- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Confusing High Limit and Credit limit columns ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Confusing High Limit and Credit limit columns in Equifax credit report

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Confusing High Limit and Credit limit columns in Equifax credit report

Just pulled my credit report and noticed odd figures for high credit and credit limit columns for one of the CC's in the equifax report. My vintage scores avarages about 830 and never carried more than $1000 on any of the 4 cards (and that's even just two or three times). I always pay the balances in full every month.

For the BOA card, the report stats $7500 in the High Credit column and $5000 in the Credit Limit column from 8/21 to 9/22. The Balance column shows $0 for all the rows except a couple of rows with $60. I've never charged any more than $500 since I got it but where did the $7500 come from? I'm confused about these figures. The report seems to suggest I overcharged and went above my credit limit while I never even utilized more the 10% of the availabe credit. It makes me look bad. In fact I haven't used this card for a very long time.

So can someone shed some light on this High Credit and Credit limit thing? Does HC mean sum of all the balances I ever had on this card or the balance I had at one point in time? Thanks

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confusing High Limit and Credit limit columns in Equifax credit report

The high credit amount can be the highest amount you've had on the card during a month, or the highest amount you've ever had on the card at one time... different issuers have different policies and parameters they go by.

Credit limit is the account's set limit. What you can charge up to before having to pay it down in order to charge more.

For example if you have a card with a $5k limit but say you charged $4k, then paid the balance down to 0 a week later, but then go and charge another $3500 within the same billing period it would show that your high credit amount was $7500 for that billing period.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confusing High Limit and Credit limit columns in Equifax credit report

@kilobite wrote:Just pulled my credit report and noticed odd figures for high credit and credit limit columns for one of the CC's in the equifax report. My vintage scores avarages about 830 and never carried more than $1000 on any of the 4 cards (and that's even just two or three times). I always pay the balances in full every month.

For the BOA card, the report stats $7500 in the High Credit column and $5000 in the Credit Limit column from 8/21 to 9/22. The Balance column shows $0 for all the rows except a couple of rows with $60. I've never charged any more than $500 since I got it but where did the $7500 come from? I'm confused about these figures. The report seems to suggest I overcharged and went above my credit limit while I never even utilized more the 10% of the availabe credit. It makes me look bad. In fact I haven't used this card for a very long time.

So can someone shed some light on this High Credit and Credit limit thing? Does HC mean sum of all the balances I ever had on this card or the balance I had at one point in time? Thanks

As far as I know the high credit is the highest balance you've ever had on the card at any one point in time.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confusing High Limit and Credit limit columns in Equifax credit report

@kilobite wrote:So can someone shed some light on this High Credit and Credit limit thing? Does HC mean sum of all the balances I ever had on this card or the balance I had at one point in time? Thanks

so high credit is the highest balance that has ever been on the card.

this balance isn't a balance that needs to be reported as a statement balance, just at any time, what has the absoulute highest balance the card has been even within billing cycles.

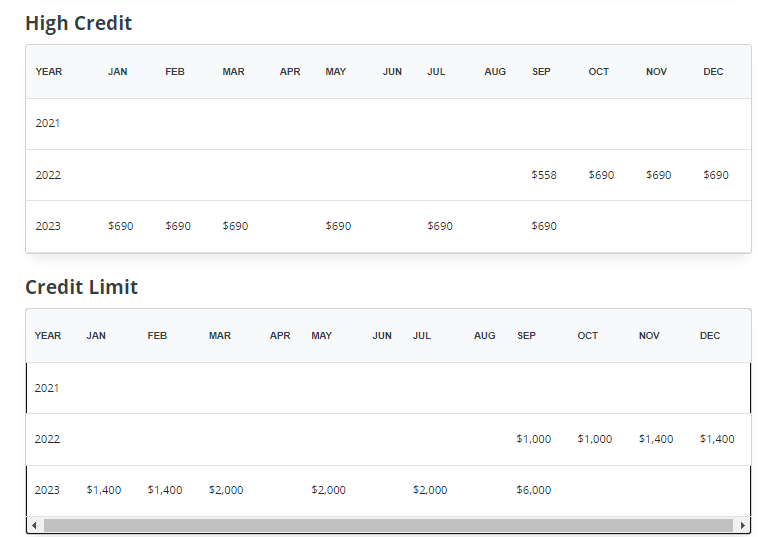

it appears that future months just post whatever the highest amount you've ever had on the card is from prior months for high credit. So because in Oct 2022, my card had a $690 balance, it just repeated that information for subsequent months.

