- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: NFCU SSL Reporting..first ever 0 point gain?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

NFCU SSL Reporting..next steps?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

@lowspender wrote:Putting a few of these in preemptively..

What are these referencing?

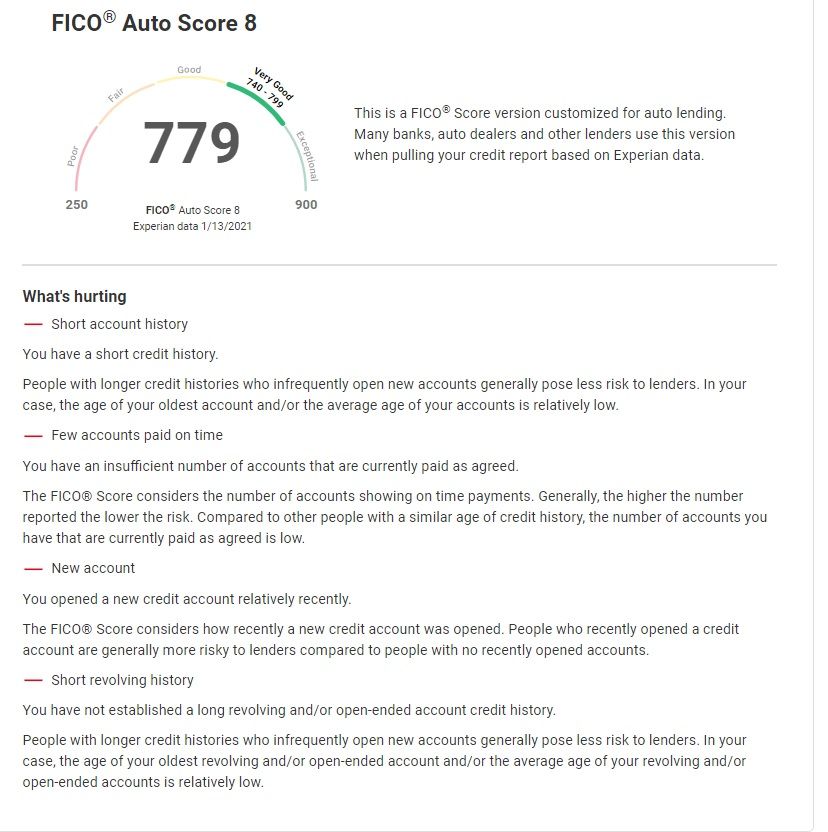

Auto8 says few accounts paid on time. All of my accounts, always have been...

Would getting closed accounts "exceptional" payment history to not be scattered among the "closed" accounts that the bank initiated the closing of, help?Short revolving history, for 8- my longest card is labeled on the report as revolving. something else?

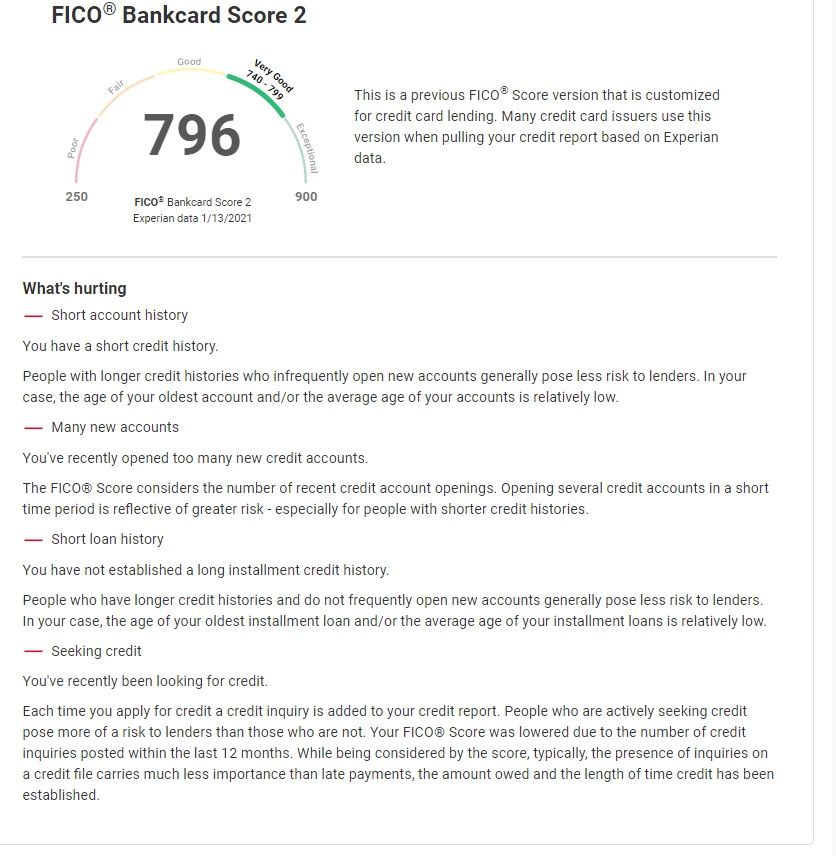

Bank 2- too many new credit accounts- unless a non hp ssl counts, 1 in the last few years? does it count the bank closing an account and opening a new one for me when the product line expires, without a hp, as a new one?

Short loan history- didn't establish installment loan history- I just got a boost for this I thought.. and it reflects on the report, don't get that..

Seeking credit- my app 4 months ago, no hp's on my record beyond that..

