- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Re: How many accounts enough to build credit?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How many accounts enough to build credit?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

@Horseshoez wrote:

@masscredit wrote:@MarkyB Did TD Bank pull a report for your secured card? I don't think they do but want to make sure.

TDBank hit me with a Hard Pull from Experian when I applied for my secured card back in June of 2020; that said, when they graduated the card to unsecured in January of 2021 and when they gave me a CLI from $5,000 to $8,500 in February of 2022, there were no pulls of any kind.

I'll have to keep an eye on my EX report. Hopefully things happen like they're supposed to but it won't ruin my day if I have to wait until after my DC.

Capital One Savor - $16000 / Capital One Venture - $13000 / Travel Advantage Visa - $13000 /Bread Rewards AMEX - $8450 / TD Cash Card - $7500 / Apple Card - $6500 / TD Double Up - $5500 / Mercury - $5000 / Ally Master Card - $4300 / DCU Visa - $3000 / Capital One QuickSilver - $600

$82,850

DCU Auto Loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

Just checked, there is a HP from TD Bank on my EX report.

Capital One Savor - $16000 / Capital One Venture - $13000 / Travel Advantage Visa - $13000 /Bread Rewards AMEX - $8450 / TD Cash Card - $7500 / Apple Card - $6500 / TD Double Up - $5500 / Mercury - $5000 / Ally Master Card - $4300 / DCU Visa - $3000 / Capital One QuickSilver - $600

$82,850

DCU Auto Loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

@masscredit wrote:@MarkyB Did TD Bank pull a report for your secured card? I don't think they do but want to make sure.

Hi, yes TD secured pulled my Experian report only.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

What's up guys! So I have my 2nd statement cycle ending in a few days on my capital one card and it still hasn't been reported on my credit report as a open account. Is it normal for capital one to take this long? My discover card just ended it's 2nd statement cycle on Monday and reported the new balance the very same day.

I'm also curious to know what fico score did people start out with after the first 6 months of new credit? I know everyone has different starting scores depending on number of open accounts and utilization usage, etc. I keep all my accounts under 10% utilization. I found out while looking at my credit report this morning they keep record of your highest balance on each card. So utilization does have a memory in terms of the highest balance. I'm sure that has some effect on scores too, and/or approval odds from lenders.

I will update the thread the moment a fico score gets generated for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

