- myFICO® Forums

- Types of Credit

- Credit Cards

- Walmart MC upgrade question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Walmart MC upgrade question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

@Anonymous wrote:

@Anonymous wrote:

Outside of credit card message boards who would consider an upgrade a bad thing? Only people out here. No pointing any fingers (point myself too) but if your profile can't take a hit of one card maybe you should have not applied for the other five last year.It does not matter whether it is a "good thing" or a "bad thing". it does not matter what Walmart calls it. What matters, according to the law, is that the prerogative of it happening lies with the consumer. If Walmart (Synchrony Bank) cannot follow the law, maybe they should not be issuing credit cards.

There are situations where a 'hit' for a single card can be a really big deal... like somebody getting ready to close on a mortgage.

Granted, a new account appearing can (usually) be explained away, but if the score 'ding' due to the AAoA change puts the mortgagor into a different bucket it can cost real money.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

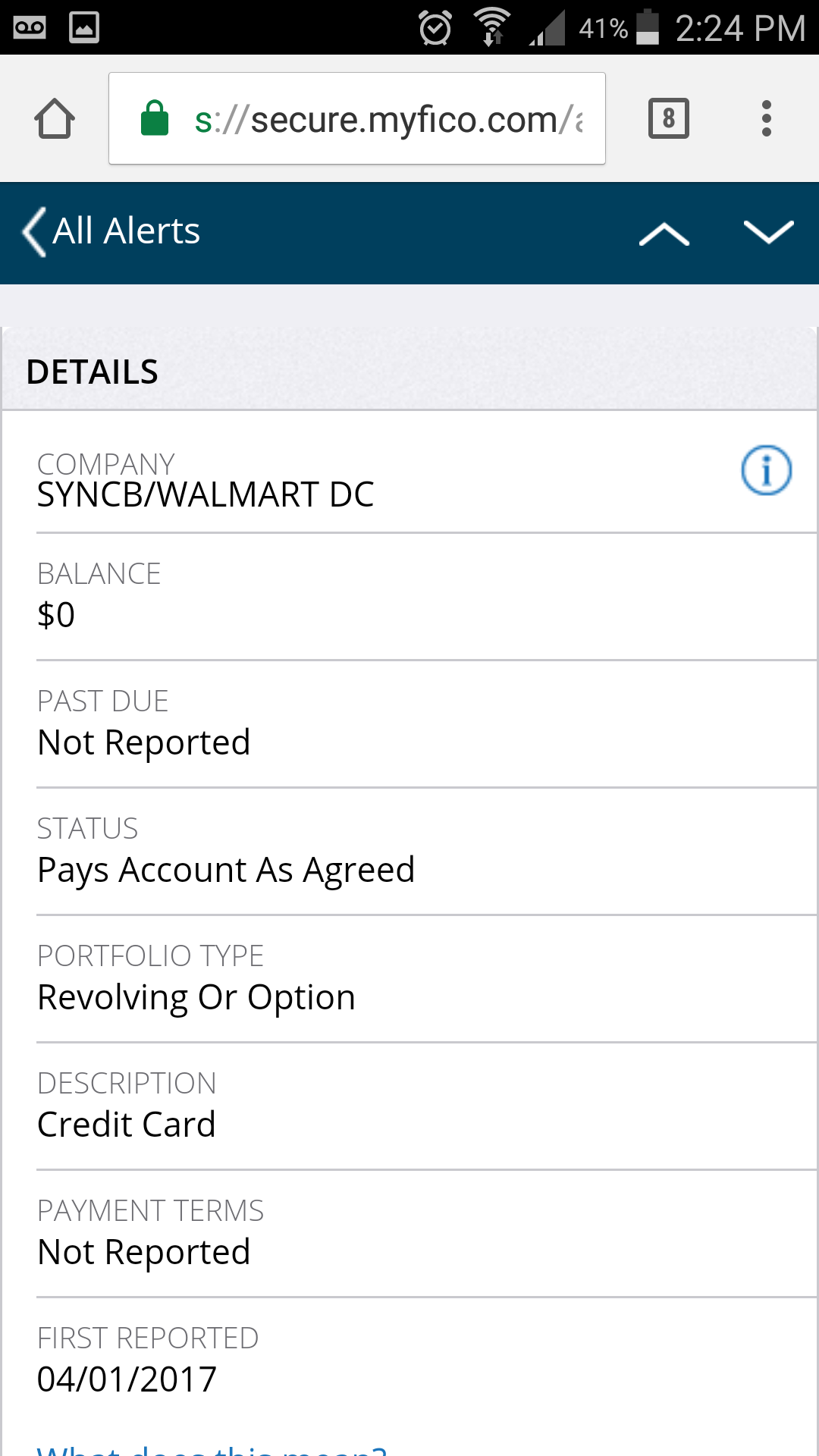

For those who are questioning if the upgrade will be a new account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

@Anonymous wrote:

I have a dumb carrier too... IDIOTS ABOUND!!!!

Yeah mine puts my mail in other peoples boxes all the time and I get other peoples mail. With 3 new cards on the way I have been really anxious.

Remember this upgrade is really a new account, new starting date and the rewards are the same for the store card except the MC rewards which are just the same you can get from any basic rewards card in your wallet. (Except maybe the PayPal MC which I think is really .75% cash equivalent for regular spend.)

