- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Consumer Finance Accounts - List of Known Lenders

Options

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Consumer Finance Accounts - List of Known Lenders

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2019

10:21 AM

09-05-2019

10:21 AM

Re: Consumer Finance Accounts - List of Known Lenders

@Anonymous wrote:

First off you need to go make an account with Wallethub. It updates with fresh TransUnion CR data at 6:00 AM every morning. If you do this every day, you will know what day the new account reports. You can then pull a 1B for TransUnion.

Have an account and check daily. I mistakenly mentioned here or in another thread that I received a Cap 1 alert for the new account but it was a different alert. The new account has not hit TU yet. If not there by the 10th, will wait until it hits to pull my EX subscription 3B. That's if it hits as I had a Synchrony card many years ago (2007?) and it only reported to EX.

Equifax is not so easy. But CK updates it weekly. And MF will shoot you an alert whenever it feels like it.

As for testing purposes, we need before and after scores and negative reason codes can be helpful. It would be nice to have a 3B from August 31 and from September 1, so we could see the AoYA gains on all 28 algorithms.

Don't have before and after other than EX. I have a myFICO 3B from 8/2 and 9/2. I have a 3B from EX for 8/10, next 9/10.

Next, before and after reports from each bureau for the new account hitting would be helpful. Do you have Experian creditworks? Yes It’s awesome you pulled the 3B on September 2. Do you have your EX scores from September 3? Yes Either by 1B or via Experian credit works? If so, that would be great because it would give us your score changes for most algorithms, depending on source. (EX credit works leaves out version 9😔. )

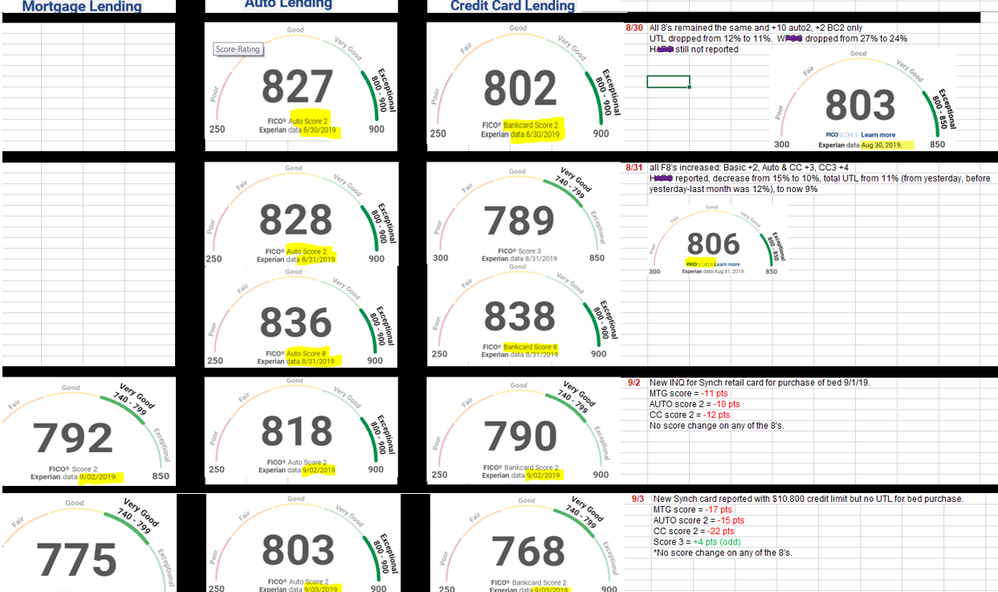

Post 20 of this thread provides EX changes with other scores once the INQ hit and new acct the next day. But here's a snapshot of my notes for EX from 8/30 - 9/3. Nothing has changed since.

FICO - 8: 05/05/23

Message 31 of 37

0

Kudos

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2019

10:57 AM

09-05-2019

10:57 AM

Re: Consumer Finance Accounts - List of Known Lenders

@Anonymous wrote:

When this account reports will it put your aggregate revolving utilization over 8.9%? The account reported on 9/3 but oddly with no UTL. This caused my AGG UTL to go from 9% to 8%, no score changes other than those listed above. Now that I think about it may be the reason for the 1 score increase on the rarely used CC Score 3. This acct was not affected by the INQ, only the reporting of the CL. But nothing on any of the "8"'s. When it reports the UTL it will bring my AGG over 8.9% again, to 14%. But it was over 8.9% before the account reported and a week or so ago before the 2 revolvers reported the new lower balances it was over 12%. No change in F8. Took my 1st UTL ding in June when my AGG went from 5% to 13%, brought me down to 799 from 802. Then back up to 803 mid July and the only thing there was my AGG UTL for installments went from 76% to 75% (very late reporting for my Auto that month). Didn't receive anything on 8/1 or early AUG for what I was expecting for AoYA reaching 1Y. Next increase on 8/31 when there was a decrease in CC UTL. since it doesn't appear I received any 1yr AoYA reset this may be the reason I didn't lose anything for the new account??? You and discussed this in the same thread where I thought the reason I didn't get anything was because the 30d made it dirty.

