- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- FICO AMA Discussion Thread

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO AMA Discussion Thread

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Credit12Fico wrote:

@Anonymous wrote:

I can also see their merit. And keep in mind as they said, if there’s no debt ($0 balances), they can’t evaluate your management of it:

“Elizabeth Warren, Senior Product Manager at myFICO: The FICO® Score measures how well you manage your debt. If you don’t have any debt, the algorithm doesn’t have any data about how well you manage your debt. Think of it like being a fast runner. You may be a very fast runner but if you’ve never run any races it would be hard for anyone else to know that you are a fast runner.”

That will change with trended data.Very interesting. While I think trended data will benefit those who happen to cary All zero once in a while, it will potentially harm those who for innocent reasons, had high statement balances post in the last year.

Actually that's the whole point of it, so you're not penalized if you have a spike at the same time every year or in patterns. It's looking for a trend upwards to penalize and it's only +\- 20 points, so it's not like it's gonna kill you, unless you're just on the edge.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

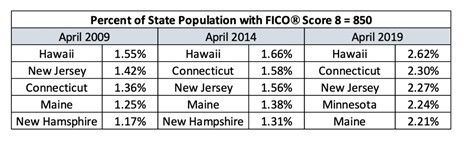

Fico 8 score inflation. Top scores have ballooned in the last 5 years.

Elimination of derogs due to liens and increases in early removal of lates has helped.

- chart from the 850 blog link.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Credit12Fico wrote:Seems the opportunity is lost on this one but:

1) Why the need for secrecy in the scoring algorithms? Is it because the predictive nature of the Fico models is influenced by whether or not the credit user knows how to "game the system" for the best score? Would knowledge of the algorithms mean that more credit risky consumers could create the illusion of a low risk profile? Is that even possible? You cannot fake account age. Debt is debt, and moving it around to different cards does nothing for reducing the balance. Inquiries are inquiries and you can't credit seek without inquiries. What am I missing?

Is it just "proprietary" because otherwise the banks would not pay for it? I can see that angle. FICO adds value in data mining that banks wouldn't be privy to given they can only mine the data of their own customers.

Pretty much for all those reasons and more

And yes... you can hide/shift debt using business accounts, most of which rely on personal credit for approvals. PL for debt consolidation consistently boosts scores, etc.

Fake age with AUs

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:Totally agreed, with the caveat that I believe there are 2 scoring factors, or as they call them, characteristics; there may be 4: #of revolvers w/ a bal, # of accts, w/ a bal, % of revolvers w/ a balance , and % of accounts with a balance. Seems # is more prevalent in thin or young files whereas % trumps in thick or mature files.

Characteristics is the correct term used by data scientists, and you used it perfectly here. It's a very common part of the vocabulary used when discussing various methods of regression analysis. Current FICO scoring models use one of those regression methods.

Tom Quinn: Within FICO Scores there are characteristics that look at balances and at utilization ratios. Generally speaking, the data shows that utilization information is more predictive of future risk versus balance information and therefore it weighs more heavily in the score.

"The data" he is referring to are the millions of credit profiles that were analyzed (regress/backtrack from known defaults to find pattern/correlation) before the time the scoring model was first released.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@SouthJamaica wrote:The key takeaways for me were:

1. balances expressed in raw dollars are a factor, but weighted less heavily than balances expressed as a percentage

Yes, that is what they said and I believe it as stated, but why is it that I don't experience much (+3 max under 5% only) of any score change in the entire (0, 9]% range while you do at each 1% step? I just don't have that much excitement down here on this already highly-sensitive, young credit file scorecard.

I'm open to the possibility that it's more than just the very large difference in our actual aggregate balance amount being reported. It could be scorecard related based on aging of revolving history/oldest account.

I'm going to be on the lookout for someone with your length of history and much lower total credit limit that doesn't see much of a score change in that interval.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:

@Anonymous wrote:Totally agreed, with the caveat that I believe there are 2 scoring factors, or as they call them, characteristics; there may be 4: #of revolvers w/ a bal, # of accts, w/ a bal, % of revolvers w/ a balance , and % of accounts with a balance. Seems # is more prevalent in thin or young files whereas % trumps in thick or mature files.

Characteristics is the correct term used by data scientists, and you used it perfectly here. It's a very common part of the vocabulary used when discussing various methods of regression analysis. Current FICO scoring models use one of those regression methods.

Tom Quinn: Within FICO Scores there are characteristics that look at balances and at utilization ratios. Generally speaking, the data shows that utilization information is more predictive of future risk versus balance information and therefore it weighs more heavily in the score.

