- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Seeking advice on building credit when utiliza...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Seeking advice on how to improve credit when utilization is high

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on building credit when utilization is high

Just went ahead and paid two of the five cards still over 90% down to 89%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on building credit when utilization is high

@Expansion, those are both great credit unions and a good place to start, but most credit unions are local. You'll have to look around your area. That's a big advantage, because you can talk to a real person, and explain your situation. While there are no guarantees they'll be able to offer you anything, they're going to be inherently more sympathic. CUs are structured very differently from banks, and their focus is more on serving their community than chasing profits. While that doesn't mean they're willing to just throw away money, they're often more generous to people who are struggling. In addition, it's more likely their decisions to extend credit will involve a personal touch not just an AI, and almost all of them make educating people on finance one of their priorities. When you're looking at local credit unions, don't let <company> in their name scare you away. Look at their membership criteria, because they're often open to anyone in the area, not just people affiliated with the company.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on building credit when utilization is high

@Expansion wrote:Hey FinStar, I really appreciate you stepping in here.

My situation is stable. My income is stable and growing. My business is full with a waitlist. I don't need credit right now. I'm in a position where I have the mental space and energy to work on this. I am not pursuing bankrupcy, that's not my path. Respect to those who do, but that's not where I'm at.

I would appreciate any suggestions.

Right now I am continuing to steadily pay things down.

Also, I am, over time, getting consolidation loans (first one through lending club paid off, second one through upstart just begun) to move utilization off the credit cards and also reduce the APRs.

Because there have been times when I was approved for something unexpectedly -- lending club when I was in much worse position than I am now; upstart this past November -- I wanted to reach out to those who have a better sense of the terrain, if there are opportunities I might not be aware of that might be worth exploring.

Sure, anytime. Thanks for providing the additional information. I'm confident we can get some momentum to see you achieve your goals over time.

I'll tag some additional members who could perhaps drive this dialogue into a productive solution for you. @GApeachy is familiar with the business credit aspect of things so perhaps she can chime in here as well. Perhaps @tcbofade, @chiefone4u, @disdreamin, @thornback and others can help.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on building credit when utilization is high

thank you @FinStar ! I appreciate it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on how to improve credit when utilization is high

Kudos on your ability to maintain ontime payment history and your resolve to not pursue BK. I definitely uniquely understand the situation you're in, as I was in the same boat with around 90% overall utilization for years paying around $5k a month in interest and getting nowhere until I got the dual lifelines in 2015 of NASA FCU giving me two offers that helped me completely rearrange my debt and finding these forums. Fortunately, one advantage you have now that I didn't have in 2007/2008 is universal default is no longer a thing so your cards have not all been rate jacked to the mid-20% range. And unfortunately, the one thing that will likely enter the picture for you as these are paid down that hurt me so much is balance chasing.

To finish up your FICO 8 baselines, your Amex account gives you a monthly Experian 8 score (it's buried since they began offering credit monitoring services using TU VantageScore 3.0, but navigate to: Account Services, Profile, View FICO Score). You can also obtain one for free once a month courtesy of Discover at creditscorecard.com

You've already stated that you paid down some of the cards below 90% since I began typing this, and that is a good place to start. Anything reporting over 89% (you'll need to allow for some interest reporting with statement close as well) is definitely an additional score killer. I would absolutely start with looking at credit unions that offer either low APR loans or credit cards with good balance transfer offers to shift some of the balances. When you have income to support the debt and an otherwise clean score history, credit unions can be far more lenient with existing high utilization.

Speaking of utilization, you mentioned that your Citi Diamond Preferred card has a $0 limit - is it actually reporting a $0 limit on your credit reports, or do you just mean that it has $0 limit because it's closed? That is a very important distinction. If it is actually reporting $0 but has a balance, that should be prioritized to be paid off because it's being essentially factored as 100% utilization until it reaches a $0 balance. If it is still reporting a credit limit, however, it's being factored just as your open cards are and with its very low APR I would probably take my sweet time paying it off.

