- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Free FICO Score Every Month: Why Financial Ins...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Free FICO Score Every Month: Why Financial Institutions Do It

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Free FICO Score Every Month: Why Financial Institutions Do It

Have you ever wondered why (Discover/Amex/banks/etc.) give "free" FICO scores every month? Of course, it is because they can mitigate their risk while seeing your data every month. But that could get expensive if they banks are actually buying the scores at retail rates. Then, one might wonder: Why in the world would a credit-scorring organization provide free/nearly-free scoring to financial institutions?

I think I figured out why. It's a bit crafty, and it actually makes one company in particular some extra $$$ even though consumers technically do not pay for the service. But before I spill the beans, I was wondering if any one would like to guess by answering the following two questions:

- Which company stands to gain the most $ because of this "free" service?

- How does the scheme work?

Hint: The "free" score does not pop-up on the same day every month, and if you call the financial institution and ask them why, they will be quick to tell you, as if trained by robots, that they have absolutely no control or intervention in the delivery of the score. They will go on to say that, even the rendering of the score's web page is not done by them, but by some other company.![]()

Why would the web page of a bank, not be under the control of the bank? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

@AnonymousHave you ever wondered why (Discover/Amex/banks/etc.) give "free" FICO scores every month?

I've always just seen it as they're pulling your report/score anyway monthly for account maintenance, so why not pass that score and a front-end report on to the customer if they may find value in it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

@Anonymous wrote:

@AnonymousHave you ever wondered why (Discover/Amex/banks/etc.) give "free" FICO scores every month?I've always just seen it as they're pulling your report/score anyway monthly for account maintenance, so why not pass that score and a front-end report on to the customer if they may find value in it?

I think that's right, BBS. It's worth observing that CC companies doing this is (in the broad sweep of FICO's history) is fairly new. Basically the last 4-5 years.

Prior to that, although many CC companies were certainly obtaining soft-pull FICO scores frequently as a means of monitoring their customers (and their risk) these same CC companies were forbidden by the terms of the license wih FICO to give out those scores in the way we now see today.

That began to change in Nov 2013 with FICO's announcement of its "Open Access" program. That permitted CC companies to share the scores regularly with their customers if they chose to (assuming the company enrolled in the OA program).

The first CC companies were Discover and Barclay, if I remember right. But after that it became just the power of the free market. Other CC companies saw that this made Discover and Barclays attractive to customers, so other CC issuers (and banks, etc.) wanted to be equally attractive (competition between CC isuers is cutthroat). And the rest was history as they say. Tons of CC issuers now participate in Open Access -- simply out of a desire to attract and retain customers.

An interesting question is why FICO shifted its policy in late 2013 to permit this kind of sharing. My belief is that Vantage had (by early 2013) made huge inroads as the chief score customers use to evaluate themselves -- simply because of Karma, Sesame, Quizzle, and many other free sites. Vantage was basically FICO's only competition, and thus its only threat to its monopoly on the industry. Open Access was a strategic move against Vantage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

@AnonymousAn interesting question is why FICO shifted its policy in late 2013 to permit this kind of sharing. My belief is that Vantage had (by early 2013) made huge inroads as the chief score customers use to evaluate themselves -- simply because of Karma, Sesame, Quizzle, and many other free sites. Vantage was basically FICO's only competition, and thus its only threat to its monopoly on the industry. Open Access was a strategic move against Vantage.

I'm only guessing, but I think that FICO gets more $ by allowing the customer to see the score every month through the customer's financial institution. The trick is to "tease" the customer into purchasing a score:

I believe this after watching my score, through several banks and both Discover and AMEX. I noticed that the day-of-the-month of revelation would vary. There is no reason, computationally, for this variation to occur. On the contrary: computers generally do better when the information is processed on the same day, every month. Also, I noticed that the CSR's for each institution were quick to express how little interaction the institution had in presenting the score, almost as if their senior management had told them what to say.

That lead me to conclude that FICO knows when the customer clicks the "View Score" button, each and every single click, and wants to know. Why? Because monitoring the customer's viewing habit will given FICO and indication of how interested the customer is, in the score, for that particular month. If the customer "normally" receives the score on the 5th of the month, and the customer starts clicking, 10 times a day, on the 5th, 6th, 7th, etc.; then FICO could reasonably conclude that there is some reason (mortgage, car, credit bump, etc) that customer really, really wants to see the score. How does FICO respond to this interest? They respond by withholding the score a few days longer. The idea is that, if the customer is desperate enough to see the score, s/he will not wait for the normal pop-up. S/he will pay for it, either at myfico.com, or throgh some third-party. Either way, FICO gets paid.

I tried this hypothesis with both Amex and Discover, and, in both cases, feigning desperation by excessive clicking on the view-score button, and, in both cases, my scores were withheld 4+ days outside the "normal" day.

