- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: How does Fico calculate AOYA for multiple new ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How does Fico calculate AOYA for multiple new accounts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does Fico calculate AOYA for multiple new accounts?

Cap One QS: $4811

CFU: $8,000

PPMC: $12,000

US Bank Cash+: $13,000

Penfed Powercash Rewards: $7,500

AAOA: 3.5 yrs

Experian (Fico 8) 756

Transunion (Fico 8) 757

Equifax (Fico 8) 764

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

While lenders obviously keep a record of both the date and time an account was opened, only the date is reported to the credit bureaus. Then the credit bureaus utilize the reported date(s) differently. Experian rounds up opening dates to the 1st day of the month the account was opened, while Equifax and Transunion used the specific date the account was opened. So for example, a credit card account opened on July 9th, will be shown as opened on July 1 at Experian, and July 9 at Equifax and Transunion.

All that actually matters when determining the Age of Youngest Account is the date the account(s) was opened. If multiple accounts are opened on the same date they are assumed to have the same age.

@Fated4Credit wrote:

@Anonymous curious about this, but if I were to apply for 2 cards on the same day & they happen to be reported to the credit breaus @ the same time, how does fico know which one is the actually the youngest account? What is the likelihood of this even happening?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

@Anonymous wrote:

Experian rounds up opening dates to the 1st day of the month the account was opened, while Equifax and Transunion used the specific date the account was opened. So for example, a credit card account opened on July 9th, will be shown as opened on July 1 at Experian, and July 9 at Equifax and Transunion.

Wow, that surprises me. So if I pulled my Experian report at annualCreditReport.com, it would show that every account was opened on the first of the month? It's been years since I have actually done that.

I had heard that FICO's algorithm interpreted account age in terms of the 1st of the month. Thus if an account was opened on June 30, FICO would consider it one month old on July 1 (one day later). And I think that is supposed to be true for a FICO score drawn on any of the three bureaus. But I didn't know that Experian actually recorded the date as June 1 in its database.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

CGID, if you pull a hard copy of your Experian credit report from annualcreditreport.com it will only show the month and year each account was opened, not the actual date. If you access your credit report online through one of Experian's credit monitoring services it will show each account opened on the 1st day of the month.

@Anonymous wrote:

@Anonymous wrote:

Experian rounds up opening dates to the 1st day of the month the account was opened, while Equifax and Transunion used the specific date the account was opened. So for example, a credit card account opened on July 9th, will be shown as opened on July 1 at Experian, and July 9 at Equifax and Transunion.

Wow, that surprises me. So if I pulled my Experian report at annualCreditReport.com, it would show that every account was opened on the first of the month? It's been years since I have actually done that.

I had heard that FICO's algorithm interpreted account age in terms of the 1st of the month. Thus if an account was opened on June 30, FICO would consider it one month old on July 1 (one day later). And I think that is supposed to be true for a FICO score drawn on any of the three bureaus. But I didn't know that Experian actually recorded the date as June 1 in its database.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

Here's an example from a now-closed Capital One account:

From hard copy of Experian credit report

From online source (Experian CreditWorks Premium)

The same account reported on Transunion credit report:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

Many thanks. I wonder why EX does that? Perhaps it is an artifact of a long time ago when (I am guessing) EX only collected month and year. And then when they added the day field to their dates they decided to keep it as the 1st for consistency with their previous data.

Otherwise it's strange that they should be deliberately recording false information into their system. (E.g. 12/01 when it was reported to them as 12/03.)

Suppose as per my earlier example, that an account was opened on June 30. Do we have a definite confirmation that FICO treats the Date Opened field as if it were opened on June 1, even when TU and EQ say that it was opened on June 30? For example, if this account was the person's first account ever opened, all three FICO scores will be available on Dec 2 -- not just EX?

I believe this has been confirmed multiple times, but just want to make sure my memory isn't faulty.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

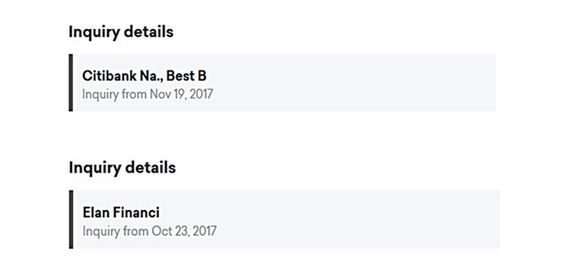

Does the same apply to inquiries - meaning some some CRAs go by actual date while others (EX) use 1st of the month?

The two inquiries I have (top one on EQ and bottom one on TU) list actual date per CK. As I recall, a prior inquiry on EQ stopped impacting Fico score based on actual date - not 1st of the month.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

@Anonymous wrote:While lenders obviously keep a record of both the date and time an account was opened, only the date is reported to the credit bureaus. Then the credit bureaus utilize the reported date(s) differently. Experian rounds up opening dates to the 1st day of the month the account was opened, while Equifax and Transunion used the specific date the account was opened. So for example, a credit card account opened on July 9th, will be shown as opened on July 1 at Experian, and July 9 at Equifax and Transunion.

All that actually matters when determining the Age of Youngest Account is the date the account(s) was opened. If multiple accounts are opened on the same date they are assumed to have the same age.

@Fated4Credit wrote:

@Anonymous curious about this, but if I were to apply for 2 cards on the same day & they happen to be reported to the credit breaus @ the same time, how does fico know which one is the actually the youngest account? What is the likelihood of this even happening?

Thanks for clearing things up, now I understand why my Discover card reported on Experian on 11/1 when I actually appiled on 11/27. Always thought it was a mistake on their part.

Cap One QS: $4811

CFU: $8,000

PPMC: $12,000

US Bank Cash+: $13,000

Penfed Powercash Rewards: $7,500

AAOA: 3.5 yrs

Experian (Fico 8) 756

Transunion (Fico 8) 757

Equifax (Fico 8) 764

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

The exact day of the month is not necessary for many reported items.

Reporting of DOFD, for example, is explicitly stated by statute (FCRA 623(a)(5)) as being only the month and year.

If a CRA uses the first day of the month, that is to the consumer's benefit, and not detriment, so that is likely why they use the first of the month rather than the last.

As regards the Open Date, the common credit reporting manual used by each of the big-4 CRAs does provide enough digits in the Metro 2 format to report mm/dd/yyyy for open date, but expressly states that "If the day is not available, use 01."

That has been the standard practice of the CRAs for decades.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How does Fico calculate AOYA for multiple new accounts?

EX inquires show actual dates.

Sadly, I know this all too well. Almost all my inquires are on EX. ![]()

@Thomas_Thumb wrote:Does the same apply to inquiries - meaning some some CRAs go by actual date while others (EX) use 1st of the month?

The two inquiries I have (top one on EQ and bottom one on TU) list actual date per CK. As I recall, a prior inquiry on EQ stopped impacting Fico score based on actual date - not 1st of the month.