- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- High-Yield Money Market Savings Experiences

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

High-Yield Money Market Savings Experiences

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

High-Yield Money Market Savings Experiences

I have multiple online-only High Yield Money Market Savings accounts that I've opened over the past few years. Maybe I've been lucky but my overall experiences have been good so-far. I've tended not to chase the absolute "highest advertised rates" since I know rates are variable. Some lenders are known to offer "teaser" rates to encourage new business which don't last, or they don't grandfather existing clients when they run those promotions. I've also read some horrible customer service experiences. I've stuck to some of the largest and reputable national banks which have solid and competitive rates over time. I just looked more carefully at DoC's monthly review of Best High Yield Savings which is an excellent resource. I have three accounts earning 1.70% right now, but I see rates as high as 2.30%. Many of the online-only accounts are affiliated with traditional brick-and-mortar banks. By researching those lenders or their parent banks through the depositaccounts.com website or online reviews, I've not been impressed with the experiences of many of the higher-earning financial institutions. Still, I wonder if I should consider moving some funds to one of these higher-earning FI's.

My question for this this thread is to ask for your experiences (both good and bad) with the leaders in this banking segment. I've seen horrible experiences with trying to fund accounts, trying to speak to customer service, trying to access funds or limitations on access, and other such annoyances. Go to the deposit accounts website to search for reviews on any online lender or their parent. For example, Ivy Bank is the online affiliate of Cambridge Savings Bank in Massachusetts. Brilliant Bank is the online affiliate of Equity Bank in Kansas. CIT bank is the online affiliate of First Citizen's Bank in North Carolina. There was a >thread< about one of our members negative experiences with TAB bank in 2019 but I haven't seen a lot on some of the others.

My own accounts earning 1.70% are with Goldman Sachs/Marcus, Capital One 360, and Discover. I also have PenFed Money Market Savings that earns 1.20% currently, but I'm expecting that rate to increase soon to match those three more closely since it's normally been competitive.

The best-earning rates above what I have now from a lender who would appear reputable and reliable is E*trade Bank by Morgan Stanley, which earns 2.00% or Comenity Bread earning 2.15%. Synchrony and Barclays both seem solid but only pay slightly higher than my best rate at 1.80% versus 1.70%. In the past, I've considered an account with Citibank or Amercan Express, but their current rates of 1.65% are slightly lower than my top three.

For reference, here is a summary of the banks paying 1.40% to 2.30% on either Money Market Savings, regular savings, or checking accounts. I'd prefer to limit the discussion to those with the fewest hoops to jump through so a fairly low minimum of $5K or less, maximums on the upper rate that go up to the FDIC-insured limit of $250K, and no fees or ability to avoid them.

- Ivy Bank – 2.30% ($2.5K+; not available in CA)

- Merchants Bank – 2.28%

- Republic Bank – 2.26% ($2.5K+; not available in IL, IN, WI, MI)

- Brilliant Bank – 2.25%

- Redneck Bank also known as All America Bank– 2.25% (maximum $50K)

- UFB – 2.21%

- MyBankingDirect – 2.20%

- Bask Bank – 2.20%

- Enzo – 2.18%

- BrioDirect – 2.15%

- Comenity ‘Bread’ – 2.15%

- Northpointe – 2.15% ($25K+)

- Valley Direct – 2.10%

- Vio Bank – 2.10%

- Citizens Access – 2.10% ($5K+)

- CIBC – 2.08% ($1K+)

- Lending Club Banking – 2.07%

- Prime Alliance – 2.05% ($10K+)

- Personal Capital – 2.02%

- First Foundation – 2.02%

- Quontic – 2.00%

- E*Trade – 2.00%

- Wealthfront – 2.00%

- TotalDirectBank – 2.00% ($2.5K+)

- Credit Karma Savings – 1.98%

- TAB Bank – 1.92%

- CIT Bank – 1.90%

- BankPurely – 1.85% ($25K+)

- Synchrony – 1.80%

- Bank7 – 1.80%

- Barclays – 1.80%

- Ally Bank – 1.75%

- Sallie Mae – 1.75%

- Usalliance – 1.75% (*$5 withdrawal fee)

- Live Oak Bank – 1.75%

- Marcus by Goldman Sachs – 1.70%

- Capital One 360 – 1.70%

- Discover – 1.70%

- Paypal/Synchrony – 1.65%

- Salem Five Direct – 1.65%

- Sallie Mae – 1.65%

- Citibank – 1.65% (not available in all states)

