- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Aging period and how Fico reacts

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Aging period and how Fico reacts

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@AzCreditGuy wrote:

@Anonymous wrote:

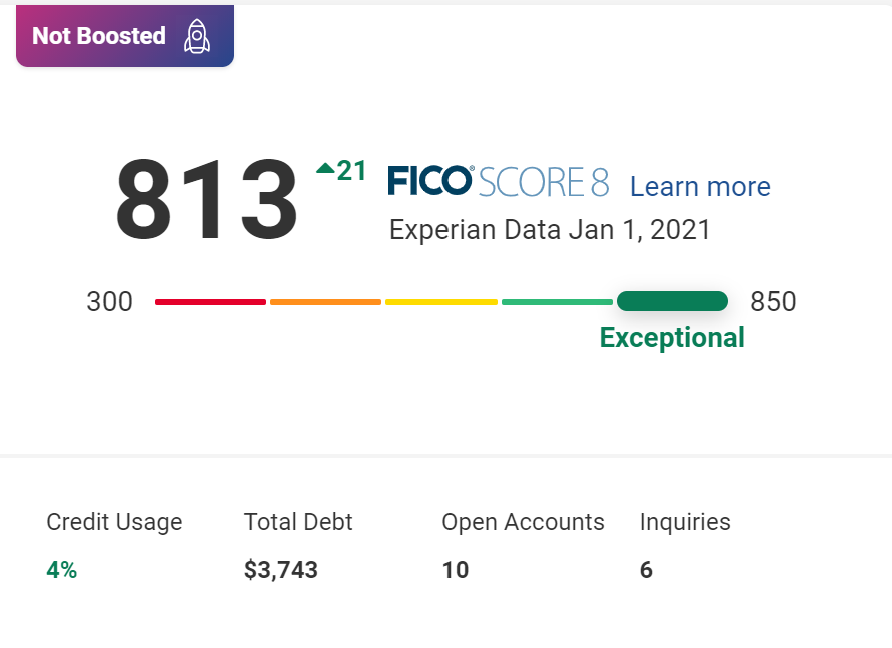

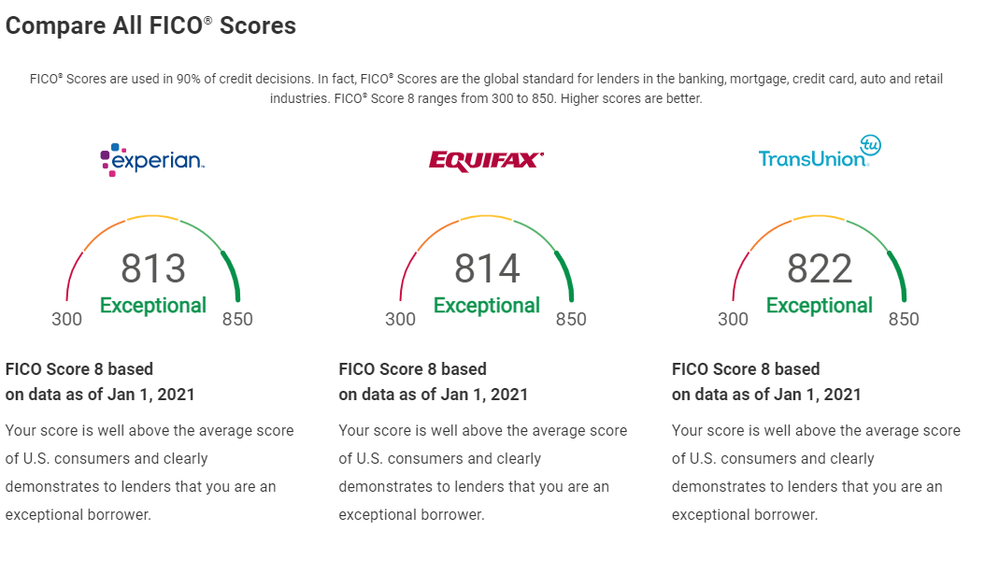

@AzCreditGuy wrote:@Anonymous Seems you were right I did get a huge bump from aging, once I hit the 6 year mark on my oldest card I got over 800. Personal loan still hasnt updated to below 8% UTI and some other card info as well...

@AzCreditGuy So when your oldest revolver hit six years, you got 21 points?

@Anonymous I got a huge bump from all the 3 big EX +21 EQ +37 TU +36, Personal loan has not posted at 8% and 2 credit cards have been paid off(not showing) Changes would be 2 cards showing $0 balances as opposed to all being used and the credit history changing

@AzCreditGuy This is awesome. We've been looking for a data points like this. But you say between the last pull and this pull, two cards reported zero balances, correct? Can you tell me your total number of open accounts?

And since your oldest account is a six-year-old Card you are in a clean/?/mature/no new account scorecard.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@Anonymous

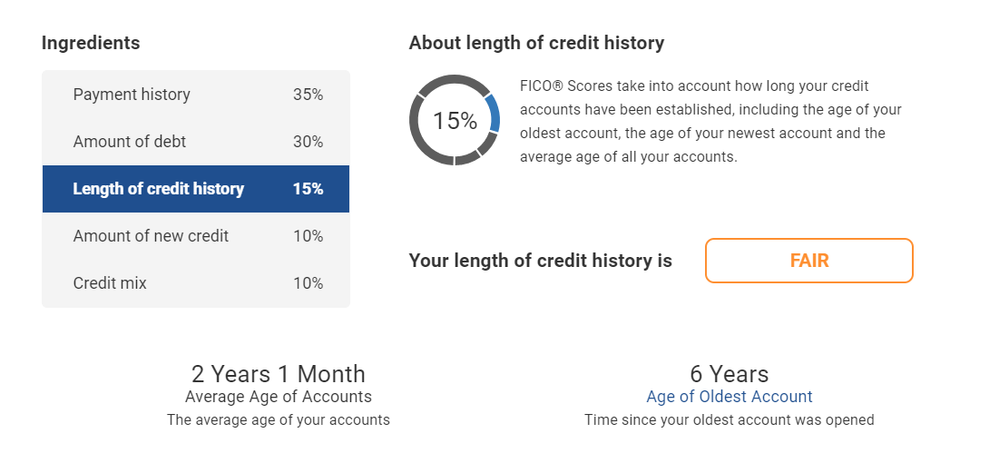

I have been in the garden since Aug 2019, clean new credit profile.

