- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Anticipated Score Jump from large drop in util...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Anticipated Score Jump from large drop in utilization?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Anticipated Score Jump from large drop in utilization?

Hello everyone! I'm new to these boards, although I've been actively in the Credit Repair game for about 4 years.

Long story short, my goal is to get my scores high enough that I can be included on our mortgage with my husband, without dragging down his 800+ scores and low rate qualification (he is already preapproved). I need it to happen quickly because we have an offer out for a house now, and if that one doesn't work out we anticipate trying again within the next 30 days.

My current FICO 8 scores are: EQ 714 - TU 731 - EX 735

My reports are all pretty great now, the only "negative" being that I have a released State Tax Lien filed in 2014, that won't be coming off for another 7 years.

I have a total of 8 revolving accounts reporting (2 are AUs), 3 retail accounts, and 1 installment account. Of the 5 accounts reporting a balance, utilization is overall low at 9%:

BofA - 15%

CapOne - 3% (usually 0 but annual fee cycled which caused my scores to drop ![]() )

)

CareCredit - 35%

Chase RR - 17%

Citi AA - 9% (AU)

I made a payment earlier this week to CareCredit which dropped utilization from 58>35%; it was supposed to be 29% but they screwed up the amount. They pushed the balance to the CBs and it caused TU to go up 8pts and EX to go up 10 pts.

When my accounts cycle end of next week, BofA and CapOne will drop to 0%, and Care Credit will drop to 9%. My question is...in your expert experience, do you think this will be a sufficient enough change to bump my TU/EX 10 more points?

I know this could be irrelevant because our lender doesn't use FICO 8, but I don't want to pull all score versions until those accounts cycle. I'm just wondering if this is all futile in the first place.

Thank you for any input!

CURRENT FICO-9 - EQ 743 / TU 744 / EX 740

GOAL - EQ 760 / TU 760 / EX 760

FAKOS - EQ 774 / TU 770 / EX 764

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

@SoCalPrincess wrote:Hello everyone! I'm new to these boards, although I've been actively in the Credit Repair game for about 4 years.

Long story short, my goal is to get my scores high enough that I can be included on our mortgage with my husband, without dragging down his 800+ scores and low rate qualification (he is already preapproved). I need it to happen quickly because we have an offer out for a house now, and if that one doesn't work out we anticipate trying again within the next 30 days.

My current FICO 8 scores are: EQ 714 - TU 731 - EX 735

My reports are all pretty great now, the only "negative" being that I have a released State Tax Lien filed in 2014, that won't be coming off for another 7 years.

I have a total of 8 revolving accounts reporting (2 are AUs), 3 retail accounts, and 1 installment account. Of the 5 accounts reporting a balance, utilization is overall low at 9%:

BofA - 15%

CapOne - 3% (usually 0 but annual fee cycled which caused my scores to drop

)

CareCredit - 35%

Chase RR - 17%

Citi AA - 9% (AU)

I made a payment earlier this week to CareCredit which dropped utilization from 58>35%; it was supposed to be 29% but they screwed up the amount. They pushed the balance to the CBs and it caused TU to go up 8pts and EX to go up 10 pts.

When my accounts cycle end of next week, BofA and CapOne will drop to 0%, and Care Credit will drop to 9%. My question is...in your expert experience, do you think this will be a sufficient enough change to bump my TU/EX 10 more points?

I know this could be irrelevant because our lender doesn't use FICO 8, but I don't want to pull all score versions until those accounts cycle. I'm just wondering if this is all futile in the first place.

Thank you for any input!

It very well might be enough to get a 10 point bump.

(BTW if I were you I'd send letters, either on your own or through an agency that sends out letters, asking for verification of the tax lien; sometimes they don't respond, and the item gets bumped)

Total revolving limits 569520 (505320 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

I agree with SJ. Possible 10 point bump. Certainly not futile to hope for, but by no means likely/certain.

It would be a little easier to judge if I could tell your total number of open revolving accounts. You write:

I have a total of 8 revolving accounts reporting (2 are AUs), 3 retail accounts, and 1 installment account.

The way you wrote that, it seems to be describing distinct things:

8 Revolving accounts

+ 3 retail accounts

+ an installment loan

Or it could mean: 8 revolving accounts (three of which are retail, five of which are major cards).

This is relevant because the significant action you are engaging in is turning some of the cards with a positive balance into $0 balances. When guessing how that might impact your score it is helpful to know the total number of revolving accounts.

It sounds like you are also lowering your total revolving utilization. If your total was just a tiny bit higher than 9% (e.g. 9.05%) then that would have been rounded by FICO up to 10%. So knowing exactly what your previous total util was and what it will be now would be helpful.

It's also possible that you might get help from a particular card going from > 30% to < 29% (the CareCredit account). Personally I am skeptical that indivdual utilization matters at all as long as a card is under 49%, but I suppose it might.

Ultimately this is academic because you have taken the proposed action already and you'll get the best answer in ten days from the mother of certainty (experience).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

@Anonymous wrote:I agree with SJ. Possible 10 point bump. Certainly not futile to hope for, but by no means likely/certain.

It would be a little easier to judge if I could tell your total number of open revolving accounts. You write:

I have a total of 8 revolving accounts reporting (2 are AUs), 3 retail accounts, and 1 installment account.

The way you wrote that, it seems to be describing distinct things:

8 Revolving accounts

+ 3 retail accounts

+ an installment loan

Or it could mean: 8 revolving accounts (three of which are retail, five of which are major cards).

This is relevant because the significant action you are engaging in is turning some of the cards with a positive balance into $0 balances. When guessing how that might impact your score it is helpful to know the total number of revolving accounts.

It sounds like you are also lowering your total revolving utilization. If your total was just a tiny bit higher than 9% (e.g. 9.05%) then that would have been rounded by FICO up to 10%. So knowing exactly what your previous total util was and what it will be now would be helpful.

It's also possible that you might get help from a particular card going from > 30% to < 29% (the CareCredit account). Personally I am skeptical that indivdual utilization matters at all as long as a card is under 49%, but I suppose it might.

Ultimately this is academic because you have taken the proposed action already and you'll get the best answer in ten days from the mother of certainty (experience).

Thanks for the input! To answer your questions, your initial interpretation was correct: 8 major cards, and also 3 retails which includes Care Credit. The other two are zero balance.

My total revolving utilization (including AUs) is currently 8.91%. After the updates it will be somewhere between 6.21% and 7.77% (range only b/c I don't know what hubs card will report exactly and it reports a few days after)...

CURRENT FICO-9 - EQ 743 / TU 744 / EX 740

GOAL - EQ 760 / TU 760 / EX 760

FAKOS - EQ 774 / TU 770 / EX 764

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

Thanks!

So it sounds like you are going from 5 out of 11 showing a positive balance to 3 out out of 11. That's going from 45% of your revolving tradelines to 27%. If there is a breakpoint at 33%, then you will get some extra points. But if the breakpoints for your scorecard are at 25% and 50% then you'd get no extra points. (Another confounder is the fact that two of the 11 cards are AUs, which might also be treated by FICO a bit differently -- I can't be sure.)

Some people have reported score changes that they think could be related to going from a util of 8.9% to (say) 6.5%. But there's not been a lot of confirming hard evidence from other people. The generally accepted wisdom is that no one should count on getting any additional scoring benefit once he/she gets down to 8.9%. (Again, the fact that some of your cards are AUs might mean that lowering further will get you some points.)

If you could create one more $0 balance you might get some benefit, but it sounds like you don't have any available money for that.

You mention that your report has one installment account on it. If it is a closed account, then it's easy to suggest a method that will get you many extra points, though not in the tight timeframe you mention. If it is an open account, then there is nothing that can be done.

Best of luck....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

@Anonymous wrote:If your total was just a tiny bit higher than 9% (e.g. 9.05%) then that would have been rounded by FICO up to 10%.

Wow, is this correct? I'm pretty new to the scoring 'game', but I had (apparently incoreectly!) assumed that it would be mathematically rounded.

Useful to know. Just made my payments for this month and am at 10.4 percent. Had reckoned if I paid another 1 percent of total credit line as my next payment, I would be rounded to 9 percent. So, very useful to know I will need to throw in another half percent to be sure.

Thanks for the info

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

@Anonymous wrote:

@Anonymous wrote:If your total was just a tiny bit higher than 9% (e.g. 9.05%) then that would have been rounded by FICO up to 10%.

Wow, is this correct? I'm pretty new to the scoring 'game', but I had (apparently incoreectly!) assumed that it would be mathematically rounded.

Useful to know. Just made my payments for this month and am at 10.4 percent. Had reckoned if I paid another 1 percent of total credit line as my next payment, I would be rounded to 9 percent. So, very useful to know I will need to throw in another half percent to be sure.

Thanks for the info

Yep. FICO rounds up. This is why a person could have four $1000 credit limit cards, with a total CL of $4000; three cards at $0; and one card at $40.

His utilization is 0.1%, but that is rounded up to 1%. (Rather than being rounded down to 0%.) Because FICO always rounds up.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

It's pretty touch to gauge credit scores gains/losses from utilization changes as they vary greatly from profile to profile. I dropped utilization significantly from 30-something % down to 6% and while estimates on this forum ranged from 5-20 point gains estimated I gained at best 2-3 points across all bureaus. My file is pretty thick overall, so I think this held back my gains... but just pointing out that while one may gain a substantial amount another may gain a minimial amount for the same profile change.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

@Anonymous wrote:Thanks!

So it sounds like you are going from 5 out of 11 showing a positive balance to 3 out out of 11. That's going from 45% of your revolving tradelines to 27%. If there is a breakpoint at 33%, then you will get some extra points. But if the breakpoints for your scorecard are at 25% and 50% then you'd get no extra points. (Another confounder is the fact that two of the 11 cards are AUs, which might also be treated by FICO a bit differently -- I can't be sure.)

