- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Re: Why are so-called FICO scores all over the map...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Why are so-called FICO scores all over the map?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

Almost the same thing happened to my report

I recently did two things -

- Decreased my Capital one card balance from $1400 to $2

- And initiate a payment to my old American express closed card (Charged off)

As the result my Fico Experian dropped by 10 points while Transunion and Equifax went up by 15 and 12 points respectively. Unfortunately my score at Credit Karma dropped by 35 pointes and I am a little worried about it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@Melisaw24 wrote:Almost the same thing happened to my report

I recently did two things -

- Decreased my Capital one card balance from $1400 to $2

- And initiate a payment to my old American express closed card (Charged off)

As the result my Fico Experian dropped by 10 points while Transunion and Equifax went up by 15 and 12 points respectively. Unfortunately my score at Credit Karma dropped by 35 pointes and I am a little worried about it.

CK is not a Fico score. I wouldn't worry about that score at all..

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@K-in-Boston wrote:

@Thomas_Thumb wrote:

One thing of note - Fico 98 model looks at B/HB on NPLS chage cards as a scoring factor. Fico 04, Fico and Fico 9 models do not look at charge card B/HB.If you have a closed NPLS charge card with a balance or open one with a very high B/HB, it could be impacting your Fico 98 score - but not to the extent you report.

I knew about the B/HB thing on older models, which is one reason a lot of us used to just bite the bullet and try to run up the balance as high as we could reasonably afford to pay at least once to not have that ding every month. Do you happen to know where the NextGen2 model falls? I've been wondering why my NG2 score from PenFed is far and away my highest score that I have access to (more so than just the change in scale would suggest), and now I wonder if it's because of my two Amex charge cards. My gold has a high balance of $19k or so and is sock drawered until November when I may close it ($0 balances reporting every month), while my Platinum has a high balance north of $22k and lately has only been seeing $1-3k a month in spend. As my profile is almost entirely hindered by revolving utilization (if I were under 10%, I'd likely be somewhere in the 800-810 FICO 08 range right now), could it be that the additional close to $40k of "available credit" is helping me tremendously by pushing my util down?

Fico NextGen is rather convoluted. I don't have access to the score myself so I don't know how it would score my profile or react to changes in # cards reporting balances. That being said here are a few differences between Fico NextGen and other Fico models:

1) Fico NextGen uses a variety of "mini-models" that capture more interactions in data. It uses 18 separate scoring models (or scorecards) as opposed to 10 with Fico 98 & Fico 04, 12 with Fico 8 and 13 with Fico 9.

Per Fico: "FICO NextGen score separately evaluates consumers according to those with very clean credit histories, those with mild forms of prior delinquency and those with more severe derogatory information

2) In Fico NextGen consumers are classified by the degree of positive or negative performance across all credit obligations. This is a key point as types of loans and credit accounts are differentiated in Fico NextGen (retail accounts vs bank/national revolving accounts, types of loans). Fico NextGen prefers profiles with diversity in types of accounts but, may deduct points for too many accounts of any given type. A couple charge cards and store cards may boost NextGen score but have no impact on other Fico 8.

3) Fico NextGen includes a reason statement: Amount of credit available on revolving accounts.

This is NOT utilization % but rather a dollar amount. Thus, if you have a lot of available credit say $200k you would score higher than someone with $20k at the same utilization level of say, 5%.

Here are a few Reason Statements exclusive to Fico NextGen:

a) Too few accounts with balances (R1)

b) Too few retail accounts (R8); Too many retail accounts (V2)

c) Too few retail accounts with recent payment information (R9)

d) Too many revolving accounts (V3)

e) Too few consumer finance company accounts with recent payment information (R6)

As you mentioned, the 950 upper end for Fico NextGen compared to 850 for Fico 8 is one reason for your higher Fico NextGen score. Another reason may be your available credit in $$$ terms is high enough to give you bonus points on NextGen - not considered in Fico 8. My guess is Fico NextGen does not weigh "high" revolving utilization as heavily as Fico 98/Fico 04/Ficoo 8.

If you have some retail accounts, they could boost NextGen score but, have no impact on Fico 8. Now, here is one that could be a major difference ... Fico 8 drops score if you have a consumer finance account on file but, Fico NextGen may actually award points for a CFA - especially if it has recent payment information.

It sure looks like Fair Isaac was catering to retail lobbyists when they developed FICO NextGen

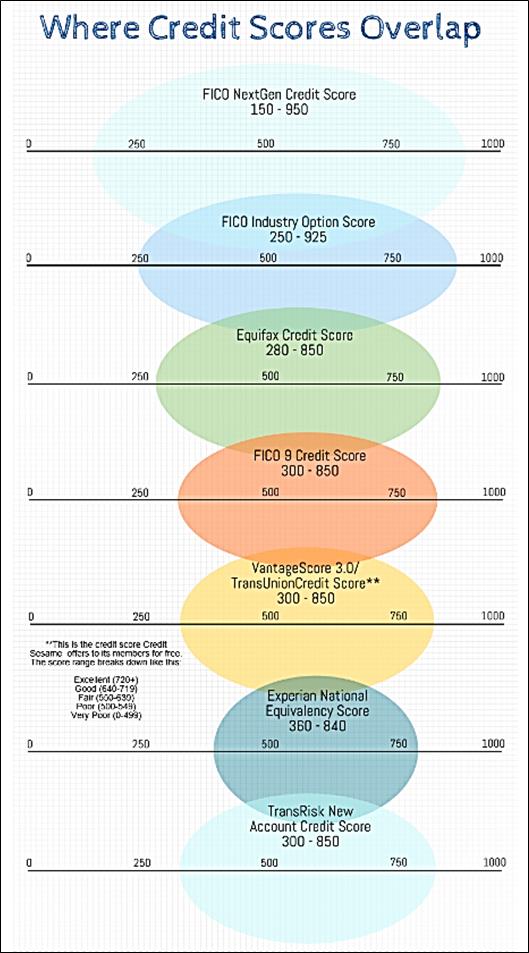

Pasted below is an old infographic on score ranges for various models. Unfortunately it incorrectly shows Fico industry enhanced models going to 925 when they only go to 900.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@SouthJamaica wrote:Interestingly my highest and lowest are all Bankcard models. My lowest is EX Bankcard 2 and my highest are in a tie: EQ Bankcard 9 and TU Bankcard 8. On May 6th the spread was 142 points!

Heh, nice!

The comparisons of course are bad as others have noted, but my own giggle-worthy data, top and bottom by bureau:

EQ FICO 9 = 790, EQ FICO 5 AU = 685

EX FICO 9 AU = 773, EX FICO 2 AU = 679

TU FICO 9 AU = 786; TU FICO 4 = 758 (actually my TU scores are surprisingly consistent across the board all things considered)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@Thomas_Thumb wrote:

@K-in-Boston wrote:

@Thomas_Thumb wrote:

One thing of note - Fico 98 model looks at B/HB on NPLS chage cards as a scoring factor. Fico 04, Fico and Fico 9 models do not look at charge card B/HB.If you have a closed NPLS charge card with a balance or open one with a very high B/HB, it could be impacting your Fico 98 score - but not to the extent you report.

I knew about the B/HB thing on older models, which is one reason a lot of us used to just bite the bullet and try to run up the balance as high as we could reasonably afford to pay at least once to not have that ding every month. Do you happen to know where the NextGen2 model falls? I've been wondering why my NG2 score from PenFed is far and away my highest score that I have access to (more so than just the change in scale would suggest), and now I wonder if it's because of my two Amex charge cards. My gold has a high balance of $19k or so and is sock drawered until November when I may close it ($0 balances reporting every month), while my Platinum has a high balance north of $22k and lately has only been seeing $1-3k a month in spend. As my profile is almost entirely hindered by revolving utilization (if I were under 10%, I'd likely be somewhere in the 800-810 FICO 08 range right now), could it be that the additional close to $40k of "available credit" is helping me tremendously by pushing my util down?

Fico NextGen is rather convoluted. I don't have access to the score myself so I don't know how it would score my profile or react to changes in # cards reporting balances. That being said here are a few differences between Fico NextGen and other Fico models:

1) Fico NextGen uses a variety of "mini-models" that capture more interactions in data. It uses 18 separate scoring models (or scorecards) as opposed to 10 with Fico 98 & Fico 04, 12 with Fico 8 and 13 with Fico 9.

Per Fico: "FICO NextGen score separately evaluates consumers according to those with very clean credit histories, those with mild forms of prior delinquency and those with more severe derogatory information

2) In Fico NextGen consumers are classified by the degree of positive or negative performance across all credit obligations. This is a key point as types of loans are credit accounts are differentiated in Fico NextGen ( retail accounts vs bank/national revolving accounts, types of loans). Fico NextGen prefers profiles with diversity in types of accounts but, may deduct points for too many accounts of any given type. A couple charge cards and store cards may boost NextGen score but have no impact on other Fico 8.

3) Fico NextGen includes a reason statement: Amount of credit available on revolving accounts. This is NOT utilization % but rather a dollar amount. Thus, if you have a lot of available credit say $200k you would score higher than someone with $20k at the same utilization level of say, 5%.

Here are a few Reason Statements exclusive to Fico NextGen:

a) Too few accounts with balances (R1)

b) Too few retail accounts (R8); Too many retail accounts (V2)

c) Too few retail accounts with recent payment information (R9)

d) Too many revolving accounts (V3)

e) Too few consumer finance company accounts with recent payment information (R6)

As you mentioned, the 950 upper end for Fico NextGen compared to 850 for Fico 8 is one reason for your higher Fico NextGen score. Another reason may be your available credit in $$$ terms is high enough to give you bonus points on NextGen - not considered in Fico 8. My guess is Fico NextGen doesnot weigh "high" revolving utilization as heavily as Fico 98/Fico 04/Ficoo 8.

If you have some retail accounts that will help NextGen but have no impact on Fico 8. Now, here is one that could be a major difference ... Fico 8 drops score if you have a consumer finance account on file but, Fico NextGen may actually award points for a CFA - especially if it has recent payment information.

It sure looks like Fiair Isaac was catering to retail lobbyists when they developed FICO NextGen

Pasted below is an old infographic on score ranges for various models. Unfortunately it incorrectly shows Fico industry enhanced models going to 925 when they only go to 900.

My only negative reason code on NG2 was revolving accounts having too high a balance. At the time my total revolving balances were ~4800, slightly over 1% utilization, but graded as 2%.

On MyFiCO this statement appeared in my EQ FICO 8 breakdown: "Most FICO High Achievers owe less than $3000 on revolving accounts such as credit cards and department store cards. " Which makes me think EQ NG2 was downgrading me for having balances > $3k.

But some other EQ scores had as a negative reason code that too many accounts were carrying balances. 6 out of around 27 accounts were carrying balances. So this was apparently a factor.

From these I conclude that NG2 is sensitive to number of accounts carrying balances & to dollar number over 3k.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@SouthJamaica wrote:My only negative reason code on NG2 was revolving accounts having too high a balance. At the time my total revolving balances were ~4800, slightly over 1% utilization. On MyFiCO this statement appeared in my EQ FICO 8 breakdown: "Most FICO High Achievers owe less than $3000 on revolving accounts such as credit cards and department store cards. " Which makes me think EQ NG2 was downgrading me for having balances > $3k.

How are you getting FICO NG2 reason codes? Penfed only gives one rather than the typical 3-4 in their interface?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@Revelate wrote:

@SouthJamaica wrote:My only negative reason code on NG2 was revolving accounts having too high a balance. At the time my total revolving balances were ~4800, slightly over 1% utilization. On MyFiCO this statement appeared in my EQ FICO 8 breakdown: "Most FICO High Achievers owe less than $3000 on revolving accounts such as credit cards and department store cards. " Which makes me think EQ NG2 was downgrading me for having balances > $3k.

How are you getting FICO NG2 reason codes? Penfed only gives one rather than the typical 3-4 in their interface?

That was the one I got from PenFed on their 2/28/17 score.

BTW I've edited my previous post to add a little more information about my other EQ negative reason codes for that time period.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

SJ -

Fico NextGen does have negative reason statements for the following:

a) Too many revolving accounts (V3).

b) Number of revolving accounts with balances higher than limits (N8).

c) Proportion of balances to credit limits on bank/national revolving accounts is too high (Q1)

d) Proportion of balances to credit limits on revolving accounts is too high (P6).

e) Too many recently opened bank/national revolving accounts (V4)

f) Too many recently opened revolving accounts (U9)

g) Too many recently opened revolving accounts with balances (V0)

h) Time since most recently opened bank/national revolving account opened is too short (K4)

i) Amount owed on bank/national revolving accounts (A4)

j) Amount owed on recently opened bank/national revolving accounts is too high (A8)

k) Too many bank/national revolving accounts (T2)

Note how NextGen differentiates bank/national from other revolving (e.g. retail/store)

SJ - Fico NextGen probably dings your score due to codes K4, V0, V3 V4 and possibly T2. I do see where NextGen looks balances in $$$ terms (codes A4 & A8). In your case, I wonder if it is balances on "new" accounts being too high. Not sure where NextGen draws the line for "recently opened" - 90 days?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Why are so-called FICO scores all over the map?

@Thomas_Thumb wrote:SJ -

Fico NextGen does have negative reason statements for the following:

a) Too many revolving accounts (V3).

b) Number of revolving accounts with balances higher than limits (N8).

c) Proportion of balances to credit limits on bank/national revolving accounts is too high (Q1)

d) Proportion of balances to credit limits on revolving accounts is too high (P6).

e) Too many recently opened bank/national revolving accounts (V4)

f) Too many recently opened revolving accounts (U9)

g) Too many recently opened revolving accounts with balances (V0)

h) Time since most recently opened bank/national revolving account opened is too short (K4)

i) Amount owed on bank/national revolving accounts (A4)

j) Amount owed on recently opened bank/national revolving accounts is too high (A8)

k) Too many bank/national revolving accounts (T2)

Note how NextGen differentiates bank/national from other revolving (e.g. retail/store)

SJ - Fico NextGen probably dings your score due to codes K4, V0, V3 V4 and possibly T2. I do see where NextGen looks balances in $$$ terms (codes A4 & A8). In your case, I wonder if it is balances on "new" accounts being too high. Not sure where NextGen draws the line for "recently opened" - 90 days?

I suspect it's longer than 90 days.

1. You opened a new credit account relatively recently. (MF translation of the reason code)

That's on TU 04 from a 6/6/17 pull when my most recent account was opened 1/11/17. I've read some other people have had that reason code for a full year, though I intend to double-check it at 6 months + 1 day to see if it's done anything like move around or disappear. Since FICO 04 kept some things but not others, I would SWAG that NG and 04 have the same new accounts period.

Somewhat tangentially with another point you made re: penalizing for new accounts, I don't have that reason code on either FICO 8 / 9 for whatever that's worth; may get some better data from EQ/EX when the lien is excluded as I won't have the 30D late as top dog in the reason codes so something else will slip in presumably.

ETA: I also have that reason code on my EX FICO 2 BC/AU industry options as of today; not on FICO 2 (only 3 reason codes there) and not on FICO 3 but I have the CFA tag on that one too in addition to being in the derog scorecard.

Starting Score: 589EQ 567EX 601TU

Starting Score: 589EQ 567EX 601TU