- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- Re: How do y'all figure out how you're doing?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How do y'all figure out how you're doing?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

So far I've been lucky: bubbles were obvious. In the mid-90s when my literally broke landscaper bought a house I couldn't afford at 3X my income, I knew to sell my two rentals. I bought one of them back just 14 months later for 40% off what my buyer paid; they were already in preforeclosure or whatever and the bank did the equivalent of a short sale but it wasn't call that then, I don't think.

The bubble in 2007 or so was massively obviously because my housekeeper and her unemployed son AND his unemployed girlfriend all bought condos in the same 3 month period. I was paying her about $20 an hour and I knew she wasn't working 40 hours a week! And the kids were high school grads with who knows what income (none, obviously) who were bragging on how they were going to flip the condos in 3 months. I called my MLS listing real estate agent and said "let's move this, price it at 5% below comps" and I was out 60 days later. Banks were underwriting anyone with a pulse, and the guy who bought one of my rentals didn't even have that.

Right now it's a hot seller's market in my area and I am getting twitchy but the rental income opportunity is way too good to liquidate. I bought my home around 20% below market because of my cash offer and quick closing (I know because there are 60 identical WW2 homes in my 5 block radius area) and now comps that aren't as nice as mine are selling for 15% more than I paid. So I figure I am up almost 40% which is totally ridiculous but our neighborhood has gotten major city makeovers, new parks, school ratings went way up, crime is way down, and the nearby airport no longer lands planes overhead (recent change for the better).

I doubt I will sell this home because of the AirBNB opportunity (I am close to a popular airport). I listed it on AirBNB last month and someone snapped it up in 6 hours or so. I am considering attempting a 2 week stay at the Red Roof Inn down the street and putting my home up for rent and seeing if I can arbitrage there, haha.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@iced wrote:I think the short answer is many people don't keep that close of an eye on net worth, which looks like what you're going after. I do tend to keep track of things, but only to a limited extent.

For my investment accounts/retirement/etc, many today have nice tools embedded in their system. For instance, e-trade has dashboards to show me where my money is and what it's done in the last year. Many tools can also take that data to predict the trend it will take in the next few months. I use similar tools at Fidelity, TIAA-CREF, and Putnam/Empower.

For me and my wife, we only base our net worth from the value residing in our accounts, excepting savings. That is, we really only factor in liquid assets to our net worth. As for debt, we have enough in emergency savings to pay off all non-mortgage debt so those cancel out and is this why we don't factor it in. We have a mortgage but we can easily get 3x and possibly 4x what we owe so we just negate it out of our calculation.

This makes it easy to calculate. Add up the values from 6-10 accounts, subtract 0 for liabilities/debt, and were done.

I think the longer answer is when I'm honest with myself, laissez-faire would be the rosy charitable view of how I've approached my finances... but that's not my world, really I've just been naive and certainly sloppy albeit maybe not stupid (least I've tried to do something useful with my money and wind up saving non-trivial percentages when I have income). Can't claim to be ignorant as I've known it's important: ML suggested plan, nah, maybe not a fool but still lucky.

I started Tac's suggestion of line chart and I built all the monthly datapoints for everything but checking account on the asset side for the last 3 years (that was actually really easy to do); I still need to include the checking for some months especially around the mortgage as I was sitting on a pile of cash but I can likely zero that out as the statement balances should be something of a rounding error for anytime recently... I'll build it when I get statements (in the mail, yay) and then see if I can exclude most of it as it's really just the money shuffling place. I think the more important thing to get out of it is savings rate, it's kinda a big difference if my napkin math of 4K a month savings/HELOC payments since Februrary (or 5K now maxing out the latest of crappy employer 401K plans I now have) isn't accurate.

Been trying to take the opinions of the thread as y'all have clearly thought about this more than I have, but still struggling with the mortgage not counting anywhere in one's financial life or as a net neutral in your description even if it's my residenence in this case. Buying it puts a dent in the data which isn't entirely accurate, and while I probably need to do something like subtract a default 6% for realtor fees that the seller picks up I guess it all boils down to whether the valuation is sane or not. I live in a complex that has 160 units and we turn over ~8% a year which makes comps fairly easy and I just pick the lower bound of the $/sqft range.

