- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- October 2020 Check In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

October 2020 Check In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

October 2020 Check In Thread

I know you are all hard at work with your credit goals. Have you progressed as far as you hoped? Were there any unforeseen expenses that cropped up and may have thrown you off schedule?

As a reminder, participation in these monthly check-ins is optional but encouraged. The goal is to help keep you on track, so feel free to post your progress updates here. This is a no-judge zone; feel free to say what's keeping you up at night or give yourself a Kudo for having it all together.

Did you hit any potholes or speedbumps? Achieve some milestones, either small or mighty? Change your goals or add new ones?

Let us know how you're doing!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Hello to All, Just checking in![]()

May you harvest your goals!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

I'm feeling really good. My Credit Score is growing. I'm waiting on one CC to update so I can pull the trigger on getting a pre-approval for a home. Hope everyone is doing good this month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

October 2018 I joined myFico. I attained a lot of personal and business credit info, picked up some good tl's and with that a lot of inquiries. Those inquiries will start to age/fall off this month. 6 in Oct and another 10 in the next few months. It'll be interesting to see how the cb's handle the removal of these....on the first Saturday of this month? on the exact date? exact date plus one month? When will they go?

ETA: Good Luck @Anonymous hope you turn the key to your new home soon.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Hard to believe another month has flown by again. I've been continuing to keep my balances low, often paying down once during the statement month, leaving <3% at statement cut, then PIF. Seem to have plateaued some, no huge jumps.

My last 2 credit cards, Discover Secured and BBVA were opened in May & early June, was considering a 2nd NFCU CC, More Rewards, but I know they've tightened their belt so might wait.

Today, I received my first decent credit card offer for a Hilton Honors Amex card with 100,000 bonus points and no annual fee. They have other cards within the offer, Hilton Honors Surpass Card and the Hilton Honors Aspire Card but they both have $95/year fees. Are they worth the ann fee? Not sure if I'm comfortable applying just yet given it's not quite 2 years since my Ch7 filing but nice to see the offer.

In the recent past, I have received a couple $3,000 pre-approval letters but just a 1% Mercury cash back card. Still better than a stick in the eye but passed on their offers.

Either way, I am sure looking forward to hitting the 700's. Will it just take time and patience or should I app for another card? Total CL just over $5k.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

@EverForward wrote:Today, I received my first decent credit card offer for a Hilton Honors Amex card with 100,000 bonus points and no annual fee. They have other cards within the offer, Hilton Honors Surpass Card and the Hilton Honors Aspire Card but they both have $95/year fees. Are they worth the ann fee? Not sure if I'm comfortable applying just yet given it's not quite 2 years since my Ch7 filing but nice to see the offer.

Did the offer have a solid apr? Not an apr range but one apr.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Hi @GApeachy, Just a variable apr, based on prime rate and my creditworthiness, almost seems like a marketing piece however it does have a custom offer code, which I entered. Both the Hilton Honors and the Hilton Surpass cards say Exclusive Offer, whatever that means. It's been so long since I've received the "offers" that I am not sure how to interpret them. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

@EverForward wrote:It's been so long since I've received the "offers" that I am not sure how to interpret them. Thanks!

Idk either, except to look for one apr. You ought to post this offer ? in the credit card forum. Their are a lot of Amex guru's over there who'd gladly help you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Subscribed to myFICO!

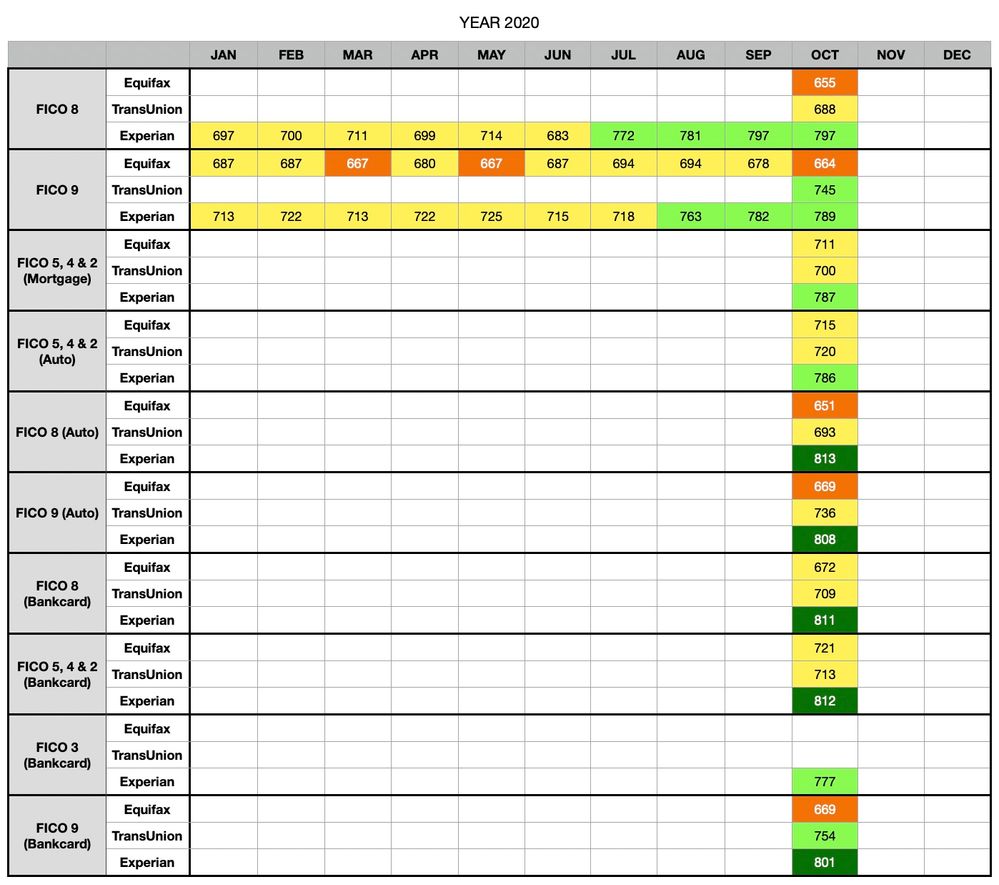

Status from September to October 2020

Experian FICO 8 had no change.

Equifax FICO 9 lost 14 points 👎🏼

Experian FICO 9 gained 7 points 👍🏼

Comparing Experian.com, Wells Fargo, and PenFed's FICO score history to myFICO:

January to October 2020

Experian FICO 8 gained 100 points 👍🏼👍🏼👍🏼

Equifax FICO 9 lost 23 points 👎🏼😭

Experian FICO 9 gained 76 points 👍🏼

Learned about my mortgage, auto, and bankcard scores... Experian is roaring! 😳👍🏼

And, seriously, I need to decipher WTH is making Equifax FICO 9 fluctuate that much!

3 hard inquiries and a baddie should drop in May 2021, and another baddie in Fall 2021.

Also, joined Navy Federal Credit Union today. So, a shares secure loan will be on the works for November, and maybe a secured credit card, to try and help my fitness challenge.

Any and all suggestions are greatly appreciated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Ok @Anonymous , you are late for check in?