- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Capital One Reporting Balance when PIF by stat...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One Reporting Balance when PIF by statement date

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital One Reporting Balance when PIF by statement date

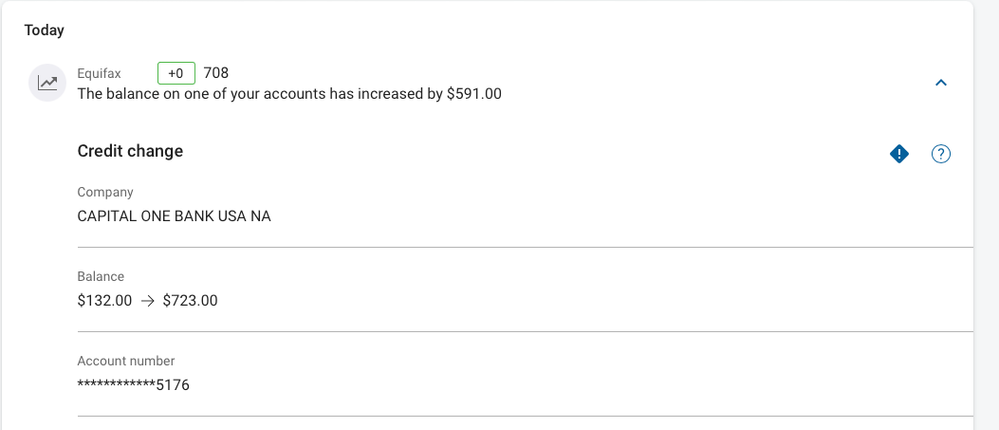

Good afternoon, so I am having an issue with Capital One SavorOne and the balances they are reporting. I recently saw that they reported a balance of 723.00 to my Equifax however I pay my card in full before statement date. Has any forum member had similiar issues with them?

Also, it seems that the prior month they reported a 132.00 when once again I PIF PRIOR to statement date. My payments owed are 0.00 on each statement. I pay WELL before statement date and dont use the card until new statement cycle has ran a few days.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

That's strange. No, I haven't had this issue nor heard of anyone else that has. Have you tried calling and asking them?

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

I will be reaching out on monday, I just noticed when I made the thread. This hasn't happened with any other card. Super odd.

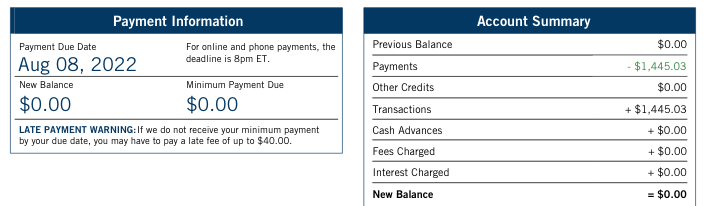

Below my last statement. As you can tell the balance was 0.00 yet it is reporting 723.00

It didn't ding my credit or anything but I am worried they may one day randomly report my balance before being paid and I am sure I will take a hit.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

Did you pay before the due date or the statement date? I wonder if that's making a difference here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

What is showing as your reporting date?

Remember that it is reporting date that is important not statement date if you want a zero balance to report. Usually statement and reporting dates are similar if not the same but sometimes completely unrelated like with US Bank.

For me, Capital One reports the last day of the statement period. Look and see what day it is reporting and make sure you have a zero balance by that day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

I've had that happen with us bank. It seems the reporting date was different than the statement date. Even though I had a zero balance on the statement date, it was still showing the higher balance I had during the reporting date.

I always thought they all reported according to what the statement shows but it seems they dont do it that way

with us bank, I kept it at a zero balance longer and got lucky and it showed zero on the reports. Us bank told me the reporting date could be any date they choose and wasn't a snap shot of each statement

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

I paid in full 06/30 and statement date was the 07/14. No balance being carried.

After paying in full 06/30 there were no charges until 07/17 (new cycle) -

@disdreamin wrote:Did you pay before the due date or the statement date? I wonder if that's making a difference here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

@GatorGuy wrote:What is showing as your reporting date?

Remember that it is reporting date that is important not statement date if you want a zero balance to report. Usually statement and reporting dates are similar if not the same but sometimes completely unrelated like with US Bank.

For me, Capital One reports the last day of the statement period. Look and see what day it is reporting and make sure you have a zero balance by that day.

I may have to reach out and see what happened.

I was at 0.00 well before statement date and didn't run new charges until 2 or 3 days in new billing cycle. Appreciate the feedback

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

@learningcredit54 wrote:

@GatorGuy wrote:What is showing as your reporting date?

Remember that it is reporting date that is important not statement date if you want a zero balance to report. Usually statement and reporting dates are similar if not the same but sometimes completely unrelated like with US Bank.

For me, Capital One reports the last day of the statement period. Look and see what day it is reporting and make sure you have a zero balance by that day.

I may have to reach out and see what happened.

I was at 0.00 well before statement date and didn't run new charges until 2 or 3 days in new billing cycle. Appreciate the feedback

Credit Karma is terrible for credit scores but one of the easiest free ways to see the reporting date for your CCs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One Reporting Balance when PIF by statement date

@purebulldogs wrote:I've had that happen with us bank. It seems the reporting date was different than the statement date. Even though I had a zero balance on the statement date, it was still showing the higher balance I had during the reporting date.

I always thought they all reported according to what the statement shows but it seems they dont do it that way

with us bank, I kept it at a zero balance longer and got lucky and it showed zero on the reports. Us bank told me the reporting date could be any date they choose and wasn't a snap shot of each statement

It's pretty well documented on here that US Bank is one of those outliers that reports your balance at the end of the month, not the balance at statement cut. Don't listen to the garbage their CSRs told you.

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores: