- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO Scores with 79 Point Spread?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO Scores with 79 Point Spread?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO Scores with 79 Point Spread?

Greetings Folks,

This is my first post to the board & I've been lurking for a little while.

My credit tanked in 2012 when I defaulted on 6 ccs. A couple CCs stood by me but with a reduced CL.

Only creditor that sued was AmEx but they withdrew the case after I filed a motion to compel. All debts are now passed the SOL.

IIRC, all my bad tradelines will be removed by Sept. or Oct. 2019.

So I'm now ready to think about repairing/improving my credit. I have zero plans or interest to finance anything, get a mortgage, buy a car, obtain a loan, etc. but I want to rebuild my credit (it was in high 700s/800s before my defaults).

I now have only one CC, a Discover card I've had since well before 2012 with a current CL of $500. I usually charge between $10-$35/mth and pay off each statement in full.

I'm going to post in the credit repair forum but for this post I'm trying to understand my FICO scores and why the spread is so wide?

I have a Discover CC and my statement shows a current FICO score of 649. One year ago it was 612, so its moved up 37 points in a year. (It further states: 7 accounts, 18 yrs of credit, 0 inquiries, 31% revolving utilization, 0 missed payments. What’s hurting: Presence of serious delinquency, Too few accounts with payments as agreed).

Today I signed up for Creditscore.com and they report FICO scorre of 570.

(7% usage, $33 total debt, 1 open account, 1 inquiry ... as an aside I can see it's not current as the $33 balance was paid off recently)

I understand they each use different FICO models, Discover uses Transunion and Creditscore.com uses Equifax. But why would the spread be so large at 79 points or is this normal?

Thanks a bunch for any input.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

@LegalTender wrote:

I understand they each use differtn FICO models, Discover uses Transunion and Creditscore.com uses Equifax. But why would the spread be so large at 79 points or is this normal?

(Creditscore.com uses Experian, not Equifax. Discover.com uses Transunion, Discover's Creditscorecard.com uses Experian.)

The basic model in those two cases is the same (FICO 8, with some CRA-specific tweaks), the main difference is the data in each CRA report. (And the day each one was pulled.)

A fairly large spread in scores isn't all that uncommon, even with fairly similar reports - but in your case, being so close to your negative items falling off, it's quite likely that some items have already disappeared from one CRA, while still being listed on another.

I'd suggest that if all your negative items are that close to falling off, that you ignore your current scores until all your reports are clean - no point in worrying about the details of scores that are about to drastically change.

Instead, perhaps plan to pickup one or two new cards once your reports are clean, which combined with your existing older Discover (and any remaining positive items?), should make getting/keeping good scores easy.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

Thanks for the reply and tradeline removal may be the factor for the spread (and thanks for correcting me re: Equifax/Experian).

"I'd suggest that if all your negative items are that close to falling off, that you ignore your current scores until all your reports are clean - no point in worrying about the details of scores that are about to drastically change.

Instead, perhaps plan to pickup one or two new cards once your reports are clean, which combined with your existing older Discover (and any remaining positive items?), should make getting/keeping good scores easy."

That's been my plan and as my 'clean slate' date is approaching I'm now for the first time giving some thought to my credit and its repair, so familairizing myself with FICO models andd scores, etc. It's no problem to be patient for another couple months.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

@LegalTender wrote:

I have a Discover CC and my statement shows a current FICO score of 649. One year ago it was 612, so its moved up 37 points in a year. (It further states: 7 accounts, 18 yrs of credit, 0 inquiries, 31% revolving utilization, 0 missed payments. What’s hurting: Presence of serious delinquency, Too few accounts with payments as agreed).

What is the serious delinquency that you have since you have 0 missed payments? C/O's? Collections?

A 79 point spread between your top and bottom score to me indicates a significant report difference... possibly a major negative item being present verses no major negative item being present, for example.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

To the best of my knowledge I have 3 charge offs still being reported. They will expire in Sept./Oct.

I don't have recent CRs so there's no way for me to discern what, if any, significant differences exist on Transunion's & Experian's reporting.

The last CR I pulled from Experian was Oct 2018 and from Transunion April 2019.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

Update:

iv wrote:

“(Creditscore.com uses Experian, not Equifax. Discover.com uses Transunion, Discover's Creditscorecard.com uses Experian.)”

“A 79 point spread between your top and bottom score to me indicates a significant report difference... possibly a major negative item being present verses no major negative item being present, for example.”

I think your supposition may be right BrutalBodyShots.

I went back into my most recent credit reports. Unfortuantely they are not current and were pulled on the following dates:

Experian = Oct 2018

Transunion = April 2019.

Equifax = April 2019

However, I found a discrepancy.

On the Experian Oct. 2018 CR an AmEx CC Charge Off is listed as “on record until Jul 2025.”

However the DOFD was in 2012 and on my other CRs state that it will remain on record until July 2019. In fact, a recent collection letter from AmEX states “We must inform you that the law limits how long a debt can be reported to a a consumer reporting agency. Because of the age of your debt, we cannot report it to a consumer reporting agency.” So to the best of my knowledge this negative tradeline should already be removed from all my CRs. The 79 point lower FICO score from Creditscore.com could be due to Experian mistakenly still reporting the negative AmEx tradeline (i.e. until 2025!).

How do I go about confirming this theory? I’ve already used up my free annual credit report privilege. Is there another way to get get a free CR from Experian perhaps for the purpose of disputing a reporting error?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

@LegalTender wrote:How do I go about confirming this theory? I’ve already used up my free annual credit report privilege. Is there another way to get get a free CR from Experian perhaps for the purpose of disputing a reporting error?

You can get one free report per month directly from Experian, including a FICO 8 score based on the report.

As of right now (August 16th , 2019), you can sign up here to get both free monthly: https://www.experian.com/consumer-products/credit-score.html

(In the past, and possibly at some future point as well, that website link only gave a free monthly report, without a score, and you had to create your account on either the Android or iOS app to also get the score for free.)

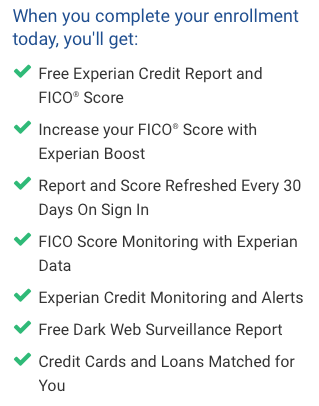

Make sure that you see the verbiage "Report and Score Refreshed Every 30 Days On Sign In" on the account-creation screen. If you don't see that, use one of the apps to setup your account instead. (Once created, the account works on both the website and the apps.)

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

Thanks for the tip iv.

I've got a Freeze on all CRAs, will that impact signing up for the service and/or will I need to remove it in order to receive the reports?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

And for the other two CRAs...

Transunion will give you a daily report (no score) for free at https://www.trueidentity.com

Equifax... is a dumpster fire... had been giving free daily access after their big breach, but much of that is currently unavailable. (Probably will be returning via the https://www.equifaxbreachsettlement.com options in the next year or so.) For the moment, your best free option for Equifax reports is probably https://www.creditkarma.com - weekly reports from both Equifax and Transunion, just ignore the VantageScore 3.0 that's also included.

There are plenty of other options, both free and paid, but there's no reason not to have access to all three of your reports on at least a monthly basis.

EQ9:847 TU9:847 EX9:839

EQ5:797 TU4:807 EX2:813 - 2021-06-06

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO Scores with 79 Point Spread?

Thanks iv.

IIRC I recently tried signing up with creditkarma, but due to a freeze I have on all CRAs it rejected/refused to process my signup.