- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: How do shared secured loans work?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do shared secured loans work?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do shared secured loans work?

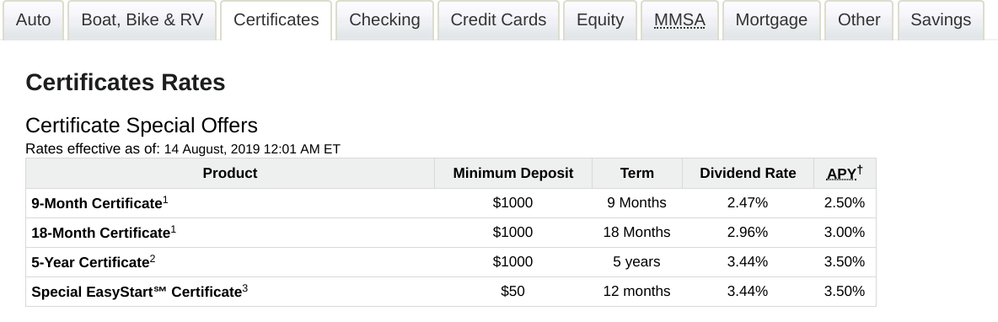

I'm looking at NFCU SSL, I see that I can do a 5-year with a minium deposit of $1,000. Let's say I took that option. How would it benefit and affect me? Do I make payments on the $1,000? At the end of my 5-year SSL, do I get $2,000? Do I pay interest or does NFCU pay interest? What would be an estimated monthly payment?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do shared secured loans work?

Here are primers:

https://ficoforums.myfico.com/t5/Personal-Finance/NFCU-SSL/m-p/5295063

https://ficoforums.myfico.com/t5/Understanding-FICO-Scoring/Adding-an-installment-loan-the-Share-Sec...

https://ficoforums.myfico.com/t5/Personal-Finance/The-Quest-for-an-SSL-alternative-to-Alliant/m-p/51...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do shared secured loans work?

2. You get the funds back as soon as you pay down to 8.9%

3. Yes, you pay interest on the open loan whatever amount that might be when interest is calculated.

ETA This is your money you are using; hence, secure. You are not doubling your money. You're not using their money.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do shared secured loans work?

@AllZero wrote:

1. You'll need $3001 minimum for the 5 year SSL. $3010 to be safe.

2. You get the funds back as soon as you pay down to 8.9%

3. Yes, you pay interest on the open loan whatever amount that might be when interest is calculated.

ETA This is your money you are using; hence, secure. You are not doubling your money. You're not using their money.

That's what i'm not understanding. If I put in the $3010, but then I have to make payments until I hit $3010 right? So wouldn't there be $6020 at the end?

What is the difference between (above) and (below)?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do shared secured loans work?

Click here https://www.navyfederal.org/products-services/loans/personal-loans/personal-loans.php

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do shared secured loans work?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do shared secured loans work?

@Anonymous wrote:

@AllZero wrote:

1. You'll need $3001 minimum for the 5 year SSL. $3010 to be safe.

2. You get the funds back as soon as you pay down to 8.9%

3. Yes, you pay interest on the open loan whatever amount that might be when interest is calculated.

ETA This is your money you are using; hence, secure. You are not doubling your money. You're not using their money.That's what i'm not understanding. If I put in the $3010, but then I have to make payments until I hit $3010 right? So wouldn't there be $6020 at the end?

You put in $3010 of your own money into the SSL account. They give you back $3010 immediately. They will freeze the SSL funds until you pay it back. Use the funds they gave you to pay back and down the SSL account to 8.9% ($2742.11). The unfrozen funds will return back into your account. The rest will be frozen to keep the account open. Set up autopay for a few dollars to keep account active. Each autopay will return the unfrozen funds back into your account, whichever amount that you set up autopay for.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do shared secured loans work?

@Anonymous wrote:

@AllZero wrote:

1. You'll need $3001 minimum for the 5 year SSL. $3010 to be safe.

2. You get the funds back as soon as you pay down to 8.9%

3. Yes, you pay interest on the open loan whatever amount that might be when interest is calculated.

ETA This is your money you are using; hence, secure. You are not doubling your money. You're not using their money.That's what i'm not understanding. If I put in the $3010, but then I have to make payments until I hit $3010 right? So wouldn't there be $6020 at the end?

What is the difference between (above) and (below)?

Initially yes, but I just make the payments via transfer back from the savings account, so the amount on hand goes down as the loan goes down.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do shared secured loans work?

I don't see how it would be benficial :\ oh well. Paying $3,000 for history is absurd.