- American Express – 1.65%

- Laurel Road – 1.60%

- Alliant Credit Union– 1.60%

- Betterment – 1.60%

- Paramount Bank – 1.55% (some accounts have $100,000 limit to earn that rate)

- Popular Direct – 1.55% ($5K+)

- T-Mobile Money – 1.50% (4% on up to $3K for T-Mobile customers;)

- Customers Bank – 1.50% ($25K+)

- SFGI – 1.50%

- Colorado Federal – 1.45%

- FNBO Direct – 1.41%

- Emigrant Bank – 1.40%

- Dollar Savings Direct – 1.40%

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

I have accounts with Vio, Paramount and Barclays, and just closed one with CIT. No real problems with either Vio or Barclays, easy to use and transfer funds. Paramount is fine but APR is a little low, was originally higher than the competition, not now.

There was a time when CIT kept introducing new accounts, which you would have to open and transfer money to, e.g. (names made up) you would start withe Super Saver at say 1%, they would keep that rate but introduce Really Super Saver at 1.25%, so you would open that and move nearly all the money from Super Saver (not closing because suddenly Super Saver might go up to 1.3%!) and then they would come up with Max Super Saver at 1.5% etc. Other banks increase/decrease rates, CIT introduced new products (as well as adjusting rates)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

Have accounts with:

USAlliance, Barclay's, GS-Marcus, Western State Bank and Cap1-360.

Every one has things that I like and things I dislike.

Nothing horrible just personal opinion of how they each do business

My two top choices would be Barclay's (1) & GS-Marcus (2)

Recently Cap1-360 (3) has been extra good however.

Gave me an offer for $450 bonus to move 50k new money in HYS for 3 months.

Got the bonus $ a few days ago.

Not the highest interest but with the bonus a good earner this year.

Western State is on the close list, would not recommend. (Last)

Have had issues with USAlliance, still have account but not heavy funded.

It might go, for now in a landing pattern.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

Recommend adding Affinity Federal CU to your list, as their Savings is currently earning 3.5% for the first $5k and then 1% over that. No hoops or debit swipes or anything like that required! I've also found their push/pulls to be next day. My DW and I both are members, so that's $10k at 3.5% with no monthly maintenance to get that rate. They also have one of the best credit cards, maybe you've heard about it? ![]()

Currently we use TMobile checking for bill pay, which is at 1.5%. Recommend it if you need an account for your "extra" $ that won't earn better rates from other institutions due to those being maxed out already or you don't want to deal with the qualifying hoops. A nice thing about this is that this account is in the Allpoint ATM network, so you can just run to the local CVS or Walgreens to manage cash. One issue I have with this account is that you can't add a benficiary or joint account... kinda odd.

Ally has our hub accounts. But even though accounts have been setup in Ally for a while, transfers still seem to take a few days to occur. They do seem to update their rates often lately, and they send notifications through email about the rate changes. I don't always get those notices from others like Penfed and CapOne for some reason.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

Timely posting of this topic Qui-Gon @Aim_High, as I've been exploring additional pockets for either savings or high yield checking options. While your discussion has a clear focus on accounts with minimal/no hoops, I've got to say that the Evansville Teachers Federal Credit Union (soon to be Liberty Financial) Vertical Checking is about as close to painless as you can get for some hoops. It's 3.3% for up to $20k, you can do P1 and P2 accounts, they take any ACH as a DD, and the 15 debits can be quick $.50 Amazon reloads. They also have an eligibility tracker that is nice feature to be sure you've met the criteria each month.

For savings accounts, I will second Duke's shout out for the AFCU Smart Start Savings giving the nice 3.5% up to $5k. For those in certain areas of CA, Safe CU has a Preferred Money Market 2% up to 2k, and Meriwest CU has a Premium Online Savings 2.25% up to 5k. Penfed savings at 1.2% is the minimum threshhold for me atm.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

I have some CU Accts paying 3.5% to 6% on smaller amounts.