Next, I would focus on freeing up existing cards that may have balance transfer offers. The more balances you can shift to 0% or very low APR balances, the more you can free up each month to throw additional money toward the ones you can't yet shift. Your Navy Federal, Discover, and Bank of America cards are the most likely options here.

Don't get discouraged when (not if) some of your lenders decide to balance chase you. That can always be undone when your utilization is back under control, and do not take it personally when it happens. You'd be hesitant to loan even your best friend more money if they owed you a ton and are taking their sweet time paying your back, after all. It's just risk mitigation and despite your payment history, you're a very high risk on paper right now.

Also, while that loan may be a little higher in APR than your other cards, it also forces you to actually make those payments to get the balances down, gives you a scoring boost by having an open installment loan account, and also helps to reduce the amount of debt in the revolving column.

As your balances come down and your utilization in turn goes down, your scores will climb right back up. Just make sure you continue to have 100% positive payment history reporting and it will be like this never happened.

Edit: Also, not something I recommend to someone drowning with no way out, but since your income seems to be something you don't expect to diminish, do you have home equity you might be able to leverage? That could be a one-and-done with your current balances.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on how to improve credit when utilization is high

Once those five accounts report to the CRAs with less than 89% utilization, you should see a noticeable score increase.

I've been playing the balance transfer game for a few years and I am not done, but can see a light at the end of the tunnel....

Once your Fico 8 scores hit 680 or so, the zero percent balance transfer offers should start to arrive.

A second navy platinum card would come with a 12 month zero percent transfer offer with no fee.

A PenFed card would come with a 12 month zero percent offer WITH a fee.

There is a world of options out there, and this is very doable!

Fico 9: EX 812 04/15/25, EQ 804 04/08/25, TU 792 02/15/25.

Zero percent financing is where the devil lives...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on how to improve credit when utilization is high

@K-in-Boston Thank you so much for your insight and specific suggestions! It means a lot, especially since you have been through what I'm going through, and you are on the other side.

I took notes on what you said ![]()

1. Good news! My Experian 8 is 680!! "GOOD"! I didn't realize I could get it through AmEx. Thank you for the specific instructions!

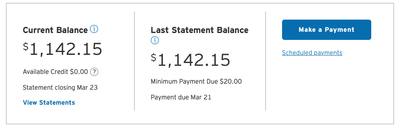

2. With the Citi Diamond Preferred, here's what it looks like in my account:

Since it says "Available credit $0.00," it sounds like that means I should prioritize paying this off (since it's currently 100% utilization no matter what the balance is)? Do I have that right?

(Also, I checked my statement and it doesn't list any limit on the statement.)

And then after I take care of the Citi Diamond Preferred, move on to getting the others under 90%?

THANK YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on how to improve credit when utilization is high

You are very welcome and this is something it seems like you can get through. Like tcbofade, I am not quite out yet and still have what most would consider a shocking amount left, but it is far less than it was in 2015 and it's steadily coming down with very little interest paid rather than stagnating.

Your scores seem easily recoverable as the debt comes down as well. And it may not even be that much to get around 700.

For the Citi card the important thing will be how it is reporting to the credit bureaus rather than on your statements. It is showing $0 in your Citi account because you have $0 available to spend. annualcreditreport.com for all 3, or Credit Karma for TU and EQ reports (ignore the VantageScore 3.0 scores) would be easy places to take a look. What you want to see is whether it is reporting $0 for your credit limit or not there.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on how to improve credit when utilization is high

@tcbofade Thank you so much for your insights and suggestions! This is exactly the kind of feedback I need. I took notes!

And also exciting that one of my FICOS (Experian) is already 680! TransUnion is close (672/675), Equifax the farthest to go (651).

Thank you for saying this is doable and also that there are lots of options.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Seeking advice on how to improve credit when utilization is high

@Expansion another thing I forgot to mention is that if you are currently putting daily expenses on a card that has a balance that is being carried, stop if at all possible. Either pay cash (that is a painful statement for me to make, rewards and all) or free up one card to use for those that you can commit to paying in full each and every month. When you carry a balance, there is no grace period. Even on rewards cards, you will usually end up paying more for new purchases than the rewards would net you back because they accrue interest immediately.