I don't know, trying to do any hardcore analytics like get the real and maybe opportunity costs of my most recent school attempt, or figure out quantatitively what the impact of sitting on my ass for a few months after a job ends is a bit challenging from this analysis as investments do fluctuate. I think I'm going to probably land on the side of, duh, these are expensive issues, you know this, precise size doesn't really matter... but I really should get the cash flow and savings analysis done, even if I know I'm OK when employed, I need to be more responsible in it and I haven't used YNAB consistently enough over the course of the last 3 years to get the correct picture.

ABCD: think I do need to take some of your idea though on expenses, like I've actively tried to reduce my energy usage and I know my bills are "lower" but I can't really quantify that. Or by working from home 1 day a week does this make a material difference in my fuel and car expenses, and if so by how much? Does it make sense to accept 20K lower in salary working from home as I did somewhat recently even if that's not a straight financial equation?

Need to be smarter rather than just going on feel.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@Revelate wrote:

@iced wrote:I think the short answer is many people don't keep that close of an eye on net worth, which looks like what you're going after. I do tend to keep track of things, but only to a limited extent.

For my investment accounts/retirement/etc, many today have nice tools embedded in their system. For instance, e-trade has dashboards to show me where my money is and what it's done in the last year. Many tools can also take that data to predict the trend it will take in the next few months. I use similar tools at Fidelity, TIAA-CREF, and Putnam/Empower.

For me and my wife, we only base our net worth from the value residing in our accounts, excepting savings. That is, we really only factor in liquid assets to our net worth. As for debt, we have enough in emergency savings to pay off all non-mortgage debt so those cancel out and is this why we don't factor it in. We have a mortgage but we can easily get 3x and possibly 4x what we owe so we just negate it out of our calculation.

This makes it easy to calculate. Add up the values from 6-10 accounts, subtract 0 for liabilities/debt, and were done.

I think the longer answer is when I'm honest with myself, laissez-faire would be the rosy charitable view of how I've approached my finances... but that's not my world, really I've just been naive and certainly sloppy albeit maybe not stupid (least I've tried to do something useful with my money and wind up saving non-trivial percentages when I have income). Can't claim to be ignorant as I've known it's important: ML suggested plan, nah, maybe not a fool but still lucky.

I started Tac's suggestion of line chart and I built all the monthly datapoints for everything but checking account on the asset side for the last 3 years (that was actually really easy to do); I still need to include the checking for some months especially around the mortgage as I was sitting on a pile of cash but I can likely zero that out as the statement balances should be something of a rounding error for anytime recently... I'll build it when I get statements (in the mail, yay) and then see if I can exclude most of it as it's really just the money shuffling place. I think the more important thing to get out of it is savings rate, it's kinda a big difference if my napkin math of 4K a month savings/HELOC payments since Februrary (or 5K now maxing out the latest of crappy employer 401K plans I now have) isn't accurate.

Been trying to take the opinions of the thread as y'all have clearly thought about this more than I have, but still struggling with the mortgage not counting anywhere in one's financial life or as a net neutral in your description even if it's my residenence in this case. Buying it puts a dent in the data which isn't entirely accurate, and while I probably need to do something like subtract a default 6% for realtor fees that the seller picks up I guess it all boils down to whether the valuation is sane or not. I live in a complex that has 160 units and we turn over ~8% a year which makes comps fairly easy and I just pick the lower bound of the $/sqft range.

I don't know, trying to do any hardcore analytics like get the real and maybe opportunity costs of my most recent school attempt, or figure out quantatitively what the impact of sitting on my ass for a few months after a job ends is a bit challenging from this analysis as investments do fluctuate. I think I'm going to probably land on the side of, duh, these are expensive issues, you know this, precise size doesn't really matter... but I really should get the cash flow and savings analysis done, even if I know I'm OK when employed, I need to be more responsible in it and I haven't used YNAB consistently enough over the course of the last 3 years to get the correct picture.

ABCD: think I do need to take some of your idea though on expenses, like I've actively tried to reduce my energy usage and I know my bills are "lower" but I can't really quantify that. Or by working from home 1 day a week does this make a material difference in my fuel and car expenses, and if so by how much? Does it make sense to accept 20K lower in salary working from home as I did somewhat recently even if that's not a straight financial equation?

Need to be smarter rather than just going on feel.

I can't speak for the others, but to me the reason behind not counting real estate is that it isn't a reliable asset. With my investments, I can sell them tomorrow and have cash in hand (less taxes), and with a little math I can know exactly how much cash in hand I can end up with.