Always follow these rules: Only take a HP for a new account. Always use the best rewards card for that reward category. Don't close a card unless you know you really should. Never use more than 35% of a credit limit. Recon as much and as best you can. Use the introductory period to the best advantage. Get the signup bonus. Whenever possible PIF or balance transfer so you pay less in interest. Never give an excellent rating when it is actually the norm. Always look for a discount as more is always better.

Always accept candy from strangers because they have the best candy or from people you know have good candy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

@Anonymous wrote:

When you move from one state to another state and get a new driver's license it's really easy for insurance to mess up and show you have no driving history. Now, that is **bleep**. 2000 ford focus 223 a month until she fixed it.

Outside of credit card message boards who would consider an upgrade a bad thing? Only people out here. No pointing any fingers (point myself too) but if your profile can't take a hit of one card maybe you should have not applied for the other five last year.

I don't consider upgrades a bad thing. I do consider an upgrade with hidden rules to be a bad thing. I'd be happy with the upgrade if it didn't hurt my AAoA. I'd be happy with a new account for which I chose the ding for. I see this as underhanded and not forward, open, or upright to the customers. When you disclose in simple, direct, and openly the results of what will happen then that is a good thing. When you hide the facts and even tell lies as they do, then it is not a good thing. Call them three times and see what they tell about what will happen to your account starting date. If all three representatives can't quickly tell you the real truth, then you know if there is anything nefarious or underhanded going on.

It is by will alone I set my mind in motion.....

Always follow these rules: Only take a HP for a new account. Always use the best rewards card for that reward category. Don't close a card unless you know you really should. Never use more than 35% of a credit limit. Recon as much and as best you can. Use the introductory period to the best advantage. Get the signup bonus. Whenever possible PIF or balance transfer so you pay less in interest. Never give an excellent rating when it is actually the norm. Always look for a discount as more is always better.

Always accept candy from strangers because they have the best candy or from people you know have good candy.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

@Anonymous wrote:

That's what I thought... Store card is one thing, the MC can be used anywhere...

True. But just about every card in your siggy will give you better reward points anywhere than a Walmart MC.

Same for me. If they offer me the upgrade I'm a No Thank You!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

@Anonymous wrote:

There's a part of me that wished I hadn't gotten that card. I was on an app approved spree and I loved getting the new cards, but it has outlived its usefulness. Good thing it's a no AF card, otherwise it'd be on a one-way ticket to the dustbin!!

I got suckered into app'ing for the store card when at the checkout cashier they were pushing a $25 statement credit for app'ing & using it for the current purchase. Yes, I sell myself too cheap sometimes, but they sure are CLI happy on the card, my CL is now $10k, almost all auto CLIs, never a HP since the original app. But I look at that $10k CL and think "Good Lord, I can't buy that much beer & steak for the grill!". ![]()

I think the only reason to have a store card is: purchase discount, 0% deferred interest, or high CL to help keep overall untilization low. Walmart only does the last one for me, my only other store card is Lowes, and it does 1&2, and a little on the 3rd ($5k CL).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Walmart MC upgrade question

@DaveInAZ wrote:

@Anonymous wrote:

There's a part of me that wished I hadn't gotten that card. I was on an app approved spree and I loved getting the new cards, but it has outlived its usefulness. Good thing it's a no AF card, otherwise it'd be on a one-way ticket to the dustbin!!I got suckered into app'ing for the store card when at the checkout cashier they were pushing a $25 statement credit for app'ing & using it for the current purchase. Yes, I sell myself too cheap sometimes, but they sure are CLI happy on the card, my CL is now $10k, almost all auto CLIs, never a HP since the original app. But I look at that $10k CL and think "Good Lord, I can't buy that much beer & steak for the grill!".

I think the only reason to have a store card is: purchase discount, 0% deferred interest, or high CL to help keep overall untilization low. Walmart only does the last one for me, my only other store card is Lowes, and it does 1&2, and a little on the 3rd ($5k CL).

Target does it for me, Walmart does it for me, Lowes does it for me, Macy's does it for me, and Home Depot does it for me. If I didn't get the rewards or deferred interest for these cards than I think I would cut them up. The Walmart MC does nothing for me, so I will not upgrade unless two things happen; 1 they keep the deferred interest for the card and 2 they use the original starting date for the conversion. When this happens the only thing that will prompt me to convert the card will be so I don't have to get offered an upgrade in the future. If I am not getting 1.5% back on every purchase it is because I forgot to pull the right card out of my wallet and that is my fault. Other than that I am always getting at least 1% anyway so the Wally World MV has no actual benefits for me and just about everyone with a rewards card. Why take a hit on your AAoA if you already have a tool that is the same or better?

We should use adjustable wrenches when we don't have a wrench of the size we need. In every situation the right size wrench was made so that it gets the best results. None of this matters when the only tool you have is a hammer.

Always follow these rules: Only take a HP for a new account. Always use the best rewards card for that reward category. Don't close a card unless you know you really should. Never use more than 35% of a credit limit. Recon as much and as best you can. Use the introductory period to the best advantage. Get the signup bonus. Whenever possible PIF or balance transfer so you pay less in interest. Never give an excellent rating when it is actually the norm. Always look for a discount as more is always better.

Always accept candy from strangers because they have the best candy or from people you know have good candy.