- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Account Aging Metrics / Utilization spreadshee...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Account Aging Metrics / Utilization spreadsheet

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Account Aging Metrics / Utilization spreadsheet

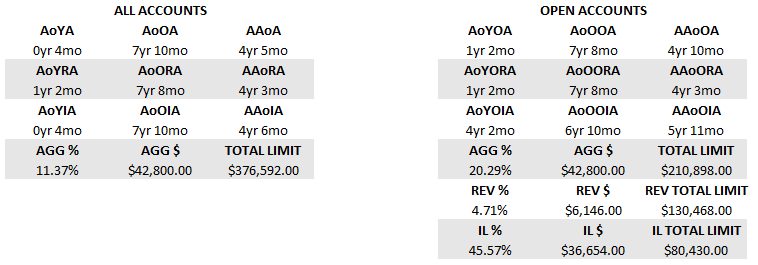

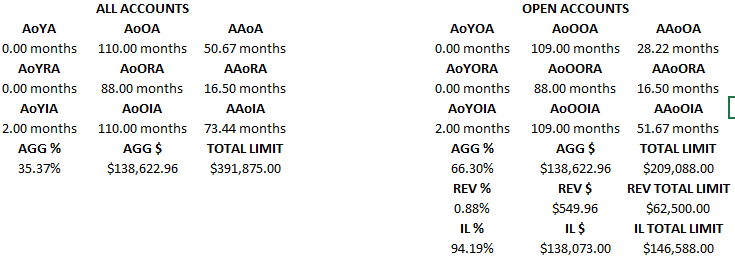

Just sharing this to maybe help some people that are wondering what their AAoA or AoYRA is or is going to be. I think I covered the big ones and also shows utilization split based on revolver and installment loans - this is one I was trying to better understand myself for scoring purposes (ie my installment loans went from 85% to 94% and that's the reason my score dropped - not just because I closed the original account).

With that in mind, the ages are based on how we understand the scoring algo sees them. That means it is dated back to the first of whatever month it was issued/opened in. 9/23 is the same as 9/1. As soon as it rolls to the next month, it counts as one month old. I also left the column for "Real Months Since Open" just to show how they compare, but it isn't used for the calculations.

The above is a screenshot for mine, each of the acronyms above gets a "tooltip" in Excel that shows what it means for those of that don't remember every acronym all the time.

Notes:

- Formulas are all set for data in rows 18 to 200, beyond that you'll have to either alter formulas or insert rows in between yourself.

- "As of date" at the top needs to be the same or later than any of the account open dates

- Closed accounts are shown striken through, you can turn that off under conditional formatting but I like it

I'm not perfect and may be overlooking something, but I think the calculations are right based on what I've read in @Anonymous 's wonderful General Scoring Primer Master Thread. Also credit to @Anonymous for the table idea.

Updated with new link because I killed the old versions. If you used one of those, any of the data rows can be copied right over to the new one. This should work on all versions of Excel (at least semi recent ones, that aren't the brand new one).

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

@ccquest wrote:

Just sharing this to maybe help some people that are wondering what their AAoA or AoYRA is or is going to be. I think I covered the big ones and also shows utilization split based on revolver and installment loans - this is one I was trying to better understand myself for scoring purposes (ie my installment loans went from 85% to 94% and that's the reason my score dropped - not just because I closed the original account).

With that in mind, the ages are based on how we understand the scoring algo sees them. That means it is dated back to the first of whatever month it was issued/opened in. 9/23 is the same as 9/1. As soon as it rolls to the next month, it counts as one month old. I also left the column for "Real Months Since Open" just to show how they compare, but it isn't used for the calculations.

The above is a screenshot for mine, each of the acronyms above gets a "tooltip" in Excel that shows what it means for those of that don't remember every acronym all the time.

Notes:

- Formulas are all set for data in rows 18 to 100, beyond that you'll have to either alter formulas or insert rows in between yourself.

- "As of date" at the top needs to be the same or later than any of the account open dates

- Age Unit for the calculations can show months or years, just use the dropdown to swap between them

- Closed accounts are shown striken through, you can turn that off under conditional formatting but I like it

I'm not perfect and may be overlooking something, but I think the calculations are right based on what I've read in @Anonymous 's wonderful General Scoring Primer Master Thread. Also credit to @Anonymous for the table idea.

@ccquest wow cool! I can't wait to check it out!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

Revised spreadsheet for those that don't have Office 365 / 2019. This one uses IF instead of SWITCH.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

@ccquest I’m getting some errors in that second one

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

@Anonymous wrote:@ccquest I’m getting some errors in that second one

Hmmm, what sort of errors/where?

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

@Anonymous what are you using to edit? I'm not seeing any on Excel, Google Drive, or Numbers on my Macbook. Numbers doesn't update any of the calculations at the top because it doesn't support the function though.

edit » just tried it on Excel on the Macbook and noticed it's throwing some other stuff at the front on some of them (MINIF, MAXIF) but I don't have a subscription and apparently they've basically blocked my old key so can't really do any testing on there to help you out if that's what you're using. If you can, try Google Sheets instead, sorry.

as of 1/1/23

as of 1/1/23Current Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Account Aging Metrics / Utilization spreadsheet

I noticed an anomaly, the first row of calculations under all accounts works in the second file but not in the first

@ccquest Microsoft office professional+ 2016