When it comes to real estate, it's not so clear. First, I have to actually find a buyer, which fortunately in my neighborhood takes around 48 hours to get offers, but for many that can take months or even years. Second, as was pointed out earlier, I need a place to live. If I sell it, I have to assume a new debt and risk elsewhere. I can sell stocks and be just fine with 0 stocks, but I can't just sell all my houses and have 0 places to live.

In fact, I would go one further and say one of the most dangerous things I see today is people placing too much value into their home equity and essentially relying on it as a retirement stream. They assume their equity will be there to help later and pour all their money into mortgage payments instead of saving in traditional ways. They borrow against it like it's some golden egg. They even do reverse mortgages or sell their house at retirement for living cash. This is the exact opposite of diversification, and trends shift. That OMG open concept stainless steel kitchen McMansion may well be worth less than what someone's put into it in 10 years, or the neighborhood fizzles out as the next hip school district comes along for young professionals. I can get out of stocks almost immediately and cut losses before they get out of control, but once the hill is crested, you may well take a much larger bloodbath on a home.

In short, I do not see real estate as a long term investment but rather than as a long term liability. I'd rather error conservatively and end up a million richer than I thought than assume it's there and be a million short when it isn't.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

Thank you for your response on your thinking around it, I guess I simply don't see a home as being different than any other investment class: they go up, they go down, and they all have differing liquidity... it's not the most illiquid of my assets either (that would be Lending Club where recent losses with rising subprime defaults are seen there too and I'm losing my historical gains with no good way to unwind it quickly. It was good alternative investment while it lasted I guess). It's also a function of price, houses that are on the market for 2 years are generally mispriced, and in that I can leverage the investment wave that's still occuring and just mark at a discount if I have to get out in a hurry for whatever reason.

I may also see it differently as I was looking toward future value down the road as this was never going to be the forever home unless life goes utterly sideways... and actually, if you take away the equity building, I'm not certain it even makes sense to buy at all currently or in the past; however, that may be changing as I expect rental prices to increase perhaps over the long term if recent market data on availability of homes of purchase is accurate. Also unless I move to a dramatically cheaper cost of living, the equity in the condo has value. To add to that I certainly spent cash assets to buy the home, presumably it wasn't just to throw the DP and fees away.

That said, it may not be worth tracking over time; the mortgage is the mortgage is the mortgage and it's value is sort of like a FICO score: it doesn't matter unless someone is looking at it. There's certainly no way in hell I'm going to pay ahead on a 3.25% mortgage so that's not a thing anyway, so it's a constant cost-of-living factor on the cash flow sheet and I'm likely more interested in analyzing the less fixed parts of my life as I have a comparitively cheap place so making a change to be smarter financially isn't really in the cards on straight economic terms anyway... little interest in getting a second job if I were to optimize the commute out for example.

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

ABCD,

do you use cash on cash return, capr rates or projected IRR's when evaluating your propertties ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@Revelate wrote:I never really tried this before, I've always been pretty good about about saving money (or at least not spending it) and I tried once to do a somewhat year over year look at my financial picture but didn't take it any further. Getting better about where my money is going too but never took a bigger picture look and think I was missing a pretty important scorecard on my financial life as a result.

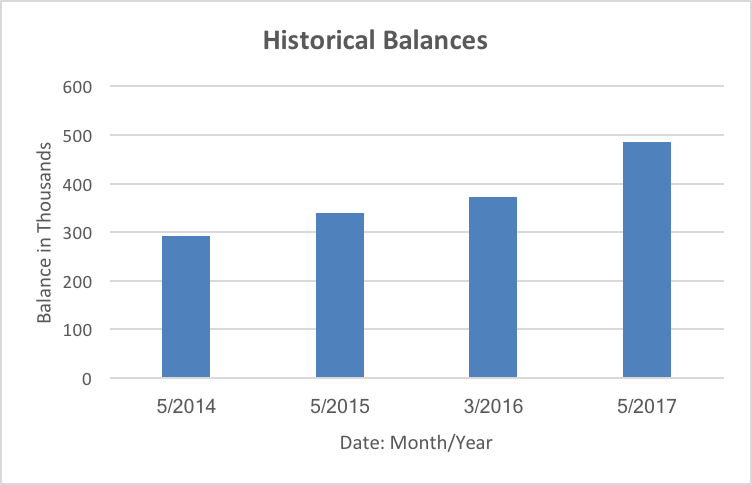

The other day I simply went and dumped data for both debts and assets for what time periods I had (2016 is a little squirly and couldn't get a May date recreation as I lost access to the statements from the checking account which is kinda core to my financials whoopsie) for a year over year comparison... happier outlook in life realizing I'm doing just fine, which got me to thinking how do others do anything similar or hopefully better?

