- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Transunion dropped with no real explanation

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Transunion dropped with no real explanation

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Transunion dropped with no real explanation

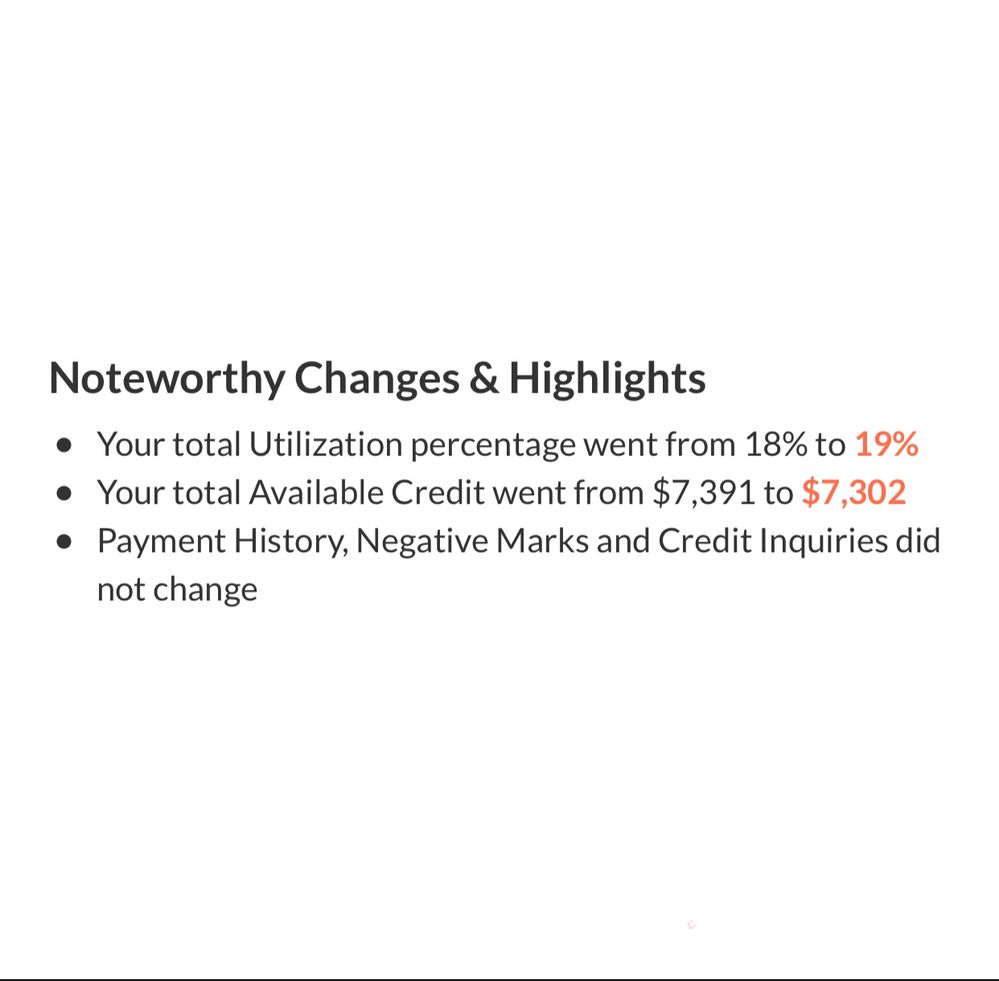

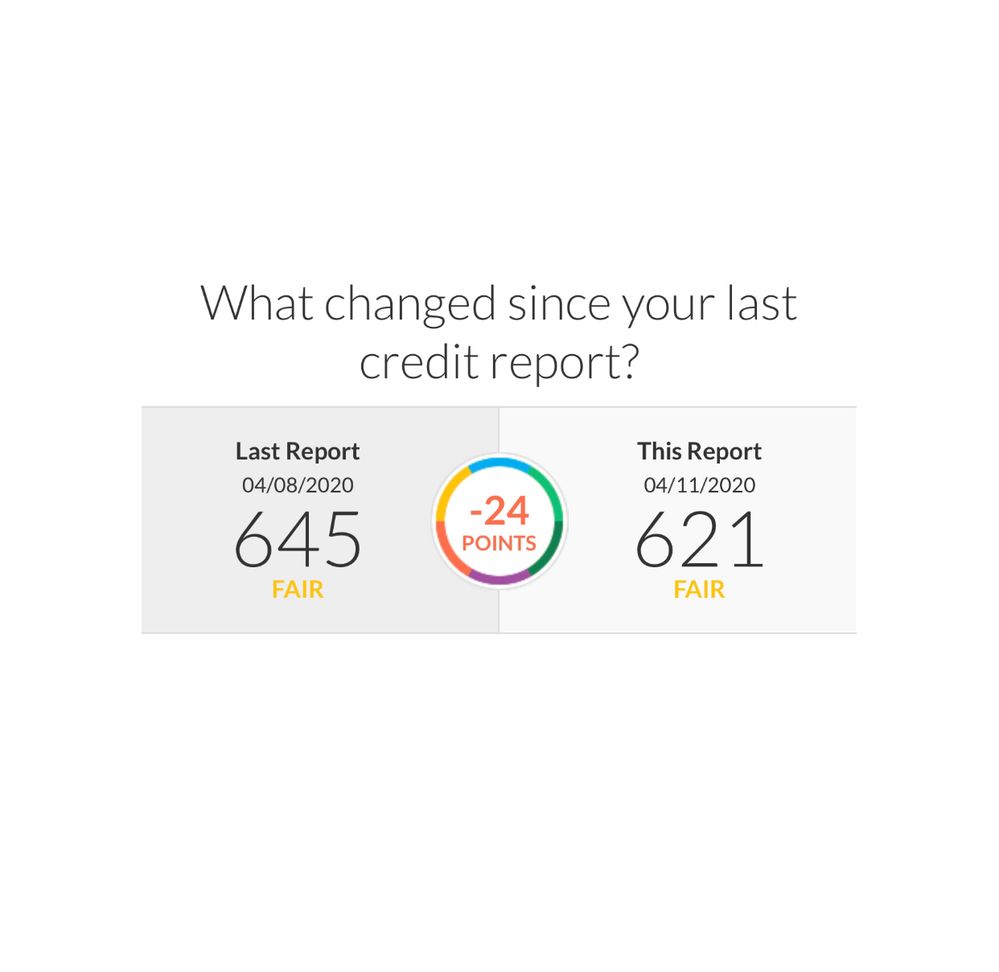

According to WalletHub & others, woke up today to find Transunion has dropped 24 points, but Equifax only dropped by one point. Experian, no change.

Does anyone know why this happens? The only changes I see are utilization went up by one point (from 18 to 19%), avaibale credit was reduced by only 89.00. That's it. Isn't this strange? Or is this normal for Transunion because if so I feel like I'll never get anywhere.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

Sounds like Vantage scoring. Major differences on how Fico looks at scoring. Pull your real scores from Fico.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

Thanks. Does anyone really look at Vantage? What's the point of punishing someone so severely for an additional 89.00 charged? It's really confusing. I'll look into posts to see what anyone else has experienced. I'm assuming it's a trmporary dip and will recover once I pay stuff down. But my overall util is still under 20% so I incorrectly assumed I was safe from these kinds of drops.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

Very few lenders are using VS scores. Many others report large swings in scoring with VS. Check your FICO's for a more accurate picture.

NFCU Cash Rewards 16K CL

Citi Custom Cash 7.5K CL

AODFCU Visa Sig 5K CL

Discover IT 2.5K CL

Capital One QS 3600 CL

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

@Anonymous wrote:According to WalletHub & others, woke up today to find Transunion has dropped 24 points, but Equifax only dropped by one point. Experian, no change.

Does anyone know why this happens? The only changes I see are utilization went up by one point (from 18 to 19%), avaibale credit was reduced by only 89.00. That's it. Isn't this strange? Or is this normal for Transunion because if so I feel like I'll never get anywhere.

