- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Go Debit?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Go Debit?

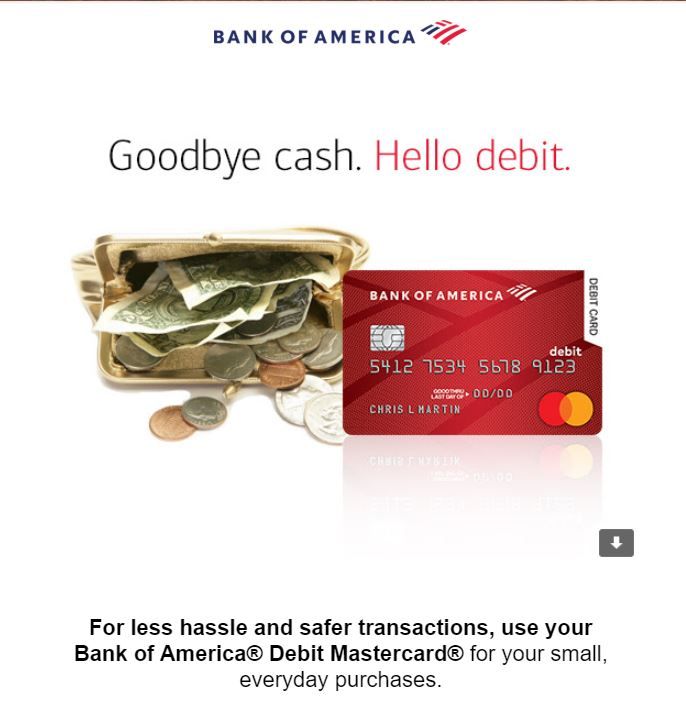

Just received a message from BOFA

It promotes using their debit card for everyday purchases

I wonder if this is a new trend in the banking industry

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

Follow the money.

A bank gets a small swipe fee for a debit transaction. The bank gets nothing when you pull out bills and spare change from your pocket.

No, not a trend, just an advertising promotion.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

is not it better (wiser) to use credit cards for such transactions? what is the point to prefer it over the credit cards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

@Anonymous wrote:Just received a message from BOFA

It promotes using their debit card for everyday purchases

I wonder if this is a new trend in the banking industry

Connected to my checking account, without the full protection of credit card. Yeah, not happening.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

Nothing new. I used debit cards for all or nearly all cashless purchases for about 20 years, until I started working on my credit this year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

@blindambition wrote:

@Anonymous wrote:Just received a message from BOFA

It promotes using their debit card for everyday purchases

I wonder if this is a new trend in the banking industry

Connected to my checking account, without the full protection of credit card. Yeah, not happening.

💯! Not as long as the US continues to allow chip and signature instead of chip and PIN.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

@Anonymous wrote:

@blindambition wrote:

@Anonymous wrote:Just received a message from BOFA

It promotes using their debit card for everyday purchases

I wonder if this is a new trend in the banking industry

Connected to my checking account, without the full protection of credit card. Yeah, not happening.

💯! Not as long as the US continues to allow chip and signature instead of chip and PIN.

Exactly! Not to mention that my SAD would cause a panic attack if money went missing from account.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

@blindambition wrote:

@Anonymous wrote:

@blindambition wrote:

@Anonymous wrote:Just received a message from BOFA

It promotes using their debit card for everyday purchases

I wonder if this is a new trend in the banking industry

Connected to my checking account, without the full protection of credit card. Yeah, not happening.

💯! Not as long as the US continues to allow chip and signature instead of chip and PIN.

Exactly! Not to mention that my SAD would cause a panic attack if money went missing from account.

Yup. I check my accounts multiple times a week despite having alerts for every single one of them except my Sync cards. My debit cards are all frozen and my main bank's debit card number hasn't even been used anywhere. Not worth the hassle.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Go Debit?

@NRB525 wrote:Follow the money.

A bank gets a small swipe fee for a debit transaction. The bank gets nothing when you pull out bills and spare change from your pocket.

No, not a trend, just an advertising promotion.

The bank also gets nothing when you oull out your checkbook and write a check, another reason why they push debit.