- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: FICO Score Stress Indicators/Indexes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Score Stress Indicators/Indexes

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I'll change scorecards in November if I don't do anything stupid. All version 8 over 800 except Experian 797

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous wrote:@Anonymous actually most of them have went up, but just haven't taken time to post an update yet I've only got 10 under 800 now I think.

Oh...well then Congratulations! on your race to the bottom of the Resilience Index while continuing to improve your already great credit profile!

It's kind of like when one moves out of a new account scorecard and is considered an outcast on the forums. haha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@Anonymous Did a new pull dated 08/24/2020 and resilience index score is still 59 with 2 flags for high revolving balances and high percentage of accounts being revolving accounts. The 3 fico 08 scores are also unchanged at 816, 822, and 831. Please update my record accordingly. I seem to just be a high moderate resilience kind of guy. Just one more blasted point and I could tell everyone how sensitive I am, but nooooo!!! We all know what moderate means...too good to be bad, and yet too bad to be good...it is much like being stuck in the friend zone with a girl in my youth. Sounds good, but is really a curse. It means I got to cheer her up when she would break up with her badboy and attend the wedding when the good guy comes. Nobody wants to be in the friend zone or be moderate.

EX fico08=815 06/16/24

EQ fico09=809 06/16/24

EX fico09=799 06/16/24

EQ fico bankcard08=838 06/16/24

TU Fico Bankcard 08=847 06/16/24

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sarge12 wrote:@Anonymous Did a new pull dated 08/24/2020 and resilience index score is still 59 with 2 flags for high revolving balances and high percentage of accounts being revolving accounts. The 3 fico 08 scores are also unchanged at 816, 822, and 831. Please update my record accordingly. I seem to just be a high moderate resilience kind of guy. Just one more blasted point and I could tell everyone how sensitive I am, but nooooo!!! We all know what moderate means...too good to be bad, and yet too bad to be good...it is much like being stuck in the friend zone with a girl in my youth. Sounds good, but is really a curse. It means I got to cheer her up when she would break up with her badboy and attend the wedding when the good guy comes. Nobody wants to be in the friend zone or be moderate.

Updated and pointing to your new post.

I'm really surprised I didn't get the flag for 'High Revolving Balances' when I let an aggregate balance of $1618 report in July.

That's the highest balance I've ever let report (I pay down a lot before statement, then PIF right after) since I've had credit cards, and it's always at/or below 9%, but everything is so much more sensitive on a new-to-credit (under 3yrs) profile.

I just get 'high percent of revolving accounts' (fair, all 4 open accounts are cards, 1 closed loan) and 'no recent installment history'.

lol @ the friendzone

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

I think my report score should improve once the September report comes in. Brought the principal on my Car loan down from $16K to $6.5 K and my credit utilization to 3% from 10%. Crossing fingers.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@joeyv1985 wrote:I think my report score should improve once the September report comes in. Brought the principal on my Car loan down from $16K to $6.5 K and my credit utilization to 3% from 10%. Crossing fingers.

I think you will get a nice score bump.

Bank of America: Alaska Air Atmos Summit Visa Infinite

Capital One: Savor WEMC, Venture X Visa Infinite

Chase: Freedom U Visa Signature, CSR Visa Infinite

Citibank: AAdvantage Globe WLMC

Elan/US Bank: Fidelity Visa Signature

Credit Union: Cash Back Visa Signature

FICO 08: Score decrease between 26-41 points after auto payoff (11.01.21) FICO as of 12.24, EX: 816 / EQ: 825 / TU: 818

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

@sjt wrote:

@joeyv1985 wrote:I think my report score should improve once the September report comes in. Brought the principal on my Car loan down from $16K to $6.5 K and my credit utilization to 3% from 10%. Crossing fingers.

I think you will get a nice score bump.

Thanks sjt. There seems to be a lag in reporting on Wells Fargo's part. Per this website, the last car payment that was reported was in June by Experian. Nothing from TU and EQ since May. Quite the lag.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

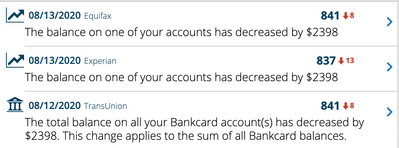

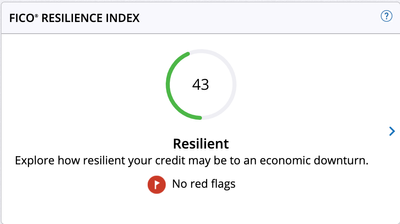

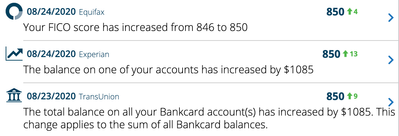

@tacpoly wrote:When all my cards reported 0, my Resilience Score improved from 56 with 2 flags last month to 43 with no flags this month, however, my FICO8 scores went down:

1% utilization reported for one card and my FICO8 scores went back up to 850s.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Score Stress Indicators/Indexes

How do we play?

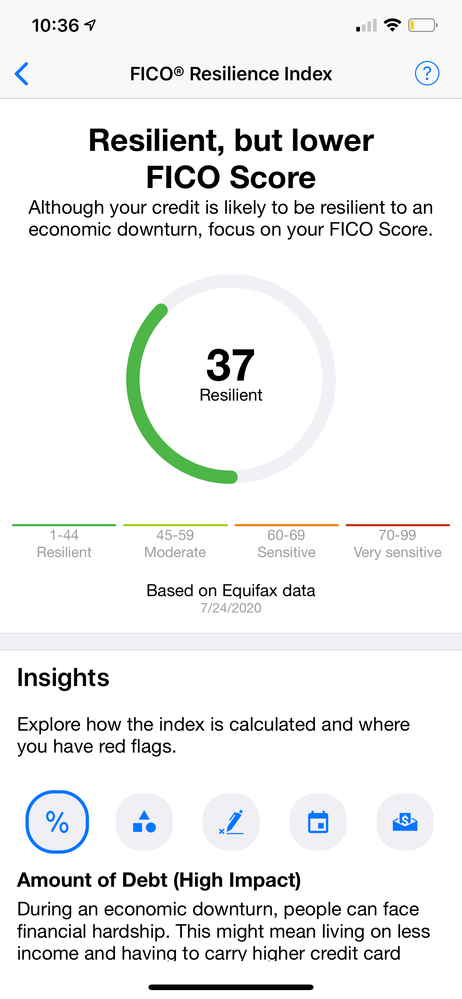

i think I've got a good one! I am working on my credit score but was pleasantly surprised with this! No red flags