- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Reliable AAOA Calculator or Advice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Reliable AAOA Calculator or Advice

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reliable AAOA Calculator or Advice

Hello there fellow MyFico denizens. I am looking for a reliable way to tell what my AAOA from a FICO score perspective. I'm planning on apping for a card and want to be able to see how hard of a hit i'll take to my AAOA. I've searched online and found several but they seem either unhelpful or innacurate.

I have a CK account but it really isn't good in this department as it literally removes cards that you close from your AAOA meter. Clearly Vantage 3.0 and FICO differ a lot here.

Is there a service out there that will calculate it for me? I don't mind entering things one-by-one but I'm unsure of a lot of things.

- How AU (and closed AU) accounts are reported, if at all.

- I have a closed car loan (paid off nearly 2 years ago), how will this affect my score?

- I have a 2 year old mortgage and HELOC as well. No baddies, lates, etc.

I really don't know how to even measure my AAOA and any and all help would be really appreciated.

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

@SecretAzure wrote:

I really don't know how to even measure my AAOA and any and all help would be really appreciated.

It's actually very simple to figure if you've got 5-10 minutes of spare time. FICO scoring looks at all accounts on your credit report, whether or not they're open or closed. Figure out the age of each individual account first in months. To do this all you need to know is that any account opened in a certain month will become 1 month old on the 1st of the following month. Another way to look at it is if you opened an account at any point in March 2018 it became 12 months old on March 1, 2019.

Once you have all of your individual account ages, add them up to get a months total. Then divide that total by the number of accounts you just added up. For example, Cornelius has 2 closed accounts and 3 open accounts on his CR. Their ages are:

1 - 26 months

2 - 71 months

3 - 3 months

4 - 66 months

5 - 39 months

Added up, this is 205 months. Then divide 205 months by 5 total accounts and you get an AAoA of 41 months. This can then be expressed as an AAoA of 3 years, 5 months for simplification purposes.

Then, if you want to know the AAoA impact of adding a new account, you simply take those 205 months and divide by 1 more account, so 6 in this example. 205/6 = 34.16 months. AAoA here would drop from 3 years, 5 months to approximately 2 years, 10 months.

If you have any further questions fire away!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

"AAOA is an acronym for Average Age of Accounts. It is a measure of how long you have managed credit. Your AAOA is responsible for up to 30% of your FICO score and other similar credit scores."

![]()

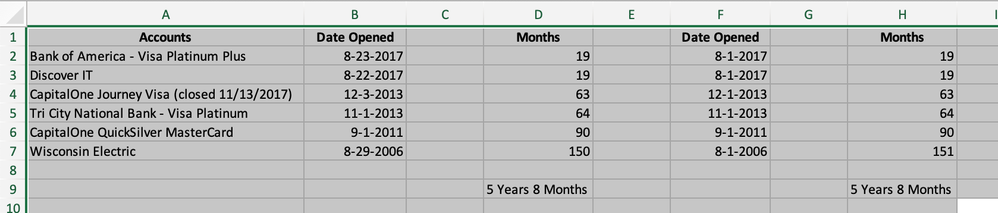

@SecretAzure, your request is very simple to do in a spreadsheet. You would probably want to calculate it two ways since Experian uses the 1st of the month as the date an account was opened while Equifax and TransUnion use the actual date the account was created.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

You can easily do this yourself! I like to use Credit Karma, as they provide exactly how long the account has been open. So what you do you is write down (or use a spreadsheet) all of your accounts. Then add how long they've been open (Ex: 12 years, 3 months) and then convert that to months (so 147 months for that example). Add all the months together for all of your accounts, then divide that by the number of accounts you have. This will give you your Average Age of Accounts (in months) which you just need to convert back to years.

I like to use a spreaksheet because I can easily add a line for a new account if I want to see how much it'll hit my AAoA. Plus formulas make things 100x easier!

OOPS! Ok all the answers before mine are probably easier to comprehend haha. But I still stand by my spreadsheet and formulas!

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

I always understood how credit affects my FICO scores but I never understood exactly how it was calculated. CK is very helpful but it's not the best when it comes to this. For example, my paid off car loan from 2 years ago doesn't even show on there.

I took the advice and it looks like my AAOA is currently 4 years. If I apply for a new CC in April my AAOA drops to 3 years.

This factor having a medium impact on my FICO score, do you think I should worry about it and grow my AAOA out some more or should I just go ahead and app? My newest card is from 11-2017 (BB).

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

@SecretAzure wrote:

I appreciate all your helps everyone!

I always understood how credit affects my FICO scores but I never understood exactly how it was calculated. CK is very helpful but it's not the best when it comes to this. For example, my paid off car loan from 2 years ago doesn't even show on there.

I took the advice and it looks like my AAOA is currently 4 years. If I apply for a new CC in April my AAOA drops to 3 years.

This factor having a medium impact on my FICO score, do you think I should worry about it and grow my AAOA out some more or should I just go ahead and app? My newest card is from 11-2017 (BB).

Honestly, you shouldn't take much of a hit if you apply. My AAoA was a little over 2 years, and when I got a new card, it dropped it a few months. My score didn't budge an inch after the account hit my reports. So if your scores are good, and you're not planning on applying for anything major soon (like a car, mortgage, etc.) then I say go for it. Your scores will quickly recover if you do lose a few points.

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

@SecretAzure wrote:

I appreciate all your helps everyone!

I always understood how credit affects my FICO scores but I never understood exactly how it was calculated. CK is very helpful but it's not the best when it comes to this. For example, my paid off car loan from 2 years ago doesn't even show on there.

I took the advice and it looks like my AAOA is currently 4 years. If I apply for a new CC in April my AAOA drops to 3 years.

This factor having a medium impact on my FICO score, do you think I should worry about it and grow my AAOA out some more or should I just go ahead and app? My newest card is from 11-2017 (BB).

4 to 3 isn’t a threshold that’s known. As long as you’re over 2 still there shouldn’t be much of a drop, if any.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

My from the hip estimate on AAoA changes is 8-10 points per year, or 4-5 points per 6 months. Could be more or less depending on profile and scorecard assignment. It's also important to understand that the changes aren't proportional; they don't happen at the same increments. I also believe strongly that diminishing returns comes into play... where a year early on "matters" more than a year later on. For example, an AAoA drop from 2 years to 1 year is going to be more impactful than an AAoA drop from 8 years to 7 years, even though both involve exactly the same amount of drop in terms of time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Reliable AAOA Calculator or Advice

@Anonymous wrote:My from the hip estimate on AAoA changes is 8-10 points per year, or 4-5 points per 6 months. Could be more or less depending on profile and scorecard assignment. It's also important to understand that the changes aren't proportional; they don't happen at the same increments. I also believe strongly that diminishing returns comes into play... where a year early on "matters" more than a year later on. For example, an AAoA drop from 2 years to 1 year is going to be more impactful than an AAoA drop from 8 years to 7 years, even though both involve exactly the same amount of drop in terms of time.

This hasn’t played out on my profile at all. By your estimations I should have lost 16-20 points on TU going from over 4 to just over 2 and in reality I didn’t lose anything on TU or EX for it although I am still confused as to what tanked EQ so much. I know about the definite 2 year threshold and the 7.8 threshold but the other ones don’t appear to be as well defined.