Had a bunch in USALLIANCE FCU High Dividend Savings @ 1.75% APY*

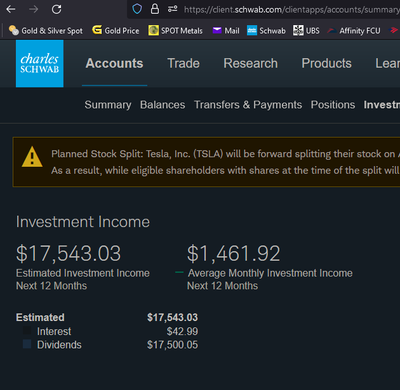

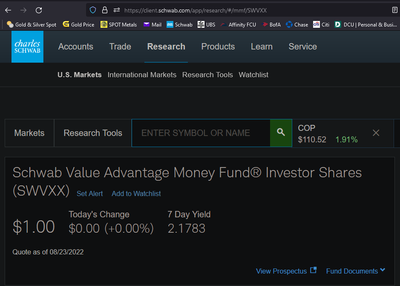

But then Charles Schwab upped SWVXX ..So I moved all those monies back to Schwab

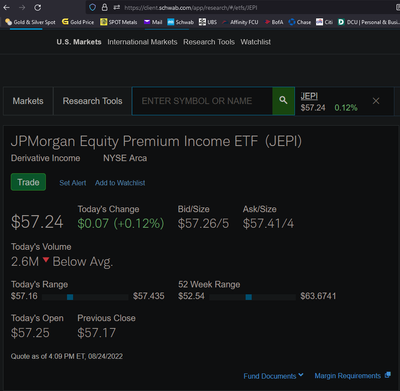

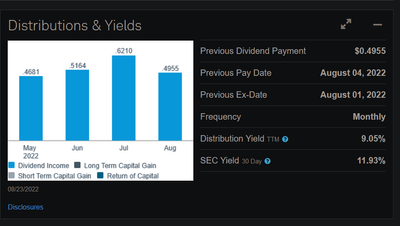

Cash positions: Right Now I have a 25% / 75% split >> 25% in SWVXX and 75% in JEPI (JP Morgan) Covered call ETF

This is in a Taxable brokerage account.

Some in low volatile dividend paying stocks.

This is current Dividend yield and interest (does not include growth / as they don't pay dividends)

SWVXX monthly yield

| 08/15/2022 |

JEPI Monthly Dividend

| 08/04/2022 |

I have recently added some monies, that is why this figure is a little larger.

Disclaimer:

Due your own due diligence, as this is only an example not investment advice

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@M_Smart007 I just moved a small bit of cash from savings to my Schwab account and invested it in SWVXX, and moved another bit into my Merrill Edge account and invested it partly in VTIP (a treasury-backed inflation-protected ETF). I view those as relatively safe alternatives to high-yield savings accounts (and I have two of those - the Affinity Smart Start, mentioned a few times above, and the regular Alliant high-yield account, currently at 1.6%).

I purchased an I-bond last week at 9.62%, but that's tied up for a year or more, so it's obviously not an alternative to savings.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

Looks like you are doing well![]()

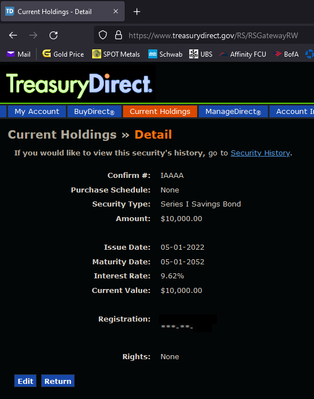

I also purchased $10K worth of I bonds back on May 1st ... ( I plan on redeeming after one year from purchase date)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

Thanks to all contributions so far, @Anonymous, @Kforce, @Duke_Nukem, @PullingMeSoftly, @M_Smart007, @5KRunner.

Some excellent feedback and discussions of alternative places to park some savings. While I want a good return, I have mixed feelings about opening multiple accounts that cap the highest returns at only $5K to $10K but I'll consider that alternative. The 1.5% on Tmobile Checking is interesting, @Duke_Nukem. I have good returns on some of my other checking accounts but nothing approaching that level of return. The Schwab, JP Morgan Chase, or Bank of America fund ideas were an unexpected but interesting twist on the topic @M_Smart007 and @5KRunner. While they don't have the protections or rate stability of FDIC-insured money markets, it appears they can earn as much (or possibly more) than similar funds.

Business Cards

Length of Credit > 40 years; Total Credit Limits >$936K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 96.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 31 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: High-Yield Money Market Savings Experiences

@M_Smart007 wrote:

Looks like you are doing well

I also purchased $10K worth of I bonds back on May 1st ... ( I plan on redeeming after one year from purchase date)

(Click image to enlarge)

You lose 3 months worth of interest if you cash out before 5 years.