This was my stupid initial first-pass Excel graph, where the values are simply assets - debts vs. time. If I had access to my old checking account statements I'd probably try to get serious and do a month to month cash flow (or more accurately asset change) graph as it wouldn't take that long and would be interesting to me to see how various decisions affected my financial life, but c'est la vie... I may go bug Chase for them since they have to have them even if I lost access in their online interface after they closed it for a fraudulent check. Darn it.

1. Counting your home as an asset is pointless. You can't do anything with it, you need to live in it. And if you didn't have it you'd just have to replace it with something even more expensive. Unless you're ok sleeping in a culvert under the road.

2. Even if the assets were all liquid assets, your net worth tells only a part of the picture. There are scenarios where a person's net worth goes down, and those where it goes up. Think of yourself as a business... a company with good net worth but shrinking earnings isn't worth much and won't last long.

3. The passage of time almost invariably involves inflation, which you haven't factored in, and inflation in home prices is huge.

A lot of us, myself included, would probably have a similar chart; and in my case it could all go up in smoke very easily, with only the slightest of ill winds.

As to your headline question: "How do y'all figure out how you're doing?", I always know how I'm doing financially, and have never had to figure it out, because I have always been aware of what I have, what I owe, and what I earn.

In case you're interested, the answer to the question has always been "lousy", and probably will continue to be.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

Relevate,

impressive balance sheet. Nice work. I forget what the median net worth by age group is but they are not impressive numbers.

I have two headwinds that have restricted greater success- kids and a wife who likes to spend. The second one is the main problem. Taking a beating during 2009/2010 did not help, but that was my fault. Bad investments, failed businesses.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

I would view a house as an asset :

- its just the composition of the balance sheet. Sell the house and have cash/ investments then rent ? The value in a house is the inputed value of rent, or another way to put it, the value of any investment/asset is the present value of future cash flows. Example. Let's say a house here on Long Island is worth 400k and rents for a reasonable ratio of 14 to 1 or 2400 a month. The present value of this 2400 monthly stream at 4% is about 400k.

- also, a house can be used as collateral.

The question about how one is doing- Looking at P&L/Balance sheet and cash flow together tells a full picture. No one would buy a business based soley on a balance sheet or 3 or 4 years of BS's. Relevate BS's show a nice trend in net worth growth but is it due to growth in investment values or incremental adds to asset accounts due to higher income ?

Relevate - nice balance sheet. Mine isn't as good as it should be with kids and an overspending wife.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@wa3more wrote:I would view a house as an asset :

- its just the composition of the balance sheet. Sell the house and have cash/ investments then rent ? The value in a house is the inputed value of rent, or another way to put it, the value of any investment/asset is the present value of future cash flows. Example. Let's say a house here on Long Island is worth 400k and rents for a reasonable ratio of 14 to 1 or 2400 a month. The present value of this 2400 monthly stream at 4% is about 400k.

- also, a house can be used as collateral.

The question about how one is doing- Looking at P&L/Balance sheet and cash flow together tells a full picture. No one would buy a business based soley on a balance sheet or 3 or 4 years of BS's. Relevate BS's show a nice trend in net worth growth but is it due to growth in investment values or incremental adds to asset accounts due to higher income ?

Relevate - nice balance sheet. Mine isn't as good as it should be with kids and an overspending wife.

Thanks senor; I'm flip flopping on the condo thing again after seeing SJ's post and wanting to point out the various reasons that writing off the mortgage altogether doesn't make complete sense... and the collateral piece was one I was thinking of: case in point, every single lender I deal with absolutely views my condo as an asset, though in their case it's another insurance policy if I flake they can file suit and have a pretty good chance of beating the money out of me. The other part of being homeless, ain't skeerd, I can go move to Kansas or Texas or even North Carolina (but maybe not Seattle) and get something nicer for 2/3 the price easy. LA is expensive but I'm not on Skid Row either and there's a range between where I am now and there anyway housing wise. Decent chance it wouldn't affect my income at all either.

