- myFICO® Forums

- Welcome to the myFICO® Forums

- Take the myFICO Fitness Challenge!

- October 2020 Check In Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

October 2020 Check In Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

@M_Smart007 wrote:Ok @Anonymous , you are late for check in?

Through me for a loop and then it hit me ... ![]()

For the month of October my credit life should be quiet. The new Chase credit products are available. No score changes on the horizon. Did notice that the Fico Scores other than 8 saw a few points in movement upward. Paying on my credit card BT. No credit seeking at this time.

Hoping all of you are able to achieve your monthly goals and stay on your planned track for credit. Feel free to share with us and let us learn from your efforts. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Hello, my fellow challengers! Missed last month but here's my update as of today!

Scores are based on fico8

Experian 706

Equifax 708

Trans 718

Still gardening

Nfcu cli by 3k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

@Anonymous wrote:Hello, my fellow challengers! Missed last month but here's my update as of today!

Scores are based on fico8

Experian 706

Equifax 708

Trans 718

Still gardening

Nfcu cli by 3k

Congrats on your NFCU CLI!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Time continues to work its magic on my scores. Earlier this month my youngest inquiry hit 365 days. EX and TU gained 3 points, and EQ didn't move. Currently EQ and EX are mid-800s, and TU is lagging at 795. I have been expecting an adjustment when my youngest account hits one year in January, but I need to read through the massive Scoring Primer thread to determine if that's actually a thing on a thick, clean, mature file. Otherwise the next big date is May 2021, when most of my inquiries age off my reports, leaving me at 1 apiece. It won't bring any scoring changes, but psychologically it feels like a fresh start.

Happy October, everyone. I can't quite believe 2021 is right around the corner, but with all the end of year busy-ness, it's coming up fast. Hope you all have a happy, safe, and healthy holiday season.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

@Anonymous wrote:I'm feeling really good. My Credit Score is growing. I'm waiting on one CC to update so I can pull the trigger on getting a pre-approval for a home. Hope everyone is doing good this month.

That's an impressive change I saw in your scores in your signature. I was right around that level as well when I started back at the beginning of the year. May I ask, how did you achieve such a dramatic change? I'm trying to figure out what is the most effective way to get mine over 700. It seems like I've plateaued. If there is something I should be reading on these forums specific to an approach, I'm all ears. I'm brand new here. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

My TU FICO 8 rose three points. My Discover it CC hit 13 months. I decided to try for a CLI. I tried in the very beginning but was shot down and never tried again. I haven't used it very much for months. So I was offered a $300 CLI, for a $1,300 CL now. Something is better than nothing.

I have now hit six months with no new credit cards or apps. I received three new cards in the spring (but only two hard pulls). Six more months, and I will go for my second NFCU CC. My aim is that that will increase my chances to finally get a card with a really nice SL. It felt great hitting the six-month mark "in the garden."

My goal is to get my TU FICO 8 to 670, so that all of my FICO 8 scores will be in the good category.

Green Dot Primor Secured (5/18) - $450 CL (CLOSED 2/2020)

Capital One Platinum (8/18) PC to Quicksilver (9/19) - $3800 CL

Capital One QuicksilverOne (3/19) - $4800 CL

Merrick Bank DYL VISA - No AF (6/19) - $1400 CL

Discover it Cash Back (9/19) - $2800 CL

Amazon Prime Store Card (4/20) - $10,000 CL

NFCU cashRewards (4/20) - $4500 CL

BB&T Spectrum Cash Rewards (5/20) - $3500 CL

Navy Federal More Rewards American Express® Card (3/21) - $9700 SL - at 9.65 %.

Experian FICO Score - 8/2018: 528

Experian FICO 8 Score - 9/2022 - 720

Equifax FICO 8 score 2/2022- 692

TransUnion FICO 8 score 10/2022 - 728

Experian FICO Mortgage Score - 725

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

@EverForward I'm working on getting 7 late payments within 3 yrs removed. My utilization is 6%, I have excellent payment history now, I'm an authorized user on $50k. I just don't have a mix. I need an installment loan. Ughhhh and just got a collection that I'm definitely disputing. Any suggestions?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Hi @Anonymous,

I'm not sure if I'll have the best answer for you, but I started with the Self loan program as they don't pull credit. I have the $25/mo x 24 months.