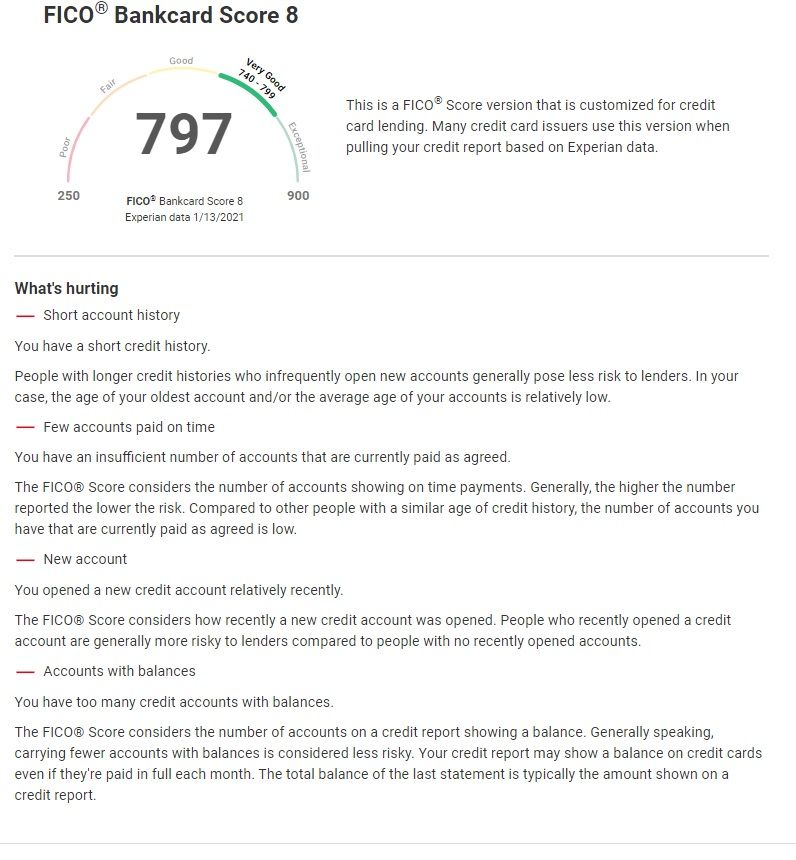

Bank8-

-too many accts with balances- the ssl and 1 card, other one reported 0 this month..

-"You have an insufficient number of accounts that are currently paid as agreed"- this again...

-Accounts with balances- "You have too many credit accounts with balances," yet I also have a thin file. I am at 2% util this month, this must be auto generated in part..

@lowspender OK yes your thin file is hurting you because you don't have enough positive payment history on your record yet.

short revolving history can be indicative of your oldest revolver or your average age of revolvers being under the highest thresholds. Yeah have to give it time without opening revolvers.

from the looks of it, the bank that changed product lines gave you a new account and a new card. Look at that account and look at the date of opening, I have a real strong hunch it doesn't have the original date but has a date less than a year. So you're losing points because you have a new revolver. True you may not of lost points for an inquiry but you did lose points for a new account and for lowering your average age of accounts and your average age of revolving accounts.

yes either your oldest loan or your average loan age is below the highest threshold, so that's the reason for that code, and yes one inquiry in the last 12 months will earn you a seeking credit code.

Yes a couple accounts with a balance can be too many if you don't have very many accounts. How many open accounts do you have? Sounds like you need a few revolvers possibly and you need time to pass from your youngest Revolver as well.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: NFCU SSL Reporting..first ever 0 point gain?

@Anonymous wrote:

OK yes your thin file is hurting you because you don't have enough positive payment history on your record yet.short revolving history can be indicative of your oldest revolver or your average age of revolvers being under the highest thresholds. Yeah have to give it time without opening revolvers.

from the looks of it, the bank that changed product lines gave you a new account and a new card. Look at that account and look at the date of opening, I have a real strong hunch it doesn't have the original date but has a date less than a year. So you're losing points because you have a new revolver. True you may not of lost points for an inquiry but you did lose points for a new account and for lowering your average age of accounts and your average age of revolving accounts.

Every cra rates my pmt history as exceptional.. I agree, the thin is hurting, though not sure why it hurts more on Exp. If payment history is an issue.. wouldn't that same closed account with 3 yrs of payment records that is now closed (same bank, same credit limit, new card when cc was compromised) make a difference? That's age. Open date is listed as mid 2015, but payment history starting in Dec '16. (Same) closed account shows open date a year older, history from early '14 until that gap where active card starts. That is my oldest and only cc acct before 2020, so a lack of old pmt old data seems like it's attributable to the bank misreporting closes/history..just to Exp..

If payment history is not hurt by the incomplete data, but all this is about lack of pmt history on a new revolver.. that would be the Chase card I got 4 months ago.

@Anonymous wrote:yes either your oldest loan or your average loan age is below the highest threshold, so that's the reason for that code, and yes one inquiry in the last 12 months will earn you a seeking credit code.

Yes a couple accounts with a balance can be too many if you don't have very many accounts. How many open accounts do you have? Sounds like you need a few revolvers possibly and you need time to pass from your youngest Revolver as well.

Oldest/only/avg loan are the 1 month old ssl. The inquiry is the chase card. These codes only show up outside of Fico 8. Think they're affecting the Fico 8 or that is the aaoa from earlier on Exp..?

3 total. SSL, original card that is a revolver that has reopened, has 5 but not 6 y/o start date, missing 3yr payment history, Chase card. Chase must age (going to apply for cli once I resolve Exp) and get one more..

I can add screengrabs of the account payment history if that would help. I have thought for a year now I'd want their backgrounds consolidated..and it does seem like 0 closed accounts could be good, unless it necessarily implies young accounts. Does make sense that closed under good terms isn't bad...

@Anonymous birdman has been very generous with his input and analysis of all these screenshots. I probably should put this in another thread with a relevant title to get advice on how to raise (only) my Exp score..to see how to change the variable affecting it, but not the other scores, whether I should dispute something etc. Any thoughts you have on this, before I do that..