- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: My journey to zero balances

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

My journey to zero balances

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

I'd payoff everything except for the BoA Elite card since it's at 37%. Doing this you'd have to come out of pocket about 3700 bucks but you'd have approx 18 cards reporting a zero balance. Then requst letters from the credit card customer service rep that states you have 0 balances and send it to the CRAs so that they can update your credit report faster like within a week. this is IMHO.

myFICO EQ 614 TU 599 EX 644

Goal 700 by March 30 2015

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

@Anonymous wrote:I'm approved for a loan from Lending Club that I'm going to use to pay down a large chunk of this debt. Does anyone have opinions on how I should pay these off? Should I go for the lowest possible monthly payment or pay off the accounts with the highest interest rates? The loan covers all but 14-15k of the 49k outstanding balance.

I would suggest paying off as many cards to $0 as possible. You should be able to pay off all but 2 cards if you do it that way.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

Yay for green! Good for you for taking this on. I never had the amount of consumer debt that you have, but I had quite a bit. Getting rid of it once and for all was definitely one of the most liberating things I've done in my life (even with the still-mountainous student loan debt).

As a side note: Do you have a handle on your budget? YMMV but, for me, having clear visibility into what's going out and what's coming in at any given moment, and also having a plan for how my money is going to be used going forward has been essential in not racking up more debt. I use YNAB (You Need a Budget - that's my referral link that gets you a discount off the regular price if you're in the market for a program) and I'm not exaggerating when I say it's been life-changing for me. I love it because it's simple and because they offer a ton of free classes and support - plus there's a fantastic online community. For the first time in my life, I've been able to get to a point where I'm living on last month's income, have an emergency fund established, and a variety of "rainy day" funds. Really, though, any budgeting method that fits your personal needs is the right one.

Good luck! I'm looking forward to following your progress and seeing more green on your chart!

Current Score: EQ 08 - 837! Whoo!! (5/14/14);EQ 04 - 795! (5/15/14) 748 (TU - 5/21/12); 760 (EX - 4/16/12 AMEX pull)

Original Goal Score: 760+ EQ --> decimated!

New Goal Score: Just keep swimming...

Take the FICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

That was me seven months ago. Every card I had was maxed out - in fact some of them were over the limit (except AMEX, which is new). Like you and your DW, I just decided I had to buckle down and get these accounts paid off. I started with the smallest balances. To help with utilization, I got a CLI on my Wells Fargo and a small CLI on my Capital One, even though they were almost maxed out. I should have my Discover and Sapphire paid off within the next two months. Almost every penny I make goes to paying these accounts off, but the feeling I get as I pay each one off is amazing. I can appreciate the process you're going through, and wish you the best of luck.

Credit Limit $20,000 | Balance $7,883 | Account Wells Fargo |

| $8,250 | $7,096 | Capital One |

| $6,000 | N/A | J.C. Penney |

| $5,000 | N/A | Chase Freedom |

| $5,000 | $910 | Chase Sapphire |

| $5,000 | $1,848 | Discover |

| $3,300 | N/A | Walmart |

| $2,150 | N/A | Victoria's Secret |

| $2,000 | N/A | Amex BCE |

| $2,000 | N/A | Chase Southwest |

| $1,900 | N/A | Merrick Bank |

| $1,450 | N/A | Credit One |

Starting Score: 532

Starting Score: 532Current Score: EQ08 702, TU08 710, EX08 701Goal Score: 760

NASA, $30,000/ Wells Fargo $20,000 / Venture $7,500 / JCP $6,000 / Ch Freedom $5,000 / Ch Sapphire $5,000 / Discover $5,000 / Walmart $4,500 / VS $2,150 / AMEX BCE $2,000/ Chase SW $2,000 / Merrick $1,900 / Credit One $1,450 Take the myFICO Fitness Challenge

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

@Education44 wrote:That was me seven months ago. Every card I had was maxed out - in fact some of them were over the limit (except AMEX, which is new). Like you and your DW, I just decided I had to buckle down and get these accounts paid off. I started with the smallest balances. To help with utilization, I got a CLI on my Wells Fargo and a small CLI on my Capital One, even though they were almost maxed out. I should have my Discover and Sapphire paid off within the next two months. Almost every penny I make goes to paying these accounts off, but the feeling I get as I pay each one off is amazing. I can appreciate the process you're going through, and wish you the best of luck.

Credit Limit

$20,000

Balance

$7,883

Account

Wells Fargo

$8,250 $7,096 Capital One $6,000 N/A J.C. Penney $5,000 N/A Chase Freedom $5,000 $910 Chase Sapphire $5,000 $1,848 Discover $3,300 N/A Walmart $2,150 N/A Victoria's Secret $2,000 N/A Amex BCE $2,000 N/A Chase Southwest $1,900 N/A Merrick Bank $1,450 N/A Credit One

Smart and well done!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

My plan is to have every thing paid off in 8 years. Both our credit score is horrible low 500's$. I will be document how this will change our credit score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

Update! Loan from Lending Club has been approved and the money is on its way. I know the advice has been mostly to pay down all the highest rates, but what I really need is some cushion in my monthly payments and I've found a way to save myself $300 a month by paying off all my cards and putting most of that money towards my wifes cards where I'm an AU.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

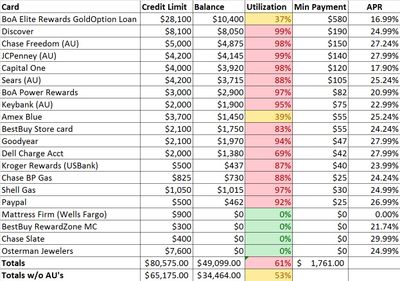

Here's a screen cap of what my debt will look like by this time next week if not before.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

@Anonymous wrote:Here's a screen cap of what my debt will look like by this time next week if not before.

That's awesome. What APR did you get on the loan and what will the monthly payment be on that? It always helps having all the payments together instead of a bunch of different cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: My journey to zero balances

Congrats on the many steps taken to upright your credit ship! Make you continue to have good luck on your journey and no unforeseen challenges. Good luck.