- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- How is my credit score compared to other 19 year o...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How is my credit score compared to other 19 year olds?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

@Anonymous wrote:

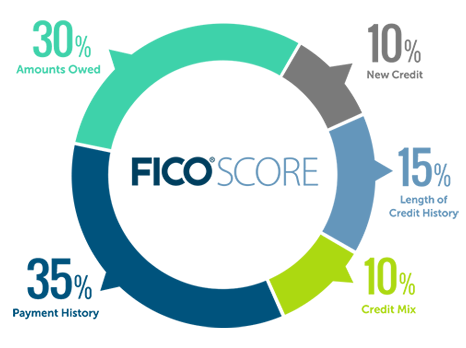

@Subexistence wrote:The highest score I achieved thus far with 770Eq08 at like month 9 AoOA. I had perfected every area except age wich I meant I had installment loans, perfect installment utilization, perfect revolving utilization, no derogs, etc. This means that the difference between 770 and 850 lie entirely in age related factors. A whole 80 points is actually a lot. FICO, I would say, does give age a lot of consideration to age.

Don't you have some inquiries? A perfect number of inquries is zero.

Under the "area" of age, are you including only those factors in the Length of Credit History category?

Or are you also including the following factors, which are typically classified under the New Credit category?

Age of Youngest Account

Number of new accounts (probably caluclated as a %)

Although "three" is generally given as the number of credit cards a person needs, I am not certain that consumers might not get a scoring advantage from having a couple more.

You also are a little borderline in terms of total number of accounts (which measures thickness vs. thinness).

You are likely in a highly restricted scorecard based on thinness, age of oldest, and age of youngest (the three factors used in scorecard assignment). You may get some more benefit when you have 1-2 more cards, a few more accounts total (no longer borderline thin), and a bigger Age of Oldest.

Sorry, I was including new credit and credit age when I said age. I also included inquiries as well.

In regards to thickness, I have SSL, secu student visa, BBR, BCE, and Discover as open accounts with an additional closed account. I believe I recieve no more scoring benefit and in fact hurt in LN scoring with more accounts.

I can definitely improvise if I were to raise my age, particular AoOA. Although, with the exception of AU history, it's hard to game AoOA. I wonder what my score would be if I added a 40 year old AU account.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

If you can add a 40 year old (!) account (that is clean with a very low utilization) then I would definitely do it. That would not help everyone but man would it ever help YOU. (As a person with an ultralow AAoA and AoOA.) It will raise your AAoA to > 6.0 and your Age of Oldest to 40.

You don't have to keep it forever, but you could keep it, while you are in school. If the ancient mortgage models in use today are still being used when you buy a house in five years from now, you can leave it in place through the home purchase too, since the old models fully count AU accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

@Anonymous wrote:

@Subexistence wrote:I can attest to the fact that UW takes it into consideration. I applied for a card a couple days ago and was declined due to short age and with recon denied. My score I believe was 750 at the time.

And this brings me to another spinoff topic that I've argued many times in the past, which is that scores should be indicative of what is determined upon a MR. f "age of accounts" is going to be the limiting factor here preventing one from obtaining credit, their score should be representative of that denial reason. IMO, score in this case shouldn't be 750. Maybe 700-710? 750 on paper basically suggests that someone can get approved for just about anything. Your denial obviously shows this is not true... so why should FICO give a score that suggests otherwise? A 700-710 score is solid, but does suggest that there's room for improvement in one or more categories, so a denial with such a score to me seems more fitting than a denial with a 750 score on an otherwise equal profile.

I admit getting turned down with 750 is very frustrating and unexpected. This means expecting the best rates at 760 is not safe. The only way to expect the best rates is to also ensure that the weakest area of your report is strong enough. My guess is Chase uses its own internal scoring which may have placed me somewhere around 700-710 assuming their internal model has a standard score range.

If all FICO scores were equal, meaning every 750 represents the same risk as every other 750, I would expect to see companies have cutoff scores that could easily let people know whether or not to apply. This would prevent wasted inquiries.

Another possibility is that I may have been flagged as a churner and Chase tried to find a reason to reject me. I am past 5/24 although the card I applied for is not limited by 5/24.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

@Anonymous wrote:

@Gmood1 wrote:

Step daughter's FICO score were between 730 and 750 with 6/8 months history. Two CC's reporting at the time with no back dating.And just to confirm.... no loans or any other installment accounts? Exactly two accounts total?

That is correct CGID. No other loans reporting at that time. Since then she's added three cards of her own along with the Alliant SSL and now an auto loan.

