- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: NFCU SSL Reporting..first ever 0 point gain?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU SSL Reporting..next steps?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

@lowspender wrote:

@Anonymous wrote:

@lowspender What do you mean about the ratings being reversed? CK Scores are vantagescore, a totally different algorithm that's not really used by lenders. Getting a number direct from fico is not possible. The CRAs license the algorithm from fico and they produce the score using it. What are your negative Reason codes for that EX score?Ok so it's a vantage score that says TU, not a fico based TU. seems misrepresented. Not direct, I should say an actual fico based number, unlike the v.s. algo base in CK.'

Negative reason for Ex is length of credit history, which they rate as "good" in the detailed score breakdown

Equ and TU list it as a strength, but in score breakdown, rate my credit history as "fair."

Ex says I would gain 34 points from having history as a positive not negative.. but Equ and TU give me more points with a lower rating for history..

@SouthJamaica wrote:

@lowspender wrote:

That's disappointing. Fico factors into TU and Exp too though, doesn't it.. seems like it would have to make a difference that I could track..Nope. Totally different. No connection whatsoever. They can be miles apart.

The SSL maneuver works on FICO 8 and 9 scores.

Isn't birdman saying that the agencies license the fico algo, so they have some connection right.. ?

Looks like it did boost my Exp and TU significantly..

Fico makes the algorithm. They license it to the CRA's and they produce the scorecards for the version at each CRA based on their respective datasets. They basically leave a black box at the CRA and the CRA runs profile data through it and the score comes out the other side.

you have to understand not only are there 30 something fico scores there are also Vantage scores and other ones. So there may be 50 scores just from TU. That's why you have to know what score you're getting from the bureau.

negative Reason Codes tell you things that could offer more points. What are you talking about strengths? Are you talking about ingredient ratings? And if so from MF?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

If you are speaking of the score ingredient ratings, you can see neither one of them are exceptional and therefore both have room for improvement. Fair and good both indicate room for improvement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting.. next steps?

@Anonymous wrote:

They license it to the CRA's and they produce the scorecards for the version at each CRA based on their respective datasets. They basically leave a black box at the CRA and the CRA runs profile data through it and the score comes out the other side.you have to understand not only are there 30 something fico scores there are also Vantage scores and other ones. So there may be 50 scores just from TU. That's why you have to know what score you're getting from the bureau.

negative Reason Codes tell you things that could offer more points. What are you talking about strengths? Are you talking about ingredient ratings? And if so from MF?

Ok, that makes sense. As for the many fico scores, after moving past the CK vantage scores, I've only been discussing fico 8 scores, from each cra. What is MF? I'm on an Exp trial. I could put a screenshot in.. strengths not being the listed "positives" we're disregarding.. yes, the score ingredient ratings.

@Anonymous wrote:

you can see neither one of them are exceptional and therefore both have room for improvement. Fair and good both indicate room for improvement.

Yes, true. What confuses me is why the "good" credit history length rating is on the lower score and cited as a weakness and the "fair" rating is on the higher scores, cited as a strength. Ignoring the "positive" on the rating, only looking at ingredient breakdown.. it says "good" on the low score and fair on the higher scores. The lower score is 50 points lower, with all the same info. Other 2 are much closer together. How does that happen?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

@lowspender wrote:

@Anonymous wrote:

They license it to the CRA's and they produce the scorecards for the version at each CRA based on their respective datasets. They basically leave a black box at the CRA and the CRA runs profile data through it and the score comes out the other side.you have to understand not only are there 30 something fico scores there are also Vantage scores and other ones. So there may be 50 scores just from TU. That's why you have to know what score you're getting from the bureau.

negative Reason Codes tell you things that could offer more points. What are you talking about strengths? Are you talking about ingredient ratings? And if so from MF?

Ok, that makes sense. As for the many fico scores, after moving past the CK vantage scores, I've only been discussing fico 8 scores, from each cra. What is MF? I'm on an Exp trial. I could put a screenshot in.. strengths not being the listed "positives" we're disregarding.. yes, the score ingredient ratings.

@Anonymous wrote:

you can see neither one of them are exceptional and therefore both have room for improvement. Fair and good both indicate room for improvement.Yes, true. What confuses me is why the "good" credit history length rating is on the lower score and cited as a weakness and the "fair" rating is on the higher scores, cited as a strength. Ignoring the "positive" on the rating, only looking at ingredient breakdown.. it says "good" on the low score and fair on the higher scores. The lower score is 50 points lower, with all the same info. Other 2 are much closer together. How does that happen?

@lowspender yes, please provide screenshots. MF is MyFico which is the customer service division of the sponsor of this forum. They provide the most comprehensive scores set from all three bureaus. like 28 scores.

even with identical data across the bureaus you can have a score change of plus or -20 points, if I remember correctly. 50 points is an anomaly.

You need to pull all three reports from annualCreditreport.com and go over them with a fine tooth comb, something else is different. Yes, it makes sense to have different scores because they weigh different metrics differently.

I highly recommend that you read the Scoring Primer linked at the top of my signature; it will give you a lot of insight into how this works and why scores are different and information about the negative reason codes etc.

You can't count on positive reason codes from any CMS other than MF. Those are the only ones confirmed by the experts to have a correlation with the algorithm that we are aware of.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

@Anonymous wrote:

MF is MyFico which is the customer service division of the sponsor of this forum.even with identical data across the bureaus you can have a score change of plus or -20 points, if I remember correctly. 50 points is an anomaly.

You can't count on positive reason codes from any CMS other than MF. Those are the only ones confirmed by the experts to have a correlation with the algorithm that we are aware of.

Ok, I went on the experian trial mentioned earlier, not getting this from MF. Also now that I browsed your primer.. I don't see reason codes on my end, seems like I've clicked everything.

It may come down to 2 score components, given that they're ranked independently..the conclusions though, not seeing it..

TU gives me the highest score, but is tied with Exp for my lowest scores in length of credit history rating (pictured) and new credit (those combined might be the discrepancy, that isn't highlighted in the comparison or negatives, I missed it).

So, why is TU so high?

Equ is a notch up in new credit, so that makes sense.

Either TU should be lower or Exp should be higher..

I see that an account is marked as "closed" that had a stolen number replaced years ago, that 5 months will change the average age..

TU ranks me high in spite of that. So, something is off..the change could help both TU and Equ, which aren't the problem..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

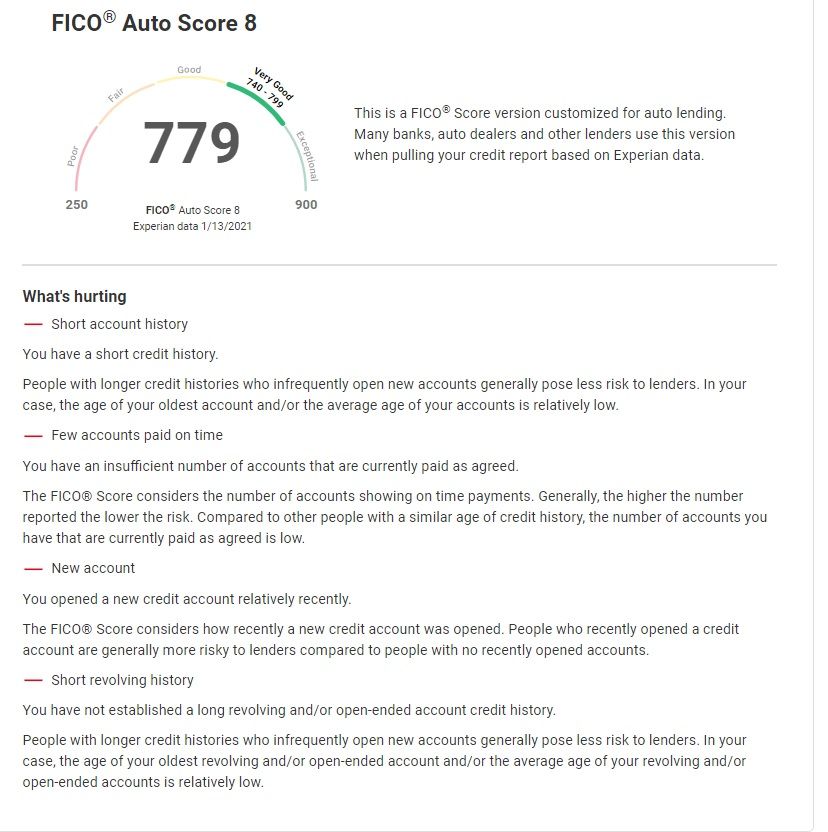

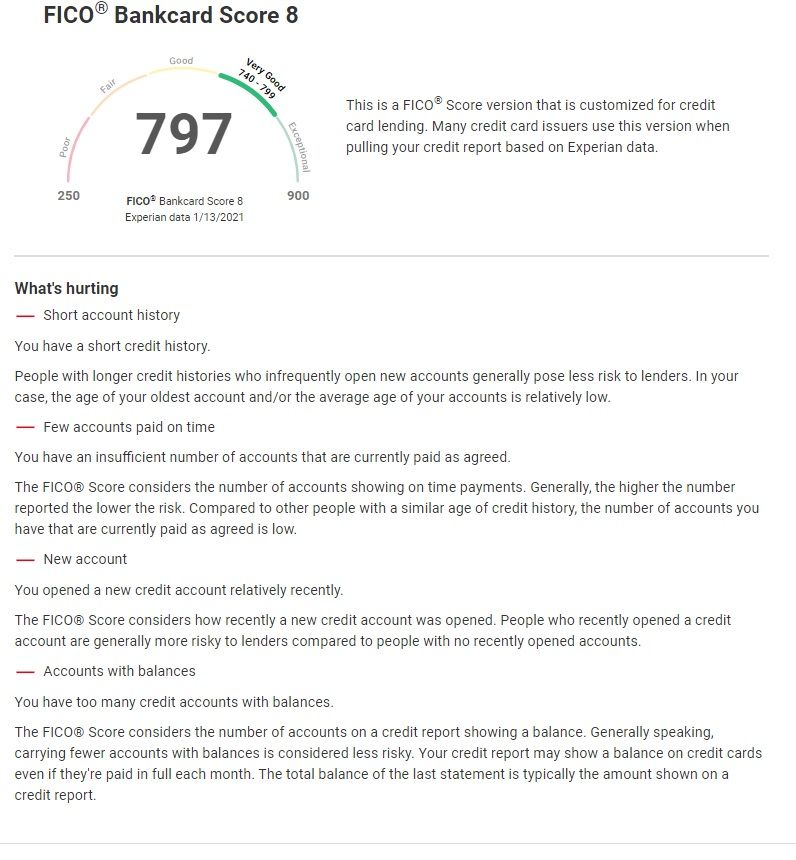

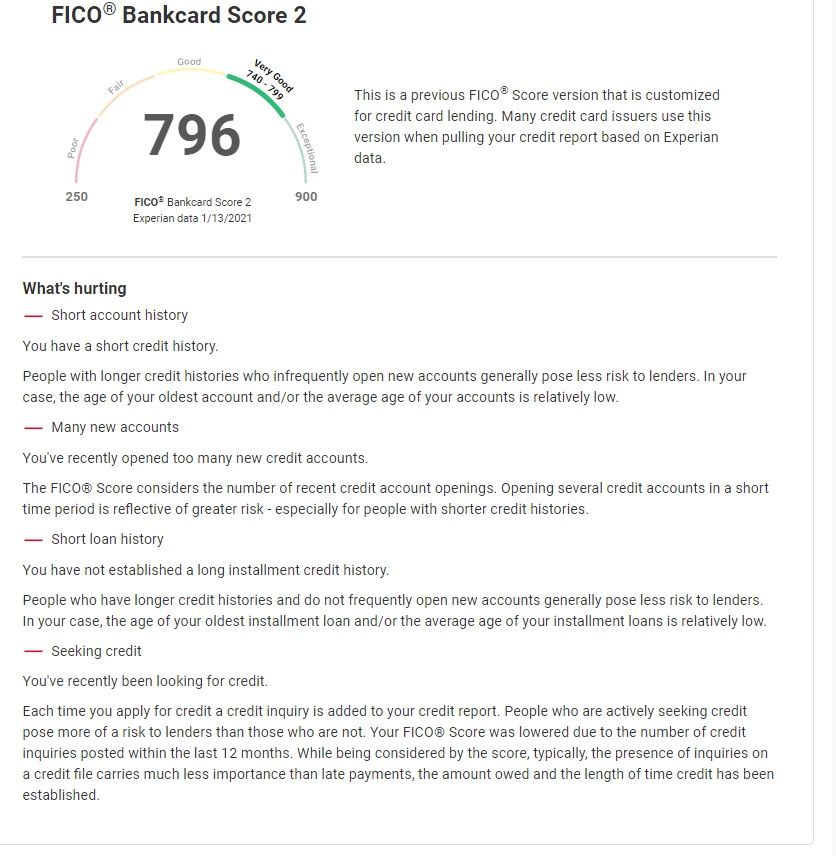

There’s kind of a workaround. Go look at the scores for the industry options, auto and bankcard. They go to 900 and will typically show reason codes up to 850. Also I’ll look a little further out what you posted.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

Nevertheless there is definitely a significant disparity between Experian and the rest. You need to exam the differences between the reports with a fine tooth comb.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

@Anonymous wrote:

OK you’re not getting negative Reason codes for the ones that are 800 or above because they’re so high. And you’re only getting one reason code on Experian for short history. That’s your negative reason code.

