- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: We all need to send Email to comenity EO offic...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

We all need to send Email to comenity EO office

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

Hi there OP,

I have removed the cross posted thread in the apps forum. As already stated by MJ please do not cross post the same topic in the future as it can lead to confusion by the members and it is against our TOS to do so. I thank you for your understanding on this. have a great day ![]()

gdale6

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

What you mean WE kemosabi??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

Comenity has a Twitter account. Individuals who wish to have the company contact them can post there and request the contact.

Credit card companies and banks do have it completely within their rights to take this action, however unfair it may seem.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

Not only do they have a reason, it is valid as far as Comenity Bank is concerned. We, as consumers, with two dozen SCT accounts in 2 weeks may not like it.

@Anonymous wrote:

... just shut down account for no reason....

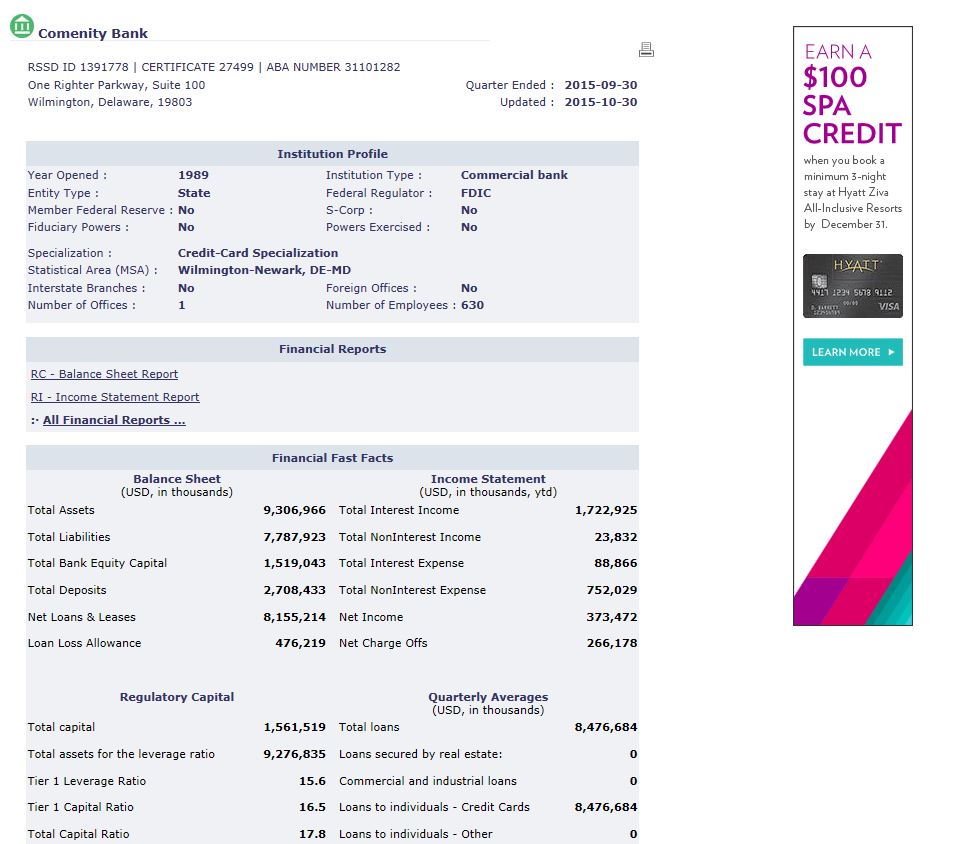

Comenity Bank closed their quarter on 9/30/2015 and SEC filing on 10/302015 shows charge offs of $266,178 for the quarter. Maybe a tad too much, and may have triggered a risk evaluation and shedding of some of that risk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

@Anonymous wrote:Not only do they have a reason, it is valid as far as Comenity Bank is concerned. We, as consumers, with two dozen SCT accounts in 2 weeks may not like it.

@Anonymous wrote:

... just shut down account for no reason....

Comenity Bank closed their quarter on 9/30/2015 and SEC filing on 10/302015 shows charge offs of $266,178 for the quarter. Maybe a tad too much, and may have triggered a risk evaluation and shedding of some of that risk.

only 268k for the quarter? Wow I would of guessed it would of been in the millions... That is chump change to them they get that back with a handful of people carrying interest on their stores cards![]()

Edit what you listed is a month and not a quarter even at a month level that doesn't seem bad for a bank as large as them

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

@JSS3 wrote:It's not about fairness. CCCs are well within their rights to terminate the relationship at any time for any legal reason. I, myself, exhibit risky behavior with my "aggressive credit seeking" so will accept the consquences should any arise.

The person's sister who had one card and was shut down might have a case(depending on if nothing else was happening) but for everyone else, we all know, or should know, this does happen and be adults about it.

I don't even understand what the point of contention would be in the emails. They aren't supposed to warn you of the actions they're going to take behorehand, and you do get notice in the mail afterwards.

Yup, while I'm sure some folks may voice their concerns or "unfairness" via Twitter or FB (or snail mail), nothing is going to change in the way of reversing these decisions. In fact, maybe as part of their audit findings, as they continue to review riskier accounts (or behaviors); it is possible that some overhauls may be on the horizon for their application origination requirements (probably needs a bit of a "dusting" in any case).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

I understand the intent behind the OP's posting, but I think the best thing to do for those who have been affected is to speak with your wallet and choose other companies to do business with going forward.

I'm sorry this happened to anyone, it's sad; however, it is a business decision and those affected can as consumers make other decisions about where to take their business.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

@CreditCuriousity wrote:

@Anonymous wrote:Not only do they have a reason, it is valid as far as Comenity Bank is concerned. We, as consumers, with two dozen SCT accounts in 2 weeks may not like it.

@Anonymous wrote:

... just shut down account for no reason....

Comenity Bank closed their quarter on 9/30/2015 and SEC filing on 10/302015 shows charge offs of $266,178 for the quarter. Maybe a tad too much, and may have triggered a risk evaluation and shedding of some of that risk.only 268k for the quarter? Wow I would of guessed it would of been in the millions... That is chump change to them they get that back with a handful of people carrying interest on their stores cards

Edit what you listed is a month and not a quarter even at a month level that doesn't seem bad for a bank as large as them

it is in thousands, $266 Millioun Doolllars (said Dr. Evil)

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: We all need to send Email to comenity EO office

@NRB525 wrote:

@CreditCuriousity wrote:

@Anonymous wrote:Not only do they have a reason, it is valid as far as Comenity Bank is concerned. We, as consumers, with two dozen SCT accounts in 2 weeks may not like it.

@Anonymous wrote:

... just shut down account for no reason....

Comenity Bank closed their quarter on 9/30/2015 and SEC filing on 10/302015 shows charge offs of $266,178 for the quarter. Maybe a tad too much, and may have triggered a risk evaluation and shedding of some of that risk.only 268k for the quarter? Wow I would of guessed it would of been in the millions... That is chump change to them they get that back with a handful of people carrying interest on their stores cards

Edit what you listed is a month and not a quarter even at a month level that doesn't seem bad for a bank as large as them

it is in thousands, $266 Millioun Doolllars (said Dr. Evil)

I actually think synchrony has more retail stores and comenity. Could be wrong but they are both up there for sure as a combined force. interesting indeed the numbers when you see then up fron. It says in the thousands year to date. That is not too bad if they have the numbers correct. I can't beleive this is all they have.