- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Too few accounts? Cut off point or does it ma...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Too few accounts? Cut off point or does it matter?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Too few accounts? Cut off point or does it matter?

Hi everyone,

I've noticed on my Amex fico page summary, the "Too few accounts current paid as agreed."

I have 3 revolvers and a car loan. I also have 2 business revolvers and I use all my cards each month. Is this something that even needs to be addressed since I've been doing AZEO for the past 6 months and the auto loan is set to auto-pay since I got it?

Aside from being post BK for 8 years, there are no lates on any report and 1 inquiry on TU, 1 on EX the past year.

Is this an excuse for me to get another card? ![]() I'm actually waiting until all reports update for June and car loan reports 12 payments also in June, before I apply for another CC.

I'm actually waiting until all reports update for June and car loan reports 12 payments also in June, before I apply for another CC.

R.I.P Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

@DoogieBall wrote:Hi everyone,

I've noticed on my Amex fico page summary, the "Too few accounts current paid as agreed."

I have 3 revolvers and a car loan. I also have 2 business revolvers and I use all my cards each month. Is this something that even needs to be addressed since I've been doing AZEO for the past 6 months and the auto loan is set to auto-pay since I got it?

Aside from being post BK for 8 years, there are no lates on any report and 1 inquiry on TU, 1 on EX the past year.

Is this an excuse for me to get another card?

I'm actually waiting until all reports update for June and car loan reports 12 payments also in June, before I apply for another CC.

No it doesn't have to be addressed.

Yes it would just be an excuse for getting another card ![]()

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

And here I thought that just having 1 card was my issue with the same repsonse from pre-quals denials. To me that a BS reponse from creditors as you have 3 cards and an installment loan, which some state you need a mix of credit. Unless your credit is new like mine (4.5yrs) I wouldnt bother getting another credit card unless you need it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

I think you will be fine and don't need another card. I would say I am a bit surprised your FICO isn't in the 700's based on what you described, even at 8 years post BK. My credit profile was almost identical 2 years post discharge and was at 700+ at 30 months. I was super careful to always keep my utilization in the single digits at all times. FICO is just wierd like that I guess.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

@Anonymous wrote:I think you will be fine and don't need another card. I would say I am a bit surprised your FICO isn't in the 700's based on what you described, even at 8 years post BK. My credit profile was almost identical 2 years post discharge and was at 700+ at 30 months. I was super careful to always keep my utilization in the single digits at all times. FICO is just wierd like that I guess.

I've been comparing my scores with others that have more recent discharges. The only conclusion I can come up with is that I had only 1 CC for almost 6 years post BK. My credit use was 10% at best and a few months where I didn't use any. I used my debit card or cash for virtually all my spend and when I did buy a high ticket item, I would use PayPal and deduct from my bank account.

Maybe since I wasn't utilizing enough credit when I did use it and had 4-5 months a year with no useage, there was nothing to report. Vehicles were paid with cash so I didn't have a loan for years.

Having said that my AAoA is 2.5 years oldest is 7 years so that would correspond with the scores being lower from what I can tell. Yeah, FICO is weird like that. I have had a decent jump in EX since April and TU is slowly creeping up

R.I.P Cards

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

I have often wondered about this too. I get the “too few” message across all report and score providers. I will get to 11 accounts once my new accounts report. This seems to be the threshold (according to Experian) for that message to go away. But as far as I can tell the message will go away but I cannot find any credible evidence that it impacts your score. I’m on the lookout to see if it does.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

Short of those lucky few who have a PERFECT credit report and 850 scores across the board, everyone will always have these "reason codes" on their credit profiles. Most of us have dozens of reason codes at any given moment, and your credit reports will typically show you the most relevant 3-5 reason codes.

People with poor credit, for example, could have reason codes that say something like "Too many derogatory accounts" when the credit report has like 12 chargeoffs on it. And that reason code most certainly reflects something that is affecting their scores in a massive way.

