- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Personal Finance

- PIF Credit Cards In Which Order?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

PIF Credit Cards In Which Order?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

PIF Credit Cards In Which Order?

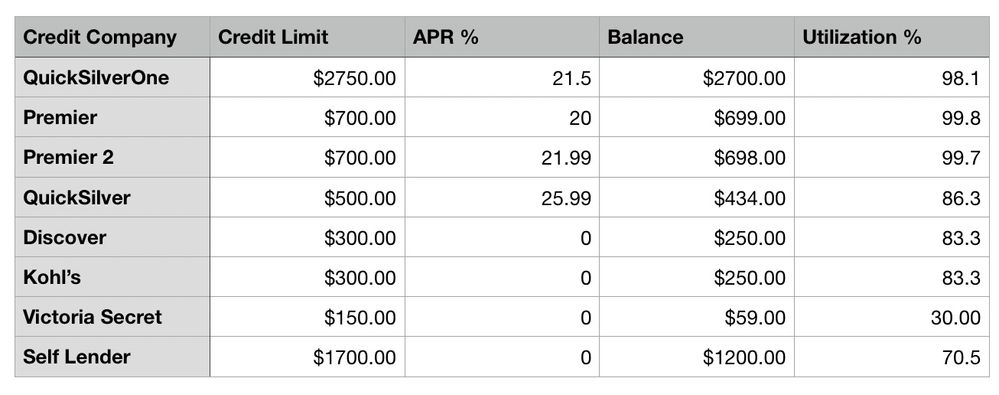

So I am finally able to pay down $2500 of CC debt. I would like some advice on what cards I should pay off first & how much if possible.

Should I pay $2500 of CC debt all this month or spread the debt payments over a span of 2-3 months?

CC debt is definitely holding back my scores. I am just not sure which way is the best way to go.

I have two cards with monthly/annual fees. They are FirstPremier cards $700 CL each. One charges $8 a month, the other $12 & both have annual fees of $96.

Here is my CC info

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

@CivalV wrote:So I am finally able to pay down $2500 of CC debt. I would like some advice on what cards I should pay off first & how much if possible.

Should I pay $2500 of CC debt all this month or spread the debt payments over a span of 2-3 months?

CC debt is definitely holding back my scores. I am just not sure which way is the best way to go.

I have two cards with monthly/annual fees. They are FirstPremier cards $700 CL each. One charges $8 a month, the other $12 & both have annual fees of $96.

Here is my CC info

Personally I would pay all the small balances off first and then knock out the biggest one last because you can hit that one with the most money and then once you pay off that one i would combine capital ones and close those crappy first premier cards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

@Anonymous wrote:

It would be useful to see when your 0% promotions end. I would fully take advantage of that interest free time. I would also throw in monthly/annual fees into your spreadsheet to get a better look at what you’re really paying. It might be best to pay off those Premier one cards, close them down, then pay off a cap one and consolidate it with your other quicksilver.

+1. Second this. Pay off your small balances, combine your CLs and then target Cap1. Combine both QS and keep the QS, not the QS1. The QS is easier to PC compared to the QS1, plus the QS1 has an AF.

Scores - All bureaus 770 +

TCL - Est. $410K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

@CivalV wrote:So I am finally able to pay down $2500 of CC debt. I would like some advice on what cards I should pay off first & how much if possible.

Should I pay $2500 of CC debt all this month or spread the debt payments over a span of 2-3 months?

CC debt is definitely holding back my scores. I am just not sure which way is the best way to go.

I have two cards with monthly/annual fees. They are FirstPremier cards $700 CL each. One charges $8 a month, the other $12 & both have annual fees of $96.

Here is my CC info

I would pay off both FP cards, then close them. At this point in time, you cannot afford more monthly or annual fees. Pay off Quicksilver, then remaining money into QS1, and work aggressively in the upcoming months towards paying it off.

Be mindful of when your 0% APRs expire

I would like to add that any payoff plan you have will only work if you stop charging.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

@Remedios wrote:

@CivalV wrote:So I am finally able to pay down $2500 of CC debt. I would like some advice on what cards I should pay off first & how much if possible.

Should I pay $2500 of CC debt all this month or spread the debt payments over a span of 2-3 months?

CC debt is definitely holding back my scores. I am just not sure which way is the best way to go.

I have two cards with monthly/annual fees. They are FirstPremier cards $700 CL each. One charges $8 a month, the other $12 & both have annual fees of $96.

Here is my CC info

I would pay off both FP cards, then close them. At this point in time, you cannot afford more monthly or annual fees. Pay off Quicksilver, then remaining money into QS1, and work aggressively in the upcoming months towards paying it off.

Be mindful of when your 0% APRs expire

I would like to add that any payoff plan you have will only work if you stop charging.

