- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- How many accounts enough to build credit?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How many accounts enough to build credit?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EASY Transunion Early Exclusion (EE)!

Hey MODS why is my new thread merged with my old one? What's going on?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: EASY Transunion Early Exclusion (EE)!

Thank you @RobynJ I appreciate the support!

I'm kinda annoyed that my new thread dedicated to my TU EE was merged with my old original thread. The whole point of the new thread is to help people that are looking for a way to go about doing it themselves. Nobody is going to know to read through 24 pages of a random thread to get the answer they need. I'm very disappointed in the mods. Everything I do is to put info out there for others to learn from my experience. I thought that's what this forum was all about. This is nonsense.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

I decided I won't be applying for a auto loan for now. Interest rates are just way too high. I will wait until 2024 once rates fall back to normal (hopefully). I did apply for a $5,000 personal loan through Discover yesterday (triple pull) and was approved instantly with no POI or any documentation. I was shocked at how easy and seamless it was to get. I also applied for the Amazon store card last night (soft TU pull) and was instantly approved with a $2,600 limit. No hard pull on that card.

I'm thinking about getting the Apple card next. I did apply for it last night as well but I got denied this morning after review due to not being able to verify my identity although they asked I submit photos my drivers license which I did. I was on my pc when I app'd and I heard they normally deny apps if you're not using a apple device so I will retry on my iPhone. I am hoping these new cards and personal loan will give me a thick enough file to garden until the beginning of 2024 to apply for a auto loan. I have my Mercedes car for now which runs fine. There's really no need for me to rush with a new one right now.

I am sending Self the final payment and closing off my account builder with them since I now have the Discover loan. I have no use for Self.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

Happy New Year everyone!

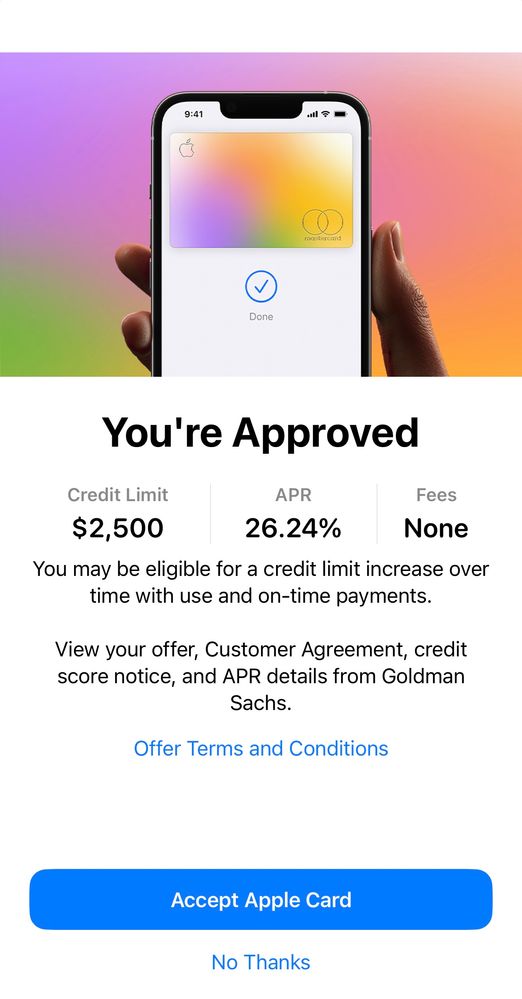

So, as expected, I got approved for the apple card once I reapplied using my iphone with a $2,500 limit. I also went ahead and applied for the B&H Photo store card and the Home Depot store card. I received very small limits on those cards, $500 each. I already used both those cards in-store and I am hoping to get a substantial CLI in the near future. I had also prequalified for the Newegg store card with a $2,500 limit but I declined it after some thought. I don't really shop there (was going to get a new graphics card for my PC) and didn't want to open the card just for the sake of doing so. I tried opening the Best Buy Visa Platinum Rewards card and got declined. Citi bank said their reasoning was "insufficient credit experience" for the denial although they pulled my Equifax with a 744 score. I was never offered the store card version in return so I left it alone assuming I didn't qualify for that one either.

All in all, I am happy with the current accounts I now have and will be going back in the garden. My scores obviously went down a bit from the inquiries and new accounts added but they will rebound with time.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

Glad to see all is going well. I would agree that it would probably be best to just let your file age now. You have a beginning of an amazing file so tread careful not to rack up too many inquiries. Happy new year to you too.

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

@MarkyB wrote:Man, I'm super annoyed. I applied for the TD secured cash card. I initially got "conditionally approved" and thought wow I got it, then when I went to the next step of the process to open the savings account, a message popped up saying they can't approve me and they'll send me a letter with their reasoning. I don't understand how they conditionally approve someone after pulling their credit but then reject them when opening the savings account? I'm so done applying to anything from now on. I got 4 hard inquiries on my report with only 2 cards to show for it. And they were all SECURED cards. Unreal. I hate big banks. They make everything so hard for no reason.

@MarkyB I am new and have been scrolling through this thread from last year and I wondered how did you get the Apple card so soon during this journey as it is listed in your sig line and you have 2 secured cards and denied for the other 2. How is it all going for you now? I am right where you were now when you posted these comments last year. Hope all is well!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

Hi @butterpecan, I hope this thread has been some help to you. All is well over here. I've been gardening since my last spree that I posted about. I have been running different tests every month trying to collect as much data points as I can. One thing I've come to realize is just how important credit utilization is to a good score. You can have a squeaky clean record and your score will tank with high utilization. I have been helping multiple people repair/build their credit with the knowledge I have gained.

