- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO AMA Discussion Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO AMA Discussion Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

Not to sound ungrateful for all the answers we were given, but I think most of the answers were fairly ambiguous, and intentionally so.

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:@Anonymous wrote: "...I have always disagreed on regarding the penalties imposed from AZ or paying off a lone loan. I feel I've always sort of been in the minority that those penalties don't bother me and with the absence of TD use I can see their merit in terms of risk assessment."

I can also see their merit. And keep in mind as they said, if there’s no debt ($0 balances), they can’t evaluate your management of it:

“Elizabeth Warren, Senior Product Manager at myFICO: The FICO® Score measures how well you manage your debt. If you don’t have any debt, the algorithm doesn’t have any data about how well you manage your debt. Think of it like being a fast runner. You may be a very fast runner but if you’ve never run any races it would be hard for anyone else to know that you are a fast runner.”

That will change with trended data.

Yes but with all due respect the logic behind Ms. Warren's statement does not stand up to scrutiny. In none of our reports is there any indication that we've "never run any races". On the contrary, the evidence is there that we've run many races. And the evidence is there as to how well we performed in each of them.

Our credit reports detail many many years of credit management history. We've run plenty of races. And every installment loan that's been paid down to zero on a timely basis, and every revolving account which has been paid down to zero on a timely basis, is a race well run.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:

@SouthJamaica wrote:The key takeaways for me were:

1. balances expressed in raw dollars are a factor, but weighted less heavily than balances expressed as a percentage

Yes, that is what they said and I believe it as stated, but why is it that I don't experience much (+3 max under 5% only) of any score change in the entire (0, 9]% range while you do at each 1% step? I just don't have that much excitement down here on this already highly-sensitive, young credit file scorecard.

I'm open to the possibility that it's more than just the very large difference in our actual aggregate balance amount being reported. It could be scorecard related based on aging of revolving history/oldest account.

I'm going to be on the lookout for someone with your length of history and much lower total credit limit that doesn't see much of a score change in that interval.

Trust me. You don't want the excitement.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@jdbkiang wrote:Not to sound ungrateful for all the answers we were given, but I think most of the answers were fairly ambiguous, and intentionally so.

To someone with very limited to no knowledge of all things FICO then it might appear that way. But for most folks here especially the regular ones, then every bit of ambiguity can be decoded and deciphered by known and well accepted DPs to arrive at a certain scientific assumption to the very least.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@JR_TX wrote:

@jdbkiang wrote:Not to sound ungrateful for all the answers we were given, but I think most of the answers were fairly ambiguous, and intentionally so.

To someone with very limited to no knowledge of all things FICO then it might appear that way. But for most folks here especially the regular ones, then every bit of ambiguity can be decoded and deciphered by known and well accepted DPs to arrive at a certain scientific assumption to the very least.

... or perhaps pseudo scientific assumption ![]()

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@JR_TX wrote:

@jdbkiang wrote:Not to sound ungrateful for all the answers we were given, but I think most of the answers were fairly ambiguous, and intentionally so.

To someone with very limited to no knowledge of all things FICO then it might appear that way. But for most folks here especially the regular ones, then every bit of ambiguity can be decoded and deciphered by known and well accepted DPs to arrive at a certain scientific assumption to the very least.

IMHO, I doubt that, but we did have some theories/concepts confirmed and some debunked. We are grateful for that. (And of course, the easy questions were answered.) For example, the known and well accepted utilization thresholds from long before I joined were debunked And revolving balances were confirmed as a scoring factor.

8.99% is incorrect. Looks as if the thresholds are 10, 30, 50, 70, 90 and 100% with typical rounding, meaning 9.4%, 29.4%, etc... to remain under the thresholds.

But these guys have proprietary secrets to keep, I understand that. I just dont think the name was chosen appropriately. IMHO, "Q and A with FICO experts" would've been more appropriate due to their limitations. But we are very grateful for what we did learn.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:

@JR_TX wrote:

@jdbkiang wrote:Not to sound ungrateful for all the answers we were given, but I think most of the answers were fairly ambiguous, and intentionally so.

To someone with very limited to no knowledge of all things FICO then it might appear that way. But for most folks here especially the regular ones, then every bit of ambiguity can be decoded and deciphered by known and well accepted DPs to arrive at a certain scientific assumption to the very least.

IMHO, I doubt that, but we did have some theories/concepts confirmed and some debunked. We are grateful for that. (And of course, the easy questions were answered.) For example, the known and well accepted utilization thresholds from long before I joined were debunked And revolving balances were confirmed as a scoring factor.

8.99% is incorrect. Looks as if the thresholds are 10, 30, 50, 70, 90 and 100% with typical rounding, meaning 9.4%, 29.4%, etc... to remain under the thresholds.

But these guys have proprietary secrets to keep, I understand that. I just dont think the name was chosen appropriately. IMHO, "Q and A with FICO experts" would've been more appropriate due to their limitations. But we are very grateful for what we did learn.

