- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- The Dispute process with Transunion and how they a...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The Dispute process with Transunion and how they are garbage

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The Dispute process with Transunion and how they are garbage

Yeah I hate Transunion and have a for a while. If you need them to fix any issues you have to send them legal letters and file a complaint with the CFPB, which now really holds no power as they did before and its showing.

I had 3 auto inquires show up on my report around June 29 2020 that were dated from Oct 19 2019. Now I know these are not mine because I Ive never had an auto loan and never would. I had a recent Transunion credit report sent to me as of June 1st 2020 and there was only 2 inquires that I had made for CCs in June of 2019. The process should be simple and even stated ny Transunion, if you find incorrect information you can open a dispute by calling, mailing or online. I called to open the dispute and the special account rep stated that I must call the companies and send Transunion my findings.

Cool they wanna play, so I had my legal sheild write them a letter about my credit rights under the law and provided Transunion the 3 companies that are showing up on my credit report. 3 weeks go by and I get a letter from Transunion on how they investigate and main point of that was the following" TransUnion reviews and considers all relevant information you provide when you open the credit account dispute process. If we are able to make changes to your credit report based on information you provided, we well make those changes. Otherwise, we will ask the company reporting the information you disputed to do all of the following: 1. Review relevant information we sent them, including any documents you have sent us as part of your dispute. 2. Investigate your dispute and verify whether information they report is accurate. 3. Provide us a response to your dispute and update any other information. 4. Update their records and systems, if necessary. What to Do next. If you have questions regarding the results of a recent investigation, please contact the creditor(s) directly. The business name, address, and, if available, telephone number of the source(s) of information contacted in connection with your dispute can be found in the “Investigation Results” document sent at the conclusion of your investigation. If you need to dispute information on your credit report again in the future, you can do so online at dispute.transunion.com"

I opened the dispute and privided them relevant information as did my legal shield. Called up to see where the process was at and again the special account rep stated" That I must call the companies and send the information to Transunion.

I open a CFPB complaint and provide them the legal shield letter which outlines relevant information and my credit rights.

This is Transunion response

Company's Response

We have reviewed your complaint along with the information you previously provided regarding this issue. The inquiries listed on your credit report are a record of the companies that obtained your credit information. All inquiries remain on your credit report for two years. Credit information may be requested only for the following permissible purposes: credit transactions, employment consideration, review or collection of an existing account or other legitimate business need, insurance underwriting, government licensing, rental dwelling, or pursuant to a court order. Your written authorization may not be required to constitute permissible purpose. If you believe that an inquiry on your credit report was made without permissible purpose, then you may wish to contact the creditor directly, in writing, regarding its purpose. Please note that your specific consent to the release of your credit information is not necessary for a permissible purpose to exist. TransUnion reviews and considers all relevant information you provide when you open the credit account dispute process. If we are able to make changes to your credit report based on information you provided, we well make those changes. Otherwise, we will ask the company reporting the information you disputed to do all of the following: 1. Review relevant information we sent them, including any documents you have sent us as part of your dispute. 2. Investigate your dispute and verify whether information they report is accurate. 3. Provide us a response to your dispute and update any other information. 4. Update their records and systems, if necessary. What to Do next. If you have questions regarding the results of a recent investigation, please contact the creditor(s) directly. The business name, address, and, if available, telephone number of the source(s) of information contacted in connection with your dispute can be found in the “Investigation Results” document sent at the conclusion of your investigation. If you need to dispute information on your credit report again in the future, you can do so online at dispute.transunion.com Should you need any additional assistance, please call us at 1-800-916-8800, Monday-Friday, 8:00 AM – 11:00 PM ET.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

I have to agree with you about Transunion. Basically their system is pretty archaic and slow.

I had to dispute an account on my CR earlier this week with Experian and TransUnion. The Experian process was a piece of cake. Went online, clicked on what I wanted to dispute, told them why and that entry was off in 24hrs.

TransUnion however was like pulling teeth. Had to call to verify my identity and then log in to this super slow site that just did everything in an odd manner. Anyway...here I am waiting for some kind of response.

Anyway, I have no suggestions to give. But I agree with you. Their processess are garbage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

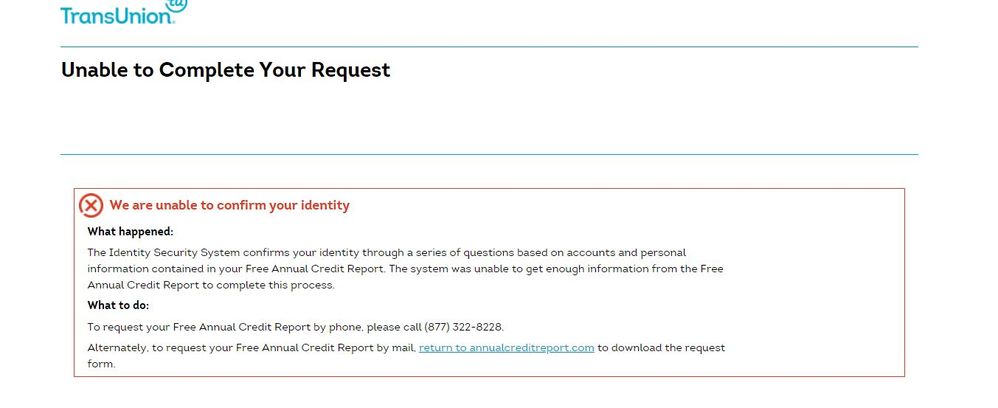

I cant do anything online with Transunion to dispute, I use to be able too and then all the sudden my access was taken away. Cant even access the weekly credit reports from Annual Credit Reports because I am asked to enter a email and phone number, which I have provided to Transunion in the past. Beyond frustrated at the moment. I wish there was a class action lawsuit that I could be in, just 1 of the many they have been sued for.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

@AzCreditGuy wrote:I cant do anything online with Transunion to dispute, I use to be able too and then all the sudden my access was taken away. Cant even access the weekly credit reports from Annual Credit Reports because I am asked to enter a email and phone number, which I have provided to Transunion in the past. Beyond frustrated at the moment. I wish there was a class action lawsuit that I could be in, just 1 of the many they have been sued for.