I'm kind of ambivalent on condo inclusion, usually I have zero trouble making up my mind but I can see both the for and against from a personal finance perspective, though I'm leaning towards trying to do a true accounting and the equity in the house is an asset no question just like the mortgage is a debt. For me the cash flow sheet I think will be what I need and Tac's suggestion of placing them on the same graph is probably brilliant and something I wouldn't have thought of on my own as I'd always kept them seperate previously.

As for the slope, I know I'm missing some things in life being single and I'm a little disappointed in that, but it doesn't show in the balance sheet to be sure. That also factors in my not being worried about having to sell the condo, and TBH I likely need to leave Los Angeles for other reasons that have nothing to do with my finances so it's not a bad idea to pay attention to market and rental prices anyway heh... though if moving, probably doesn't make sense to try to keep it as a rental.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How do y'all figure out how you're doing?

@Revelate wrote:

@wa3more wrote:I would view a house as an asset :

- its just the composition of the balance sheet. Sell the house and have cash/ investments then rent ? The value in a house is the inputed value of rent, or another way to put it, the value of any investment/asset is the present value of future cash flows. Example. Let's say a house here on Long Island is worth 400k and rents for a reasonable ratio of 14 to 1 or 2400 a month. The present value of this 2400 monthly stream at 4% is about 400k.

- also, a house can be used as collateral.

The question about how one is doing- Looking at P&L/Balance sheet and cash flow together tells a full picture. No one would buy a business based soley on a balance sheet or 3 or 4 years of BS's. Relevate BS's show a nice trend in net worth growth but is it due to growth in investment values or incremental adds to asset accounts due to higher income ?

Relevate - nice balance sheet. Mine isn't as good as it should be with kids and an overspending wife.

Thanks senor; I'm flip flopping on the condo thing again after seeing SJ's post and wanting to point out the various reasons that writing off the mortgage altogether doesn't make complete sense... and the collateral piece was one I was thinking of: case in point, every single lender I deal with absolutely views my condo as an asset, though in their case it's another insurance policy if I flake they can file suit and have a pretty good chance of beating the money out of me. The other part of being homeless, ain't skeerd, I can go move to Kansas or Texas or even North Carolina (but maybe not Seattle) and get something nicer for 2/3 the price easy. LA is expensive but I'm not on Skid Row either and there's a range between where I am now and there anyway housing wise. Decent chance it wouldn't affect my income at all either.

I'm kind of ambivalent on condo inclusion, usually I have zero trouble making up my mind but I can see both the for and against from a personal finance perspective, though I'm leaning towards trying to do a true accounting and the equity in the house is an asset no question just like the mortgage is a debt. For me the cash flow sheet I think will be what I need and Tac's suggestion of placing them on the same graph is probably brilliant and something I wouldn't have thought of on my own as I'd always kept them seperate previously.

As for the slope, I know I'm missing some things in life being single and I'm a little disappointed in that, but it doesn't show in the balance sheet to be sure. That also factors in my not being worried about having to sell the condo, and TBH I likely need to leave Los Angeles for other reasons that have nothing to do with my finances so it's not a bad idea to pay attention to market and rental prices anyway heh... though if moving, probably doesn't make sense to try to keep it as a rental.

Sure it's an asset technically, in accounting terms. But in reality, using it as a way of convincing yourself you're in good financial shape is misleading.

What my lenders think isn't what I think.

My lenders are in business. Their business consists partly of making mortgages and collecting monthly payments on them... and everytlhing's lovely along with the white picket fence. But their business also consists of selling the mortgages to others, thus absolving themselves of any risk of default. And part of their business, and the business of people who buy their mortgages, is acquiring real estate at a fraction of its value, because of the owner's default.

So if they say you can afford a mortgage, that's from their perspective, and it may not be true at all from your perspective.

If you have enough money in the bank that you don't have to worry about working and staying healthy and things like that, then you're in good financial shape. I wouldn't know, I've never had that, and likely never will.

That I might live in a house, off of which the bank might make out like a bandit if I defaulted on a mortgage payment, gives me no comfort, regardless of how much my so-called "equity" appears to be.

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 691 EX 682