- myFICO® Forums

- Types of Credit

- Credit Cards

- Re: X1 Card review :)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

X1 Card review :)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

X1 Card review :)

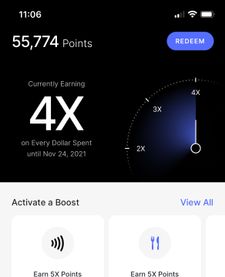

It doesn't have a bonus but today they emailed me a free 5000 points for my recent spending ![]() ! cash back is redeemable at .07 cents so 2.8% card. (Unless it's being used to redeem at their partners could be much higher).

! cash back is redeemable at .07 cents so 2.8% card. (Unless it's being used to redeem at their partners could be much higher).

2 weeks for the 5000 points to be taken into my account, also I can receive x5 points in my next Apple Pay purchase (one of vendors takes Apple Pay so I'll make sure I max out the card using Apple Pay) ![]() !

!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

@Creditplz wrote:

Whoah! That's an insane amount of rewards in such a short time. Congrats!

FICO Scores (current as of November 24, 2020): Equifax: 740 | Experian: 751 | TransUnion: 732

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

Thank you! I forgot to post it without any text in the box! Sorry! But a free 5k points for just using the card in the last week!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

Glad to see you're enjoying it! It appears to me that they've just disabled the viewable waitlist as everytime I try to see my current spot it now just redirects me to the main page. Hoping to get an invite soon!

FICO Scores (current as of November 24, 2020): Equifax: 740 | Experian: 751 | TransUnion: 732

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

@Creditplz have you been able to get your friend invite codes working ?

I gave out 1 code and now it says "No Invites Remaining".

I thought we had a total of 3 invites ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

We should? You make sure whoever you gave it to didn't share it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

Sounds like you're liking this card. Hoping to recieve the invitation to apply sometime before I die of old age....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

Question for the X1 card users since I didn't want to make a topic solely for my question

What are all the redemption options with the rewards for this card? Any that didn't make the list on their website?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

@Creditplz wrote:

It doesn't have a bonus but today they emailed me a free 5000 points for my recent spending

! cash back is redeemable at .07 cents so 2.8% card. (Unless it's being used to redeem at their partners could be much higher).

2 weeks for the 5000 points to be taken into my account, also I can receive x5 points in my next Apple Pay purchase (one of vendors takes Apple Pay so I'll make sure I max out the card using Apple Pay)

!

Interesting... I wonder what I'd get with my deposits haha. If I get an invite code is it automatic entry to get the card or does it just bump you up a few spots on the wait list? I just went on the list today so who knows when I'd get the card lol

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: X1 Card review :)

I applied and was approved for the card yesterday.

I have to say this is by far the most seamless application and setup I have ever experienced. I did it on a mobile phone and loved how every detailed had been accounted for. Here are a few examples of how the process was far superior to any other card company I have ever used:

1. My credit reports were frozen. I knew that and was hoping that they would tell me which one they were trying to access. Every other bank would react to the inaccessibility of a credit file with a denial and a letter, or with an invitation to unlock the credit files and start over. X1 had a much better process: the message displayed on the (mobile) web page was something along the lines of "your Experian credit file is frozen - please remove the freeze and click the button below to continue". It was perfect! I took a few minutes to lift the freeze, went back to the application and clicked "try again" to pick up right where I had left off.

2. As part of the application process, I connected my bank account using Plaid -- a commonly used software that allows banks to connect accounts.

3. Received my approval ($30,500 limit off the bat).

4. I was told to expect the card by next Tuesday via Fedex and prompted to setup autopay. That is wonderful! Many banks don't let you set up Autopay until the first statement is in. Or they don't make Autopay obvious to find. What's most impressive is that it took two clicks to set it up: they had saved the bank account information from the application process so I did not have to start anything over. Impeccable user experience.

We'll see how the card works in the long run (clearly many of the perks and benefits aren't here to stay in perpetuity), but it looks like it won't be hard to average >3% back on every purchase for the foreseeable future. As a marketer by trade, I also love how they have all the "boosts" available in the app to engage users. Thank you to Spark Capital, Craft Ventures and the other Venture Capital firms behind this company for footing the bill for the generous rewards structure and amazing UX.