- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: FICO vs Vantage, Help Me Understand

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FICO vs Vantage, Help Me Understand

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FICO vs Vantage, Help Me Understand

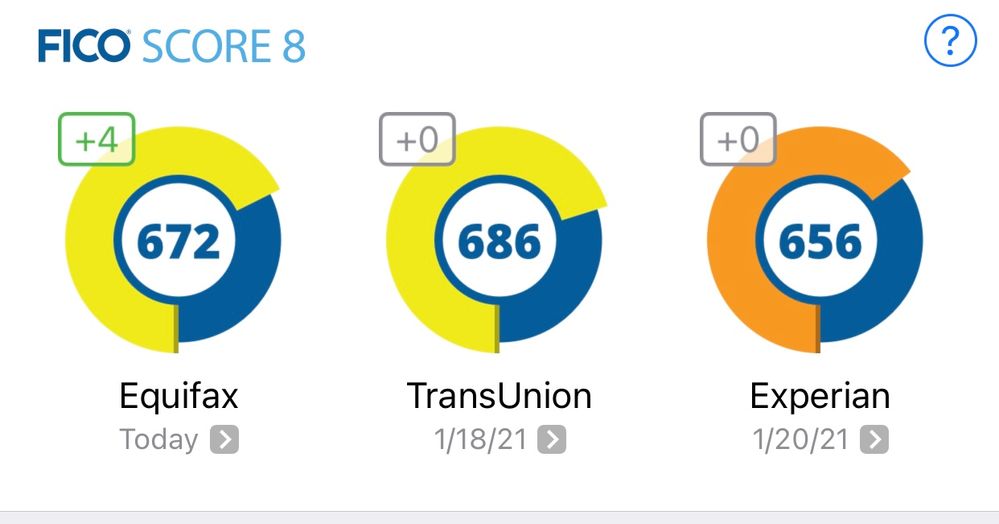

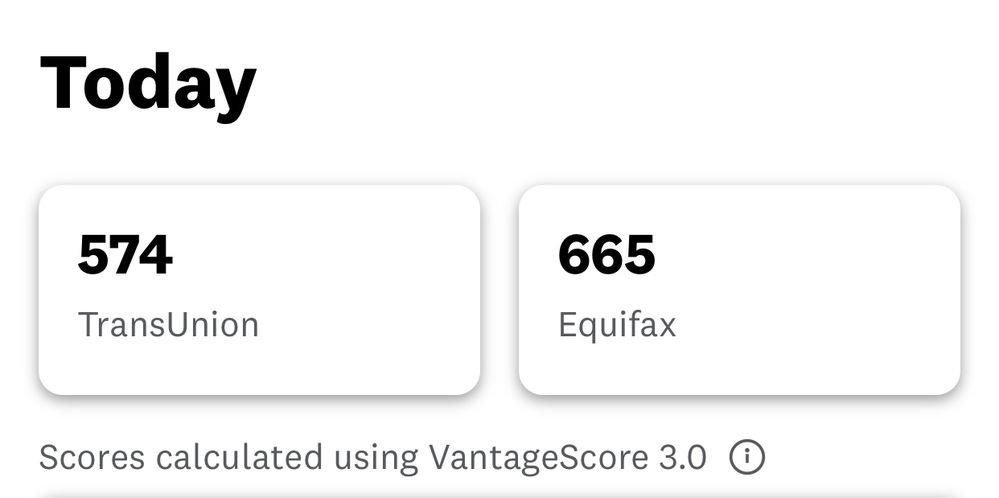

I have been working my butt off fixing my credit scores. My FICO scores are going up beautifully (in the 400's early March 2020). I don't get how my FICO is continuously rising but my Vantage Score plummets. It concerns me because I know some places go off the VS rather than FS.

I paid off one of my credit cards, my FS rose while my VS plummeted by around 100 points. My overall credit usage is around 20%.