"The data" he is referring to are the millions of credit profiles that were analyzed (regress/backtrack from known defaults to find pattern/correlation) before the time the scoring model was first released.

Yes and the values for the characteristics are called attributes. I was thinking of adding that to the Primer.

So both scoring factors and segmentation factors are all characteristics and their values are attributes in proper language.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:

@Credit12Fico wrote:Also, I wish someone was brave enough to ask the experts:

What are your credit scores?

. But perhaps that is a bit too much. Just curious if the experts are even allowed to have credit cards and if they do, do they have rituals or restrictions because of their line of work.

I don't think they would answer that type of personal information. We were lucky to get the information we did.

Yep I agree, it's way too personal. Just curious if there are any perks to having the inside view on credit scoring. It feels like it would be like "insider trading", so I wonder if their are any restrictions if you work in these groups that develop the algorithms. Its hard to imagine developing the algorithms on Monday, and then letting all of your cards post balances on Tuesday ![]() .

.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Credit12Fico wrote:

@Anonymous wrote:

@Credit12Fico wrote:Also, I wish someone was brave enough to ask the experts:

What are your credit scores?

. But perhaps that is a bit too much. Just curious if the experts are even allowed to have credit cards and if they do, do they have rituals or restrictions because of their line of work.

I don't think they would answer that type of personal information. We were lucky to get the information we did.

Yep I agree, it's way too personal. Just curious if there are any perks to having the inside view on credit scoring. It feels like it would be like "insider trading", so I wonder if their are any restrictions if you work in these groups that develop the algorithms. Its hard to imagine developing the algorithms on Monday, and then letting all of your cards post balances on Tuesday

.

I suppose that could come in very handy if there is a mortgage, HELOC, charge cards, and maybe a Consumer Finance Account on their profile. It scares me just trying to imagine all the interactive permutations of that kind of credit mix.

But my cards-only profile is pretty easy to figure out: I just imagine what the defaulted profiles might have done in the lead up to going 'bad', and I try to do as little of that as possible. No lates, no util at 10%+ on anything works fine. Even my lowly VS3 scores have been extremely stable month-to-month when I see many posting about wild swings in that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO AMA Discussion Thread

@Anonymous wrote:

@Brian_Earl_Spilner wrote:

@Anonymous wrote:

@Brian_Earl_Spilner wrote:

@Anonymous wrote:

@Brian_Earl_Spilner wrote:It was interesting to learn that percentage of on time payments is indeed factored in despite conventional wisdom on here.

@Brian_Earl_SpilnerI'm not sure that was resolved in that context. Anything less than 100% penalizes. (Exceptions are new files that dont' have any established payment history.) Anything can be converted to a percentage and the more lates, the more penalty and the percentage drops drops.

It pretty much was. While they weren't talking about the higher percentage of on time payments on an account, they mention number of accounts that are paid as agreed. That would mean adding more on time accounts would have a positive outcome for someone that has missed a payment.

Respectfully I think they were referring to when you add your second and third revolving accounts, which adds points by reducing the too few bankcard penalty. Jmho.

Yeah, I'm not seeing where you get that.

"FICO Scores reward consumers who have a higher percentage of accounts with no delinquencies, more accounts currently paid as agreed, and those who have a longer credit history."

OK taking it piece by piece, those who have a higher percentage of accounts with no delinquencies will of course have a higher score because they will have less delinquencies, and they will be rewarded because they won't be as penalized by the delinquencies.

A profile with 3 accounts paid on time will have a higher score than a profile with 1 account paid on time.that's just my reading of it.

Don't mean to butt in here, but based on "consumers who have a higher percentage of accounts with no delinquencies, more accounts currently paid as agreed," I think the correct interpretation is that, all other things being equal, someone with 25 accounts with 1 delinquency would have a higher score than someone with 22 accounts and 1 delinquency.

![Chase Southwest Premier 3K 10/17 [canceled]](https://i.imgur.com/66R5N3K.png)

![American Express Hilton Honors Ascend 3K 04/18 [canceled]](https://i.imgur.com/iJxp0t4.png)

![Petal Card 3.25K 07/18 [closed for inactivity 04/20]](https://i.imgur.com/rGjGptU.jpg?1)

![American Express Hilton Honors Card 3.6 K 11/18 [canceled]](https://i.imgur.com/jmINR11.jpg)

[2/2019]

[2/2019]

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content