What will be the individual utilization on this account? Unfortunately 54%. Hoping I can get the paperwork in the mail soon so I can set up an account and pay it below 48.9% (no interest). How many accounts with a balance do you currently have? 2 revolvers, auto and home. And then we know you will have one more when this report correct? Yes.

FICO - 8: 05/05/23

Message 32 of 37

0

Kudos

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2019

02:05 PM

09-05-2019

02:05 PM

Re: Consumer Finance Accounts - List of Known Lenders

I think the 30 day late is acting as a modifier and capping your score. I think the changes occurred, but we can’t see them basically because its buffered above your cap. Just my humble opinion, maybe I’m wrong.

Nevertheless you could go study your negative reason codes. If you look before and after the first you should see “new accounts” moved down. Then, when the new revolver reported you should see it move back up. If so, I think that would support my hypothesis.

I’m assuming 13 accounts including the new one, from your signature. You were at 4/12, then 4/13, and when it reports a balance, 5/13. That will put you over the 33% threshold for F8 number of accounts with a balance, where before you were under it. So, that could take a couple points.

Not to mention crossing the individual utilization thresholds for the new revolver.

You’re going to take a nice jump when that late falls off.

Nevertheless you could go study your negative reason codes. If you look before and after the first you should see “new accounts” moved down. Then, when the new revolver reported you should see it move back up. If so, I think that would support my hypothesis.

I’m assuming 13 accounts including the new one, from your signature. You were at 4/12, then 4/13, and when it reports a balance, 5/13. That will put you over the 33% threshold for F8 number of accounts with a balance, where before you were under it. So, that could take a couple points.

Not to mention crossing the individual utilization thresholds for the new revolver.

You’re going to take a nice jump when that late falls off.

Message 33 of 37

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2019

05:17 PM

09-05-2019

05:17 PM

Re: Consumer Finance Accounts - List of Known Lenders

@Anonymous wrote:With inquiry binning, it's possible to take one on and receive no score drop. Whether binning is the same across all models, I'm not sure.

Quickie... What is "binning"? Thanks.

Message 34 of 37

0

Kudos

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2019

05:28 PM

09-05-2019

05:28 PM

Re: Consumer Finance Accounts - List of Known Lenders

Binning is the theory that maybe you lose six points for inquiry number 1, 4 points for inquiry number 2, but then for inquiry 3-4 maybe there’s only a 4 point loss.

So maybe there’s not a loss for the third one but there is for the fourth; similarly there maybe a so many point loss for the range of 5-6 and again for the range 7-9.

So the point is there may not be a point loss for each individual inquiry but there may be ranges.

Plus we know once you get to the maximum penalty for inquiries, after that there are no further dings.

So maybe there’s not a loss for the third one but there is for the fourth; similarly there maybe a so many point loss for the range of 5-6 and again for the range 7-9.

So the point is there may not be a point loss for each individual inquiry but there may be ranges.

Plus we know once you get to the maximum penalty for inquiries, after that there are no further dings.

Message 35 of 37

0

Kudos

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2019

09:18 PM

09-05-2019

09:18 PM

Re: Consumer Finance Accounts - List of Known Lenders

@Anonymous wrote:

I think the 30 day late is acting as a modifier and capping your score. I think the changes occurred, but we can’t see them basically because its buffered above your cap. Just my humble opinion, maybe I’m wrong. Sounds sound to me. Interesting.

Nevertheless you could go study your negative reason codes. If you look before and after the first you should see “new accounts” moved down. Then, when the new revolver reported you should see it move back up. If so, I think that would support my hypothesis. I have and will continue and will provide later.

I’m assuming 13 accounts including the new one, from your signature. You were at 4/12, then 4/13, and when it reports a balance, 5/13. That will put you over the 33% threshold for F8 number of accounts with a balance, where before you were under it. So, that could take a couple points.

Not to mention crossing the individual utilization thresholds for the new revolver.

You’re going to take a nice jump when that late falls off. Hoping so. Got 50 pts on TU in Jan 19 and 29 ( I think) on EQ in Aug 19. EX is an interesting study considering prior to the new account this month, which now has reported on EX and EQ, all 3B's were = with all lenders reporting for all accounts with the exception of EX and EQ having one (same) closed acct in good standings but doesn't change my AAoA.. Not the oldest either.

I'm kind of intrigued by the comparison between the other 2B's "clean" report with 850 scores and the 1B identical with the exception of a 6Y9M old 30D.

FICO - 8: 05/05/23

Message 36 of 37

0

Kudos

Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-05-2019

10:48 PM

09-05-2019

10:48 PM

Re: Consumer Finance Accounts - List of Known Lenders

If that stray account is not your oldest and doesn’t cause AAOA to cross a threshold then I have no doubt it’s not causing any more damage than possibly one point.

Who knows you may not be able to see changes or full changes on TransUnion Equifax now that you’re at the big 850! 😁 There is a buffer.

Yes it is definitely interesting to say the least.

Who knows you may not be able to see changes or full changes on TransUnion Equifax now that you’re at the big 850! 😁 There is a buffer.

Yes it is definitely interesting to say the least.

Message 37 of 37

0

Kudos

† Advertiser Disclosure: The offers that appear on this site are from third party advertisers from whom FICO receives compensation.