Both of these are screenshots from today.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

Which places do you know of that use Vantage for lending decisions? The only one I've heard of is the debated example of Synchrony, and that's VS4. Regardless, VS3 isn't much researched here because basically no lenders use it, and, imo, you don't need to worry about a negative change to VS3 that isn't reflected in your FICO scores for the same reason.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

@Slabenstein wrote:Which places do you know of that use Vantage for lending decisions? The only one I've heard of is the debated example of Synchrony, and that's VS4. Regardless, VS3 isn't much researched here because basically no lenders use it, and, imo, you don't need to worry about a negative change to VS3 that isn't reflected in your FICO scores for the same reason.

Unfortunately, all of my rebuilding cards use it for credit determination, to include credit increases. I was supposed to be up for CLI on all 3 this month but they all go off the Transunion VS 3.0 and this knocked me out of eligibility.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

@Anonymous wrote:

@Slabenstein wrote:Which places do you know of that use Vantage for lending decisions? The only one I've heard of is the debated example of Synchrony, and that's VS4. Regardless, VS3 isn't much researched here because basically no lenders use it, and, imo, you don't need to worry about a negative change to VS3 that isn't reflected in your FICO scores for the same reason.

Unfortunately, all of my rebuilding cards use it for credit determination, to include credit increases. I was supposed to be up for CLI on all 3 this month but they all go off the Transunion VS 3.0 and this knocked me out of eligibility.

The denail letter explicitly discloses a TU VS3 score? Interesting. Which rebuilders do you have? Since VS3 metrics aren't really researched, I know very little about them, but if you're comfortable posting the details of your profile from before and after the drop I can try to make some educated guesses about the causes of it, if you would find that helpful. I guess the silver lining is that you'll probably be closing your rebuilders once you've grown your profile to better cards, so being denied a CLI due to low VS doesn't matter much in the long run.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

I have Surge, Credit One, and Mission Lane. The ONLY thing that changed is that I paid a credit card off in full to 0% usage. I normally keep about 10-20% on one. I had a balance I do not normally have on one of the rebuilders from Christmas that was paid in full by this new report.

Negative:

For what's on my credit, I have 0 collections, 1 derogatory from 2017, 4 paid charge offs (2016-2019-I was going through a never ending divorce that cost me over $50k as a single parent).

Positive:

11 months on time payements of all bills. Those 3 CC's plus my newer NFCU cash rewards card (3 months old). 2 credit strong credit building loans (12 month terms, 7 and 9 months into them), and a predatory loan that is 60% paid off (never late- always overpay to get it done with).

Since approval of NFCU, I am trying to only use the rebuilders once monthly and pay in full each month. I also pay my NFCU in full each month, but have a small balance on it when reported each month (4 day delay between billing/payoff and reporting).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

One of the few things I know about VS3 is that it loves $0 balances, so I wouldn't think that paying off that cc would have led to a score drop. But not knowing much else about it, vs. the usual "hidden" causes of FICO drops, I'm not sure where else in your profile to suggest to look.

ETA: This is the first I've heard of CreditOne using VS3. Are you sure that's what the denial letter disclosed? They have their own internal score that they use for credit decisions.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

They actually recently switched from their internal system to the VS3 a couple of months ago. I have not yet received letters, that was verbally when I spoke to them.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

Don't worry about the VS scores, or your lenders that use them. You're in a position to dump those lenders any day you'd like, as you've already found your way to non-rebuilder/predatory lenders. Your Fico scores in the upper 600s are likely capable of acquiring you other major bank cards from lenders like Discover and Capital One, so I'd forget about the VS-using lenders and think more about eliminating them from your profile.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

The predatory is actually older with a 6 year payoff. That is something I will never do again once paid off. I had to take actions I didn't want to during a difficult time.

I would love to get rid of my rebuilders, but then my credit age will drop drastically so it's a double edged sword. Ideally, I will be approved for a CLI and new card through NFCU next month. It really sucks being at that in between stage and the wrong move can drop my score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FICO vs Vantage, Help Me Understand

Oh, and Capitol One and Discover said I was not prequalified so I didn't want to risk a hard pull on my credit.