There’s kind of a workaround. Go look at the scores for the industry options, auto and bankcard. They go to 900 and will typically show reason codes up to 850. Also I’ll look a little further out what you posted.

Ok, I checked out the auto and bankcard. They have pretty much everything as a negative, in ways that I don't understand and some aren't possible. Tell me which of the autos you want me to post, or the bank 2, I can do that.

@Anonymous wrote:

Yeah see what you’re talking about now. EX has the higher average age but has the negative Reason code for short history. If you could see negative Reason codes for the other two, they would probably list that as well.

Nevertheless there is definitely a significant disparity between Experian and the rest. You need to exam the differences between the reports with a fine tooth comb.

I was focusing much more on the good v fair than average age numbers, yet the numbers almost certainly mean more..

Biggest difference I see is that my low score shows me with 2 closed accounts, the others with 1. Nothing was closed by me, that was a bank changing my card type and a closing error that was fixed. Maybe I need to call my bank to change what they reported years ago. Not a deliquent account, but "closed" isn't exactly a plus...

My low score has each of the payment histories in their own "closed account" section. Not sure if that matters, as they show all the way back to when it started.. now in my higher score reports, it actually has payment history as unknown on the old record for the closed account.

Should I post some screengrabs? not sure if this is coherent.

Thank you for looking at that so thoroughly btw..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

Putting a few of these in preemptively..

What are these referencing?

Auto8 says few accounts paid on time. All of my accounts, always have been...

Would getting closed accounts "exceptional" payment history to not be scattered among the "closed" accounts that the bank initiated the closing of, help?

Short revolving history, for 8- my longest card is labeled on the report as revolving. something else?

Bank 2- too many new credit accounts- unless a non hp ssl counts, 1 in the last few years? does it count the bank closing an account and opening a new one for me when the product line expires, without a hp, as a new one?

Short loan history- didn't establish installment loan history- I just got a boost for this I thought.. and it reflects on the report, don't get that..

Seeking credit- my app 4 months ago, no hp's on my record beyond that..

Bank8-

-too many accts with balances- the ssl and 1 card, other one reported 0 this month..

-"You have an insufficient number of accounts that are currently paid as agreed"- this again...

-Accounts with balances- "You have too many credit accounts with balances," yet I also have a thin file. I am at 2% util this month, this must be auto generated in part..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

@lowspender wrote:

@Anonymous wrote:

OK you’re not getting negative Reason codes for the ones that are 800 or above because they’re so high. And you’re only getting one reason code on Experian for short history. That’s your negative reason code.

There’s kind of a workaround. Go look at the scores for the industry options, auto and bankcard. They go to 900 and will typically show reason codes up to 850. Also I’ll look a little further out what you posted.Ok, I checked out the auto and bankcard. They have pretty much everything as a negative, in ways that I don't understand and some aren't possible. Tell me which of the autos you want me to post, or the bank 2, I can do that.

@Anonymous wrote:

Yeah see what you’re talking about now. EX has the higher average age but has the negative Reason code for short history. If you could see negative Reason codes for the other two, they would probably list that as well.

Nevertheless there is definitely a significant disparity between Experian and the rest. You need to exam the differences between the reports with a fine tooth comb.I was focusing much more on the good v fair than average age numbers, yet the numbers almost certainly mean more..

Biggest difference I see is that my low score shows me with 2 closed accounts, the others with 1. Nothing was closed by me, that was a bank changing my card type and a closing error that was fixed. Maybe I need to call my bank to change what they reported years ago. Not a deliquent account, but "closed" isn't exactly a plus...

My low score has each of the payment histories in their own "closed account" section. Not sure if that matters, as they show all the way back to when it started.. now in my higher score reports, it actually has payment history as unknown on the old record for the closed account.Should I post some screengrabs? not sure if this is coherent.

Thank you for looking at that so thoroughly btw..

@lowspender I want to see the negative Reason Codes from every versions bankcard and auto and, if they have it, from the classic version! At least from the low bureau, we need to see what's triggering the low score. Is it low on every version?

don't worry about closed accounts, they don't hurt you and they will end up helping you with age. As long as there's nothing derogatory or owed, you're good.