But this is just speculation.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

@AnonymousI'm only guessing, but I think that FICO gets more $ by allowing the customer to see the score every month through the customer's financial institution. The trick is to "tease" the customer into purchasing a score:

I believe this after watching my score, through several banks and both Discover and AMEX. I noticed that the day-of-the-month of revelation would vary. There is no reason, computationally, for this variation to occur. On the contrary: computers generally do better when the information is processed on the same day, every month. Also, I noticed that the CSR's for each institution were quick to express how little interaction the institution had in presenting the score, almost as if their senior management had told them what to say.

That lead me to conclude that FICO knows when the customer clicks the "View Score" button, each and every single click, and wants to know. Why? Because monitoring the customer's viewing habit will given FICO and indication of how interested the customer is, in the score, for that particular month. If the customer "normally" receives the score on the 5th of the month, and the customer starts clicking, 10 times a day, on the 5th, 6th, 7th, etc.; then FICO could reasonably conclude that there is some reason (mortgage, car, credit bump, etc) that customer really, really wants to see the score. How does FICO respond to this interest? They respond by withholding the score a few days longer. The idea is that, if the customer is desperate enough to see the score, s/he will not wait for the normal pop-up. S/he will pay for it, either at myfico.com, or throgh some third-party. Either way, FICO gets paid.

I tried this hypothesis with both Amex and Discover, and, in both cases, feigning desperation by excessive clicking on the view-score button, and, in both cases, my scores were withheld 4+ days outside the "normal" day.

But this is just speculation.

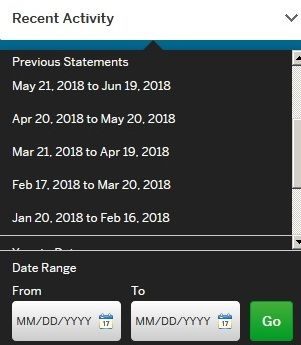

I don't think there's a "usual date" that you can go by. Definitely not with Amex. See my screenshot of my Amex statement dates, which vary as much as 4 days over just the last handful of months. If the statement dates are going to vary, your FICO score update date is going to vary as well. I don't think any conspiracy theory stuff is at play here.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

I should have mentioned that my "usual" date varies just like yours.

If someone had asked me to set up a system like this, one of the things I would do is make sure that there is no "usual date". That would defeat the purpose, which is to create uncertainty as to when, each month, the score is rendered, regardless of what is happening to the score. If there were a "usual" date, or if the window-of-revelation were, say, limited to 2 days, then this scheme would never work, because the customer would know, roughly, when the score is coming, and if it did not come on a certain date, they would simply wait-it-out. But if the window-of-revelation is extended to 10 days (as happened in my case once), then you have opportunity to stimulate the customer into purchasing a FICO score. The key is to vary the revelation date, while monitoring the click behavior of the customer, so as combine uncertainty-of-revelation-date with desperation-of-knowing. In cases where the customer really wants to know, the trick would be to maximize the probability that the customer will become frustrated and simply purchase a score from FICO or a third-party.

It's a lot like fishing, now that I think about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

It's an interesting idea, bud, but I am inclined to think along the same lines as BBS. The number of people who :

(a) know about myFICO.com and that you can purchase scores there, AND

(b) get so frustrated after an extra few days that they go there purchase to their scores (but wouldn't otherwise have done so)

is I am guessing extremely tiny. FICO could and should think about ways to make profit on their scores. But their profit margin is likely in the hundreds of millions of dollars each year. This scheme might get them an extra $1000 -- but might actually lose them money if some of these people decided to start using a Vantage based tool that gives them frequent updates like Karma, WalletHub, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

@AnonymousI don't think there's a "usual date" that you can go by. Definitely not with Amex. See my screenshot of my Amex statement dates, which vary as much as 4 days over just the last handful of months. If the statement dates are going to vary, your FICO score update date is going to vary as well. I don't think any conspiracy theory stuff is at play here.

There is no "usual date" for an AmEx statement. But it is not by random. The statement is exactly 25 days before the next due date, with one exception: If according to this rule, the statement day would fall on a Saturday, the statement will be one day earlier (on Friday).

So I know that your due date is the 14th of the month. Also in February your statement date should have been on the 17th. But February 17 was a Saturday, so the due date was on the 16th.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Free FICO Score Every Month: Why Financial Institutions Do It

It is just a perk, I am sure the CRAs have special b2b deals with the credit card companies to feed a service like this.

That way the credit card company can try to sell you on this service. The ones I see with Wells Fargo, Credit One, Cap 1 and Discover are all pretty useless. No good data, you have to have a real service like Myfico to see anything.