credit limit is just what the credit limit for the card was during that month, so my nRewards started out at $1k, got a $400 auto CLI, graduated to $2k, got a 3x CLI to $6k, which is where it's at now

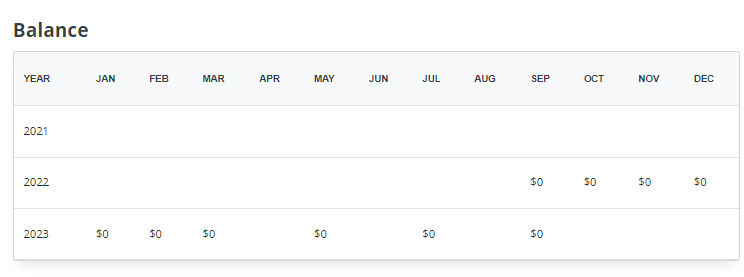

and yeah, here is the reported balances, so "high credit" amounts don't need to be statement balances:

it's a good thing, IMO

it's a data point that says that you used your card for a high amount at some point and paid it off in the same month or very soon after that

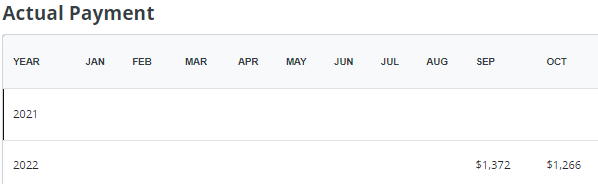

the less cutthroat FI's will even provide 'actual payment' information, which shows how much has been paid off on the card during a given cycle

so in Sept 2022, I paid $1372 to the card, in Oct 2022, I paid $1266 to the card, etc.

Current FICO 8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confusing High Limit and Credit limit columns in Equifax credit report

@kilobite wrote:For the BOA card, the report stats $7500 in the High Credit column and $5000 in the Credit Limit column from 8/21 to 9/22. The Balance column shows $0 for all the rows except a couple of rows with $60. I've never charged any more than $500 since I got it but where did the $7500 come from? I'm confused about these figures. The report seems to suggest I overcharged and went above my credit limit while I never even utilized more the 10% of the availabe credit. It makes me look bad.

The most important takeaway is that reported "High Credit" has no impact on your credit scores. Nor do other issuers pay any appreciabl attention to this field. It doesn't make you "look bad".

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confusing High Limit and Credit limit columns in Equifax credit report

@SouthJamaica wrote:As far as I know the high credit is the highest balance you've ever had on the card at any one point in time.

"High credit" varies from lender to lender in what data they report and for some it is what you mentioned. Looked at my reports a couple days ago and Capital One reports the highest posted balance you've had on the card at any time. Discover and Amex report the highest statement balance. I can't speak for other lenders because I only have cards from those 3 lenders and don't remember how Citi reported way back when I had them pre BK.

June 2022 FICO 8:

June 2022 FICO 9:

June 2022 FICO 10:

June 2022 FICO 10T:

Sep 2025 FICO 8:

Sep 2025 FICO 9:

Sep 2025 FICO 10:

Sep 2025 FICO 10T:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Confusing High Limit and Credit limit columns in Equifax credit report

@kilobite wrote:Just pulled my credit report and noticed odd figures for high credit and credit limit columns for one of the CC's in the equifax report. My vintage scores avarages about 830 and never carried more than $1000 on any of the 4 cards (and that's even just two or three times). I always pay the balances in full every month.

For the BOA card, the report stats $7500 in the High Credit column and $5000 in the Credit Limit column from 8/21 to 9/22. The Balance column shows $0 for all the rows except a couple of rows with $60. I've never charged any more than $500 since I got it but where did the $7500 come from? I'm confused about these figures. The report seems to suggest I overcharged and went above my credit limit while I never even utilized more the 10% of the availabe credit. It makes me look bad. In fact I haven't used this card for a very long time.

So can someone shed some light on this High Credit and Credit limit thing? Does HC mean sum of all the balances I ever had on this card or the balance I had at one point in time? Thanks

The term usually used on credit reports is High Balance. Depending on the bank it either represents the highest statement balance up to that point in time or ... The highest balance accumulated on the card up to that point in time.

It is rare for high balance to exceed credit limit because many cards don't allow charges to exceed the CL. That situation is most often seen on cards that have undergone a credit line reduction (CLD). An old time poster, NRB525, had many of his cards undergo CLDs at one time which pushed some HBs above adjusted CLs.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950