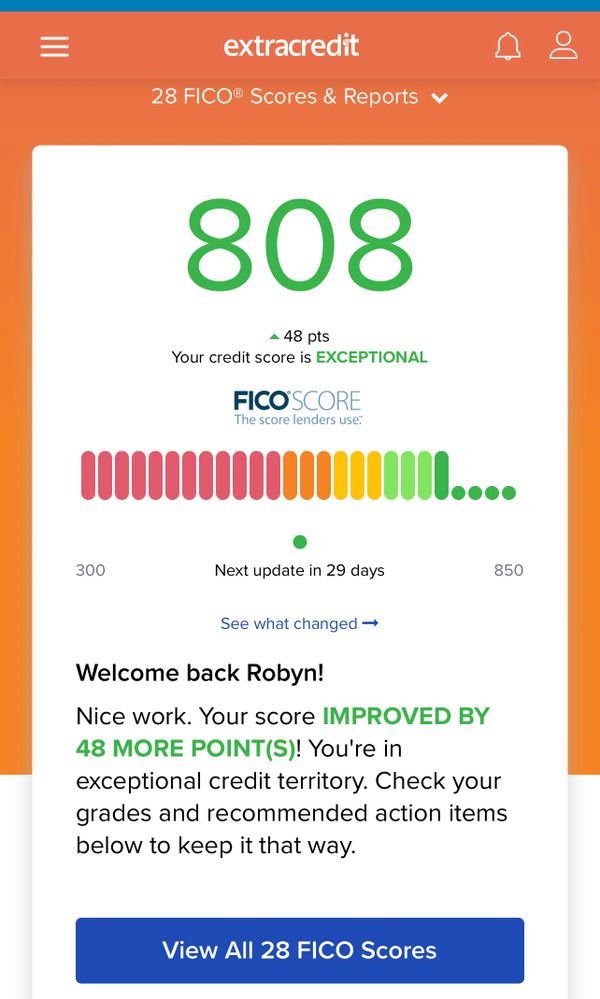

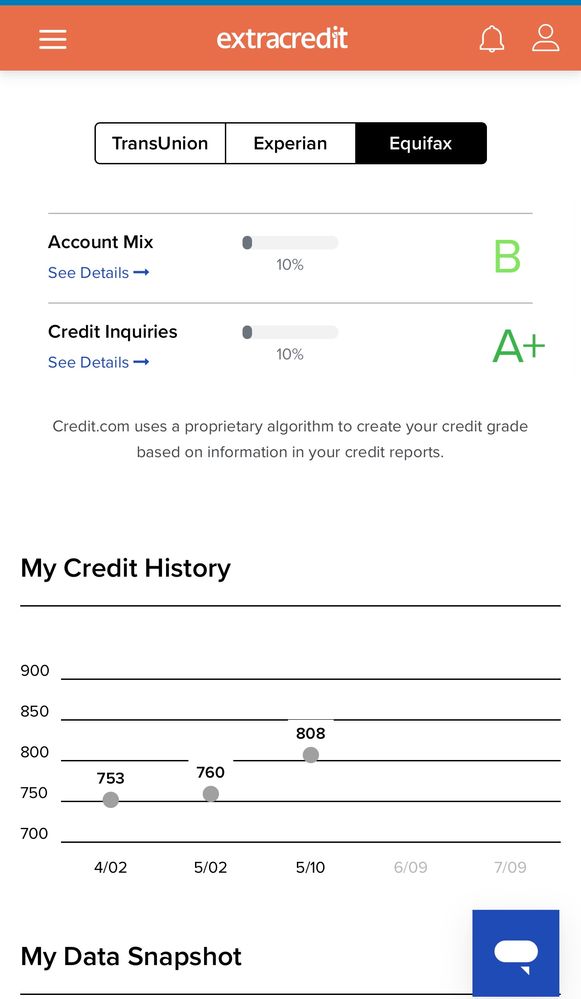

Mark I got my new updates

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

@Anonymous nice! Congrats! So your first ever fico score started at 753? How many open accounts do you have again? And what mix between cards and loans do you have?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

I have a cap 1 secured, disco it secured, open sky secured, NFCU NRewards secured, cap 1 AU, and Amex AU, and an SSL loan thru NFCU, plus rent reporters.

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

@RobynJ so that's a total of 6 open accounts. Keep up the good work! I know it feels so good seeing the results. My vantagescore3.0 jumped up 6 points yesterday as a result of discover reporting my 2nd statement balance, which was even lower than the previous balance. I went from 8% utilization to 6%. Hopefully capital one reports my card soon as I'm sure I'll see an even bigger jump once that happens.

It may be wishful thinking that I'd start in the 700s but I may need to open the open sky card to add an extra account to my file. The fact it doesn't do a hard pull is very appealing. I just don't like the annual fee but I guess once I get the auto loan I can always close it. Hopefully closing it won't drop my score too much but I'm sure I'll recover as I pay off my auto loan over time.

How do you like the open sky secured card? Any issues with it?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

@MarkyB wrote:@RobynJ so that's a total of 6 open accounts. Keep up the good work! I know it feels so good seeing the results. My vantagescore3.0 jumped up 6 points yesterday as a result of discover reporting my 2nd statement balance, which was even lower than the previous balance. I went from 8% utilization to 6%. Hopefully capital one reports my card soon as I'm sure I'll see an even bigger jump once that happens.

It may be wishful thinking that I'd start in the 700s but I may need to open the open sky card to add an extra account to my file. The fact it doesn't do a hard pull is very appealing. I just don't like the annual fee but I guess once I get the auto loan I can always close it. Hopefully closing it won't drop my score too much but I'm sure I'll recover as I pay off my auto loan over time.

How do you like the open sky secured card? Any issues with it?

It's useful for helping to get your credit started. I wouldn't recommend it for anything other than that. It serves its purpose. Good luck my friend.

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

@Anonymous thank you. I will open it along with a "credit strong" secured loan (basically another version of self) so I can save some extra money in the process.

The reason I'm going for more accounts is because my best friend went to BMW to ask about the new M4. He has a credit score of 786 but only 2 credit cards on his file and the dealership told him his file is too thin to get approved for a loan that high ($100k). Mind you, one of his cards is well over 6 years old and never missed a payment on it. That just showed me how important having many open accounts is, regardless of your score.