- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Experian Score Planner?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Experian Score Planner?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Experian Score Planner?

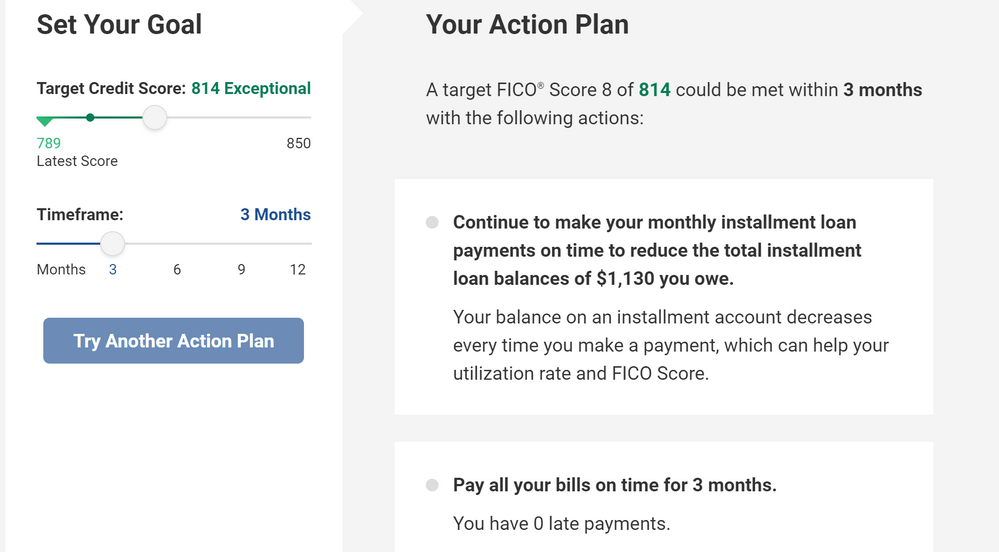

My action plan is different than Experian, but how accurate is the score planner? I am looking at the plan and this might be were my lost pts are at since the real balance is $1,024. My current score is 789 and in 3 months it seems I would gain 25 pts??

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Score Planner?

Well, this is just another form of a simulator and all of them IMO are notoriously inaccurate. I wouldn't trust it. However, such a score gain could be possible, but we'd need some more information regarding your loan utilization.

Do you only have 1 open installment loan? If so, what is its current balance and what was its original balance? Crossing under 10% overall installment loan utilization could result in a score gain similar to what you referenced.

For example, if this original loan was for say $1200, you currently owe $1100 and paid down $1000, you'd be left with $100. You'd thus move from 92% installment loan utilization to 8% installment loan utilization. A shift such as this could in theory produce such a gain. It would have to be your only open installment loan though, or if you have multiple open loans you'd have to calculate your before/after overall utilization for loans to see if you'd end up going from over 10% to under 10%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Score Planner?

Never been accurate for me either. I find that the most accurate one is the one offered by MyFico.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Score Planner?

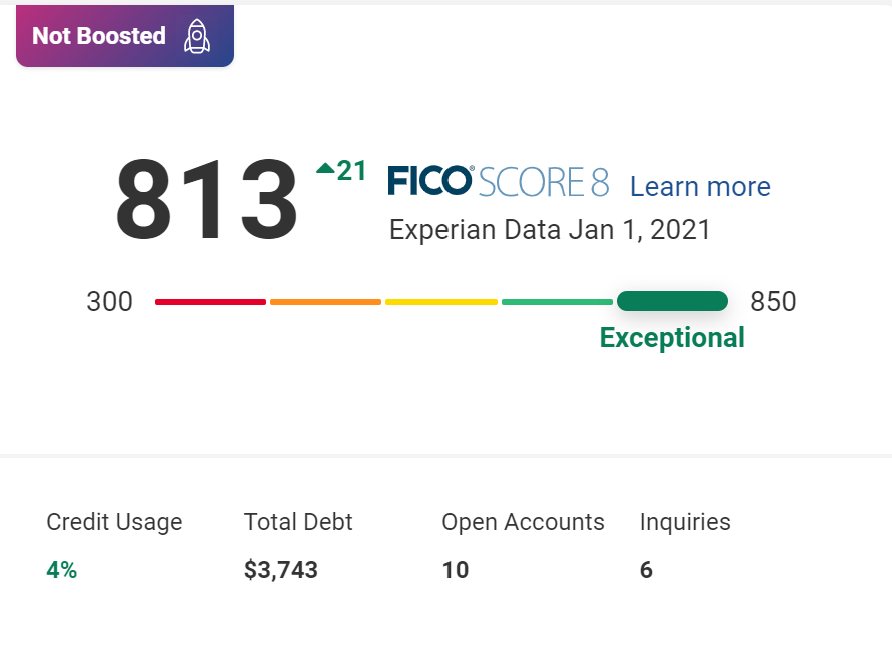

Well it seems it only took a couple of days to get over 800 and not 3 months...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Score Planner?

What changed to cause the jump?

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Score Planner?

@RonM21 Aging and 2 accounts at 0% balance, seems I got nice bumps on all 3 https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Aging-period-and-how-Fico-reacts/td-p/61...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Score Planner?

@AzCreditGuy wrote:@RonM21 Aging and 2 accounts at 0% balance, seems I got nice bumps on all 3 https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Aging-period-and-how-Fico-reacts/td-p/61...

Cool. I just read followed up on that thread. That's interesting if in fact that's what took place is that one card hitting 6 years caused the +21 result. Everyone's individual file is different, and maybe that's just how the bureau reacted to yours. But hey, great positive news!!

| Total CL: $321.7k | UTL: 2% | AAoA: 7.0yrs | Baddies: 0 | Other: Lease, Loan, *No Mortgage, All Inq's from Jun '20 Car Shopping |

BoA-55k | NFCU-45k | AMEX-42k | DISC-40.6k | PENFED-38.4k | LOWES-35k | ALLIANT-25k | CITI-15.7k | BARCLAYS-15k | CHASE-10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Experian Score Planner?

I have not heard of 1 card reaching 6 years of age resulting in any score gain / definitely not 21 points.