- myFICO® Forums

- Types of Credit

- Student Loans

- Re: Are these loans reporting correctly?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Are these loans reporting correctly?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Are these loans reporting correctly?

I have many older student loans with delinquencies on them that were consolidated into 2 loans... and they are showing closed with a 0 balance, BUT in the area where is says pays it just says 120 days delinquent, it does not say paid or pays as agreed even though technically they are paid since they were paid off from the consolidation.

Is this correct?

(No one seems to know the answer to this- help!)

Also... many of these have no payment history showing... they say NR in the boxes where you would normally see the 30-60-90 etc.

Should I dispute these with the CRAs or are they correct?

These are killing my scores.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

Loans can destroy you're credit report if you are behind on anything. While you reconsolidated you're debt ( which is a great way out of a stinky situation) you need to get verbal/written communication stating the loan is PAID IN FULL from the company. If they can provide that it is P.I.F then you should dispute the date, and provide evidence that its closed.

Great job!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

If you have lates at some point in the loan that was 120-day lates, then this is correct. Older lates may not show up in the payment history as not all the CMS systems show older than 2 years of payment history. If you have a MyFico subscription under the Older or More Details section, you should see dates listed for delinquencies. I believe you can also see these if you order your yearly reports from annualcreditreport.com.

They will stay for 7 years from the first one in the chain of lates. Probably the best you can do with these now is to try some goodwill letters to get them removed, but I have not heard of many people having much luck with these and student loans. Never hurts to try and you may get lucky.

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

Also, if you had a Forbearance or deferment it reports as blank. Or if they just don't have or want to report for that month. That's fairly common for older payment history. As long as they don't say it's late when it's not.

You could dispute it but I'm not sure you'd get far.

They are however, not allowed to goodwill lates. For federal loans they are required by law to report them accurately. You might just have to wait it out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

Hello!

Thanks OP for creating this thread.

Hope you don;t mind if I also ask about my situation.

My loans show a $0 balance but are not showing as closed.

Last activity is 2013 with several 90 day lates.

I have already disputed, with no luck. There is a statement on report stating that I disagree with the data.

I can dispute this again, but since this would be my 3rd dispute on this item, the CRAs are not obligated to go through the full process to verify.

Given activity dates and above info, am I better off letting this be?

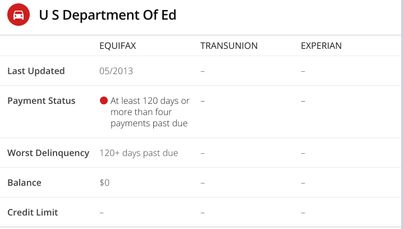

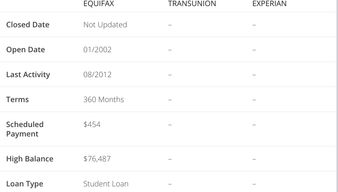

Here is a screenshot of report:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

If you're not sure you paid it off, check the National Student Loan Database, NSLDS, to see where it is now. I can talk you through your options to get it out of default. If you did pay it off, you should be able to get a letter from the servicer that you were dealing with, with the date the loan was satisfied. Then you send that in with your dispute and they'll correct it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

The problem I am having is that their STATUS still shows at least 4 payments delinquent- Shouldnt this be updated to say paid since these loans were PIF in the consolidation?

It looks like the above poster has the same question.... maybe I am not explaining what I am asking clearly.... if you look at the PAY STATUS on the loans... shouldn't this specific area say PAID OR PAYS AS AGREE since the account is PIF due to the consolidation? (As the other poster seems to be having the same issue as me- says 120 late)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

Hi Sabii,

The loan is still in repayment. I do not see that it was ever in default. FSA is showing an RP status.

Great Lakes took over the loan in 2012.

I continued paying as usual but they are saying that during this time, I became 90 days late.

This resulted in 7 months of 90 days lates.

I did not know that I was behind...and I'm still not sure if I ever was.

This could certainly have been my error...but I'm simply not sure.

As best I can tell, something got crossed during the changeover from Dept of Ed to Great Lakes.

I have disputed several times but comes back as legit...and they contimue reporting it as an open loan...although a $0 balance.

One note, Great Lakes is really bad about sending out statements. There are many months that I do not receive them until after the due date has passed. Obviously, I send payments in with or without a statement...

So wondering if there is much more that I can do.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

YES...kathyups. We are in the same boat.

But in my situation, there was no consolidation.

The loan simply changed servicers and something got crossed during the change.

I suppose I could go to my old bank and ask for payment proof...but in my case...not sure if worth it.

Very frustrating!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Are these loans reporting correctly?

It's the other servicers accounts that I am having trouble with... it sucks lol