People with excellent credit, on the other hand, could have a reason code that says "Too many recent credit inquiries" even though the number of inquiries is just 1. Or "No open mortgages" when the person has finished paying off their home. If there is any reason why your credit score is less than 850, no matter how petty and insignificant the reason may be, the credit report will tell you the reason.

That said, the reason codes are not necessarily always something you can (or should) do something to fix. For example, it would be a bad idea to take out a new mortgage just to get rid of the "No open mortgage" reason code. Similarly, it may not always be a good idea to open more credit card accounts to get rid of the "Too few accounts" reason code. By most people's point of view, your 3 cards and 1 installment loan is all you really need to achieve an excellent score, after that any more new accounts will provide very little boost to your score, and there's a even good chance they end up dropping your score.

Also, rest assured that as soon as the "too few accounts" reason code goes away, it'll just get replaced by a new one that says "too many new accounts" ![]() It's a fool's errand to try to get rid of all your reason codes, there's something like 150 different possible ones and a lot of them contradict each other, like "Not enough retail accounts" and "Too many retail accounts". And the actions you take to fix one reason code will almost always result in several new ones popping up to replace it.

It's a fool's errand to try to get rid of all your reason codes, there's something like 150 different possible ones and a lot of them contradict each other, like "Not enough retail accounts" and "Too many retail accounts". And the actions you take to fix one reason code will almost always result in several new ones popping up to replace it.

"Not enough retail accounts"...

ok, I'll just open a new retail account, then!

"Too many retail accounts! Too many new inquiries! Average account age too young!" ![]()

You can Google "credit bureau reason codes" to find complete lists of them, if you're curious.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

All a negative reason statement means is that it's impacting that FICO score by at least 1 point. In many cases these negative reason statements are barely impacting the score provided, so trying to make changes to eliminate the negative reason statement is often a waste of time and even counterproductive.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

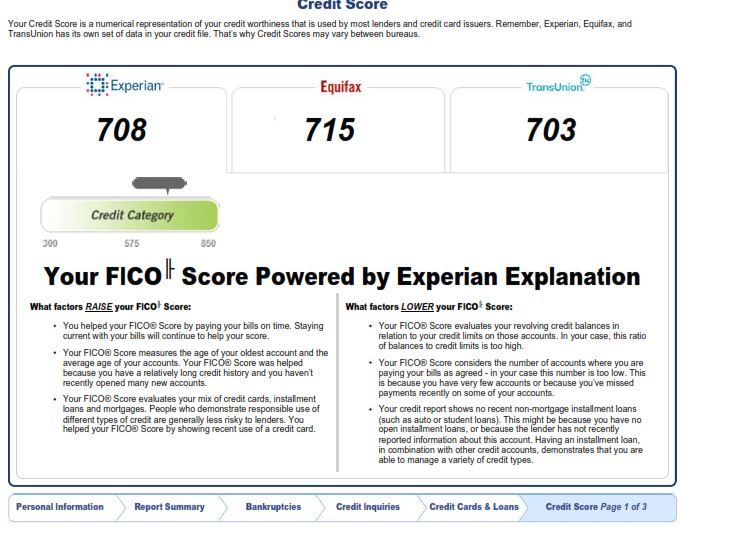

Just to show another point of why you shouldnt care about Too few accounts, it effecting me at the moment too and I had to look at a credit report from 2015, im more annoyed now that I didnt apply for more credit cards back than...Check out the the pro and cons on my report back than....I get why I am getting the messgae now since 2 old good standing accounts dropped off, but for the cards you have its about paying off and gardening now...dont worry aboy the message of Too Few Accounts

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Too few accounts? Cut off point or does it matter?

Keep in mind that there are no such thing as positive reason statements and that FICO scoring only considers negative reason statements, as those are part of the algorithm. Any positive statements ever seen are just fluff provided by the front-end of whatever CMS is being used and have nothing to do with FICO.