Some people have reported score changes that they think could be related to going from a util of 8.9% to (say) 6.5%. But there's not been a lot of confirming hard evidence from other people. The generally accepted wisdom is that no one should count on getting any additional scoring benefit once he/she gets down to 8.9%. (Again, the fact that some of your cards are AUs might mean that lowering further will get you some points.)

If you could create one more $0 balance you might get some benefit, but it sounds like you don't have any available money for that.

You mention that your report has one installment account on it. If it is a closed account, then it's easy to suggest a method that will get you many extra points, though not in the tight timeframe you mention. If it is an open account, then there is nothing that can be done.

Best of luck....

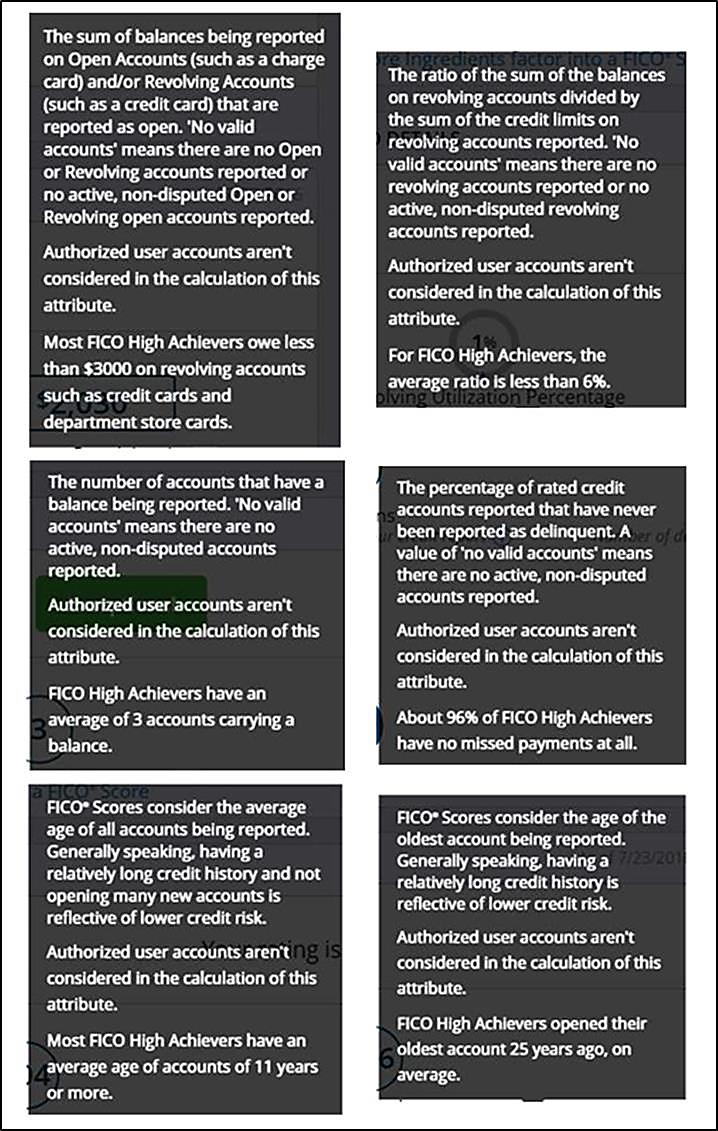

CGID - Below is a summary of what I have experienced for AU and NPSL charge card accounts followed by a listing of statements direct from Fico.

| Credit scoring | AU cards part | AU cards | AU cards part of | NPSL Charge cards | NPSL Charge cards | Charge cards part |

| Scoring | of Ag UT% | considered | open accounts with | part of Ag UT% | looked at | of open accounts |

| Model name | Calculation | for card UT% | balance count | calculation | for B/HB UT % | with balance count |

| Fico 09 | NO | NO | NO | NO | NO | YES |

| Fico 08 | NO | NO | NO | NO | NO | YES |

| Fico 04 | YES | YES | YES | NO | NO | YES |

| Fico 98 | YES | YES | YES | Not Sure | YES | YES |

| VS 3.0 | YES | YES | YES | NO | NO | Not Sure |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Anticipated Score Jump from large drop in utilization?

@SouthJamaica wrote:It very well might be enough to get a 10 point bump.

(BTW if I were you I'd send letters, either on your own or through an agency that sends out letters, asking for verification of the tax lien; sometimes they don't respond, and the item gets bumped)

Is it definitely still always more advantageous to dispute via CMRRR vs. online now? I know I disputed some other accounts about 2 years ago online, and they were removed without an issue. But I'm pretty sure the courts are used to getting disputes for judgments all the time so I'm wondering if it's more likely to get missed in the shuffle of paperwork vs. a ding on their computer screens.

And btw, the second Care Credit payment was reported, but no change in the scores. Boo. I guess we'll see if the other account going to zero on the 29th makes a difference.

CURRENT FICO-9 - EQ 743 / TU 744 / EX 740

GOAL - EQ 760 / TU 760 / EX 760

FAKOS - EQ 774 / TU 770 / EX 764