1 PC link. I'm still holding out for them to relent on this, they helped me out when my credit was in bad shape and I'm loyal. If nothing else, sock drawer for the oldest account.

I applied for the QS card back in 11/2020 after getting frustrated with the lack of progress on the Plat, it was approved for a $500 CL. A few days ago I requested CLI and got $600. I have been in repair mode the whole time and I really should have waited to make this request because my scores were still depressed by an unexpected medical collection account that has since been removed and by high revolving utilization (88%) which has also since been paid down to under 20% both overall and individually, but not yet reported. I only did the Cap1 CLI because I got a wild hair and took a shot at a CLI on my Discover, becoming emboldened by the huge increase from $1300 > $4500.

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Remedios wrote:

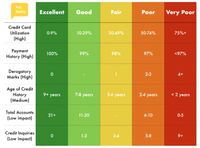

@dytch2220 wrote:The root source of the information may well be Credit Karma, however, I got it from a YouTube channel called "Ask Sebby". See chart below.

As far as Sebby goes, he's like those people on Ancient Aliens, he doesn't believe 💩 he's saying but he's getting paid to say it.

I'm asking this to anyone including Remedios, because a few have commented about Sebby.

It sounds like the chart is not inaccurate, from what some have said, but easy to misinterpret because it is a representation of what people in that score range tend to have and not what one needs to have. Is this right?

Putting the chart aside and acknowledging the concerns about his bias due to being sponsored, are there any threads that go into examples of what he is saying that's wrong? I watch his channel casually but enjoy it. I'd like to get some facts about falsehoods he is perpetuating before I start changing my opinion on the guy.

Revolving Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Strategy to get to 21 cards...

@Remedios wrote:You didn't get scolded by anyone, but you sure did some scolding of your own.

I don't want to get into the weeds on this because the thread has moved beyond it. While I don't agree with all of what you said, I can admit I over-reacted out of emotion in making that post.

Revolving Accounts