- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- What's the deal with Samsung Financing?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What's the deal with Samsung Financing?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What's the deal with Samsung Financing?

Hi all,

My old cell phone is on its last legs and I'm looking to upgrade in the near future. Right now I've got a promotion through a work-discount program with Samsung that will get me about 30% off MSRP plus about $150 in free accessories. The catch is that the deal is only applicable if I use 0% APR Samsung financing. This sounds good on its face, but I'm worried about the implications. I previously had a phone financed via Google Financing that doesn't appear to have impacted my score in any lasting way minus the hard pull, or if it did it hasn't been in any meaningful way since I was a 761 via Experian last I checked. I think it showed up as a revolving balance, oddly enough.

In any case, I'm not particularly worried about a hard pull - this would be my second in about six months, but I average about one hard pull a year otherwise, maximum. What I am concerned about is that I've read about these showing up as a "Consumer Finance Account," which, as I understand them, are usually used for places like Aaron's and Rent-A-Center that are for very high-risk borrowers, and the associated baggage of a CFA can hurt your score more than a hard pull alone would.

Does anyone have any insight?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

Alright, quick follow up - I spoke to TD, who administer the Samsung Financing, and they told me it was a Retail Line of Credit, which reports as Revolving, rather than as a CFA. Is a retail LOC a separate classification from other revolving credit lines, or should I just think of it as another revolving line like my credit cards? If it is different, should I be worried about any associated baggage like I would with a CFA? My thought is that since as far as I can tell my credit has not been negatively impacted by Google Store Financing from 2016, presumably also a retail LOC, I should be in good shape.

Again, I'm not particularly worried about a hard pull as I have no intention of taking out any more loans or credit cards in the near future unless there is some sort of emergency (like my car getting totaled and me needing to finance a new one, but that only seems to happen once every ten years, knock on wood) so it'll bounce back before I need it to.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

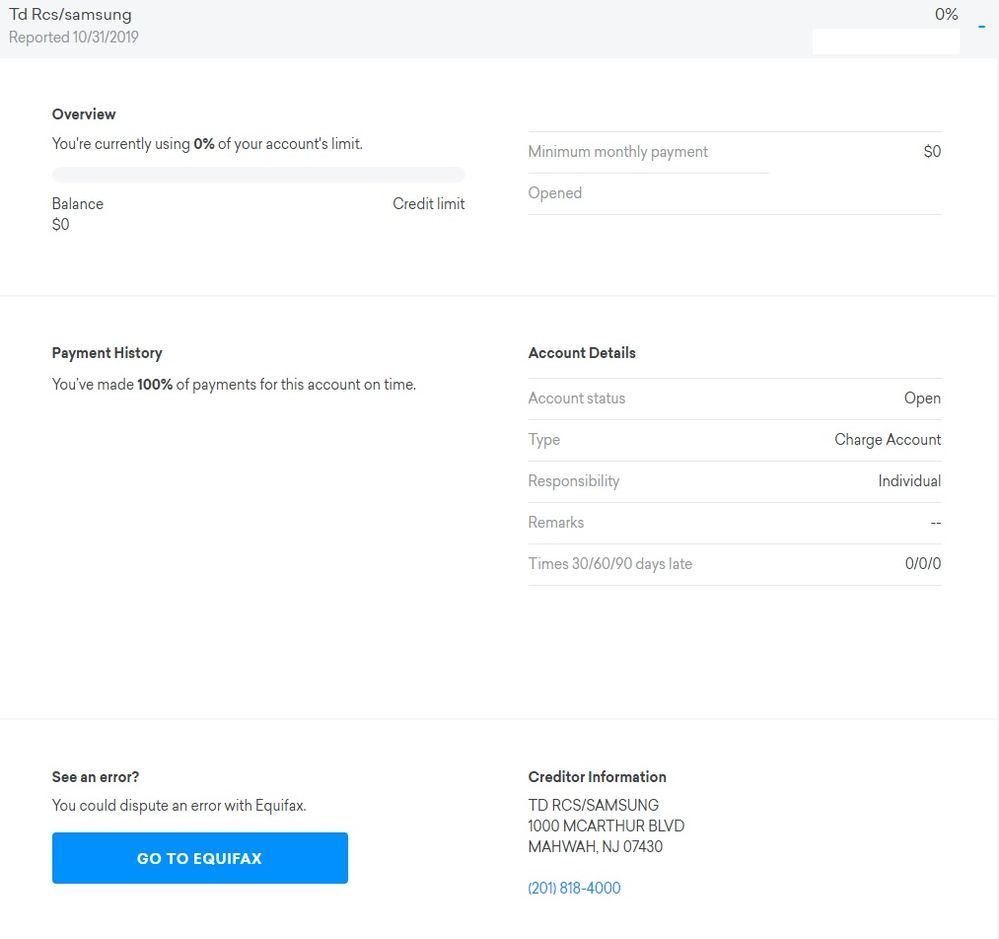

I have it, it's considered a revolving account but as a charge (store) card. It's not a CFA. Here's a quick look at how it reports from CK:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

Cool, thanks. I have no other CC debt and a $25k limit split between three different cards, the only issue being average age of accounts (I just turned 30 and have two cards from the past three years messing up the average). I'm not seeing a downside to save a few hundred bucks on something I'd need to buy anyway. Am I missing something?