Scores are in the 750 to 780 range now..she's 20 yrs old with AAoA of 13 or 14 months. Her TU8 on Discover was a 779 a few weeks ago. Her EQ9 on Navy Fed was a 731, lower than her Fico 8 scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

@Subexistence wrote:

Another possibility is that I may have been flagged as a churner and Chase tried to find a reason to reject me. I am past 5/24 although the card I applied for is not limited by 5/24.

But you are not a churner, right?

Strictly speaking to churn a credit card or bank account is to open a very specific card or deposit account, get the bonus, close it, and then reopen that same product again in an attempt to get that bonus again. I (for example) have been churning Chase savings and checking accounts for three years and I hope to do that for years to come (opening and closing the same product every year). This link is devoted to identifying credit cards that are churnable:

https://www.doctorofcredit.com/list-of-churnable-credit-cards/

I don't think you are even a CC bonus chaser, which you can be without being a churner. If you were a bonus chaser you would have several credit cards that you had opened in the last two years that gave you a bonus. But you only have a very few credit cards on your report right now. You may be a bonus chaser in the inner tabernacle of your consciousness, but not according to your report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

Sub, if you were denied by Chase, chances are that it was because of your short history.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

Back in 2013, when I really I didn't have a score (apparently without a CC, loan of any kind for 12 years they basically just delete your account). Well anyway, I got a Discover (Dad co-signed) and when it reported I was over 700. Like 706. I was 47 at the time. Though it took another CC and a long time to get 720.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

@Anonymous wrote:If you can add a 40 year old (!) account (that is clean with a very low utilization) then I would definitely do it. That would not help everyone but man would it ever help YOU. (As a person with an ultralow AAoA and AoOA.) It will raise your AAoA to > 6.0 and your Age of Oldest to 40.

You don't have to keep it forever, but you could keep it, while you are in school. If the ancient mortgage models in use today are still being used when you buy a house in five years from now, you can leave it in place through the home purchase too, since the old models fully count AU accounts.

I don't have any old account I can simply add to my knowledge. I might be able to find some credit repair service that adds AU but I'm not sure about the cost of that. I'm very cost sensitive, but if investing in an AU account could pay off financially, then I'm open to the idea of buying AU. If I would have known I would have been rejected from my SUB of $200, then I might have paid less than $10 to get the AU on, in order to make the SUB. I don't have any current plans to apply for more cards, although if I do, I wouldn't be opposed to buying an AU boost.

I find the AU effect on FICO 08 to be disadvantegeous to me. It provides advantages to my competitors(everyone else who applies for the same product as I do), while giving me no advantage.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

@Anonymous wrote:

@Subexistence wrote:Another possibility is that I may have been flagged as a churner and Chase tried to find a reason to reject me. I am past 5/24 although the card I applied for is not limited by 5/24.

But you are not a churner, right?

Strictly speaking to churn a credit card or bank account is to open a very specific card or deposit account, get the bonus, close it, and then reopen that same product again in an attempt to get that bonus again. I (for example) have been churning Chase savings and checking accounts for three years and I hope to do that for years to come (opening and closing the same product every year). This link is devoted to identifying credit cards that are churnable:

https://www.doctorofcredit.com/list-of-churnable-credit-cards/

I don't think you are even a CC bonus chaser, which you can be without being a churner. If you were a bonus chaser you would have several credit cards that you had opened in the last two years that gave you a bonus. But you only have a very few credit cards on your report right now. You may be a bonus chaser in the inner tabernacle of your consciousness, but not according to your report.

Oh I should have known that I'm not a churner. I do consider myself a bonus chaser![]()

Anyways, how many new accounts need to be on a report for it to be considered bonus chasing.

I am quite surprised by this article.

http://clark.com/personal-finance-credit/how-a-19-year-old-got-a-credit-score-of-820/

It seems a single AU account can raise ones score up to 820. The 19 year old in the article is only missing credit thickness and credit mix which must account for the 30 points that keeps him/her from 850. If that person had gotten SSL at age 18, his/her AaOA and AoYA which take a hit but gain installment boost. Perhaps a person at age 19 could theoretically achieve a score as high as 830 or 840 with perfect conditions. The perfect conditions is a lot of AU accounts with 30 years and the SSL with 1-9% utilization for both revolving and installment. A lot of AU accounts would increase thickness and AaOA to maximize in those areas. The only factor in the way of an 850 in this case would be that the SSL is only a little over a year old.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How is my credit score compared to other 19 year olds?

@HeavenOhio wrote:Sub, if you were denied by Chase, chances are that it was because of your short history.

True.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit