- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: Credit update - Experian Boost

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit update - Experian Boost

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit update - Experian Boost

Hello Everyone! So in december of 2018 my credit scores were all in the 470-480 range.

As of today here is where I am at:

Experian: 602 (Used the boost today and it went from 589 to 602)

Equifax: 535 (Should jump on the next update)

TransUnion: 575

FICO 2: 549

FICO Auto 2: 553

FICO Auto 8: 592

FICO Bankcard 2: 513

FICO 3: 551

FICO Bankcard 8: 612

I currently have:

1. Moneylion loan at 5.99% for $500 (Not reported yet)

2. Bank of America Secured; $300 - Bal. $50 (Carrying bal. and paying minimum to establish payment history)

3. Citi Diamond Secured: $200 - Bal. $0

4. Capital One Platinum; $200 - Bal. $0

5. Capital One Platinum AU: $300 (Not reported yet) - Bal. $0

6. Capital One Platinum Secured AU: $300 (Not reported yet) - Bal. $0

7. Amazon Prime Store Builder: $300 (Not reported yet) - Bal. $110 (Will be paid down to $50 before it is reported and will then carry the bal. until it is paid so I can build payment history)

I currently have several items I am disputing on my report that has previoiusly been paid and one creditor who sold a collection account but the contact information for the current debt holder is not accurate.

Total Amount of Derog: $2,500+/-

I also just paid off a medical collection account and that has not reported either. Total was $996 and ended up paying $500 instead.

I am working on gardening for the next 6months and then will see where my score is at once all items are reporting and derog items have fallen off. My goal for the year of 2019 is to get my scores to the 660s and then see if I pre-qual for a Amex (Start with the Amex ED). Do you think it would be in my favor to have my partner add me to his Amex ED? His CL is $10k and has a bal. of around $2,500 which is about to be paid down even more. Thoughts?

Anything i'm missing here or I could be doing?

Thanks for your time! I know this was a long post lulz.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

@Anonymous wrote:Hello Everyone! So in december of 2018 my credit scores were all in the 470-480 range.

As of today here is where I am at:

Experian: 602 (Used the boost today and it went from 589 to 602)

Equifax: 535 (Should jump on the next update)

TransUnion: 575

FICO 2: 549

FICO Auto 2: 553

FICO Auto 8: 592

FICO Bankcard 2: 513

FICO 3: 551

FICO Bankcard 8: 612

I currently have:

1. Moneylion loan at 5.99% for $500 (Not reported yet)

2. Bank of America Secured; $300 - Bal. $50 (Carrying bal. and paying minimum to establish payment history)

3. Citi Diamond Secured: $200 - Bal. $0

4. Capital One Platinum; $200 - Bal. $0

5. Capital One Platinum AU: $300 (Not reported yet) - Bal. $0 Not Needed

6. Capital One Platinum Secured AU: $300 (Not reported yet) - Bal. $0 Not needed

7. Amazon Prime Store Builder: $300 (Not reported yet) - Bal. $110 (Will be paid down to $50 before it is reported and will then carry the bal. until it is paid so I can build payment history)

I currently have several items I am disputing on my report that has previoiusly been paid and one creditor who sold a collection account but the contact information for the current debt holder is not accurate.

Total Amount of Derog: $2,500+/-

I also just paid off a medical collection account and that has not reported either. Total was $996 and ended up paying $500 instead.

I am working on gardening for the next 6months and then will see where my score is at once all items are reporting and derog items have fallen off. My goal for the year of 2019 is to get my scores to the 660s and then see if I pre-qual for a Amex (Start with the Amex ED). Do you think it would be in my favor to have my partner add me to his Amex ED? His CL is $10k and has a bal. of around $2,500 which is about to be paid down even more. Thoughts?

Anything i'm missing here or I could be doing?

Thanks for your time! I know this was a long post lulz.

The AU cards your on aren't really doing much. You have enough on your own. You have a good start to kick off the rebuild. Work on the derogs. In 4-6 months hit up Disco and try for the unsecured version. Otherwise pay everything on time. Have 1 card report a balance and dont 0 out all the cards and your on your way. More cards dont mean higher scores. Good luck.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

Hey FireMedic1,

I do appreciate it! I'll make sure to see about getting removed from the AUs and go at it since I have enough.

I appreciate your advice and will post in a few months where I am at! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

Can I ask your score when you got the Moneylion loan? And did you have a prior relationship with them before you pulled it?

Thanks!

Venmo Card- Mission Lane-Cap1 Walmart- Amex Optima- Cap1 QS- Cap 1 QS1- NFCU Nrewards Secured- Williams Sonoma- Care Credit- Grain- scores hovering around 644-653

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

So the thing is when Moneylion is won't really matter what your credit is or pre-existing relationships.

When you sign up online you get the debit card and you are then given the option to upgrade to a plus account.

Upgrading gives you the option to take out the personal loan regardless of credit.

Keep in mind that with this, you will be required to make monthly deposits into an investment account which you are able to set your risk tolerance so you can be as safe as your want or as risky.

My loan payment is around $29 a month and I invest $50ish dollars into the account. With the the app, you can swipe through the tiles daily giving you $1 into your account so you can offset the monthly fee if you open the app daily.

Here is the link: https://www.moneylion.com/

If you still have questions, I would check out youtube.

Also, I'd recommend checking out the Experian boost as well.

If you have certain bills you pay every month like rent, insurance or pre-paid phone bills, then these items can be added to your report and it will only report the on-time payments as well.

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

The MoneyLion pop ups are very interesting.

But then when I go read about it and the requirements to keep it fee free, I get scared. Also the comments people make scare me off too.

Having to go to the app every single day and then also being required to invest some of your money? Seems too much.

Banks and credit unions offer credit builder loans without all these hoops.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

Experian Boost is interesting. I would love to sign up for it but every time I log in it loops me back to the sign up page... So weird.

Venmo Card- Mission Lane-Cap1 Walmart- Amex Optima- Cap1 QS- Cap 1 QS1- NFCU Nrewards Secured- Williams Sonoma- Care Credit- Grain- scores hovering around 644-653

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

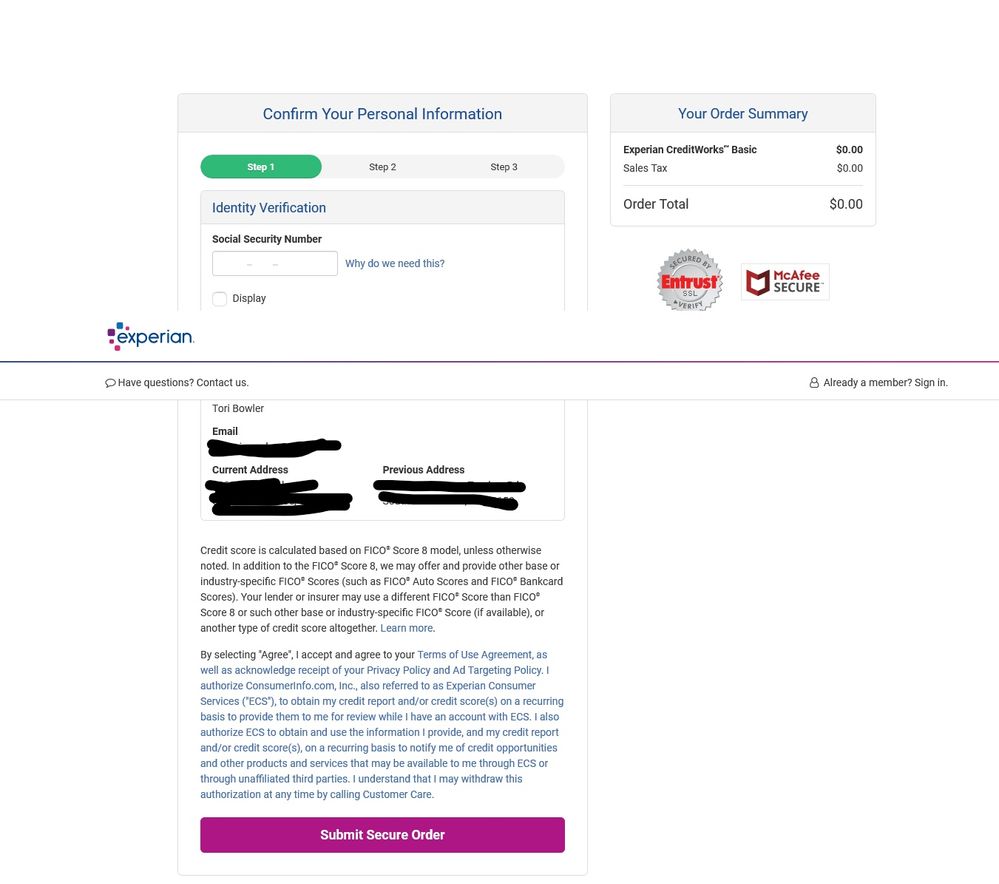

After I sign in it loops me to this page

and you can click that purple bar and it takes me to this

and if i fill in my information it them takes me to the login screen again saying i already have an account... starting the loop back over... ahhh

Venmo Card- Mission Lane-Cap1 Walmart- Amex Optima- Cap1 QS- Cap 1 QS1- NFCU Nrewards Secured- Williams Sonoma- Care Credit- Grain- scores hovering around 644-653

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

I get stuck in the same loop

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit update - Experian Boost

Me too. I stopped trying