Wallethub is definitely Vantage scores just like Credit Karma and many others. They are good to monitor your reports and they usually update sooner than a lot of others that give you Fico scores but the scores they give you will often fluctuate wildly. (sometimes you can put a finger on what happened and other times you are left totally confused on why scores went up or down).

As was stated before your Fico scores are what really matter when you are considering a purchase or apping for other cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

@Anonymous wrote:According to WalletHub & others, woke up today to find Transunion has dropped 24 points, but Equifax only dropped by one point. Experian, no change.

Does anyone know why this happens? The only changes I see are utilization went up by one point (from 18 to 19%), avaibale credit was reduced by only 89.00. That's it. Isn't this strange? Or is this normal for Transunion because if so I feel like I'll never get anywhere.

Vantage is still used by less than 10% (I'd suggest even lesser) of creditors. So there's not a lot of energy put here in the MyFICO forum to decipher why things change. There may be a few other creditors, but the only one I know that uses Vantage is Synchrony and it's Vantage 4, not 3. Although many people see similar scores with Vantage 3 and Vantage 4 and even FICO, many see great difference in FICO scores and Vantage 3 (since vantage 3 is the prevalent with free score providers). Bottom line, different formulas so they can produce different scores. Take a look at the pie chart for each score model then figure out the lenders who pay any attention to Vantage scores if that;s what you focus on.

Even if it's close, that doesn't mean it will be close when other changes occurs. Some are close, some are 50 to 100 difference between Vantage and FICO.

Use CK for updates and account activity since it's free and provided frequently. But get your FICO scores. That's what matters in 90%+ lending decisions.

The FAKO forum if it still exists explains most of this. Although Vantage and proprietary scores are real, they simply aren't used for most credit lending decisions. This may change, but it hasn't to date. And I personally believe if it changes, it will no longer be free.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

Last week, I awoke to a 140 point drop on TU Vantage 3.0 (reported on TU service, WalletHub, and Credit Karma). What changed? An old, paid off collection account was removed for age; an old derogatory charge off with a $389 balance was removed for age; my student loan balance increased by $434; and a remark was added to my student loan account that the payments are in forbearance. That's it. I had old versions of the report to compare against to ensure I wasn't missing anything obscure. No other changes. Even if the increase of a few hundred dollars balance removes points, it shouldn't be minus 140 points. To be clear, my utilization was below 4%, I had no other collections, etc. Before the drop it was 718. Also, the removal of the old negatives didn't have a huge affect on my AAoA, which remains at nearly 12 years. Also, in the meantime, my FICO scores all went up around 3 points. I'm convinced that there is an anomaly in the model for Vantage. I assume those points will come back. I only hope it doesn't affect my ability to get a Cap 1 CLI in the meantime given that their Credit Wise service also reports TU Vantage 3.0. Long story short, you're not alone here. And it took me a week of stress before I realized that I had no similar FICO drop coming and that Vantage really is just poop.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

I'm so sorry for what your going through it's very frustrating isn't it? And since I have Cap 1 cards (they are the lender that gave me a chance when others wouldn't with their credit steps platinum MC), - now several store cards with them as well as PL to QS and their Walmart MC, ughhh I hope they don't look to Vantage to determine my CLIs. Yeah it's weird. I just don't get it. What you're describing as far as changes should never result in such a huge drop. GL to you and thanks so much for sharing your experience. Sorry to hear about it, but at least I know I'm not alone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

Gatorsfan15, I feel for you. Transunion for me seems to be harsher then EQ or EX.

Mine dropped 7 points last friday. The cause. I paid off the last $3500 of an installement loan that had a high apr.

EX dropped 3 points, EQ dropped 2, TU dropped 7 points.

All because I paid off a loan, and it closed an account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Transunion dropped with no real explanation

VS is definitely annoying! I mainly just use it to keep track of what updates. For no reason, my Equifax dropped 44pts today according to CK...I'm sure there isn't a drastic drop in my fico fico score so I'm not too stressed since there wasn't a change to my profile.

Starting Score: 544

Starting Score: 544