On the subject, is it better to close out or leave open the long since paid off Google/Synchrony store credit? I don't have an annual fee, so, leave it open, right? Can't hurt?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

@Anonymous wrote:Cool, thanks. I have no other CC debt and a $25k limit split between three different cards, the only issue being average age of accounts (I just turned 30 and have two cards from the past three years messing up the average) so I'm not seeing a downside to save a few hundred bucks. Am I missing something?

I got it when I had very little credit and scores maybe around 700ish. I don't have any regrets using them when I needed a new phone and computer monitor. I haven't used them since I paid off my current phone in January of this year and just going to let it ride until they close it because of inactivity. If you don't mind the hard pull and ding to your average age of accounts, IMO it's def worth a look to save a few hundred bucks.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

I have a Samsung store account. Picked it up last year to replace appliances in my kitchen for about $2800 with corporate discount. Normally they give you a CL equal to the amount of the purchase so you can finance it. There was a mix up with my order and I had at one point to pay for a refridgerator that I cancelled and the new one at the same time so that is how I ended up with a $3900 limit.

The appliances were given a 0% APR for 12 months payoff term. TD however did not divide the balance in 12 for equal payments. My payments were around about 5% of the total balance due each month so the only way I could escape interest charges was to pay it off early which I did after about 6 months. My thought was at the time that I could keep the card around for a cell phone purchase financing it unlocked.

With my corporate discount I get around 5% off on the price. Not great but the real value is on the trade in where I can get $350-$450 for my Galaxy S8 trading it in for a model. They accept elevated trade ins for Apple, Samsung and Google with iphone 7/Galaxy 7 about as old as what you can go so the trade-ins age out. You also usually get the same trade in for model variants. The Galaxy S10e/S10/S10+ are all worth approximately the same for trade in though they could be bought at retail for significantly different prices. Note 10 is going to be worth a little more than Galaxy S10 for a trade in and the Note 9 a little less ect.

The discount is definitely worth going through the corporate site. The financing is tricky. One advantage is they will allow you to take on 36 month financing for cellphones which might be nice if you want to Note 10 5G or Galaxy Fold. It might make more sense however to buy it in cash to redeem the SUB for a new credit card instead. Pick a card strategically that strengthens your card lineup that you would want to hold on to for the longer haul. Yes you'll take a credit hit in the short run but I wouldn't worry about it at all if you are 720+. Also pay the new card in full so you might want to get a CLOC from your bank just to protect against a potential overdraft.

I didn't feel like the store card was worth the hassle. You also miss out on credit card points. Rakuten is offering 8% cash back currently and can be linked to a master reward earning AMEX account. For a $1000 dollar purchase then you can scalp 8,000 MR which is enough to almost pay for a Delta domestic flight round trip.

https://www.cashbackmonitor.com/cashback-store/samsung/

Chase Ultimate Rewards 696,884 | IHG One Rewards 144,957 | Hilton Honors 144,521 | AMEX Membership Rewards 102,729 | World of Hyatt 76,095 | Marriott Bonvoy 65,343 | Citi Thank You 38,153 | Choice Rewards 32,460 | United MileagePlus 13,316 | British Airways Avios 12,333 | Jet Blue TrueBlue 11,780 | Wells Fargo Rewards 2,858 | Southwest Rapid Rewards 2,447 | NASA Platinum Rewards 1,883 | AA Advantage 1,744 | Navy Federal Rewards 1,087 | Delta Sky Miles 175 | Virgin Atlantic Virgin Points 100 | Lowes Business Rewards 7,102 ($71.02) | Amazon Rewards 2,200 ($4.75) | Discover CB 10 ($0.10)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

@Anonymous wrote:Cool, thanks. I have no other CC debt and a $25k limit split between three different cards, the only issue being average age of accounts (I just turned 30 and have two cards from the past three years messing up the average). I'm not seeing a downside to save a few hundred bucks on something I'd need to buy anyway. Am I missing something?

On the subject, is it better to close out or leave open the long since paid off Google/Synchrony store credit? I don't have an annual fee, so, leave it open, right? Can't hurt?

Here is another way to think about whether to close or not; could you upgrade that co-branded store credit card to something more useful?

