- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- The Dispute process with Transunion and how they a...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

The Dispute process with Transunion and how they are garbage

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

@cr101 wrote:

@Anonymous wrote:So quick update: the collections account has been removed from my report. Yay!

Here's the process- First off, give them a call and have them do what ever they say they need to do to verify your Identity. If they say you are good to go stay online with them and log into your account.

Now here's what's weird. TransUnion has like three different sites that each accomplish different things. You have to log into the DISPUTE Center site. You can also find it on their page somewhere.

When you land on the page click on start dispute. Basically it starts with all the versions of your name they have on record, as well as every phone number and address.

Hit delete beside the ones that aren't accurate and it will draw a line through it. Then you can click on the dispute button? Or something at the bottom of the screen.

They will come back in like 24-48hrs with an update .

i don't believe that you can dispute inquiries online. i followed this same process a few days ago. you can select the checkbox for other items, like accts, but for inquiries, iirc, it just explains the process that op was requested to follow...op, since you are indeed claiming that they're fraudulent, you may not have to contact the creditor. follow the process for the fraudulent inq.

They are fraudulent and due to the fact that Transunion is pulling them from YOU KNOW WHAT....No I am not going go that route as I feel Transunion would require a police report and make the issue even worse. I contacted all 3 auto ceditors and explained what the issue was, Chase was the best and called Transunion on the phone and opened a dispute to fully research where Transunion is obtaining its information since Chase could not find me in the systems at all. The rep stated that the INQ would prob come off but its going to take 30 to 90 days for the research to be completed. The other 2 auto creditors require me to mail in documents and a letter to research.

This process should not be handled by me but Transunion, which they are asking for the information from the creditors anyways. Just shows how Transunion is complete Garbage....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

Too many people try to get inquiries off that aren't fraud. Can't blame TU for not wanting to waste resources on investigations for inquiries.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

@Anonymous wrote:Too many people try to get inquiries off that aren't fraud. Can't blame TU for not wanting to waste resources on investigations for inquiries.

To waste resources is just to sit back and not do a thing, they will have to investiagte the issue and where they are pulling in these 3 INQ that are not mine in which the 3 creditors have confirmed, but yes thank you for that comment

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage (Update)

1 of 3 Inqs has been removed and interesting how my credit score didnt change for TU? But would my scores change? These false INQs popped up on my report June 28th 2020 and since they are not mine and pulled on Oct 16 2019, I would assume no pts lost, but just the too many inq code to pop up, until they are removed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage (Update)

I have to say, I "think" this is a YEMV

Whether they use the actual pull date of OCT 2019 or the post date of JUN 2020, both are within 12 months so technically, scorable.

Once something is flagged as disputed, it puts it on "pause" from being included in any scoring equation while it's in that status..which is my understanding...I could be wrong but I have read this before...but I am NOT entirely sure if that goes for inquiries as it does for Open/Closed Accounts.

I don't recall you saying your score dropped when you first started to post about this other than it was incorrect. Did your score drop in June as a result?

Another factor is depending on your profile and which scorecard your on, INQ can have a small change of 1 pt to 5pt to 10pt. It all depends on your profile overall. So, the fact that it's been removed successfully...congrats....and it's within scoring parameters of 12 months, that's good...but you should not expect to see 5 or 10 point jumps as a result.

You can back yourself into your scorecard and then determine if you would be seeing a jump at all as a result by reading thread:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

Transunion has always been the easiest to win a dispute with for me.

They even deleted my car that I threw into bankruptcy immediately after the discharge because I told them that the account was inaccurate and it only belonged to my ex now.

Same dispute in with the two other bureaus right now. It raised my Transunion 9 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage

Posts have been removed. Please remember that FSR is mandatory on MyFico. If you are unable to communicate opposing positions without crossing the FSR line, keep it to yourself.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage (Update)

@cashorcharge wrote:I have to say, I "think" this is a YEMV

Whether they use the actual pull date of OCT 2019 or the post date of JUN 2020, both are within 12 months so technically, scorable.

Once something is flagged as disputed, it puts it on "pause" from being included in any scoring equation while it's in that status..which is my understanding...I could be wrong but I have read this before...but I am NOT entirely sure if that goes for inquiries as it does for Open/Closed Accounts.

I don't recall you saying your score dropped when you first started to post about this other than it was incorrect. Did your score drop in June as a result?

Another factor is depending on your profile and which scorecard your on, INQ can have a small change of 1 pt to 5pt to 10pt. It all depends on your profile overall. So, the fact that it's been removed successfully...congrats....and it's within scoring parameters of 12 months, that's good...but you should not expect to see 5 or 10 point jumps as a result.

You can back yourself into your scorecard and then determine if you would be seeing a jump at all as a result by reading thread:

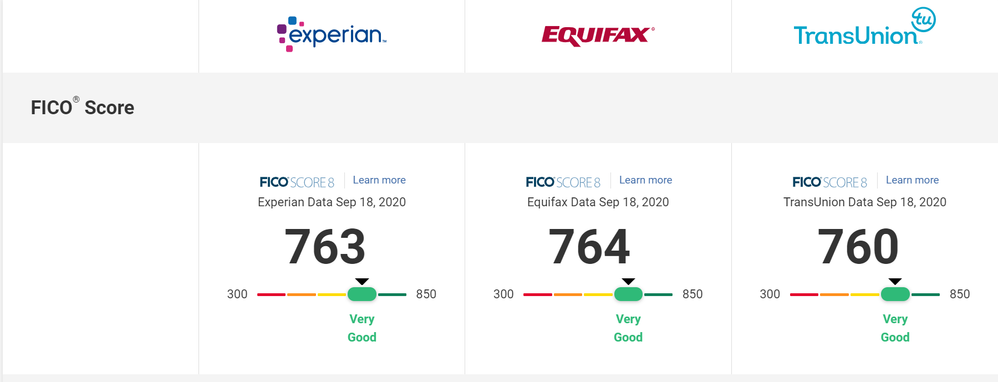

YEMV is right, I cant tell if my score lowered at the time since I had already pulled with TU on Experian membership on the 17th of June. My score at the time was 723 but I did a lot of improvements to my credit and my score jumped 38 pts between the 17th and into July...There are 2 more inqs to be removed and I'll be checking to see if any pts are gained

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: The Dispute process with Transunion and how they are garbage (Update)

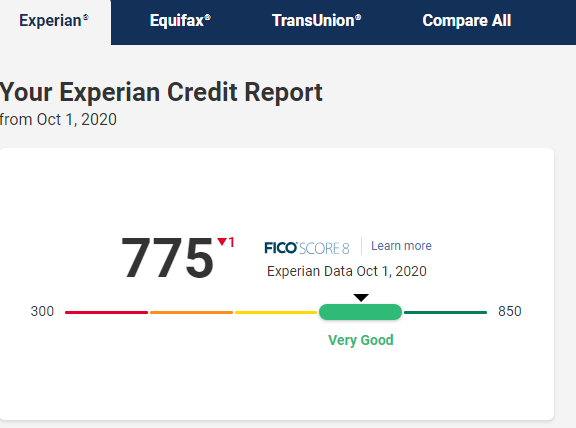

Just a small data point, since I started putting balances back on the AU and my own cards, be it small balances: cellphone bill, Dish, etc it seems I have lost 1 point....I am still 7% UTI overall and these small balances have not raised my UTI....Thats Fico for you...