Agree as well. Would be nice to pay both First Premier off ($1400 roughly) and close them, prevent any future fees / interest. Take the remainder and put $1,000 on the Quicksilver One to get that cut down, and maybe drop $60 on Victoria Secret so it's showing your first 0, and the remaining $40 save for a rainy day.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

I like the suggestions about combining tradelines, verifying promotions and taking AFs into consideration. Without looking at that I plugged what you have into how I went about deciding how to eliminate my debt. Each of the three options has specific benefits so it depends on your specific goals. I chose Option 2 because it freed up a significant amount of additional dollars each month to apply to the last big card to get the utilization down asap. The only downside I found with this approach is that the last card will be flagged with the high utilization. But, I believe my score results were better with all paid off but one or two vs paying everything down below the threshold where cards are considered fully utilized and still having balances on everything. Hopefully some more seasoned folks could let me know if I am off track. I hope this helps in some way.

fyi...the column "Target Max of 68%" is what I utilized to identify a minimum I wanted to see on my cards.

Option 1: GOAL - Reduce all card utilization below 50% | |||||||

| Balance | Limit | Target Max of 68% | Payments | New Balance | Current Util % | Post Util % |

QuickSilverOne | 2700 | 2750 | $1,870.00 | $1,360.00 | $1,340.00 | 98% | 49% |

Premier | 699 | 700 | $476.00 | $360.00 | $339.00 | 100% | 48% |

Premier2 | 698 | 700 | $476.00 | $360.00 | $338.00 | 100% | 48% |

QuickSilver | 434 | 500 | $340.00 | $200.00 | $234.00 | 87% | 47% |

Discover | 250 | 300 | $204.00 | $110.00 | $140.00 | 83% | 47% |

Kohl's | 250 | 300 | $204.00 | $110.00 | $140.00 | 83% | 47% |

Victoria Secret | 59 | 150 | $102.00 | $0.00 | $59.00 | 39% | 39% |

Self Lender | 1200 | 1700 | $1,156.00 |

| $1,200.00 | 71% | 71% |

Totals | 6290 | 7100 |

| $2,500.00 | $3,790.00 | 89% | 53% |

OPTION 2: GOAL - Reduce tradelines with balances | |||||||

| Balance | Limit | Target Max of 68% | Payments | New Balance | Current Util % | Post Util % |

QuickSilverOne | 2700 | 2750 | $1,870.00 | $110.00 | $2,590.00 | 98% | 94% |

Premier | 699 | 700 | $476.00 | $699.00 | $0.00 | 100% | 0% |

Premier2 | 698 | 700 | $476.00 | $698.00 | $0.00 | 100% | 0% |

QuickSilver | 434 | 500 | $340.00 | $434.00 | $0.00 | 87% | 0% |

Discover | 250 | 300 | $204.00 | $250.00 | $0.00 | 83% | 0% |

Kohl's | 250 | 300 | $204.00 | $250.00 | $0.00 | 83% | 0% |

Victoria Secret | 59 | 150 | $102.00 | $59.00 | $0.00 | 39% | 0% |

Self Lender | 1200 | 1700 | $1,156.00 |

| $1,200.00 | 71% | 71% |

Totals | 6290 | 7100 |

| $2,500.00 | $3,790.00 | 89% | 53% |

OPTION 3: GOAL - Combine Reduce tradelines with balances and Reduce per card utilization | |||||||

| Balance | Limit | Target Max of 68% | Payments | New Balance | Current Util % | Post Util % |

QuickSilverOne | 2700 | 2750 | $1,870.00 | $675.00 | $2,025.00 | 98% | 74% |

Premier | 699 | 700 | $476.00 | $500.00 | $199.00 | 100% | 28% |

Premier2 | 698 | 700 | $476.00 | $500.00 | $198.00 | 100% | 28% |

QuickSilver | 434 | 500 | $340.00 | $300.00 | $134.00 | 87% | 27% |

Discover | 250 | 300 | $204.00 | $250.00 | $0.00 | 83% | 0% |

Kohl's | 250 | 300 | $204.00 | $250.00 | $0.00 | 83% | 0% |

Victoria Secret | 59 | 150 | $102.00 | $59.00 | $0.00 | 39% | 0% |

Self Lender | 1200 | 1700 | $1,156.00 |

| $1,200.00 | 71% | 71% |

Totals | 6290 | 7100 |

| $2,534.00 | $3,756.00 | 89% | 53% |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

Wow that was a real break down! Thank you. I honestly would like my overall utilization to drop. I am also looking to close the two Premier cards but I am afraid that will cause my UTL to go back up again so I might have to pay it off and let them sit in a drawer until I pay off my QS1 or receive a CLI on any of my accounts to even it out. What’s your take on this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: PIF Credit Cards In Which Order?

@CivalV wrote:Wow that was a real break down! Thank you. I honestly would like my overall utilization to drop. I am also looking to close the two Premier cards but I am afraid that will cause my UTL to go back up again so I might have to pay it off and let them sit in a drawer until I pay off my QS1 or receive a CLI on any of my accounts to even it out. What’s your take on this?

You are welcome. Personally, I wouldn't consider closing the Premier cards until your overall utilization would be less than 10% and even better 8% with out including them. This is the key threshold for showing Excellent utilization which was my goal.