I have 9 CCs on my profile

1 Cap 1 opened in 2015

6 of those opened in June/July 2019

2 are AU cards opened in 2003 and 2007

And I have 1 sofi personal loan opened in July 2019 for $12,500 but the balance is now is $1,057 which has not been refllected on my reports as the balance showing is $1,145

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

I should also note that I will be doing a BT on a card that is paid down to zero for $949 applied to Sofi loan, so I can get it down to $75 and re-amortize the loan for the smaller amount and pay it off before I apply for a mortgage, which will be 5 to 8 months from now. ( reason to keep it is to show I am paying down the loan)

I hoping my plan doesn't change my scores that much and keeps me around 800, since the card will show a balance on it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@AzCreditGuy wrote:I should also note that I will be doing a BT on a card that is paid down to zero for $949 applied to Sofi loan, so I can get it down to $75 and re-amortize the loan for the smaller amount and pay it off before I apply for a mortgage, which will be 5 to 8 months from now. ( reason to keep it is to show I am paying down the loan)

I hoping my plan doesn't change my scores that much and keeps me around 800, since the card will show a balance on it.

@AzCreditGuy considering you have 10 accounts, one more account with a balance is probably not gonna make a difference, unless you're on a threshold.

As for scores, I don't think I'd worry about it because when you pay off the loan that will lower the number of accounts with a balance and plus I'm sure you'll be paying that credit card off too, which will further reduce number of accounts with a balance. So you'll be able to maximize your scores when you get ready.

if you're getting ready for a mortgage then you're trying to maximize those scores, so having more zero accounts is more important and debt is counted less against you while it is a loan rather than revolving. So while it's OK to do the BT for now, just have the card paid off when you're ready for the mortgage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@AzCreditGuy wrote:@Anonymous

I have been in the garden since Aug 2019, clean new credit profile.

I have 9 CCs on my profile

1 Cap 1 opened in 2015

6 of those opened in June/July 2019

2 are AU cards opened in 2003 and 2007

And I have 1 sofi personal loan opened in July 2019 for $12,500 but the balance is now is $1,057 which has not been refllected on my reports as the balance showing is $1,145

@AzCreditGuy sounds like you've got a pretty nice mix for your profile! You got everything you need to have great scores, just need to let time pass and watch them increase!

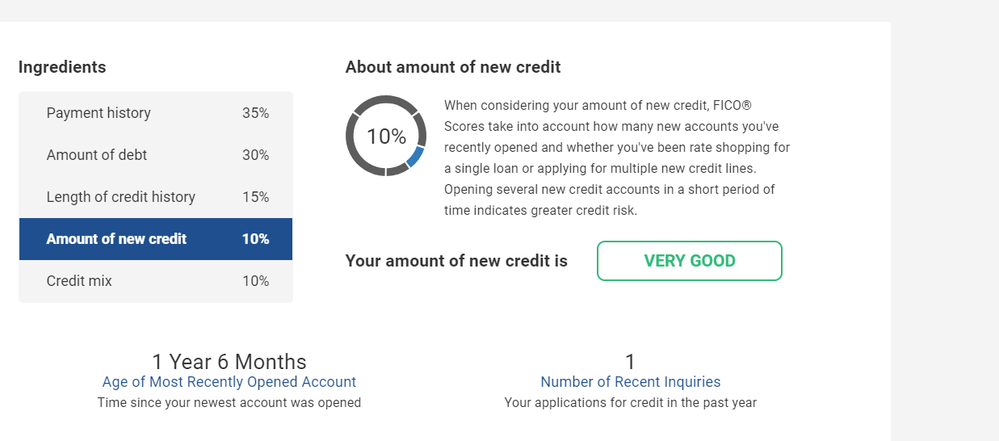

I do have a question you may be able to help me with. We are trying to find a new account threshold for the mortgage Scores. It's 12 months for version 8 and 9, but we don't know what it is for 5/4/2.

Can you please check your negative reason codes for those three scores and see if you have new account listed still, as we are trying to find out how many months after the youngest Revolver that disappears. I am at 13 months and still have the code on all three mortgage scores.

and now that you given me more profile details, I can tell you exactly which scorecard you're in: clean/thick/mature/no new account!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@Anonymous I dont use myFico for scores, using Experian only.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@AzCreditGuy wrote:@Anonymous I dont use myFico for scores, using Experian only.

@AzCreditGuy that's cool, give me the negative Reason Codes for Score 2, please.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@Anonymous Thnaks again for the score card info

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@AzCreditGuy wrote:@Anonymous Thnaks again for the score card info

@AzCreditGuy somehow I missed this thank you very much. So we know the code is gone by 17 months AOYRA. So it's somewhere between 14 and 16 months, I believe.

Do you have past months' access? If you do, and you feel like checking, it should be either October or November or December. September may have been the last month you had the code, if not it was somewhere before December.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Aging period and how Fico reacts

@Anonymous I had the code until Dec 31st? And once Jan 1st hit, the too many new accounts went away