- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Understanding CC reporting

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Understanding CC reporting

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Understanding CC reporting

Hello, all.

I want to make sure I understand CC billing cycles/reporting. I wanted to try AZEO to see my score vs 90%+ UTI. The rebuilder cards all have toy limits. I've paid them to 0/0/8%, and all statement dates are the 15th.

My question is, do CCs always report the balance on the statement for their monthly reporting? For example, all statements cut tomorrow with the 0/0/8%, but on the 16th I use them again...but one sends in the monthly report on the 18th. Would they still report the statement balance, or the actual balance at the exact second they reported on the 18th (just an example scenario).

As always, thank you so much!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding CC reporting

After your statement cuts its safe to use them again. So for example for one of my capital one accounts the payment due date is always the 9th, and the statement cuts on the 12th. I normally start back using the card again on the 13th.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding CC reporting

Perfect, thank you.

I'm financing my rebuild with side hustles (Doordash, Uber, Lyft, etc), and would prefer to keep using the cards for fuel and expenses while sending the profit to old debt. Like I said, they are toy limits, so paying them to AZEO is easy enough even when maxed.

Speaking of, anyone interested in financing their rebuild should look into some of these side gigs (not an advertisement, just food for thought). I'm personally retired military, so it's not as easy as just picking up some overtime shifts at work.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding CC reporting

I've been doing Uber eats, Grubhub, and now Instacart. I actually pay my car payment with the proceeds. I usually do about 3 hours after work every day and then a lot more on the weekends. The extra cash definitely helps.

Starting Fico Scores:November 2019

Current Fico Scores: January 6, 2021

Goal Scores: 700 across all three

Goal Scores: 700 across all three

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding CC reporting

Yes, credit card companies only report the statement balance. Most credit card companies, with the exception of U. S. Bank and Elan Financial, report to the credit bureaus at midnight of the date the statement is cut. So it would be highly unusual for a statement to be prepared, then reported a few days later.

That said, you can even use your card the day the statement is cut since those transactions will be Pending when the statement is prepared and will not be reported.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding CC reporting

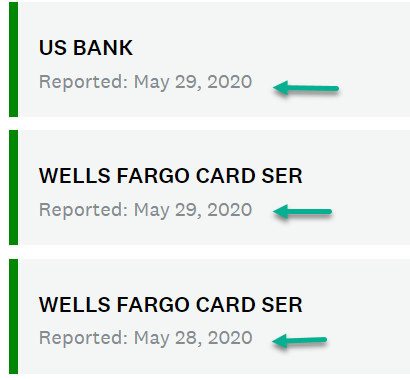

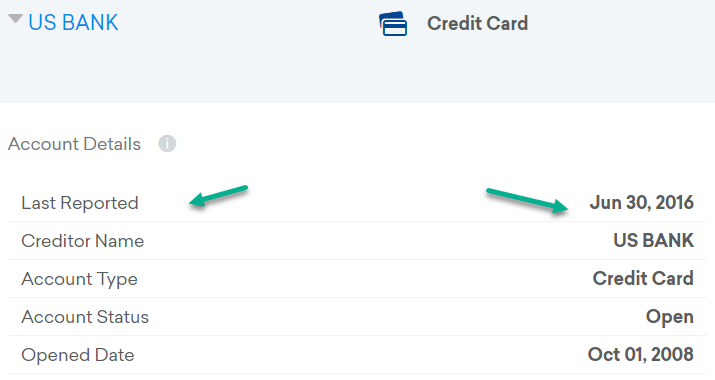

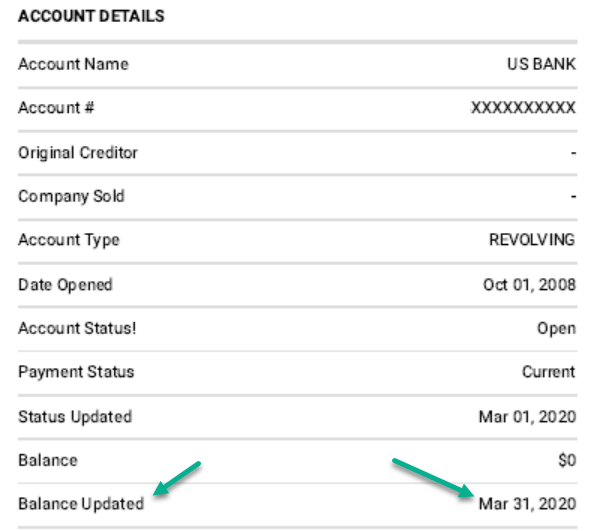

You can easily find the report balance as of date from Credit Karma (Reported or Last Reported date) or from Experian's site (Balance Updated date). MyFICO reports only show month/year. Using anytime after this is safe. For some cards this day may vary by a day each month due to how many days are in the month.

Just an FYI - USbank reports the balance as of the last business day of the month, regardless of your statement date. I learned about a year or so ago while testing AZEO. Confirmed by not only calling USbank but also going back to review old Credit Karma reports when my due date was the 18th. I changed my statement date to the 28th to allow for less days of not being able to use should I need to.

Credit Karma

Credit Karma (view old reports)

Experian

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding CC reporting

@Anonymous wrote:Hello, all.

I want to make sure I understand CC billing cycles/reporting. I wanted to try AZEO to see my score vs 90%+ UTI. The rebuilder cards all have toy limits. I've paid them to 0/0/8%, and all statement dates are the 15th.

My question is, do CCs always report the balance on the statement for their monthly reporting? For example, all statements cut tomorrow with the 0/0/8%, but on the 16th I use them again...but one sends in the monthly report on the 18th. Would they still report the statement balance, or the actual balance at the exact second they reported on the 18th (just an example scenario).

As always, thank you so much!

I definitely wait until statement cut date before using again.

Just a couple months ago, I had made a purchase on the 24th, statement cuts on the 24th, the CCC backdated it to the 23rd and included it in my statement balance and put me at 80%+ util for that card. Card has toy limit of 250. It hurt for the whole month. I had even made a payment immediately on the 24th and it cleared, but put it on the next statement, saying it was the 25th when they received it. This is Comenity for you! I always make any purchases well outside the statement cut date now.

So I always make sure all my pending transactions clear and any payments I process clear before the statement cut date. Say with my Cap one, payment due date is the 10th and statement cut is the 13th. I stop using on the 10th to let any transactions clear, make any payment by the 11th/12th, wait for statement to cut on the 13th, and then start using it again on the 13th.

Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Understanding CC reporting

Now that's a different story. Yep, Cap 1 (used in my example above) used to post charges within 24 hrs of purchase before the breach. Now pending transactions takes longer to post. So I either stop using 3 days before due date if I'm concerned about reporting a balance (average time for it to post now) to ensure it doesn't post when I don't want it to, or do a push payment in advance knowing it will post to cover should it post between the 20th and 23rd. A payment received and posted by the 23rd will reduce the balance reported.

Not that big of a deal for me but I like to know should it be. It's good to know and for my bank that sends the payment through bill pay I know how long it will take for it to post to Cap since you can't pay more than 10% over the outstanding balance with Cap 1 through their site.