I didn't see any discussion of those thresholds, so I would be wary of stating that the Q&A session confirmed some kind of thresholds.

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@SouthJamaica wrote:

@Anonymous wrote:

@JR_TX wrote:

@jdbkiang wrote:Not to sound ungrateful for all the answers we were given, but I think most of the answers were fairly ambiguous, and intentionally so.

To someone with very limited to no knowledge of all things FICO then it might appear that way. But for most folks here especially the regular ones, then every bit of ambiguity can be decoded and deciphered by known and well accepted DPs to arrive at a certain scientific assumption to the very least.

IMHO, I doubt that, but we did have some theories/concepts confirmed and some debunked. We are grateful for that. (And of course, the easy questions were answered.) For example, the known and well accepted utilization thresholds from long before I joined were debunked And revolving balances were confirmed as a scoring factor.

8.99% is incorrect. Looks as if the thresholds are 10, 30, 50, 70, 90 and 100% with typical rounding, meaning 9.4%, 29.4%, etc... to remain under the thresholds.

But these guys have proprietary secrets to keep, I understand that. I just dont think the name was chosen appropriately. IMHO, "Q and A with FICO experts" would've been more appropriate due to their limitations. But we are very grateful for what we did learn.

I didn't see any discussion of those thresholds, so I would be wary of stating that the Q&A session confirmed some kind of thresholds.

@SouthJamaica Don't misunderstand, I said it confirmed revolving balances as a scoring factor; it debunked existing known and well accepted thresholds. (Kudos to you for questioning that existing known and well accepted knowledge.)

We do however have official clarification on rounding that establishes 8.99% is incorrect as the highest percentage before crossing into the next interval. Speaking of which, it also confirmed utilization is in ranges or intervals.

Notice my language: I said "Looks as if the thresholds are 10, 30, 50, 70, 90 and 100% with typical rounding." I never said those thresholds were confirmed, but if 8.99% worked, 9.4% seems to be the highest percentage before crossing into the next interval.

Confirmation on some things helps us to extrapolate and form new theories on related matters.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@SouthJamaica wrote:

@Anonymous wrote:IMHO, I doubt that, but we did have some theories/concepts confirmed and some debunked. We are grateful for that. (And of course, the easy questions were answered.) For example, the known and well accepted utilization thresholds from long before I joined were debunked And revolving balances were confirmed as a scoring factor.

8.99% is incorrect. Looks as if the thresholds are 10, 30, 50, 70, 90 and 100% with typical rounding, meaning 9.4%, 29.4%, etc... to remain under the thresholds.

But these guys have proprietary secrets to keep, I understand that. I just dont think the name was chosen appropriately. IMHO, "Q and A with FICO experts" would've been more appropriate due to their limitations. But we are very grateful for what we did learn.

I didn't see any discussion of those thresholds, so I would be wary of stating that the Q&A session confirmed some kind of thresholds.

Just jumping in for a bit before I return to regularly scheduled deprogramming.....but I'm changing my aggregate utilization chart to use these thresholds from the FICO Score Estimator (not simulator) until something better comes along. They certainly won't hurt anyone that uses them.

Maybe it's even more granular, with a few 5% steps? I certainly have a 5% threshold between 0 and 9 on my thin(guessing)/young/[recent & non-recent account] scorecards.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

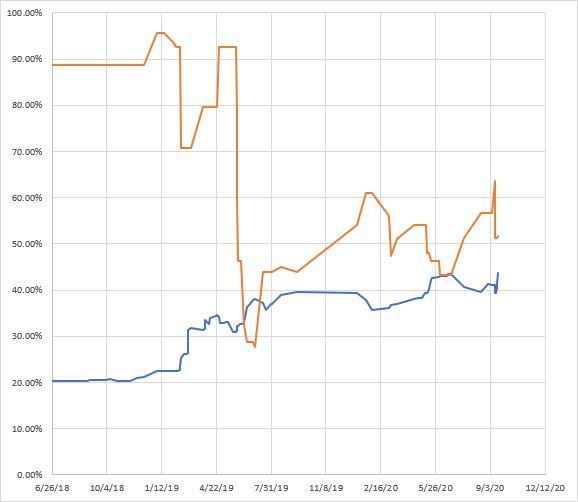

Since there's discussion about how util% affects scores, and to what extent, I've put together this datapoint as an example. Here's a chart showing my util% (orange) compared to my score (average of 5 different scoring models * 3 bureaus each, expressed as percentile ranking) over the last 2 years or so:

Of course, over those 2 years there were a lot of changes besides just my util%, but it's pretty clear to see that util% and score were pretty tightly correlated. Thought some of you might be interested to see how util% played out, at least for me, in the real world.

Total SL: $78k

Total SL: $78kUnited 1K - 725,000 lifetime flight miles | Chase Status: 4/24