The apple card has become my go-to card. I use it for everything. It is so convenient and it gives you daily rewards directly to your apple cash card which you can then use on apple pay for purchases, send another iphone user money or transfer it to your bank account. I earn cash rewards every morning from my total spending the previous day. Also the payments you make towards the card are instantly applied to your available balance. There's no waiting to use the card or to clear a balance. I also avoid paying interest since I'm constantly making payments instead of using cash to pay for things. Say I want to spend $20 on lunch, I will use my Apple card then make a $20 payment to it right away to clear the balance. I never use it if I don't have the cash to make a payment right after. That's how I keep my balance at $0 and avoid interest.

Regarding application, you need to apply using your iphone or ipad/macbook. They did a soft pull on my Transunion report. This was about 4 weeks after I got my collection account removed early so my report was clean when they ran it. My TU credit score was 752 at that time. My utilization and dti were really low, 3% and 2% respectively. My oldest account age was 10 months and newest was 9 months. Perfect payment history. The only negatives were a thin and young file but it seems Apple doesn't care about that. Long as you have a score in the 700s and keep your utilization and dti really low you shouldn't have an issue. It was an easy approval for me.

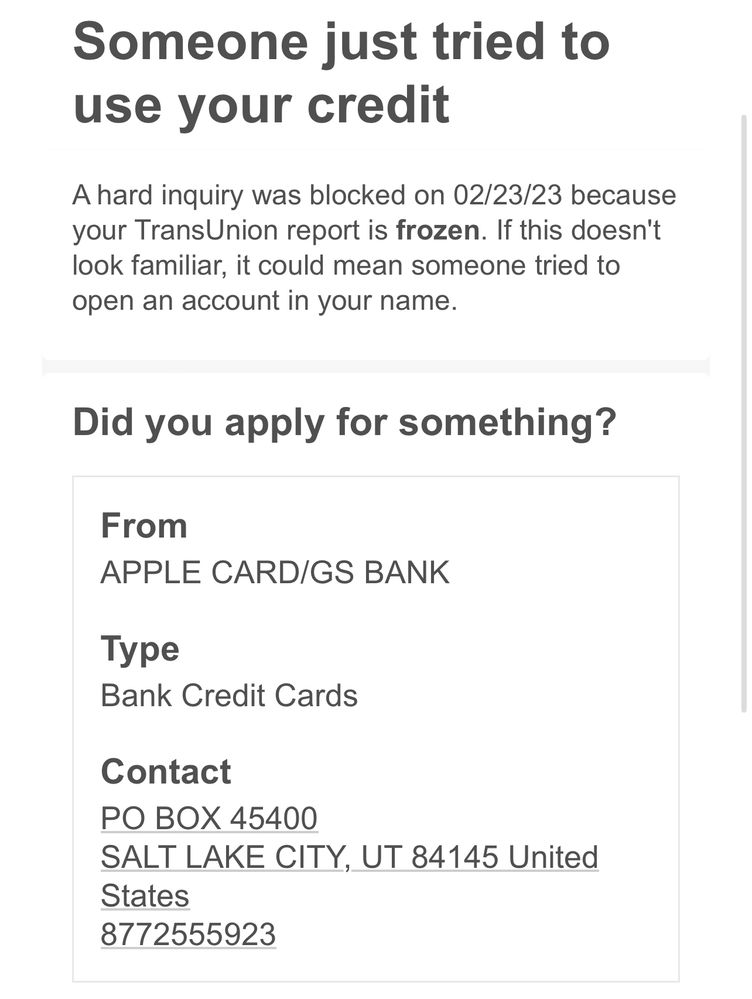

I was able to avoid a hard pull from it. What happened was I unfroze my reports to apply and once I got approved I froze them again. Apparently Apple didn't submit the hard pull until almost 2 months later while my Transunion was frozen and it got blocked. I received an email regarding it which is how I know. I instantly called Apple thinking someone tried using my credit to open a account but they explained that was from the recent card I opened. They said sometimes it takes a while for the hard pull to hit your credit and that nobody can open a new account in my name fraudulently since I opened one already. I clipped the email on the blocked HP and posted it below along with my Apple approval.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

I also forgot to mention that my collection account on my Experian report finally dropped off this past Monday. It was due "on record until 4/2023" and it finally fell off on the 3rd monday of the month, 4/17/23. Now all my reports are clean and I intend on keeping it that way.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

Good for you Markb, I very glad to see you building your file so well. Did you ever get the car loan yet? If so who did you use? It is awesome to see you keep getting a better profile.

>

> >

> >

> >

> >

> >

> >

> >

> >

>

Starting Score:

0

Current Score:

My highest 818

Goal Score:

850

Take the myFICO Fitness Challenge

/

/

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How many accounts enough to build credit?

@MarkyB Awesome work on the apple card and all else in general. I look forward to being where you are I'm still starting out about 2 months into this. I don't qualify for the apple card yet but continue to follow all DP here I can about it. Thx for the input, it really does help. I troll and stroll through these posts as often as I can digging for answers to my own questions that fit my profile so I appreciate your experience being posted.