- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: HUGE differences between FICO 8 and FICO 9.. w...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

HUGE differences between FICO 8 and FICO 9.. why?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

HUGE differences between FICO 8 and FICO 9.. why?

Hi everyone!

So I decided to finally check my FICO 9 scores today since I recently opened accounts with NFCU and heard that they pull FICO 9. To my surprise my FICO 9 scores are higher, in one case to a very high degree. I've research the differences between FICO 8 and 9 and can't really understand why such a large variance would exist in my case.

For reference I just went through chapter 7 and it was discharged a little over a month ago so I'm fresh out of bankruptcy. I had around 15 credit cards or so that were included in the bk. Other than the cards that were discharged I have no other negatives on my report. Currently there is a car loan on all 3 reports and 2 student loans on Experian and Equifax, but for some reason they haven't yet reappeared on my TU report, which I assume is why my TU score is so much lower on the FICO 8s. I got 3 new credit cards after the discharge to start rebuilding, but none are on my credit reports yet.

One more question, on myfico it only displays the hard inquiries from the past year, but on Experian and other sites they list the inquiries from the past 2 years. I thought that banks check for inquiries 2 years out, is that accurate?

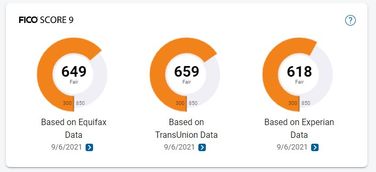

Here are my scores. If anyone has any thoughts as to why my TU in particular is over 100 points higher on FICO 9 I'd appreciate the insight. If you need any other information just let me know.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HUGE differences between FICO 8 and FICO 9.. why?

@Scylla wrote:Hi everyone!

So I decided to finally check my FICO 9 scores today since I recently opened accounts with NFCU and heard that they pull FICO 9. To my surprise my FICO 9 scores are higher, in one case to a very high degree. I've research the differences between FICO 8 and 9 and can't really understand why such a large variance would exist in my case.

For reference I just went through chapter 7 and it was discharged a little over a month ago so I'm fresh out of bankruptcy. I had around 15 credit cards or so that were included in the bk. Other than the cards that were discharged I have no other negatives on my report. Currently there is a car loan on all 3 reports and 2 student loans on Experian and Equifax, but for some reason they haven't yet reappeared on my TU report, which I assume is why my TU score is so much lower on the FICO 8s. I got 3 new credit cards after the discharge to start rebuilding, but none are on my credit reports yet.

One more question, on myfico it only displays the hard inquiries from the past year, but on Experian and other sites they list the inquiries from the past 2 years. I thought that banks check for inquiries 2 years out, is that accurate?Here are my scores. If anyone has any thoughts as to why my TU in particular is over 100 points higher on FICO 9 I'd appreciate the insight. If you need any other information just let me know.

Possible differences between FICO 9 & FICO 8:

-paid collections not counted in 9

-unpaid collections given more weight in 9

-medical collections given less weight in 9

-rental history counted in 9

-recent inquiries given less weight in 9

-average age of accounts given less weight in 9

-no. of accts reporting balance given more weight in 9

-premium for open as opposed to closed installment loans reduced in 9

-installment loan utilization percentage given more weight in 9

-9 more sensitive to revolving utilization

-9 has a separate clean scorecard for people with high revolving utilization

Total revolving limits 568220 (504020 reporting) FICO 8: EQ 689 TU 691 EX 682

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HUGE differences between FICO 8 and FICO 9.. why?

@Scylla wrote:Hi everyone!

So I decided to finally check my FICO 9 scores today since I recently opened accounts with NFCU and heard that they pull FICO 9. To my surprise my FICO 9 scores are higher, in one case to a very high degree. I've research the differences between FICO 8 and 9 and can't really understand why such a large variance would exist in my case.

For reference I just went through chapter 7 and it was discharged a little over a month ago so I'm fresh out of bankruptcy. I had around 15 credit cards or so that were included in the bk. Other than the cards that were discharged I have no other negatives on my report. Currently there is a car loan on all 3 reports and 2 student loans on Experian and Equifax, but for some reason they haven't yet reappeared on my TU report, which I assume is why my TU score is so much lower on the FICO 8s. I got 3 new credit cards after the discharge to start rebuilding, but none are on my credit reports yet.

One more question, on myfico it only displays the hard inquiries from the past year, but on Experian and other sites they list the inquiries from the past 2 years. I thought that banks check for inquiries 2 years out, is that accurate?Here are my scores. If anyone has any thoughts as to why my TU in particular is over 100 points higher on FICO 9 I'd appreciate the insight. If you need any other information just let me know.

FICO doesnt count HP's after 1 yr and you wont see them on MyFICO. Yes they stay on your credit reports for 2 yrs. You can see them on your real reports on annual credit report. Side note. Stop apping for any more cards for a while. 3 in a month right after BK is all you need to start your rebuild. Congrats. The CRA's all update at their own set times. And some creditors can take up to 90 days to place the new account on your file.

BK Free Aug25

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: HUGE differences between FICO 8 and FICO 9.. why?

I actually don't plan on ever getting any more credit cards. Possibly 1 more in the future, but that's it. After the bankruptcy I didn't want to get any new credit cards at all, but I did just as a means to build my credit back up.