Older accounts are important to keep because they help age out your credit file. If it doesn't have an AF it can't really hurt but even better if you can convert it to something you'll actually use, even if its for just one category. Of course with a conversion you won't get the SUB but in a lot of instances that doesn't really matter. SUB's can be a trap in themselves because of the high minimum spend requirement. There is only so much that you can catch up on. I'm looking at a new A/C unit for example to meet mine.

Churning makes less sense over the long haul than a strong earning set of cards across all categories. When new cards arrive on the scene that is when SUBs tend to be best anyways.

Chase Ultimate Rewards 696,884 | IHG One Rewards 144,957 | Hilton Honors 144,521 | AMEX Membership Rewards 102,729 | World of Hyatt 76,095 | Marriott Bonvoy 65,343 | Citi Thank You 38,153 | Choice Rewards 32,460 | United MileagePlus 13,316 | British Airways Avios 12,333 | Jet Blue TrueBlue 11,780 | Wells Fargo Rewards 2,858 | Southwest Rapid Rewards 2,447 | NASA Platinum Rewards 1,883 | AA Advantage 1,744 | Navy Federal Rewards 1,087 | Delta Sky Miles 175 | Virgin Atlantic Virgin Points 100 | Lowes Business Rewards 7,102 ($71.02) | Amazon Rewards 2,200 ($4.75) | Discover CB 10 ($0.10)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

That said, with current pre-black friday sales plus my corporate discount and trade in I'm looking at a Note 10+ with the Galaxy Buds for under $700. If I'm going to get a new phone, that seems like the way to go. Plus, if the credit line is revolving, I've got it as an option once the phone is paid off, so if I end up moving somewhere where the appliances aren't up to our standards or my 10+ year old Samsung TV bites the dust I've got it as an option.

If I'm not planning on changing my spending habits in the near future as far as new lines of credit are concerned and I'm over 720, the positives outweigh the negatives, yeah? Just want to make sure I'm thinking this through!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

I like the cash back strategy you have going on. A couple category killer cards.

Chase Freedom 5% cash back on rotating categories.

AMEX Blue Preferred 6% on supermarkets.

Credit Union XYZ double cash on local businesses.

Might be worth canceling the co-branded google card if its on the lower end of the AoA spectrum. If you've card for 18 months while other accounts have been open 5 years.

Example:

3 cards open 5 years

Google open 18 months

Samsung open 1 month

AoA = 3.32 years.

Remove the samsung card from the account.

3 cards open 5 years

Samsung open 1 month

AoA = 3.77 years.

I price check the Samsung site all of the time. The basically throwing in the buds for free on top of the regular sale price which is a great deal. From my experience dealing with similar phone go for the + version because of the bigger battery. I like the S10+ personally more than the note with the rounded edges it seems more pocket friendly.

One other thing I didn't mention. Samsung will try to approve you for the full cost of the phone on their revolving line without the sales taxes included. You may have to phone in for a credit limit increase just to make sure you are covered like I did.

720+ is a very comfortable score. I wouldn't apply for a store card it going for a rebuild from 550 as the utility is limited. Some on here are "gardening" until 820+ with 10 cards too many.

Chase Ultimate Rewards 696,884 | IHG One Rewards 144,957 | Hilton Honors 144,521 | AMEX Membership Rewards 102,729 | World of Hyatt 76,095 | Marriott Bonvoy 65,343 | Citi Thank You 38,153 | Choice Rewards 32,460 | United MileagePlus 13,316 | British Airways Avios 12,333 | Jet Blue TrueBlue 11,780 | Wells Fargo Rewards 2,858 | Southwest Rapid Rewards 2,447 | NASA Platinum Rewards 1,883 | AA Advantage 1,744 | Navy Federal Rewards 1,087 | Delta Sky Miles 175 | Virgin Atlantic Virgin Points 100 | Lowes Business Rewards 7,102 ($71.02) | Amazon Rewards 2,200 ($4.75) | Discover CB 10 ($0.10)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What's the deal with Samsung Financing?

yeah, the AmEx has been open 12 years, Chase has been open 4, Credit Union has been open 6 months - that was my other hard pull this year, it replaced a two-year old Aviator Red with half the credit limit because they increased the annual fee and geared it towards bigger spenders. Google card has been open about 2.5 years but I don't see myself using it again. Not sure what I'll do about it, especially because there's no annual fee.

Also, yeah, I live in Oregon, so no sales tax.

Might as well apply given the cost savings and the knowledge that I'll use it to buy more Samsung stuff in the future. Thanks for helping talk me through this, everyone. I am an impulsive spender sometimes but I do care about my financial health long term - it looked like a safe bet to me on paper but wanted to make sure it looked good to more savvy individuals than myself, as well.