- myFICO® Forums

- Types of Credit

- Credit Cards

- Tips for triggering auto CLI Chase Freedom?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Tips for triggering auto CLI Chase Freedom?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tips for triggering auto CLI Chase Freedom?

Is there anything that I can do that might help trigger a CLI? I don't mind carrying a balance or raising my utilization since I still have 3 months of 0% APR left and I responsibly budget all of my purchases.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tips for triggering auto CLI Chase Freedom?

Are there any other personal Chase cards you like? Sometimes it can be better to get a new card and reallocate some CL than to apply for a HP CLI or hope for an automatic one.

I've had Freedom for nearly 6 years and have never gotten an auto CLI. I did take a HP for one around month 8 ($600 to $2k) and started getting several other Chase cards from months 14 to 24, reallocating some CL to Freedom at maybe month 20.

Now that my total Chase credit is around $45k, I don't exactly expect auto CLIs!

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Tips for triggering auto CLI Chase Freedom?

Your guess is as good as mine. I have frequent usage and plenty of cycles where my UTI is over 80%(although I don't let it report). Off the top of my head I don't know how many years that I have been with Chase but I have never received an auto CLI on anything. My Freedom is my last card remaining with them and I have been debating closing it for a long time but my yearly return is quite nice.

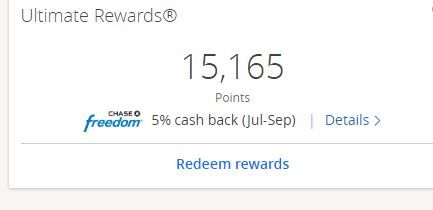

I typically cash in my rewards at the end of the year. I've capped the gas category in Q1, groceries from Q2, and will cap the gas again from this quarter. So I'm on pace to get the $75 per quarter for the 5%. The return is the only reason that I haven't closed it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How long before Chase auto CLI ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How long before Chase auto CLI ?

Auto CLI + Chase = sometimesif you reall

It's never a given that it will actually happen. If you're consistently hitting close to your limit there's a chance it will happen but, if you really need a higher CL then you're going to take the HP for either a CLI or a new account.

With a 1K/2300CL I'm guessing you were in the mid 6's for a score at the time of approval?

Has your score went up dramatically since the approval?

Have you opened additional cards since the approval?

What does your UTIL look llike with Chase and other lenders?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How long before Chase auto CLI ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How long before Chase auto CLI ?

It sounds to me like your spend/payment pattern will eventually stimulate an auto-CLI from Chase. Nothing you can really do (outside of taking a HP) to make it happen any faster, so just continue using your cards naturally and wait it out. They should come though, as it would be a win-win for you and Chase.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How long before Chase auto CLI ?

@Anonymous wrote:

Yeah my scores were 690’s and now it’s sitting around 740 I have opened many cards after my chase freedom and freedom unlimited I would say about 5. My chase cards I would usually have around 80% utilization and then pay in full I just don’t like being so close to my credit limit especially if I have to spend big one month.

IMHO, since both Chase cards are <1yo and you’ve opened 5 more, your likelihood of getting an auto CLI is close to nil. This is just my 2 cents.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How long before Chase auto CLI ?

Could go either way.. I know I will never get one on any of my chase cards as I only use about 5% of any of my giving CL's on my cards, granted chase usually throws huge approvals at you if you income/profile support it and most will never come close to utilizing even 25% of their limits unless they are lower end like yours and at 690 approval surprising enough that really isnt a bad score for chase as alot more goes into what chase will approve you for than score such as income/utilization/do you own a house, etc, etc.

So long story short chase will give some auto CLI's although it is nothing like say discover where you can ask for one by SP CLI ever month or every 3 months. you can take a HP eventually for one if you dont see one in a few months or wait it out for something that might or might not happen. Have had my cards over 4+ years and never seen a dime, but I have a 30k csr which I use about 1-2k a month on a freedom that i use about 200-300 a month on a 5k limit and a 6k IHG card that is a card that I only use for a free night yearly and might or might not put my stay on it so I expect notta from them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How long before Chase auto CLI ?

I remember when I got my first Chase card (Amazon Prime Visa), and the banker said pay it off in full every month for 6mths...I did just that (using it regularly of course) and at month 6 I got an auto-CLI. I know it won't work for everyone like that but I hopefully it provides a little insight...