After I joined the forum, I learned SSL loans are likely better but then you have to qualify for them, likely with a HP. I am almost a year through my Self term, been pleased with the Self site overall.

I may app for a SSL with NFCU early next year, depending on my available savings.

Hope this helps!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

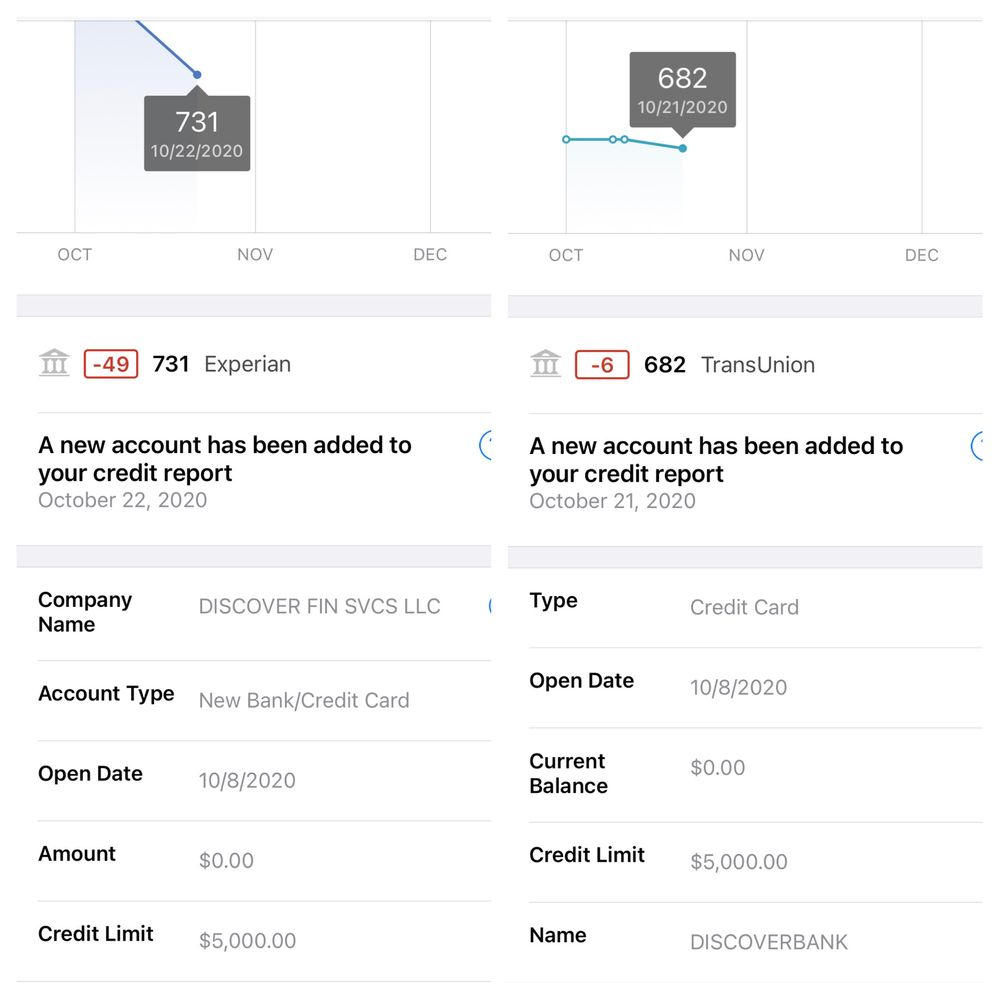

Well, well, well... I guess that when you excercise for the first time in quite some time, your body aches...

Well, I excercised my credit, and... yup! It's started to hurt. No update yet on EQ.

But... "No pain, No gain!"

I expect a good gain from having a thin file with only 2 CC on my own, plus 3 AU CC, onto 2 new CC, an SSL, and $25k in CL ceiling increase!

Only the new Disco acct is showing up there (but Disco's HP ate 17 pts out of EX a few of days earlier). Also, the Card should come along, as well as the HP for the denied Amex app. So, still a little more hurting before I see some improvement.

Ouch! 😬

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: October 2020 Check In Thread

Ohh... and I need to update my signature with the new scores. Maybe tomorrow. The acceptance of the fall!

¯\_(ツ)_/¯