That's the same message that would pop up for me. I gave them a call and after some back and forth they cleared that up.

But the dispute process on the site was a bit frusterating. It allowed you open just one dispute in 24hrs. So I disputed all the wrong spellings of my name they had listed and when I tried to dispute the actually account in question it said I had to come back in 24hrs.

*Sigh ... Try calling again. Perhaps you'll get someone more helpful.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

@Anonymous What was the process for you for the email and phone number issue? Im going to try to call back today and get this fixed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

Dealing with TU can be tough and I've successfully filed CFPB complaints against them to remove incorrect information, but on the surface it sounds like you might not be attacking the problem correctly.

A CRA generally will not remove the report of a hard inquiry unless:

a) it is requested by the entity that reported the hard inquiry in the first place, or

b) You are claiming that the inquiry was fraudulent. You usually need to be prepared to also provide evidence such as the filing of a police report to validate that the claim is based upon actual fraud and not just a back-door frivolous attempt to remove a valid inquiry.

Have you filed a police report and did you include it in your requests for removal?

Did you contact the entity or entities that requested the hard pulls and request they withdraw them? If so, what was their response?

FICO 8 (EX) 850 (TU) 850 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

@coldfusion wrote:Dealing with TU can be tough and I've successfully filed CFPB complaints against them to remove incorrect information, but on the surface it sounds like you might not be attacking the problem correctly.

A CRA generally will not remove the report of a hard inquiry unless:

a) it is requested by the entity that reported the hard inquiry in the first place, or

b) You are claiming that the inquiry was fraudulent. You usually need to be prepared to also provide evidence such as the filing of a police report to validate that the claim is based upon actual fraud and not just a back-door frivolous attempt to remove a valid inquiry.

Have you filed a police report and did you include it in your requests for removal?

Did you contact the entity or entities that requested the hard pulls and request they withdraw them? If so, what was their response?

The 3 entities were called and could not find me in their systems nor any information about me based on my SS and personal information provided. In that matter it is up to Transunion to investigate and contact the 3 entities with the information I have provided. The fact that Transunion said They don’t need my permission to pull my credit is BS. Strange how the TU report that was sent to me on 06/15/2020 didn’t have these 3 entities which based on a pull of Oct 19th 2019 and started reporting on June 28th 2020 on my credit file, after another complaint against TU from me with legal letters and CFPB, denying me access to my credit reports online was filed in June 2020.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

So quick update: the collections account has been removed from my report. Yay!

Here's the process- First off, give them a call and have them do what ever they say they need to do to verify your Identity. If they say you are good to go stay online with them and log into your account.

Now here's what's weird. TransUnion has like three different sites that each accomplish different things. You have to log into the DISPUTE Center site. You can also find it on their page somewhere.

When you land on the page click on start dispute. Basically it starts with all the versions of your name they have on record, as well as every phone number and address.

Hit delete beside the ones that aren't accurate and it will draw a line through it. Then you can click on the dispute button? Or something at the bottom of the screen.

They will come back in like 24-48hrs with an update .

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

i think that all bureas have this policy, specifically w inquiries. i encountered it w EQ a few months ago, and w TU the other day. EQ suggd that i reach out to the creditor and the creditor would ask EQ to delete after the creditor confirmed that it's invalid. i followed their procuedure and the creditor did ask EQ to delete it. it has been deleted. w TU, they suggested that i contact the creditor and ask for a letter of deletion or request for deletion. i can then fwd that to TU.

yes, i can see how this could turn into a nightmare and frustrating process if the consumer is forced to contact a company that they know nothing about and give out their personal info just to prove that they didn't authorized the inq. then, there's the matter of getting them to actually follow through w requesting that the bureau delete it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

@Anonymous wrote:So quick update: the collections account has been removed from my report. Yay!

Here's the process- First off, give them a call and have them do what ever they say they need to do to verify your Identity. If they say you are good to go stay online with them and log into your account.

Now here's what's weird. TransUnion has like three different sites that each accomplish different things. You have to log into the DISPUTE Center site. You can also find it on their page somewhere.

When you land on the page click on start dispute. Basically it starts with all the versions of your name they have on record, as well as every phone number and address.

Hit delete beside the ones that aren't accurate and it will draw a line through it. Then you can click on the dispute button? Or something at the bottom of the screen.

They will come back in like 24-48hrs with an update .

i don't believe that you can dispute inquiries online. i followed this same process a few days ago. you can select the checkbox for other items, like accts, but for inquiries, iirc, it just explains the process that op was requested to follow...op, since you are indeed claiming that they're fraudulent, you may not have to contact the creditor. follow the process for the fraudulent inq.